We’ve previously looked at all the reasons we could think of as to why to buy gold. So it seems only fair that we should give “poor mans gold” the same treatment and so today we look at the question – “Why buy silver?”…

Table of Contents

Reasons to Buy Silver? Same as the Reasons to Buy Gold

First up a number of the reasons we mentioned to buy gold also hold true as to reasons to buy silver in 2023. These include:

- Global markets in general are still as risky as ever.

- Geopolitical risk is still very high.

- Inflation rates are at multi-decade highs

- Central Banks are caught between a rock and a hard place: Inflation vs Easy Money

- Real interest rates are negative.

- 5 major bank failures already in 2023

- Mine supply has peaked (Recycling was up 1% in 2022, but is 30% below all-time highs). And unlike gold, much of silver supply comes as a by-product to other industrial metals such as copper and zinc, so during economic slowdowns supply can diminish.

- Chinese are buying – But are likely much larger holders of gold than they declare

- Central Bank buying has pushed global gold reserves to an almost 30 year record

- To remove some of your wealth from the banking system.

- Physical silver also has no counterparty risk.

- Protection from devaluation.

- Every fiat (government decreed) currency has eventually gone to zero throughout history.

- Silver has also been used as money for millennia – like gold it is a store of value, unit of account and medium of exchange. On this last point, if things really go pear shaped then silver’s smaller value per unit of weight means it would be better suited to small everyday purchases. Learn more: What Use Will Silver Coins be in New Zealand in a Currency Collapse?

(For a fuller explanation of each point check out the Why Buy Gold? article).

So Why Buy Silver Specifically?

Those were reasons to buy gold and silver. But now let’s look specifically at the reasons to buy silver.

Read more: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver

Why Buy Silver? It’s cheap compared to gold

First up the fact that silver is poor mans gold is enough of a reason for many people who view gold as too expensive for them. Silver currently costs around 1/83rd of gold. So even those with limited savings and limited spare cash-flow can still buy some silver regularly.

(Of course you can buy smaller denominations of gold to make up for this but you’ll usually pay a higher premium above the spot price for the privilege. See: What Type of Gold Bar Should I Buy? The 2020 Ultimate Guide).

Why Buy Silver? It’s in a stealth bull market

Silver is still off the radar of the average person in the street. From personal experience the average person we talk to (who doesn’t buy precious metals), may know that gold rose in price following the COVID-19 panic, the war in Ukraine and more recently the US bank failures. But, they are completely unaware of silver.

Also unlike gold they have no idea what silver sells for per ounce. So the silver bull market is less mature than gold and still in the stealth phase where it rises without too many noticing.

Why Buy Silver? The silver market is tiny

Estimates are that the above ground silver inventory is only about 1 billion ounces. At today’s prices that would total only US$23.7 billion. So it wouldn’t take too many billionaires getting on board to dramatically affect this supply and therefore the price.

Why Buy Silver? Growing Industrial demand

Silver is the most widely used commodity next to oil (source). It has over 10,000 industrial uses. Besides electronics and solar energy production, silver’s medical uses are also growing due to its anti-microbial and anti-bacterial properties.

There is no economically viable substitute for silver in many industrial uses, so manufacturers have to accept any price rise. But silver’s price is low enough so that for the amounts used industrially, even a doubling or tripling of the price would not significantly affect the end price of produced goods such as consumer electronics.

However this greater industrial demand is a doubled edged sword as this makes silver even more volatile than gold. It reacts even more to changes in the global economy.

Why Buy Silver? It’s being used up

There is also the argument that as silver has many more industrial uses than gold that it is being used up. Whereas pretty much all the above ground gold ever mined still exists today.

So the theory goes that the silver supply is steadily diminishing versus the gold supply which slowly rises every year. Estimates have been made that 95% of the gold ever mined still exists. Whereas 95% of the silver mined has been used up.

Why Buy Silver? Investment demand is growing

Investment demand for silver is growing. Evidenced by notable increases across the board in 2022:

TOTAL GLOBAL SILVER DEMAND POSTS RECORD HIGH OF 1.24 BILLION OUNCES IN 2022

All major silver demand categories achieved record highs in 2022, pushing total silver demand to a new high of 1.242 billion ounces (Boz) last year. Silver industrial demand rose by 5 percent, physical investment increased by 22 percent, and jewelry and silverware rose by 29 and 80 percent, respectively, leading to the total global silver demand milestone. Since 2020, the global total has increased by 38 percent as world economies recover from the pandemic.

Along with record silver demand and lower mine production, the silver market achieved its second consecutive annual structural deficit, at a significant 237.7 million ounces (Moz) last year.”

Source.

