Prices and Charts

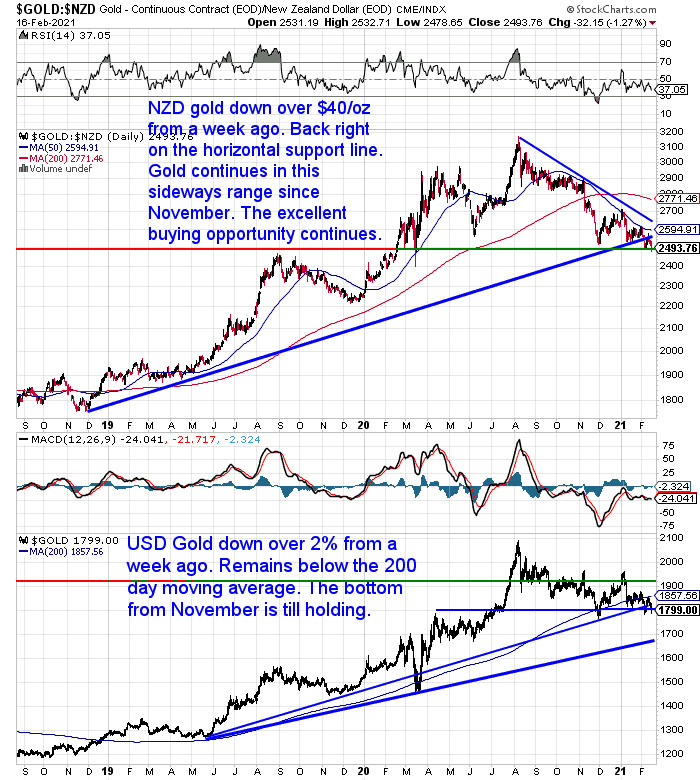

Gold Back Down to Support Level Around NZ$2500

Gold is down over $40 from a week ago. Today sitting just under the $2500 and right on the horizontal support line. So gold continues to trade in this sideways range it has been in since November. Consolidating the large rise since 2019. Of course there is no way of knowing if it might go a little lower yet even. But this is a chance to buy at the lowest level since March last year. So likely a very good zone in the long run.

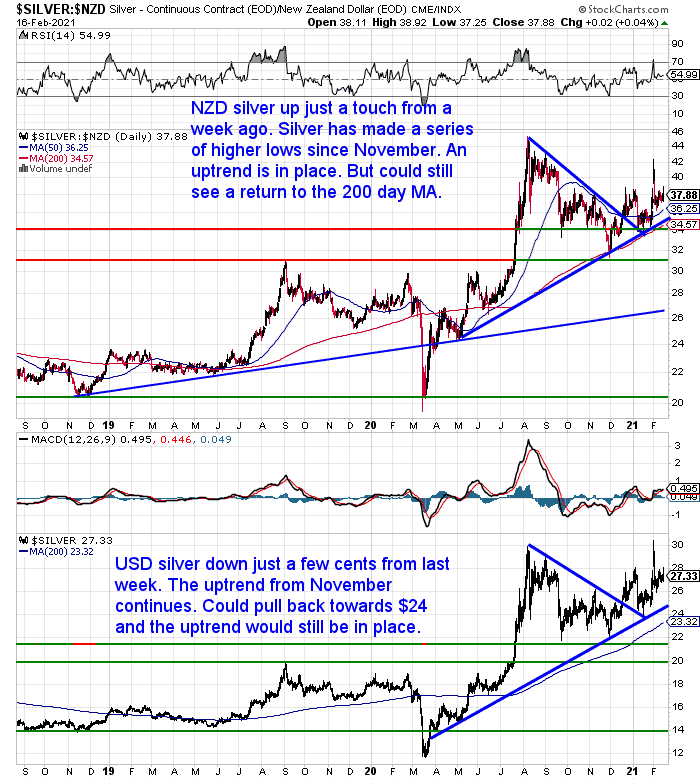

Silver Continues to Outperform Gold

Unlike gold, NZD silver is up (albeit only just) from a week ago. So silver continues to outperform gold as it has done in recent weeks.

