|

Gold Survival Gold Article Updates:

Aug 6, 2014

This Week:

- A Bipolar week for precious metals

- Kiwi Dollar Actually Going Sideways

- Does Gold Seasonality Affect the NZ Dollar Gold Price?

A bipolar week for precious metals with gold up and silver down quite sharply.

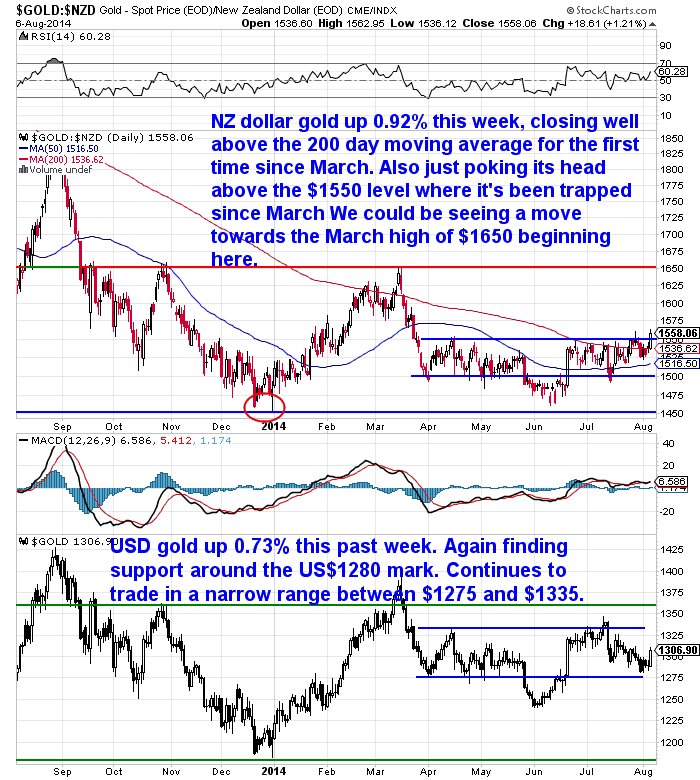

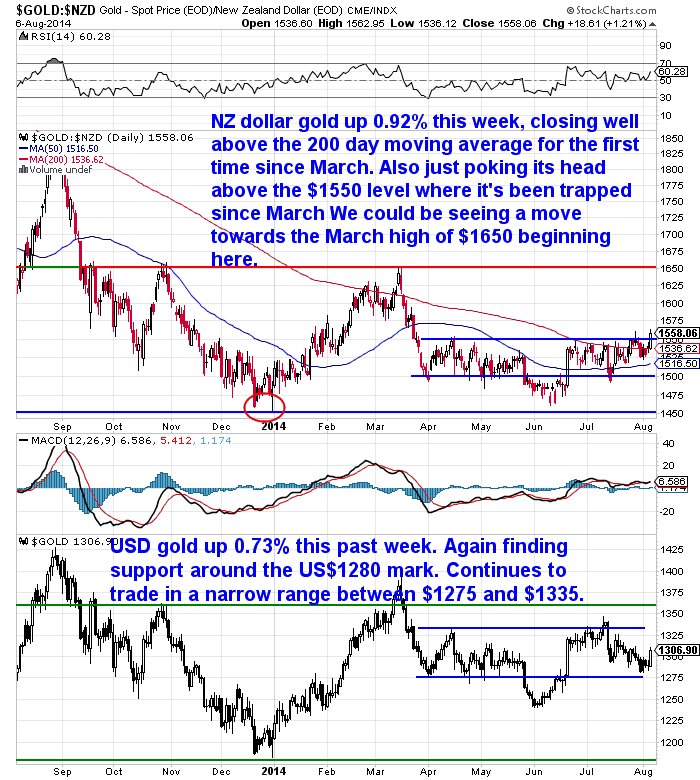

Gold in NZ dollars is up NZ$14.11 or 0.92% to NZ$1543.11. While in US dollars gold is up US$9.50 or 0.73% to US$1306.24

