Is inflation coming?

Central Banks the world over have engaged in massive amounts of currency printing in recent months as a response to government imposed lock downs.

Surely this means inflation is inevitable?

Here’s a few opinions on inflation that we’ve come across recently. Along with our thoughts on the matter at the end…

Firstly Graham Summers on “The Potential for an Inflationary Spiral”

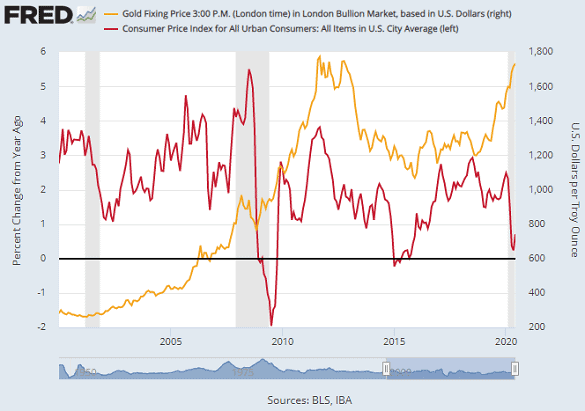

Graham Summers explains that a rising gold price signals that the market is “smelling” higher inflation. And because gold is now grabbing headlines, the average person is waking up to this fact.

So… what does all this mean?

“The Fed will now either be forced to confront inflation (hike rates or tighten policy) OR it will begin to lose control.

Confronting inflation, by tightening monetary policy, would mean kicking the already weak economy just as it’s getting back on its feet. This is a guaranteed “depression” trigger and stock market crash.

On the flip side, ignoring gold’s move higher means letting inflation get out of control.

Can the Fed afford to let the inflation genie out of the bottle? The last time it did this was in the 1970s, and it didn’t stop until the Fed had raised interest rates to 19%.

This is a literal “no win” situation for the Fed. One choice leads to a depression/crash.

The other leads to stagflation at best – a situation in which inflation is high, economic growth slows, and unemployment remains steadily high. Otherwise known as recession-inflation.

And our money is on stagflation.

We believe the Fed would rather risk letting inflation get out of control than triggering a depression. The Fed has always adopted a “kick the can” mentality when it comes to major problems.

Inflation will prove no different. Which is why we believe inflation will continue to spiral out of control in the coming months.”

Fund Managers and Commentators Also See Inflation as More Likely

Bullionvault recently covered a number of reports on inflation from larger fund managers and commentators:

“Some investors seem to think inflation is finally making a comeback after a long absence,” says Michael Mackenzie, the Financial Times‘ senior investment commentator, pointing to demand for Treasury inflation-protected securities.

Investors poured more than $5 billion into mutual funds holding Tips in the week ending July 8, reversing outflows seen during the Covid deflation panic of March and April.

With returns adjusted to account for moves in consumer prices, demand for 30-year Tips has been so strong that the annual yield offered to new buyers today sank below minus 0.30% according to Bloomberg data.

“For the first time in 40 years, we believe we may now have to face up to the corrosive power of inflation,” says Teun Draaisma and Ben Funnell, co-portfolio managers at hedge fund giant Man Group’s DNA team.

“Attempting to protect portfolios could mean buying not-so-liquid inflation-linked securities and floating-rate bonds; pursuing value and momentum strategies in equities; and purchasing commodities, gold in particular.”

Gold-backed ETF trust funds also continued to expand last week, as both the SPDR Gold Trust (NYSEArca: GLD) and the iShares gold ETF (NYSEArca: IAU) saw additional investor inflows mark their 16th consecutive week of new growth.

“[Inflation] is going to happen, so we need to be ready for,” reckons Merryn Somerset Webb, editor-in-chief of UK magazine MoneyWeek.

“It takes a very, very long time to get proper inflation going but [then] it is almost impossible to stop without really nasty stuff happening…We need to hold gold obviously.”

But Could it Be Deflation Instead?

The counter argument is that we instead see a deflationary recession in the next year or so. Vern Gowdie in the Rum Rebellion just today wrote:

“Inflation is a comin’…or so we are told.

Don’t bet on it.

This extract is from a Bloomberg article published on 31 July 2020 by Gary Shilling (emphasis added):

‘The situation is ghastly, with Covid-19 infections accelerating…there are the problems of reopening businesses, re-establishing and reorienting supply chains and encouraging many to return to work who are now paid more by federal and state unemployment benefits than when they were employed.

‘The recent [US] Treasury bond rally fits with our forecast that the recession has a second, more serious leg that will extend well into 2021, despite massive monetary and fiscal stimulus. Declining business activity saps private credit demand and makes Treasuries shine as havens. A deep recession also breeds deflation to the benefit of Treasuries.’

The containment of inflation was due to an excess of supply over demand.

