Prices and Charts

NZD Gold Dipping Down From Near New All Time High

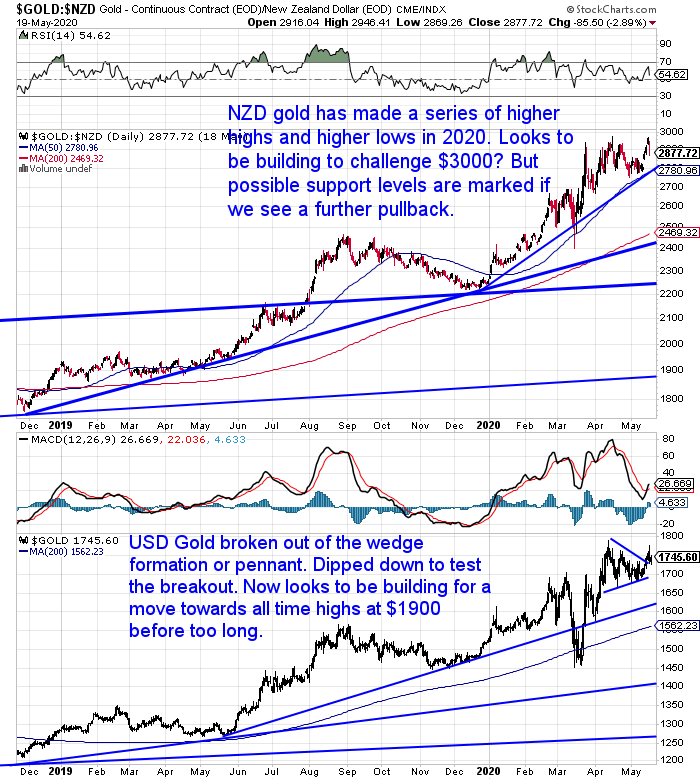

Gold in New Zealand Dollars is up 2.4% this week. It bounced off the rising trendline last week. Then rose up above $2900 touching the all time highs from earlier this year before pulling back yesterday.

It looks to be building to challenge the big round number of $3000 before long.

Silver Surging 12%!

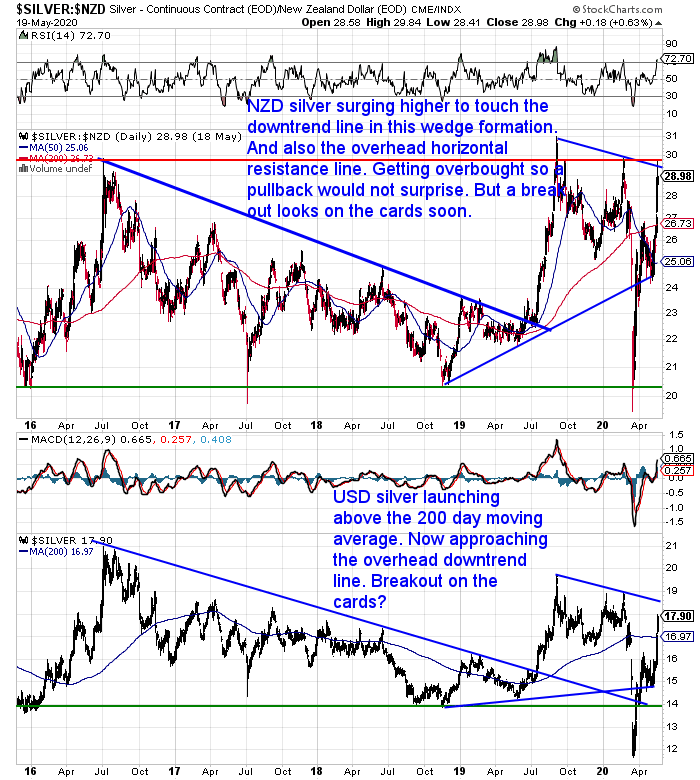

Silver has been the star this week. Surging up 12% from last Wednesday. It has touched the downtrend line in this bullish wedge formation. Also touching overhead horizontal resistance. It’s now in overbought territory. But seems to be ready to break out. Silver is looking strong.

