Prices and Charts

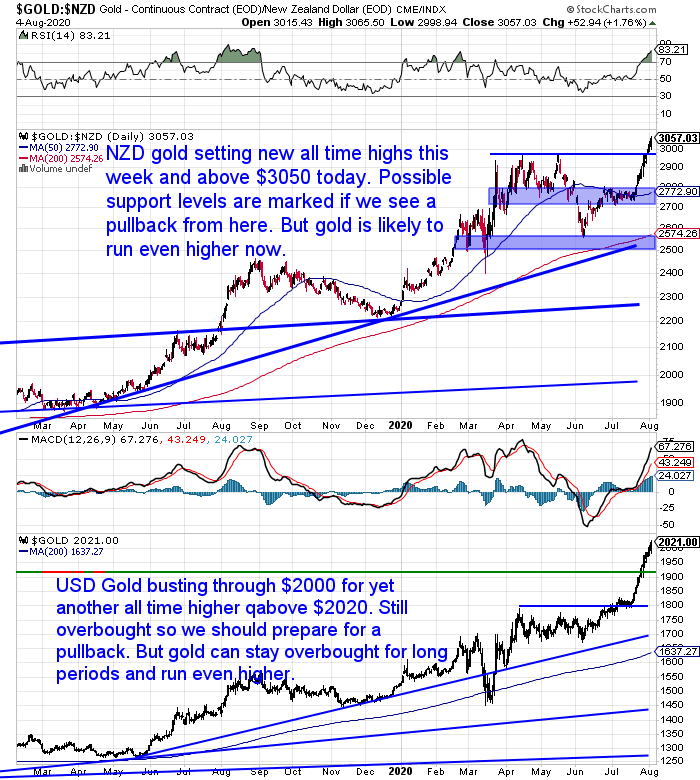

Gold Breaks US$2000 and NZ$3050

This gold bull market looks serious. Gold doesn’t seem to be down for more than a day or 2 at the moment, before bouncing back.

Gold in New Zealand dollars launched higher this week to set a new all time. But has jumped even more this morning getting above $3000 but then carrying on all the way to $3050.

Meanwhile USD gold also broke through the significant $2000 barrier after the new all time high last week.

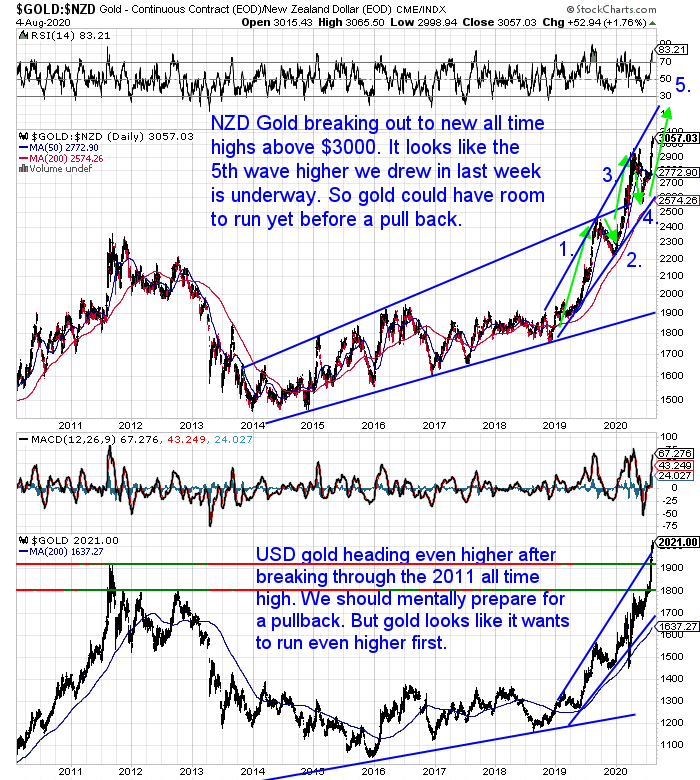

It looks like the 5th wave up we wrote about last week is now underway.