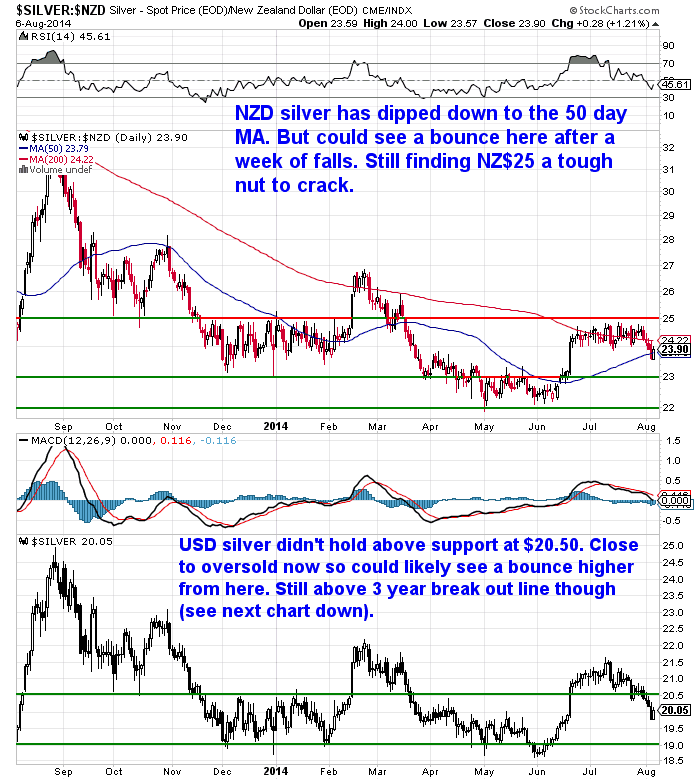

Conversely silver in NZ dollars is down 63 cents or 2.59% to NZ$23.69 and silver in US dollars is down 57 cents or 2.76% to US$20.06.

Looking at the gold chart there have been a few significant occurrences this past week.

Firstly we’ve seen the price close clearly above the 200 day moving average for the first time since March.

NZ dollar gold has also poked its head above the $1550 level that it has been trapped beneath since March.