Also unlike gold, silver looks to be in an uptrend since November last year. Making a series of higher highs and higher lows from then. NZD silver could drop right back to near $34 and still be in a clear uptrend. The 200 day moving average would be a good buy zone to watch for – if we see it.

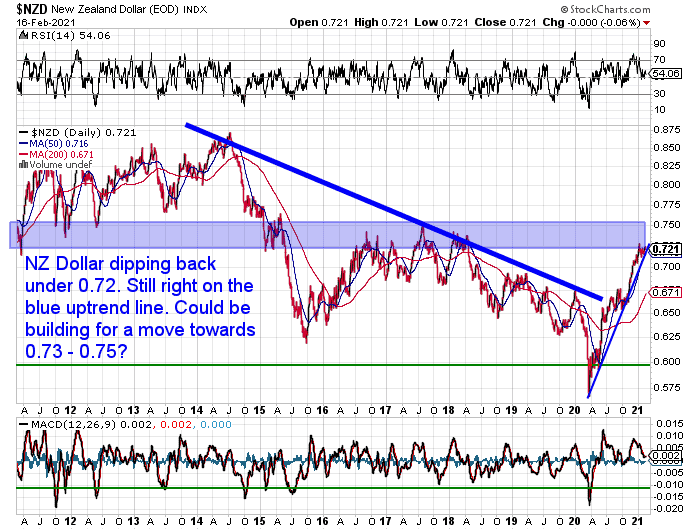

NZ Dollar Down 0.50% From a Week ago

Meanwhile the New Zealand dollar is down about half a percent from last week. Continuing to bump along the steep rising uptrend line. The Kiwi still looks to be building for a move into the 0.73 to 0.75 range.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Silver Short Squeeze – Is it Over Already?

Not too much has changed from what we wrote about silver in last week’s update.

Silver is up slightly on a week ago and demand remains pretty strong.

So was that it for the short squeeze? Perhaps… More thoughts below…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Premiums Down or Paper Price Up?

Premiums on silver coins have risen markedly in February. Now we wait to see what happens…

Do these premiums fall back to more normal levels in the coming weeks and the paper price stay about where it is? Or does the paper price rise higher and closer to the physical coin prices?

Our favourite newsletter writer Chris Weber (Learn more about Chris here) this week posted an update from US bullion dealers Mish International that nicely explains the above possibilities:

“Come the end of the month when longs and shorts settle COMEX contracts for March delivery of 1000 oz bars, we will know if the buyers or sellers are stronger. This is when a real “squeeze” on short sellers can start to manifest. One of two things will happen: 1) either strong funds and/or physical investment buyers will stand for delivery or rollover their paper to May in numbers beyond expectations (in which case the price of paper will move closer to the current market price of physical –or (2) paper longs will sell or roll forward their paper rather than take delivery, enabling the shorts to retire their paper and reshort the higher May futures price.

The third thing that will happen is manufacturers (Gov’t and Private Mints) will take delivery into mid/late March and begin to manufacture the enormous backlog of orders for silver 1, 10, & 100 oz bar products…a process that is estimated to run through June. This in time will relieve some of the shortage of manufactured products; however, new demand if significant can continue to overwhelm production capabilities. In the interim, the market price of silver can keep rising, deliveries or not.”

That about sums it up for silver currently.

In the interim we do still have some silver coins available to order where the premiums have hardly changed since this recent surge in demand began. See the deal at the top of this email on the limited mintage 2020 Cayman Islands Marlin 1 oz Silver Coins, if you want to avoid paying higher premiums.

Otherwise in silver coins we only have Royal Mint Britannia and South African Krugerands on back order. Everything else has not only got huge premiums above spot, but unknown wait times, so we don’t sell any of those.

Silver bars can be locked in but there is a 4 week wait on ABC bars and a 2 week wait on local silver bars.

There are a lot more options available in gold.

Get in touch if you have any questions about buying…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Rising Long Term Interest Rates Give Markets a Scare - Gold Survival Guide