So despite remaining overbought on the RSI indicator (see the green shaded area in the bar at the top of the chart below), NZD gold could push even higher under this 5th wave up scenario.

If you look at the chart above you can see that in August 2019 gold remained overbought for more than a month. It’s only been about 2 weeks so far.

We keep saying prepare mentally for a correction. But that doesn’t mean it will happen tomorrow.

But if gold keeps charging higher then when a correction arrives it could be a deeper one. So consider keeping some “powder dry”.

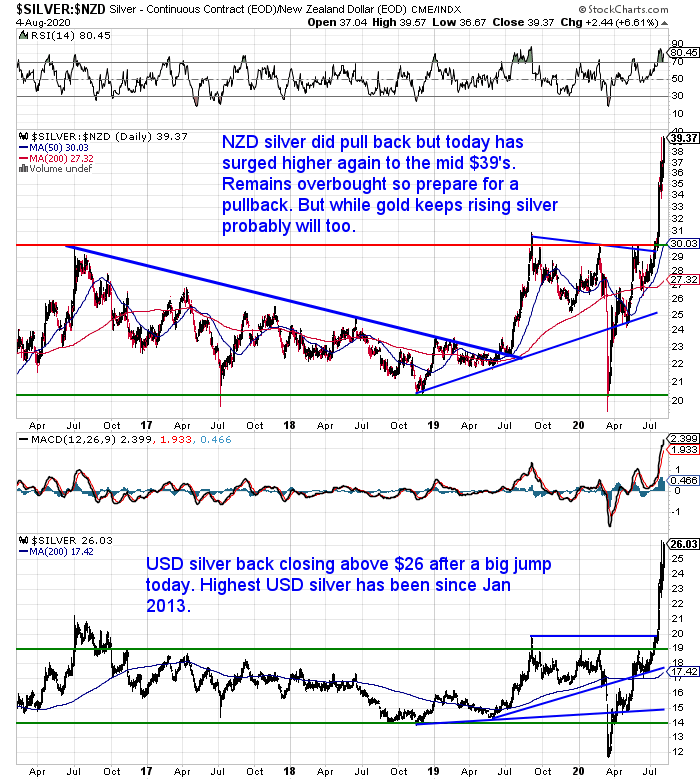

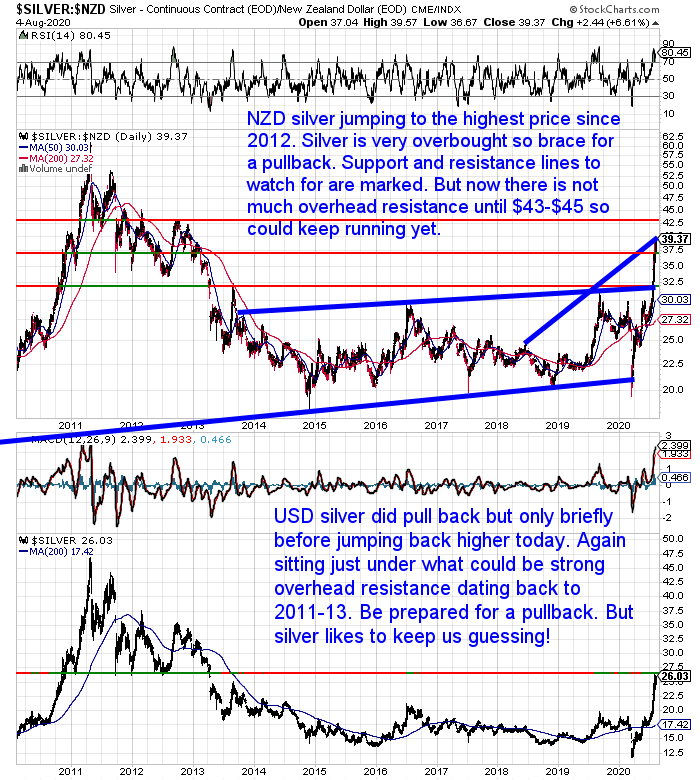

Silver Bounces Back Strongly

Silver is up over 6% this week. Just under NZ$40 per ounce. While in US Dollars silver is just over $26. It had the briefest of pullbacks before charging back.

