Consumer Price Inflation didn’t arrive after 2009 but this time around we also have a Government spending storm worldwide...

Table of Contents

- Inflation: What’s Different Between 2009 and 2021?

- Headline Inflation Rates Remain Low

- Food Price Inflation is the Best Predictor

- Inflation Expectations Are Also Rising Here in New Zealand

- If Consumer Price Inflation is Starting to Heat Up, Will Central Banks Raise Interest Rates Soon?

- Why Central Banks Might Move to Average Inflation Targeting

- Views From Other Analysts on Why Inflation is Coming

- Summary: Why Consumer Price Inflation is Coming

Estimated reading time: 12 minutes

There was much talk in the 2008 financial crisis of the coming inflation. With so much currency being created we expected consumer price inflation (the price of everyday common goods) to increase too. However inflation (as measured by the government CPI anyway) didn’t increase. Why?

Likely because all the currency created ended up being held as excess reserve with the US and other central banks worldwide. So it didn’t make it into the average man or woman in the streets hands. It was just those closest to the central banks that got the benefit. Which is why we instead saw asset price inflation. With the likes of shares and real estate rising, rather than everyday consumer goods.

So why might this time be any different?

Inflation: What’s Different Between 2009 and 2021?

In response to the COVID19 lock downs we have had even greater currency printing than the 2009 financial crisis. But on top of this we have also had much greater direct government spending too. Just about every developed nation has followed the same path to varying degrees.

This looks like it will be ongoing too. Take the latest from the USA. Graham Summers reports:

“The Biden Administration will soon sign off on a $1.9 trillion stimulus program. It has also proposed a $2 trillion infrastructure program, as well as a $1.7 trillion climate change program.

That’s an additional $4.7 TRILLION in money printing on top of what the Fed is already doing ($1.4 trillion per year).

All of this is going to unleash an inflationary storm, the likes of which we have not seen in decades.

And the markets know it.

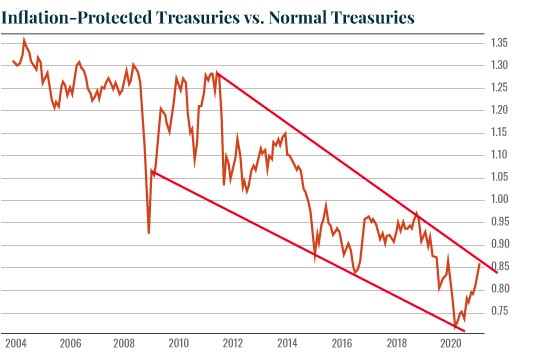

Take a look at what the yield ratio between Inflation-Protected Treasuries (TIPS) vs. normal Treasuries is telling us.

You’re looking at a 10-year deflationary downtrend ENDING as inflation begins to rip through the financial system. In the simplest of terms, this chart represents the bond market SCREAMING, “INFLATION IS ABOUT TO HIT.”

Again, an inflationary storm is coming. And it’s going to annihilate most investors.

Those who are properly prepared, however, will make literal fortunes.”

Source.

So unlike 2009 which was mostly limited to currency creation, this time around we are also seeing large government spending. This spending is likely to end up in the hands of the poorer sectors of society. They will be the ones most likely to spend it on everyday necessities. So this time around we could see them rise in price too.

Headline Inflation Rates Remain Low

However headline inflation rates are not very high here or in the USA currently. The annual inflation rate in the US was steady at 1.4% in January of 2021, the same as in December. Source.

While in New Zealand the consumer price inflation rate remained unchanged also at 1.4 percent in the fourth quarter of 2020. Source.

Food Price Inflation is the Best Predictor

However Food price inflation is the best predictor of inflation according to the US Federal Reserve:

“As I keep emphasizing, inflation has already arrived in the U.S.

If you don’t believe me, take a look at what the Fed has admitted in its research.

Back in 2001, Fed researchers set out to discover the single most accurate predictor of future inflation. Their findings were surprising…

The key paragraph from the paper is the following:

“We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…“

– St. Louis Federal Reserve

I realize this sounds odd. After all, publicly, the Fed states that its preferred measures of inflation are the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE).

And yet, the Fed’s OWN RESEARCH has shown that these metrics do a horrible job of predicting future inflation. Not only that, but the Fed has KNOWN this since 2001!

With that in mind, if you want to accurately predict future inflation in the financial system, you HAVE to look at food prices.

Corn prices are up 47% since mid-2020…

Soybeans are up 55% since mid-2020…

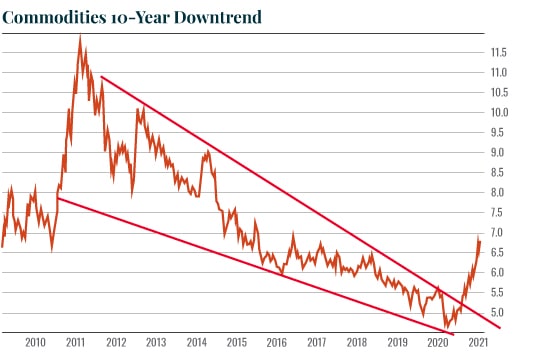

Heck, the entire agricultural commodities space (which are used to make food) is up over 40%!