Think about this. With the zombies still being kept alive, supply has not suffered a natural attrition.

However, demand has fallen off a cliff. Savings rates are up. Credit is harder to come by.

Consumers are lacking confidence.

If the supply and demand imbalance was bad before, it’s even worse now.

Deflation is a comin’.

…At present, two of the most crowded trades are…higher gold price and weaker US dollar.

In my experience, when almost everyone thinks things are headed in one direction, invariably the opposite happens.

Here’s my wild prediction for the next 12 months…as a deflationary recession grips the world.

Gold to fall to US$1,000.

AUD versus USD goes to 50 US cents.

Gold in AUD will be $2,000, around 30% lower than the current price.”

Related: Inflation Versus Deflation and What Comes Next?

Alisdair Macleod Theorises Why Stagflation Will Arise This Time Around

Macleod explains how stagflation could be coming. As the COVID lockdowns have resulted in high unemployment but also a vast reduction in the production of goods. Central banks worldwide have responded…

“Into this situation are injected enormous quantities of money, none of which defeats the constraints on true supply of goods, nor on overall demand in a high-unemployment economy. Put in a more familiar way, we will have too much money chasing not enough goods. There is only one outcome, other things being equal; the purchasing power of the dollar in terms of consumer goods will be driven significantly lower. But central bank analysis rules this out, associating too much money chasing too few goods with only an expanding, overstimulated economy.

This explains stagflation, the situation where an economy stagnating in overall demand is accompanied by rising prices. Nor are other things ever equal, the condition for the paragraph above. The early receivers of inflated money will spend it, driving up the prices of the goods and services they acquire before the prices of other goods and services are affected. These early receivers include the federal government, which in an election year is doubly unlikely to hold back. Distribution of state money will increasingly be in the form of welfare to the unemployed, skewing spending toward life’s essentials. Inevitably, in an economy with subdued activity not responding quickly enough to produce the volumes of products desired, prices, mainly of essential items, will increase sharply.

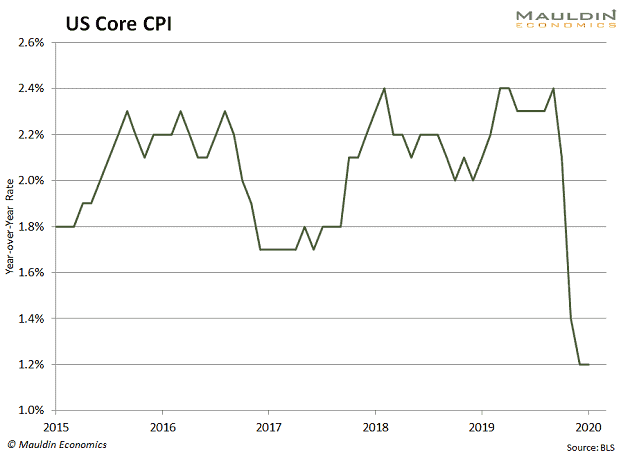

Almost certainly, a broad index of prices will not capture this secular effect until too late. The CPI (Consumer Price Index) includes a majority of items which are only occasionally bought by individuals. Poor demand for nonessentials where there is now an oversupply puts downward pressure on their prices even in an inflationary environment. It is therefore possible for the CPI to record little or no price inflation as an average when food and energy prices are rising strongly, particularly when statistical methods designed to show little or no increase in price inflation are additionally taken into account.

Consequently, central banks are already being badly misled by the CPI’s statistical method. And when prices for essentials are soaring, they will continue to increase the quantity of money in circulation, distracted by that 2 percent increase in the CPI target. By the time it creeps up above that rate it will be too late, much monetary water having already flowed under the bridge.

The politicians will likely dismiss rising prices for food and fuel as the result of profiteering—they always do and then contemplate introducing price controls, making this outcome even worse.”

Source.

Jared Dillian in the 10th Man on Inflation and Silver

Jared Dillian highlighted what is different between 2008 – when the expected inflation didn’t arrive – and now…

A lot of people (myself included) were worried about inflation in 2008. There were a lot of inflation trades back then—some worked, some didn’t. But we never got inflation.

There’s a reason to think things are different this time.

Last time, we had inflation in asset prices (but nothing else), which caused all sorts of inequality and led to some of the civil unrest that we are seeing today.

This time, we are getting a fiscal response as well as a monetary response, in the form of the stimulus checks and the additional unemployment benefits, as well as the PPP loans. This money is going to people who have a higher marginal propensity to consume. Sorry for the economist-speak—that means they are more likely to spend the money, which will push up prices.

I’m pretty sure we will get inflation this time around.

Source.

