A week or so ago we read something from Bill Bonner on the Daily Reckoning that got us to thinking, “Just how low could gold fall?”

Bill has been recommending gold to readers of his daily column for years and years but he may have scared a few people with these recent thoughts on the yellow precious metal…

Now, let’s look at the gold market. Gold went down $30 yesterday.

Is it too late to join the party?

Investors don’t know what to do. They were buying gold this week because the Fed is putting on its annual shindig at Jackson Hole, Wyoming. Everybody knows the Fed sees itself as a booster for Wall Street. They know, too, that QE2 came out of the Fed last summer. That program didn’t do anything for the economy….but what a gift to gold holders!

Gold is up 33% so far this year. And by the look of the chart…it could easily finish the year above $2,000. Maybe above $3,000.

But — remember we’re just guessing — gold looks like it has gotten ahead of itself. It looks over-bought. Besides, investors may be expecting too much of the Fed.

Of course, if the Fed comes out with some more high-octane market hooch…this party could really go wild. But, it isn’t likely. Everybody’s watching. Bernanke needs to give the markets enough juice so they don’t fall apart on Friday…but not enough so the gold market goes blind.

Most likely, he will encourage investors. But he won’t cause a panic. Not yet.

And most likely, gold will fall.

Look, we’re gold bugs here at The Daily Reckoning. We have more faith in gold than we do in the fellows running the world financial system. Not that they’re not nice men. And they’re plenty smart. It’s not that we think they’re stupid. It’s just that we think they’re human. They put on their pants one leg at a time, just like everybody else. And just like everybody else, if you put them under pressure…they’ll crack.

But not yet. Our views on the stock market were severely tested during the big rallies of the ’00s. Now, it is the gold bulls who face a test. Gold has gone up every year since 2000. It’s been too easy.

So, it’s time for Mr. Market to pull a fast one on gold buyers.

The process of de-leveraging the private sector, following in Japan’s footsteps, will be long, slow and hard. The feds will fight de-leveraging. They’ll zombify the economy. They’ll make a bigger mess of things….but they won’t create conditions for the real Third Phase of the bull market in gold. Not yet.

Yes, dear reader, you pried it out of us. We were trying to be coy. We wanted to hold off. We thought that maybe if we gave it to you all at once, well…maybe you wouldn’t respect us.

But there…we’ve gone and done it anyway. You have our Big Prediction on gold right in front of you. And it didn’t cost you a penny.

We’re gold bugs. But we’re not always gold bulls. And our guess now is that Mr. Market is going to throw us a curve. (Bugs…bulls…curves…why the hell not?) Yep. He’s drawing in millions of Johnny-come-lately gold buyers into the market. And now he’s going to massacre them…and test us.

Because gold is going lower…not higher.

Yep, you read it here first. Stocks are going down. But so is gold.

“Bill, you’ve been saying that gold is going higher for 11 years. Are you now really saying that it’s probably going down?”

“Yep.”

“But didn’t you just urge readers to sell stocks and buy gold?”

“Yep.”

“So you now think it’s going down, right? ”

“Yep.”

“So, are you selling your gold?”

“Nope… You think I’m crazy? This is just a temporary setback…maybe a few years, that’s all. This bull market in gold won’t end until gold and the Dow meet.”

Our guess is that gold goes down…shakes out the speculators and weak investors…and then — perhaps a couple years from now…perhaps longer — begins its third and final phase.

Bill actually wrote this prior to Bernanke’s speech. You might recall that Bernanke didn’t came out with anything significant – yet – but left the door open with a now extended 2 day meeting planned for later this month by the Fedsters. And so gold didn’t actually drop back much at all after that and now a week later it’s actually close to retesting $1910.

But is it hard to believe gold could fall after 11 years of straight gains (in US dollar terms)? This is worth some contemplation.

Gold did fall 30% in 2008

Gold has had some good sized corrections in those 11 years. The largest came in 2008, when gold fell about 30% from March to October (although it still ended the year up a few percent), but could it really stay down or at least not make significant new highs for a couple of years?