Indeed, in the big picture it’s clear that the 10 year BEAR market in food prices is OVER.

These charts are SCREAMING that hot inflation is coming sometime this year.”

Source.

Inflation Expectations Are Also Rising Here in New Zealand

Here in New Zealand, a quarterly survey is showing markedly higher expectations for future consumer price inflation:

“The two-year expected inflation rate in the latest survey is 1.89%, and that’s up from just 1.59% as of three months ago, while as recently as June last year the expectation was just 1.24%. On the face of it those moves don’t sound much, but the reality is the expectation figures generally don’t fluctuate much from survey to survey, so to see inflation expectations move up by as much as 30 basis points in just one survey is significant.

Additionally, the shorter term inflation expectations (a year out) have moved up even more sharply to 1.73% from 1.23% at the end of last year.”

Source.

If Consumer Price Inflation is Starting to Heat Up, Will Central Banks Raise Interest Rates Soon?

So while the headline government numbers are low, there are some early indicators that inflation may be starting to heat up. So central banks are likely to start raising interest rates soon aren’t they?

Not so fast…

Care of Bullionvault, precious metals analysts Metals Focus comment on why they believe interest rates won’t be raised anytime soon:

Metals Focus “still believes that the investment case should overall remain favourable for gold [because] inflationary expectations were a key driver of the post-2008 gold rally [and] many investors feel that, this time around, the extent of monetary and fiscal accommodation and their more targeted nature have a greater likelihood of driving prices higher.”

Most importantly, the threat of high unemployment “means that central banks will be constrained from raising rates at a time when inflationary pressures start to creep higher…[as] doubts about the solidity of this recovery are likely to persist.

“This, coupled with other tail risks [from over-priced stock markets to excessive debt], should all help maintain investor inflows into gold.”

Why Central Banks Might Move to Average Inflation Targeting

Here’s another reason why central banks such as the Reserve Bank of New Zealand (RBNZ) may be slow to raise interest rates.

It looks likely that the RBNZ may move to average inflation targeting (as they are talking about elsewhere in the world). This could well lead to an overshoot in the reported inflation rate.

What is Average Inflation Targeting?

Here’s a summary of what the impact of average inflation targeting may be:

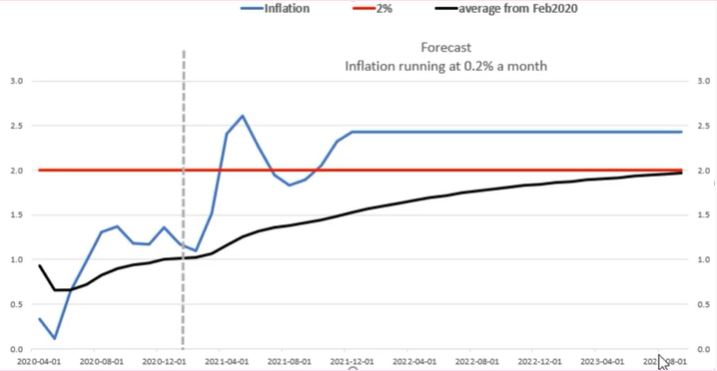

In the US the Federal Reserve have met the prospect of a temporary COVID related spike in prices with their new average inflation targeting policy. Rather than raise rates when annualised CPI crosses its 2% target the Fed have avowed to wait until average inflation hits 2%. Is this some kind of formula? Over what period? Well not really. It’s more a framework so in some ways they can just make it up.

But in the sense of brevity, former Head of FX Strategy at HSBC David Bloom (now freelancing) put together a quick graph of what would happen if inflation in the US increased by 0.2% per month. As you can see below annualised CPI gets above 2% as early as June 2021, but average CPI (as calculated from Feb 2020 onwards) does not make 2% until August 2023.

If global central banks jump on this bandwagon (and there is every sign they will) then rate hikes will be delayed, equity markets will remain supported and commodity prices will be primed.”

Source.

“So basically, the public shouldn’t feel worried that any headlines about rising inflation may herald an imminent rise in mortgage rates. That won’t happen until 2023, at the earliest. In the meantime, inflation could reach (or even briefly exceed) the virtuous 2% midrange point, for a time. Even so, [Infometrics senior economist Brad] Olsen believes, the Bank would remain reluctant to risk pulling the interest rate trigger too soon, given that this would disrupt business planning and push inflation back below 2%. To the Reserve Bank, inflation is a fragile flower that needs to be nourished, not crushed.”

Source.