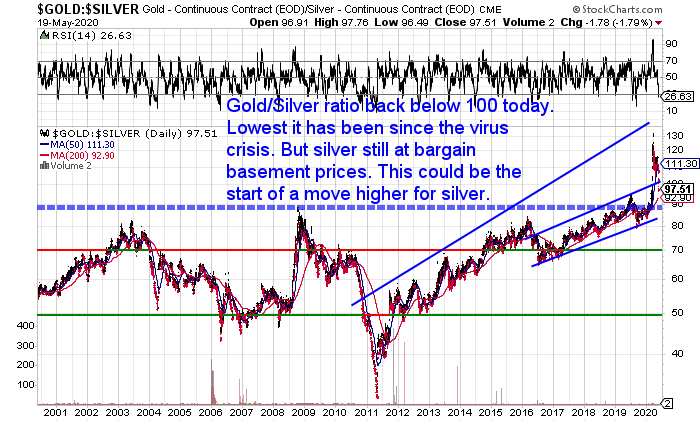

The gold to silver ratio is clearly showing this silver strength. With the ratio back down below 100 for the first time since the March crash. Even so silver is still very cheap. This could well be the start of a more significant move higher for silver. Especially if we see the USD price of gold break out to new all time highs. Expect silver to move higher then too.

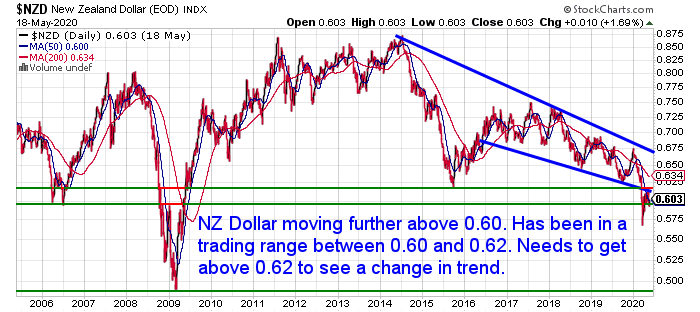

NZD Still Range-Bound Between 0.60 and 0.62

Not much change this week for the NZ dollar. The Kiwi continues to trend sideways between 0.60 and 0.62. The huge spending and expected increase in Government debt in last weeks budget hasn’t helped it.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

RBNZ Nearly Doubles QE to $60 Billion – More to Come?

Just after we sent last weeks newsletter the RBNZ announced it was nearly doubling its “Large Scale Asset Purchases” (a.k.a. QE on currency printing) to $60 Billion.

But already we have the likes of ANZ economists saying the central bank will have to increase this to $90 billion as soon as August.

The massive spending increases in the government budget will need to be paid for somehow.

“Government net debt is set to increase from 20 percent of GDP to a peak of just over 55 percent, the peak during the painful economic restructuring of the late 1980s.” Source.

The argument is we are starting from a better position than many. And other countries will have to do the same.

But, it still has to be paid for.

As we pointed out last week, Ray Dalio thinks it’s almost guaranteed currency printing and debasement will be used to “Solve” the crisis.

Maybe our politicians will take the easy way out and look to fund this via further QE in the coming years?

What Would Negative Interest Rates Mean for New Zealand?

We think the RBNZ won’t stop at just quantitative easing. There’s likely more to come. As other central banks have found (we’re looking at you US Federal Reserve) and to paraphrase The Eagles: “Welcome to the Hotel Quantitative Easing, You can check out any time you like, but you can never leave”.

One of the possible (likely?) coming options is for the RBNZ to set a negative interest rate.

Marketwatch reports:

“The Reserve Bank wants retail interest rates to fall “substantially more” than they have since it began purchasing government bonds two months ago, Mr. Hawkesby said.

“What we haven’t seen yet, which we expect and need to see, is a continued decline in retail interest rates,” he said.”

…The Reserve Bank of New Zealand is considering unconventional tools such as a negative cash rate because the coronavirus pandemic has created high uncertainty and skewed economic risks to the downside, Assistant Governor Christian Hawkesby said Tuesday.

The European Central Bank and the Bank of Japan “get a bit of a bad rap” because they employed negative rates for longer than envisioned and didn’t get inflation back to target, but that reputation may not be deserved, Mr. Hawkesby told The Wall Street Journal.

“You also need to consider what the counterfactual would have been if they hadn’t taken those actions and that’s the real test,” he said.”

Source.

So, in this week’s feature article we answer a number of reader questions on the topic of negative interest rates in New Zealand. Including:

- What would negative interest rates mean for NZ? What does that actually mean?

- Would I be paying to store money at the bank?

- If the RBNZ goes into negative interest rates will it need to BAN CASH first?

- Are my savings in the bank keeping up with inflation or am I losing money?

- We also show how negative interest rates are already here.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Should I Buy Gold and Silver Coins or Bars?

The huge demand for gold and silver in March saw almost all stocks of coins depleted across the globe. We’re starting to see some coins become available again now. So it’s worth looking at the pros and cons of coins versus bars.

Trying to decide which to go for. Read on…

Check out some of the products below that are back available to order now. Plus the specials at the start of today’s email.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Clarification on Negative Interest Rates - Gold Survival Guide

Pingback: RBNZ QE Ahead of Plan - Chart Proves There’s More to Come - Gold Survival Guide