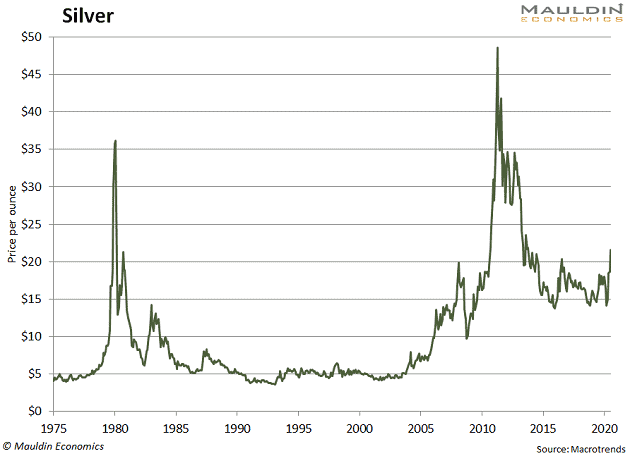

Then Dillian also had some thoughts on silver and inflation…

“Inflation and the Right Tail

It sure seems like we’re going to get inflation.

Precious metals are roofing, copper is flying, the yield curve is steep (under the circumstances), and every other indicator is flashing green for go.

Of course, actual inflation, as measured by the Consumer Price Index (CPI), is muted at 1.2%.

The interesting thing about CPI is that it’s surprising to the upside, even in the middle of a pandemic. We should be experiencing deflation right now, and we’re not.

My guess is that actual inflation will severely lag inflation in the capital markets, and it’s useless to look at it as any kind of leading indicator.

How do you get positive exposure to inflation? There are a bunch of ways, which we will talk about at some point in the near future.

In the past, I have written about silver, which I consider to be a right tail asset. When silver crashes, it doesn’t crash down, it crashes up. It’s done this a couple of times in history—once, during the Hunt brothers fiasco, and again, during the quantitative easing (QE) panic of 2011.

An asset with a big right tail can be very useful in a portfolio.

Silver, of course, broke out above $20 this week, and it seems poised to go higher. Investment demand will be robust. But there is also talk of increased industrial demand for its use in solar cells, which might become a reality if Joe Biden is elected president.

But it’s not just silver. Any asset with positive exposure to inflation has a big right tail, because inflation has a big right tail. It’s unlikely that we would ever experience hyperinflation…

…but there is always a chance. And, given the political path that we are on right now, I would not rule it out.”

Source.

Meanwhile the Government Reported Inflation Rate in New Zealand Dropped

“New Zealand consumer price inflation [CPI] slowed from 2.5% to 1.5% per year in Q2, or maybe slipped to 2.4% per year in June from above 3% pre-Covid (ANZ gauge).”

But as pointed out by Jared Dillian, after shutting down economies, the fact we don’t actually see deflation is what is surprising!

Also as Alisdair Macleod said we may not see the CPI rise.

Why?

Because non essentials may fall in price due to lack of demand. While essentials could increase in price. However the CPI includes both essentials and non essential goods and services. Therefore the CPI is watered down and so it won’t be a true reflection of what the average person is paying to stay alive.