That about sums up a central banker’s view on inflation. To the ordinary person inflation means a hidden tax that silently steals from you each year. Whereas to a central banker, “inflation is a fragile flower that needs to be nourished, not crushed.” It might take them a good long while, but eventually the central bankers fragile flower will likely grow into an invasive creeper that smothers everything else!

Views From Other Analysts on Why Inflation is Coming

We’ve seen a number of reports on why inflation may be on the horizon recently. Here’s a quick summary of a few of them:

Bill Bonner

Here’s another well put together argument from Bill Bonner on why inflation will likely arrive:

Two Routes to Inflation

Inflation happens, grosso modo, (according to the classic Quantity Theory of Money) when the supply of goods and services goes down compared to the supply of “money” that bids for it.

That can happen in one of two ways.

Either the economy heats up (cyclical inflation)… and businesses need more labor and raw materials to keep up with the demand. Shortages then arise. Everyone tries to keep up with the whirlwind of getting and spending, leading to higher prices…

Or… the other possibility (systemic inflation) is that the economy cools down. Fake money, false price signals, regulation, bubbles, giveaways, and COVID-19 shutdowns could simply cause a cutback in buyable output… while the supply of available money continues to rise.

Closer Look

So let’s look more closely…

Last year, the output of money – as measured by the Federal Reserve’s balance sheet – rose by $3.25 trillion.

The output of goods and services, on the other hand – as measured by GDP (even somewhat faked by a huge increase in government spending) – fell by $300 billion.

This looks like “systemic” inflation to us.

…Look for prices for just about everything to rise as the real economy – the part that actually produces goods and services – cools down…”

JP Morgan Quantitative Analyst Marko Kolanovic

“Two days after Dylan Grice published an article “The Stage is Set for a Bull Market in Oil”, with various commodities around the world soaring, and the price of oil up a stunning 64% since November, today Marko Kolanovic made a bold prediction – that the world has entered a new commodity supercycle:

“It is generally agreed that over the past 100 years, there were 4 Commodity supercycles and that the last one started in 1996 . We believe that the last supercycle peaked in 2008 (after 12 years of expansion), bottomed in 2020 (after a 12-year contraction) and that we likely entered an upswing phase of a new commodity supercycle.”

…Inflation hedging: The past decade was marked by low growth and low inflation. Bonds, bond proxies and secular growth stocks were in a bull market, while commodities, value and cyclical stocks performed poorly. Kolanovic believes that the tide on yields and inflation is turning, which will pose “a major risk to multi-asset portfolios” and in light of the consensus view that commodities are the best way to hedge rising inflation, the JPM quant expects “these multi-asset portfolios to add commodity and commodity equity exposure to hedge inflation.”

Source.

Incrementum Asset Management

A recent inflation special report from investment and asset management company Incrementum was titled:

The Boy Who Cried Wolf: Is An Inflationary Decade Ahead?

The key takeaways from their report were:

• Recent developments – politicians’ growing control over credit creation, average inflation targeting policy, and the historic expansion of the broad monetary aggregate – suggest the 2020s could become a stagflationary era.

• The vaccine breakthrough could bring back pre-Covid-19 spending habits. Such a return will increase monetary velocity and drive up inflation.

• The gargantuan credit expansion in 2020, recent months’ bond, real estate, commodity, and equity rallies signal that we have likely entered a crack-up boom.

• The global economy’s new inflationary paradigm requires a thoughtful re-examination of traditional portfolio theory. In light of recent developments, investors must have increased concern about the risk of inflation.

Summary: Why Consumer Price Inflation is Coming

So to summarise…

2021 and beyond is likely different to 2009 and its aftermath due to the level of government stimulus. Stimulus that is more likely to end up in the hands of those who will spend it on everyday necessities.

As Bill Bonner points out, this is likely to be compounded by the production of goods in the USA and much of the world falling sharply due to COVID19 shut downs.

So we will see more currency units chasing fewer goods. Which is the very definition of monetary inflation.

Meantime central banks will be unlikely to raise interest rates because:

- They will fear it will smother a weak recovery due to high unemployment rates

- Their new average inflation targeting methodology will tell them far too late that inflation has risen.

The difficult part is predicting when this rise in consumer price inflation may arrive.

But analysts point to commodities as the best shield from high inflation. Gold and silver are likely to perform the best if we take history as any guide. The time to buy these assets are before their prices rise significantly. Got gold yet?

Pingback: Current Stock Levels Update - Gold Survival Guide

Pingback: Real Interest Rates vs Gold Prices - When to Buy Gold in New Zealand?

Pingback: Rising Long Term Interest Rates Give Markets a Scare - Gold Survival Guide

Pingback: What's Next for Gold and Silver in New Zealand Dollars?

Pingback: How Would Hyperinflation in The USA Affect New Zealand? - Gold Survival Guide

Pingback: Could a Record High NZ Crown Settlement Account Boost Inflation in NZ? - Gold Survival Guide

Pingback: Even the Mainstream is Now Finally Wondering "is Inflation Here to Stay"? - Gold Survival Guide