Check out the longer term chart below. NZD silver could run even higher yet as there is not much overhead resistance until $43-$45. But like gold, prepare also for an eventual pullback.

In US dollars silver is sitting right on the overhead support/resistance line that dates all the way back to 2011-2013. So we’d expect that to take some breaking.

But silver is certainly keeping us guessing at the moment.

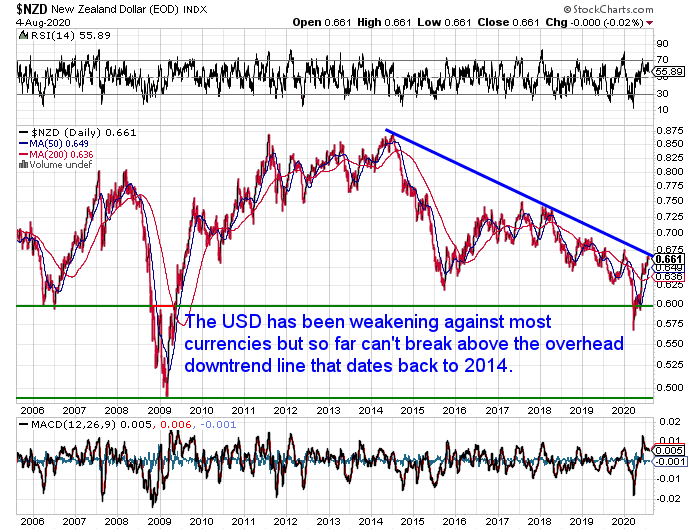

NZ Dollar Still Sitting Just Under Long Term Overhead Downtrend Line

The New Zealand dollar is down a little from last week. So far it hasn’t managed to get above the long term overhead downtrend line dating back to 2014.

This is despite the fact that the US Dollar is weakening against most currencies. We could expect a bit of a further pullback in the Kiwi from here. As the USD index appears to be showing a bit of short term strength after the recent steady fall.

That could give local precious metals prices a further boost.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

What Does Gold Spot Price (Or Silver Spot Price) Mean?

With gold and silver prices continuing to rise, like our reader below, you might have wondered what exactly is the spot price?

“must say I like your approach to educate us novices… it is how it ought to be…. But….

….why is there a difference between the spot gold/silver price and the gold/silver bar price?

If it’s because the bars have been manufactured…. then in what form does the spot gold/silver come in?”

So here’s a full run down on the spot price of gold and silver… even if you’ve been around gold and silver for a while you might still learn something…

Is Inflation Coming? If So, What Kind?

Is inflation coming?

Central Banks the world over have engaged in massive amounts of currency printing in recent months as a response to government imposed lock downs.

Surely this means inflation is inevitable?

Here’s a few opinions on inflation that we’ve come across recently. Along with our thoughts on the matter at the end…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Contrarian Sign? ASB Mentions Gold

We’ve been receiving the ASB Commodities Weekly report for years. But this is the first time we recall seeing gold even mentioned!

“On a final note for the week, the price of gold has just set a new record high of US $1,980 per ounce, beating the previous high of $1,920 set back in 2011. Whilst NZ commodity price developments over recent months have been largely been driven by recovering demand for consumption, the gold price surge this year seems to be fueled by investors looking for alternative assets to ride out the COVID -19 pandemic.”

To us, when gold starts to appear in the mainstream that is a warning it is getting a bit frothy. A pullback is then on the cards. Or, at least a consolidation to remove gold from the headlines.

So a reminder to consider keeping some funds aside in case of this. That way you can get a good overall entry position. But still have a stake in the ground in case prices run higher.

A good buying plan is to split your cash up into a number of tranches or lots. Buy a slice of gold and/or silver now and then wait and see what happens. Price rises. At least you bought some lower. Price falls. Buy more at cheaper prices.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: The Precious Metals Correction Finally Arrives! Gold and Silver Down Sharply - Gold Survival Guide