Why Buy Silver? Supply insufficient to meet demand

Global mined silver production fell by just 0.62 percent in 2022, reaching 822.4 Moz. So silver supply was pretty stable.

However it was again not enough to meet demand in 2022:

“Record global silver demand and a lack of supply upside contributed to last year’s 237.7 Moz market deficit, the second consecutive annual deficit, possibly the most significant deficit on record. Of note, the combined shortfalls of the previous two years comfortably offset the cumulative surpluses of the last 11 years.”

Source.

The outlook for 2023 supply is not likely to be any better:

“[2023] will also see another large deficit for silver, amounting to a projected 142.1 Moz, which would be the second-largest deficit in more than 20 years. Adding up the supply shortfalls of 2021-2023, global silver inventories by the end of this year will have fallen by 430.9 Moz from their end-2020 peak. To put this into perspective, it is equivalent to more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.”

Silver – More Upside Than Gold?

So with these factors in its favour, it’s not too surprising that many people believe silver has potentially much more upside than gold.

This is shown by a number of measures such as:

Silver still to reach previous highs

Silver is the only commodity still cheaper than 43 years ago and still to make a new nominal high. Gold has well and truly surpassed its nominal high from 1980 of US$850.

Whereas the price of silver is still someway off its 1980 high of US$49.50, when the Hunt brothers had basically cornered the silver market. Some would argue that these prices were “bubble-like” and not fair comparisons.

However the likelihood is that gold and silver will eventually reach bubble prices again in this current bull cycle. A general rule is prices usually make extremes in either direction at the start and end of a cycle.

There is still a lot of upside left, even to reach the high from 2011. In NZ dollars this was just above NZ$60 as seen below.

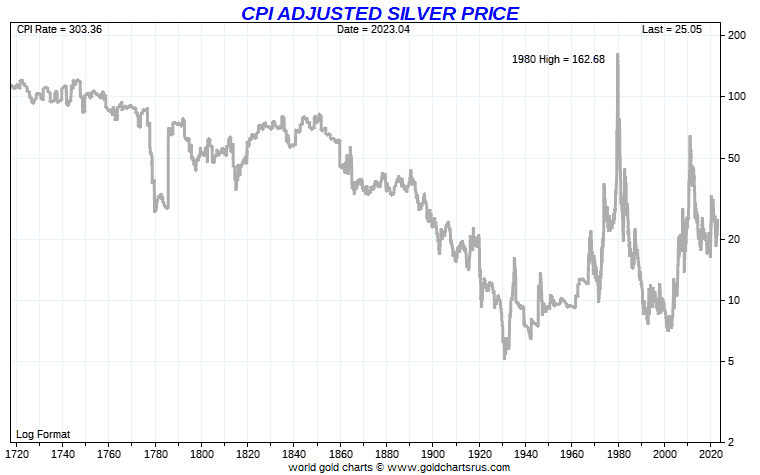

Silver has even further to reach inflation adjusted highs

Gold has to rise to US$3,517 to reach its inflation adjusted 1980 high of US$850 (1.8 times the current price). Silver has even further to go, needing to reach US$162.68 to match its inflation adjusted 1980 high of US$49.50. Almost 7 times higher than the price right now. (This projection is up from US$149.56 in April 2022).

However these numbers are using the very fudged US government CPI figures that have been tweaked many times over the past decade or so. With the result being that these adjustments and substitutions definitely under report inflation. So using Shadow Government Statistics numbers we’d arrive at something closer to US$28,642 for gold and US$1324.86 for silver (up from US$1089.90 in April 2022).

The gold silver ratio is currently way above long term historical norms

This ratio is simply the amount of ounces of silver you can buy with one ounce of gold. Currently it stands at 83:1. In the last 25 years it’s been as high as 125:1 and as low as 32:1. The 20 year average is around 60.

While the long term ratio (we’re talking hundreds of years here) is about 16:1 – similar to estimates of the ratio of silver to gold in the ground. At the end of the last bull market in precious metals the ratio reached 16. If it was to reach 16 again, silver would have to rise significantly from here comparatively to gold.

Even to reach the higher level of 50 would still be a large increase in the price of silver. Learn more about the gold silver ratio: What is the Gold Silver Ratio? What are New Highs in the Ratio Telling Us?

Learn more about why silver could have more upside than gold: Could Silver Be Worth More Than Gold?

In Conclusion: Lots of Upside in Silver as Well as Protection

So that’s quite a list of reasons as to why to buy silver right now in 2023!

If history even comes close to repeating then there is a fair bit of upside left in silver. Or rather, at the rate central banks are creating paper currency, a fair bit of downside to go in all of them.

Like gold, buying physical silver will not only protect your purchasing power from steady erosion via currency debasement, but also protect you with it’s lack of counter-party risk from the likes of banking default and financial system collapse.

Editors Note: This post was first published 1 October 2012. Last updated 23 May 2023 to include the latest numbers for the various measures discussed.

If you can think of any other reasons as to why to buy silver, then please share them with us and other readers by leaving a comment below.

For more information on the process of how to buy silver see: How to Buy and Invest in Gold and Silver >>

Or if you’d like a quote to buy silver bullion today then visit our order page at the link below:

Pingback: The Solar Silver Thrust | Gold Prices | Gold Investing Guide

I think that you should address the issue of Kiwisaver. Is it better or should you just buy Gold/Silver. I am retired but my children are not.

I know that if you were in a kiwi saver type fund overseas our Govt takes 100% of the proceeds. Thus there is no reason whatsoever for anyone currently overseas and planning to come here, to invest in such schemes.

The issue is much more complex here. If you buy gold /silver every month will you end up better off than placing your hard earned in a kiwisaver fund bearing in mind taxes and loss of freedom of choice!

I would like to make a comment regarding Maurices message on Kiwisaver. As a Kiwisaver participant, I recently did some research on Kiwisaver funds, I am also an investor in Precious metals with diverse holdings in stocks and physical metals. I was keen to find a fund that had precious metals as part of a portfolio. The only provider with a % of commodities in a fund is AXA Kiwisaver Growth fund of which make up 5% of the fund with 11% of that in Gold futures and 3.8% made up in silver the rest is made up with various other commodities. With the future prices in silver and gold set to sky rocket, I believe this fund will outperform the rest. I don’t however have information on how secure these investments are. I hope this helps.

Hi Chris,

Thanks for sharing your thoughts. That’s the only fund we’d heard of that was remotely invested in precious metals too.

Of course being only 5% commodities and only a sliver in gold and silver, it will be as or even more important how the rest of the fund investments perform. And it is invested in futures by the sounds of it, so there will of course be counter-party risk involved.

We’re a long way from being Kiwisaver experts so not sure if we can offer too much else of value at this stage.

Thanks for your comments anyway Maurice and Chris.

Glenn.

I would like to put my kiwi saver into silver bullion as well…

@Heiko, We imagine a few people would like to do the same. Unfortunately there are no precious metals funds in Kiwisaver that we know of. Last we looked there was only one that invested in commodities and this had only a tiny sliver in gold. Maybe some other readers have come across other options but we haven’t to date.

Pingback: Silver and Gold in NZD: Performance Year to Date 2012 | Gold Prices | Gold Investing Guide

Pingback: Gold and Silver in NZ Dollars: 2012 in Review and What Lies Ahead? | Gold Prices | Gold Investing Guide

Pingback: Why is Silver Lagging Gold? | Gold Prices | Gold Investing Guide

Pingback: Gold Prices | Gold Investing Guide Silver or Gold? Which Should You Buy?

Pingback: Gold & Silver in NZ Dollars: 2014 in Review & Some Prognostications for 2015 - Gold Prices | Gold Investing Guide

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: The Last Great Silver Buy - Gold Survival Guide

Bought 15 ounces of gold in 03 & 04, at close to 400 US per. bought some silver also. Could have bought over twice that much, and wish I had. No big time here, but sold it the latter half of 2011 and made 358% profit. Just goes to show what the everyday person can do with a little patience. Once you’ve made money at it, you can smell it coming. The aroma is very strong these days. Even if you only have five or ten thousand, I would suggest that anybody buy as much as they can get their hands on.

Nice work in timing the purchase and the sale! Odds are that right now is not that dissimilar to 2003/04 in terms of time to buy.

Pingback: 12 Reasons Why Gold and Silver Will Rise in 2018 - Gold Survival Guide

Pingback: 30 of the 100’s of REASONS to Sell Gold & BUY SILVER - Gold Survival Guide

Pingback: Should I Buy Gold or Silver? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: What Type of Silver Bar Should I Buy? - The Ultimate Guide to Silver Bars - Gold Survival Guide

Pingback: 5 Reasons to Buy Silver Right Now

Pingback: Can Silver Rise When JP Morgan Controls So Much Physical and Paper Silver? - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide

Pingback: Why Buy Gold? No Fiat Currency Lasts Forever - What About the NZ Dollar? - Gold Survival Guide

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: The Death of Term Deposits in New Zealand? - Gold Survival Guide

Pingback: In Gold We Trust Report 2022 Out Now: Stagflation 2.0 - Gold Survival Guide

Pingback: Are You Happy to Work an Extra 22 Days a Year For Free? - Gold Survival Guide

Pingback: Exit Strategies For When the Time Comes to Sell Gold and Silver