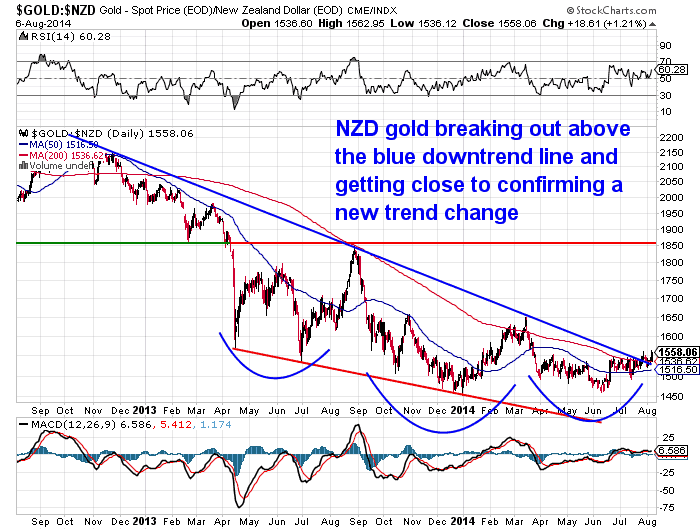

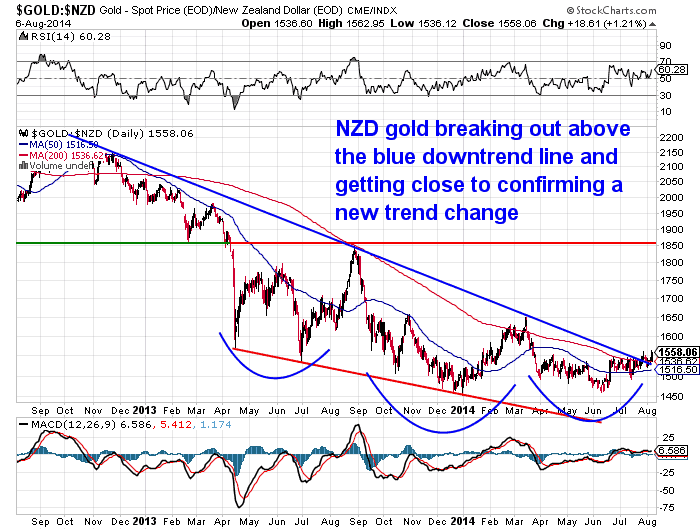

Also on a longer term chart we have possibly seen a change in trend take place this past week. NZD gold has been trading within the confines of a downward trend line for the past 2 years. (See the blue line in the chart below). But today it looks to have broken out above this downtrend line – albeit with little fanfare.

The fact that this has gone largely unnoticed and that buyers still remain thin on the ground is a positive factor we’d say.

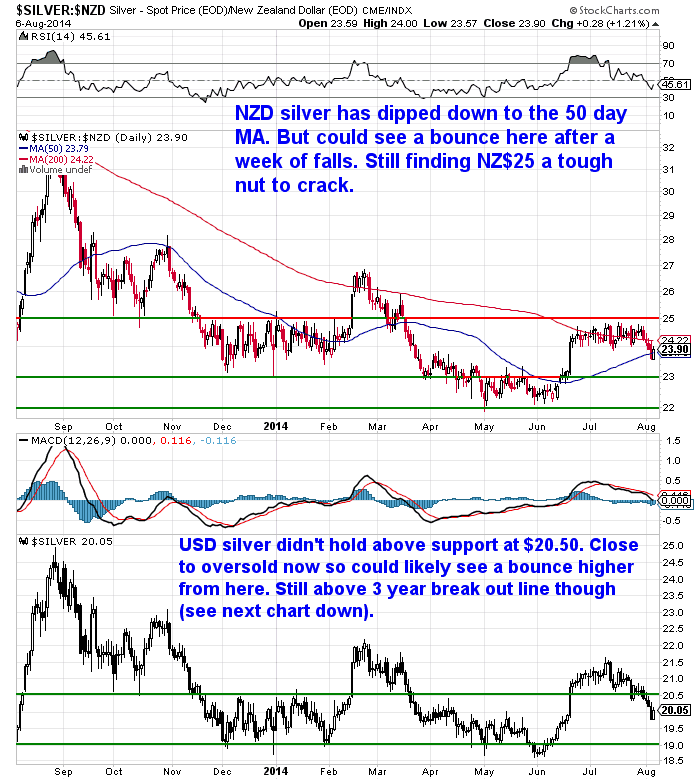

The silver chart is not as buoyant as gold however. Dropping back below NZ$24. However this was perhaps necessary given the large $1 single day jump back in June possibly needed some “backing and filling”.