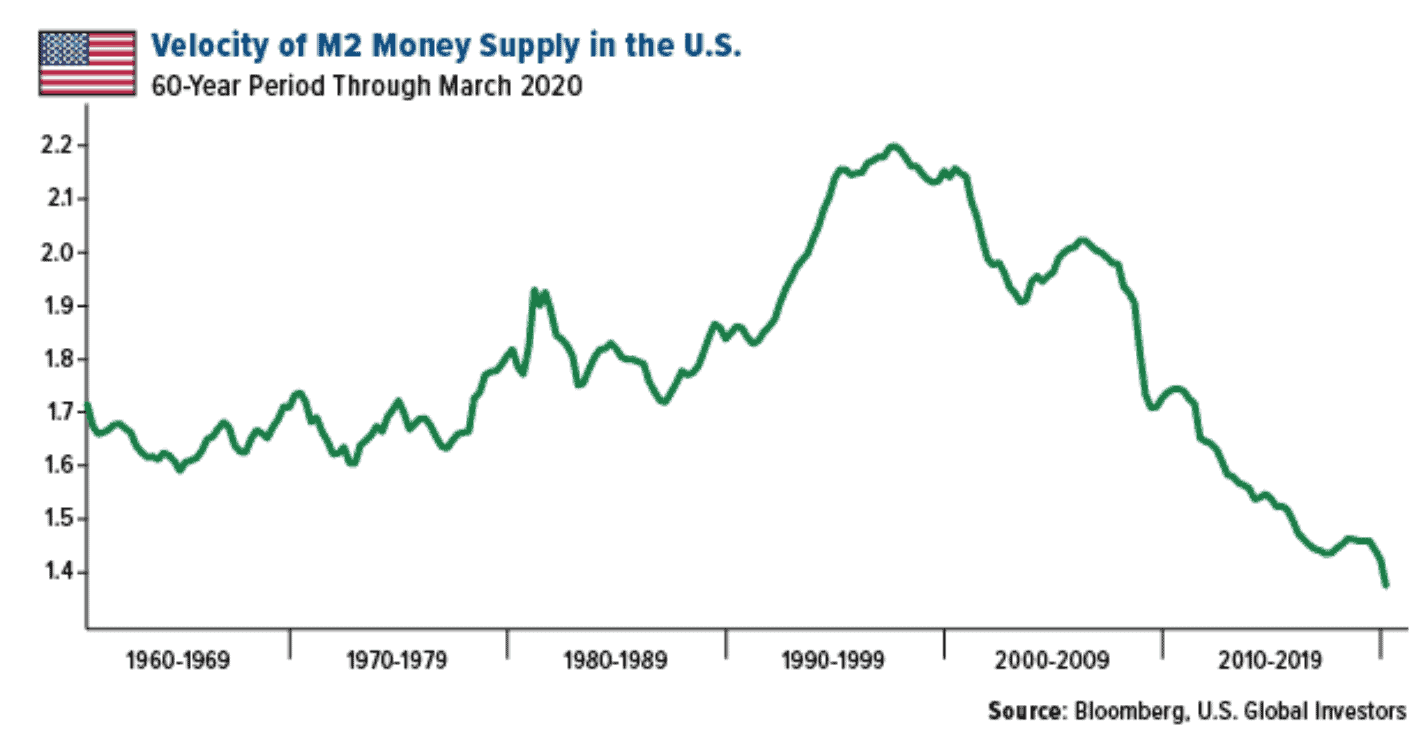

The Velocity of Money May Be a Key Factor in What Plays Out

Our favourite investment newsletter writer Chris Weber this week pointed out the velocity of money remains low:

Money Supply Soaring, But Velocity Collapses

The normal measures of the money supply have been soaring at rates not seen since at least the 1970s. M2 has been rising at around an annual 35%. But is that certain to cause inflation, the kind of price inflation people had back then?

I’m not sure yet. The velocity of money continues to be very low. If money does not turn around then it is not a sure thing that prices will soar. Also, there is an important historical example for rising monetary inflation not translating into price inflation. This was the 1920s. Monetary inflation rose, but such was the huge increase in productivity during that time that the price level stayed stable. However, the money inflation found its way into bad investments, nearly none of which came to the fore until 1929, when it was too late.

This chart only goes to this past March. The period since then has seen consumer buying collapse even further. So an up-to-date velocity chart would almost certainly be even lower. The Fed and other central banks can only flood the system with new money. They cannot make people start to borrow and spend again.

History never repeats itself exactly. It is too soon to tell if productivity has soared like it did in the 20s, but I doubt it. It is the low rate of spending and meagre velocity of money that may not result in a soaring rate of price inflation, at least not yet. The new money will go into something, however. We just have to wait and see where.

Learn more here about the guy we call our “secret investment advisor”

Inflation Could Be More a “When” Than an “If”

Jared Dillian wrote “actual inflation will severely lag inflation in the capital markets”. It appears Chris Weber seems to be in line with that thinking.

Put in layman’s terms, we might not see inflation in basic everyday goods and services for a while. But all the new currency will go into something. Dillian reckons it could be silver.

So inflation seems like a “when” rather than an “if”.

We have our doubts that gold will drop to US$1000 an ounce as Vern Gowdie is betting.

Our impression is not so much that people are buying gold because the price is rising (although that helps shine a light on gold). i.e. greed. But rather that it is fear moving people into gold. As we said in last weeks newsletter:

- Fear of low and negative interest rates. (Westpac economists this week said they expect a negative OCR in New Zealand early next year).

- Fear of depreciation of currencies.

- Fear of what may happen in other markets such as shares and property.

Fear is the stronger emotion. It will likely lead to higher prices. That’s not to say a correction won’t arrive soon. Gold is looking frothy and a pullback anytime soon wouldn’t be a surprise. It could be a decent sized pullback too. In the interim we could still see even higher gold prices ahead before such a correction happens. That is exactly what is happening this morning, as gold breaks above $2000 in US dollars and NZD gold pushes above $3050.

Shop the range of gold and silver products currently available here.

See this post for the latest on the likelihood of inflation in 2021 and beyond:

Inflation in 2021 and Beyond: What’s Different to 2009?

Pingback: More All Time Highs: USD Gold Breaking $2000 - NZD Gold Over $3050 - Gold Survival Guide

Pingback: Gold vs Collectibles: Should I Sell My Vintage Car and Buy Gold if Inflation is Coming?

Pingback: The Precious Metals Correction Finally Arrives! Gold and Silver Down Sharply - Gold Survival Guide

Pingback: More on Inflation (and Inflation in NZ) - Gold Survival Guide