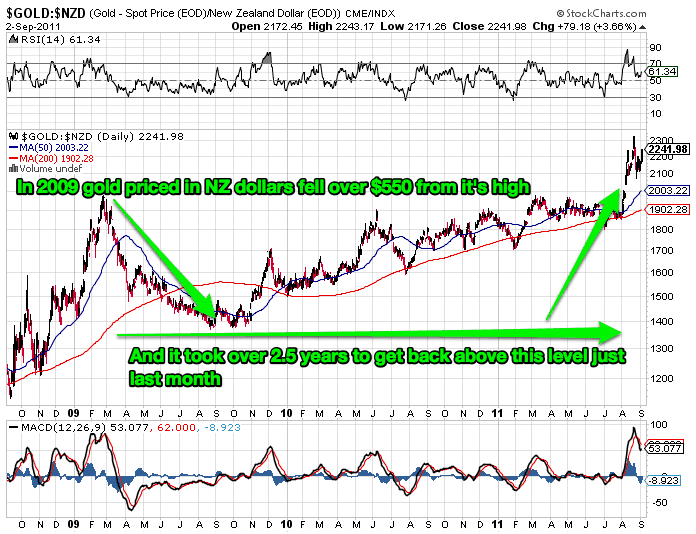

Well in New Zealand dollar terms gold already has. Remember gold hit $1950 in February 2009, then fell over $550 and took until last month to decisively break above this number. So that was almost 2.5 years to get above a previous high.

So kiwi gold holders should be somewhat accustomed to the notion that gold can stay down for a good long while.

And gold fell 50% in the middle of the 1970s bull market

It’s also worthwhile looking at the last precious metals bull market of the 70’s. From the end of 1974 to the middle of 1976 gold actually fell 50% from $200 to $100! Ouch. You don’t hear this discussed too much even by those in the gold game. But this wasn’t actually the end of the bull market in gold. Real interest rates were still very negative during this period – not getting consistently into positives until 1980. Can you imagine if gold fell 50% now?!!! That would be a price of $950US! Although for us New Zealanders it’s likely if this took place that the NZ dollar could also be significantly weaker so we may not see such a drop in local gold prices.

So what caused this massive fall in the gold price in late 1974?

Well interestingly on 1 January 1975 it was again made legal after 42 years for Americans to own gold. But at the same time the US Treasury and other central banks actually sold vast amounts of gold, thereby flooding the market and depressing the price.

What’s different today?

This year central banks are actually net buyers of gold for the first time in almost 2 decades. Instead of selling we are actually hearing regular reports of central banks buying including India, Korea, Mexico, Russia and even Iran. And unlike 1975, since 2009 western central have also become net buyers. In fact the World Gold Council reported that as of July 2011, collectively central bank net purchases had already passed the total for 2010. Plus of course China is likely continuing to surreptitiously add to its bullion stockpile as indicated in a recently released wikileaks document – a US diplomatic cable from 2009 reported,

“The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao)(04/28): “According to China’s National Foreign Exchanges Administration China’s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries. The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency. China’s increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB.”

So it seems unlikely that central banks are going to be supplying large quantities of bullion to the market place in the near future.

Likewise with world gold production still down from it’s peak in 2001 it’s seems unlikely that we will see a massive influx of supply coming from this quarter to depress prices.

With the amount of uncertainty around at present it’s hard to envisage such a fall happening. But while a 50% fall seems unlikely, it’s not an impossibility. And we reckon if you’re a holder of gold it’s worth thinking through scenarios such as this to consider how you’d react. Those of us who held silver in 2008 had to sit through a very large drop then and so know what it might feel like. But if you’re a more recent buyer it’s worth contemplating your possible reaction.

As we explained in this article from last week, we prefer to follow indicators other than price as a measure of when a top might be reached. And as the 1970’s show a 50% fall isn’t necessarily indicative of the end of a bull market. But it pays to have patience when it comes to gold as while it can move upwards very quickly, history shows there are also periods where it may go nowhere for a while too.

Nice Article!

It is interesting to see the main stream media only now talking about gold and silver. On CNBC, they are finally mention about the good side of investing in precious metals…a little bit too late, but better than never I’d say.

One thing you have to remember while investing in Precious Metals: Remember that you are investing on the long term. Don’t let downturns in prices affect your plans. Rest assure, it is better hold gold and silver than cash.

Pingback: Gold and Silver in NZ dollars - 2011 the year in review | Gold Prices | Gold Investing Guide

Pingback: Plunging Gold and SIlver Prices and Supply Delays on Their Way? | Gold Prices | Gold Investing Guide

Pingback: How Far Can Gold and Silver Climb? | Gold Prices | Gold Investing Guide

Pingback: Is it Time to Sell Gold or Silver? | Gold Prices | Gold Investing Guide

Pingback: After the Fall - Bill Bonner: The "Good News" About Gold | Gold Prices | Gold Investing Guide

Pingback: Gold and Silver in NZ Dollars: 2012 in Review and What Lies Ahead? | Gold Prices | Gold Investing Guide

Pingback: How Much Further Could Gold in NZD Fall? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Special Deal on 30 oz’s or more of NZ Gold

Pingback: Gold Prices | Gold Investing Guide Gold and Silver in NZ dollars: 2013, the Year in Review and Some Guesses for 2014

Pingback: Gold & Silver Plunge Again - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide

Pingback: How Much Further Might Gold Fall - What About in NZ Dollars? - Gold Prices | Gold Investing Guide