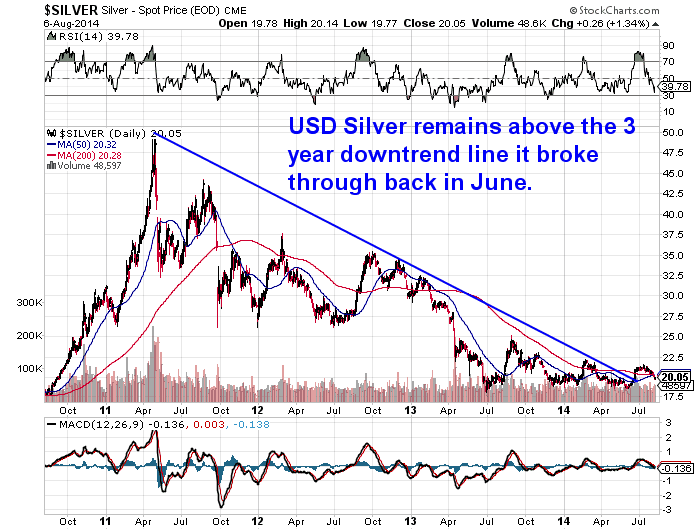

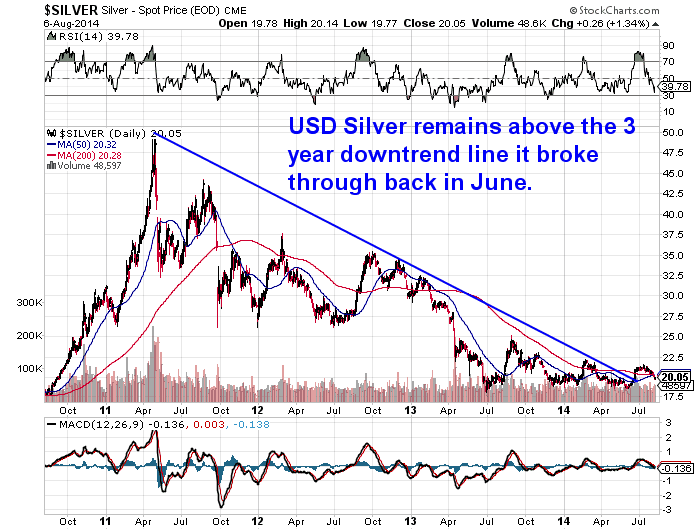

The breakout above the 3 year downtrend line we noted back in June for US dollar silver is still in play however – clearly seen in the chart below.

Kiwi Dollar Actually Going Sideways

With another massive fall in the Global Dairy Index following auctions yesterday (down 8.4%) the NZ dollar has taken another fall this week. Albeit it has bounced back today. We’ve seen more analysts lower their Whole Milk Powder price projections for next year again as a result too.

So we might be seeing a change in sentiment and therefore trend in the kiwi dollar too. Although the interest rate differential is likely to offer some ongoing support – while it lasts anyway.

But for all the talk of a record high kiwi dollar, it’s actually been in a sideways trading range for the past almost 4 years as you can see clearly below. Given we remain near the top of this range you’d have to say there is more risk to the downside than the upside still.

As mentioned already there have been a few marks quietly broken through for gold this week. But what does the rest of the year have in store now?

We look at this in our feature article for the week: We look at this in our feature article for the week:

Does Gold Seasonality Affect the NZ Dollar Gold Price?

Given we are coming out of what is often the northern hemisphere summer “lull” we thought we’d have a look and see if the pattern of a rising gold price in the later part of the year was also true in NZ dollar gold. So check that out now.

We’ll give you a hint in advance: Once you’ve read it you might get an inkling that now is a decent time to be buying.

If so you know where to find us. And trust us when we say you’ll be one of the very few currently buying – not a bad thing to be usually.

This Weeks Articles:

| Where will NZ fit in a rejigging of the world monetary order ? |

2014-07-31 01:56:04-04 2014-07-31 01:56:04-04

Gold Survival Gold Article Updates Jul 30, 2014 This Week: NZ Dollar Continues to Drop Would Rising US Interest Rates Dent Gold? Where will NZ fit in a likely rejigging of the world monetary order? The weakening kiwi dollar has again been the main driver this week for precious metals prices in NZ dollars. While […]

read more…

The Single Most Important Strategy Most Investors Ignore |

2014-08-06 17:59:20-04 2014-08-06 17:59:20-04

Both the Eurozone and Canada are mentioned in this article as sanctioning bank “bail ins” or confiscation of savers funds, and given as a reason for internationalising some assets. Sound advice we reckon, especially since NZ was actually the first to enact such rules. (See this article/video for a primer: RBNZ Bank “Bail In” Scheme […]

read more…

Does Gold Seasonality Affect the NZ Dollar Gold Price? |

2014-08-06 21:23:04-04 2014-08-06 21:23:04-04

If you’ve been around the gold sector for a little while you’ve no doubt come across talk of “gold seasonality”. What is Gold Seasonality? Gold seasonality generally refers to the northern hemisphere mid summer lull in precious metals markets – which often seems to match the share market lull at this time of year. This […]

read more…

|

|

We look at this in our feature article for the week:

We look at this in our feature article for the week: 2014-07-31 01:56:04-04

2014-07-31 01:56:04-04

2014-08-06 17:59:20-04

2014-08-06 17:59:20-04

Pingback: Gold in NZD Has Broken Out of a 2 Year Downtrend - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide