Just over 5 years ago John Butler gave an excellent talk in Auckland which we were fortunate to attend entitled “Remonetisation of gold is inevitable”.

Butler outlined why we may have a full return to gold backed money. He believed a remonetisation of gold would be the ultimate response to the current situation. Where policy makers are deliberately trying to create inflation to stimulate growth and get us out of the current mess. We will again see gold being used to settle balance of payments transactions internationally.

Gold Allowed as Tier One Capital For Banks?

In this talk way back in 2013 Butler explained that a change was being mooted in the Basel banking regulations to allow gold as Tier one capital. This would give banks more flexibility to hold gold as collateral. A move driven by weaker European countries whose banks are no longer able to hold their nations sovereign debt as it is now no longer of Tier One calibre.

We also highlighted this potential change back in 2012. Along with an email from the Reserve Bank of New Zealand showing how they don’t hold any gold because it does meet their “liquidity requirements”.

Read on and you’ll see why this statement from the NZ reserve bank looks very foolish now.

Gold Remonetisation Closer Than We Think?

Last week our favourite financial newsletter writer Chris Weber drew our attention to an excellent article on this same subject by Palisade Research entitled: Could Gold Remonetisation Be Closer Than We Think?

The author explains how gold was officially demonetised in 1978. But now remonetisation is quietly underway.

A significant moment occurred in February when the Swiss National Pension Fund exited their synthetic gold derivatives and instead moved into physical gold – a.k.a. monetary gold. In the new Basel III banking capital rules,Monetary gold is defined as “physical gold held in their own vaults or in trust.”

This move into physical gold puts the pension fund in line with new banking regulations regarding capital adequacy for which Systemically Important Financial Institutions (SIFI) must comply by January 2019.

Financial Crisis Forces a Rethink of How Assets Are Valued

The financial crisis forced a rethink of how assets are valued and demonstrated the importance of considering counter-party risk.

“The Basel Committee on Banking Standards (BCBS) scrapped the old Basel II framework and put in place a plan that will be fully realized by all SIFIs by 2019.

And this new system is already in place in Canada, as confirmed by Canada’s top financial regulator, the Office of the Superintendant of Financial Institutions (OSFI). Under the previous rules, gold was rated as a Tier 3 asset (there are now only two Tiers), and had a 50% Risk Weighting Assessment (RWA).

This meant that an institution that held gold reserves on its balance sheet could only apply half of its market value towards its solvency requirements.

But under Basel III, monetary gold now qualifies as a Tier 1 asset, and is 100% valued for the purposes of banking viability.

Another point to consider is that SIFIs are now required to quadruple their reserves when compared to the previous minimum requirements before the banking crisis.

Essentially, monetary gold is now considered risk free. This significant development remains relatively unknown – for now.”

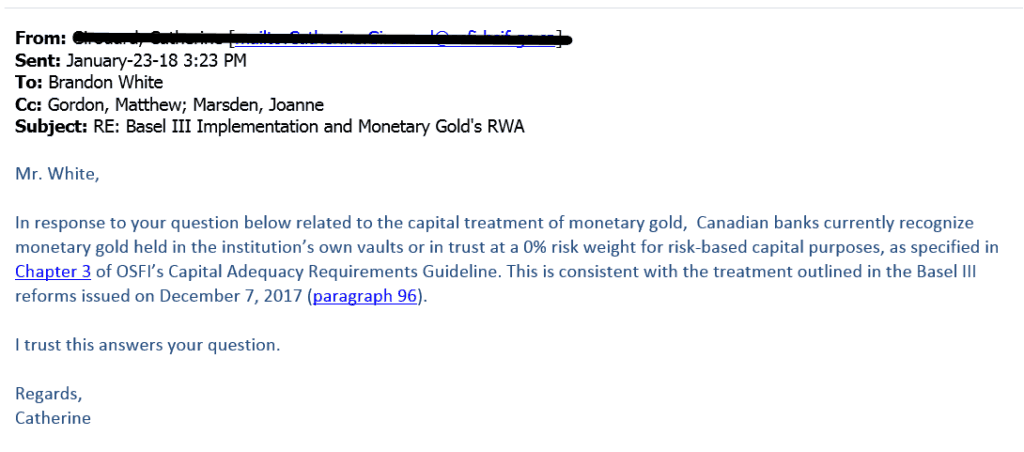

We knew it was coming but have to admit we’d missed the latest update to Basel III as mentioned in the below email from the top Canadian financial regulator. Gold is already being treated as a 0% risk asset in Canada:

ETF’s Now A Major Risk Compared to Last Financial Crisis

The author also points out that the allocation to gold ebbs and flows with sentiment, market fundamentals and, now increasingly, monetary policy. He then goes on to explain a significant change since the last crisis, a risk that few people are aware of:

“A notable change in the investment landscape is the incredible capital flows into a relatively new financial instrument: the exchange-traded fund (ETF). The potential for a liquidity event in ETFs is ominously being disregarded. The risk with these instruments lies in the fact that they have not been tested in a systemic event.

The ETF market cap was tiny when the last crisis hit. But this is no longer the case.

The Securities and Exchange Commission (SEC), the International Monetary Fund (IMF) and even the Bank for International Settlements (BIS) have warned of the risks associated with these complex derivatives.

And other than an ETF’s Authorized Participants (AP), and a curious few, almost no one seems to grasp how the Market Makers and the Secondary Market own or trade the underlying asset(s). Few are clear on how ETF shareholders or APs will fare in a liquidity event. The average money manager and investor seem to think ETFs are just a less expensive mutual fund with better liquidity. Nothing could be further from the truth when examined with an eye on counter-party risk.

Had the market considered the counter-party risk in mortgage-backed securities (CDOs), there may never have been a crisis. . .

Gold derivatives are not monetary gold, and cannot serve the role prescribed by the Basel III framework.

Central banks and large institutions will increasingly turn to monetary gold in the coming months and years (as we’ve seen post-2008). They will seek to add the quality that only monetary gold provides [no counter-party risk].

Capital flows into monetary gold will reflect the need for an asset that is liquid, tested and trusted. Gold’s re-monetization is now officially a matter of global monetary policy.”

So the steady buying of gold by many central banks around the world in recent months is not likely to subside anytime soon.

It seems as though the central planners are preparing for the next crisis with gold remonetisation. So make sure you have your own financial insurance as a hedge too. Become your own central bank and buy gold.

Pingback: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation? - Gold Survival Guide