Casey Research recently reported that wages are rising across the USA. Let’s see what’s happening in the USA and then take a comparative look at the push for higher wages taking place in New Zealand.

Then we’ll see what the impacts of this push for higher wages may be.

Wages are rising across the [USA]…

“Last week, the Labor Department reported that labor costs jumped 2.8% year-over-year. That’s the biggest annual increase since September 2008.

This is happening for a couple reasons: 1) the U.S. economy’s doing well and 2) the unemployment rate is near its lowest level since the 1960s.

So, there’s a lot of demand for workers… but not many spare workers to go around. That puts upward pressure on wages. But those aren’t the only reasons wages are rising.

• The minimum wage is climbing…

Now, I’m not talking about the federal minimum wage. That hasn’t been lifted since 2009.

I’m talking about state minimum wages. You see, 18 states effectively raised their minimum wage rates on January 1 of this year. Those measures impacted about 4.5 million workers nationwide.

In other words, it’s a big deal. And I wouldn’t be surprised if we see more measures like this.

…Inflation in the U.S. is already on the rise.

The Consumer Price Index (CPI), a broad measure of inflation, is now rising at its fastest pace since 2012. And the Producer Price Index (PPI), another popular measure of inflation, is also climbing fast. In fact, it just had its biggest yearly jump in nearly seven years.

Of course, companies can only raise prices so much before it hurts their business. At some point, they’ll have no choice but to lay off workers.”

The Push For Higher Wages in New Zealand

We can see the same situation playing out here in New Zealand.

For the year ending June 2018, the minimum wage increase in New Zealand triggered a 0.6% quarter on quarter increase in private sector Labour Cost Index wages. With annual wage inflation at 2.1% year on year, the highest in six years.

Last month 4000 staff from Inland Revenue and Ministry of Business, Innovation and Employment downed tools in a call for higher wages. We currently have nurses pushing for higher pay, despite their unions recommending them to take a pay offer.. Then teachers are on strike tomorrow for higher wages.

So we’re likely to see public sector employees receiving pay rises this year.

There is also the plan to increase the minimum wage to $21 by 2021. Along with proposed labour law reforms which could lead to industry-wide pay settlements, something opposed by some business groups.

Higher Wages Will Likely Lead to Higher General Price Inflation

These pay increases are likely to spread into the private sector too. Then as Casey Research mentions, wage increases will then show up in higher general price inflation numbers.

Of course, inflation has been surprisingly absent post the global financial crisis. But only in the government reported inflation numbers. Interest.co.nz just published some useful numbers looking at the change in net disposable income for 3 typical families.

Government Inflation Numbers Not the Same as in the “Real World”

While the government reported inflation rate is low, we see a different story when looking at actual spending for typical families.

These show a quite different picture to the “no inflation” government numbers.

Despite increases in household income of about 2%, the interest.co.nz 30-35 year old median household didn’t fare too well in the year ending June 2018. Especially if based in Auckland and renting, their net disposable income fell 12.5%. Even Auckland home owners saw a 2.7% reduction. The median household in the rest of the country weren’t so badly affected, but renters net disposable income still went down by 2.1%. Source.

The first thought might be that an increase in wages will help the average household out.

But not if the prices of everyday goods continue to rise faster than income. The falling NZ dollar won’t help the average household’s cause either. See: NZ Dollar Falls – Why is the NZ Dollar Weaker and Where to Now?

Why Haven’t Wages Increased?

So where have all the supposed gains in the economy gone in recent years? Why haven’t wages increased?

There are the commonly recited reasons, such as high immigration has meant a ready labour force fighting for jobs. Along with technology and automation and global outsourcing.

But we’d say the gains have likely gone straight into the land in the form of higher real estate prices and higher debt levels. The net disposable income numbers above back this up. With higher rents and mortgage payments despite low interest rates. But also higher house insurance premiums and rates.

People may feel richer because their house is worth more, but the average families actual net income has gone backwards. We haven’t seen great gains in productivity.

Why the Push for Higher Wages May be at Just the Wrong Time

The trouble for New Zealand is that it seems this increase in wages may come just as the whole economy is starting to lose steam. So we won’t see any gains in productivity in the next few years either.

Read more: Net Migration Falling – Could This Tip NZ into Recession?

Will employers settle for lower margins? Maybe, but likely not. Instead they’ll pass the costs onto consumers i.e. wage getters. Best case we’ll see general price inflation eat into any wage gains. Worst case we’ll see job losses as employers retrench to make up for higher labour costs.

A possible outcome is we could be heading for a stagflationary environment like the 1970’s. With low growth but higher inflation. More on that next week…

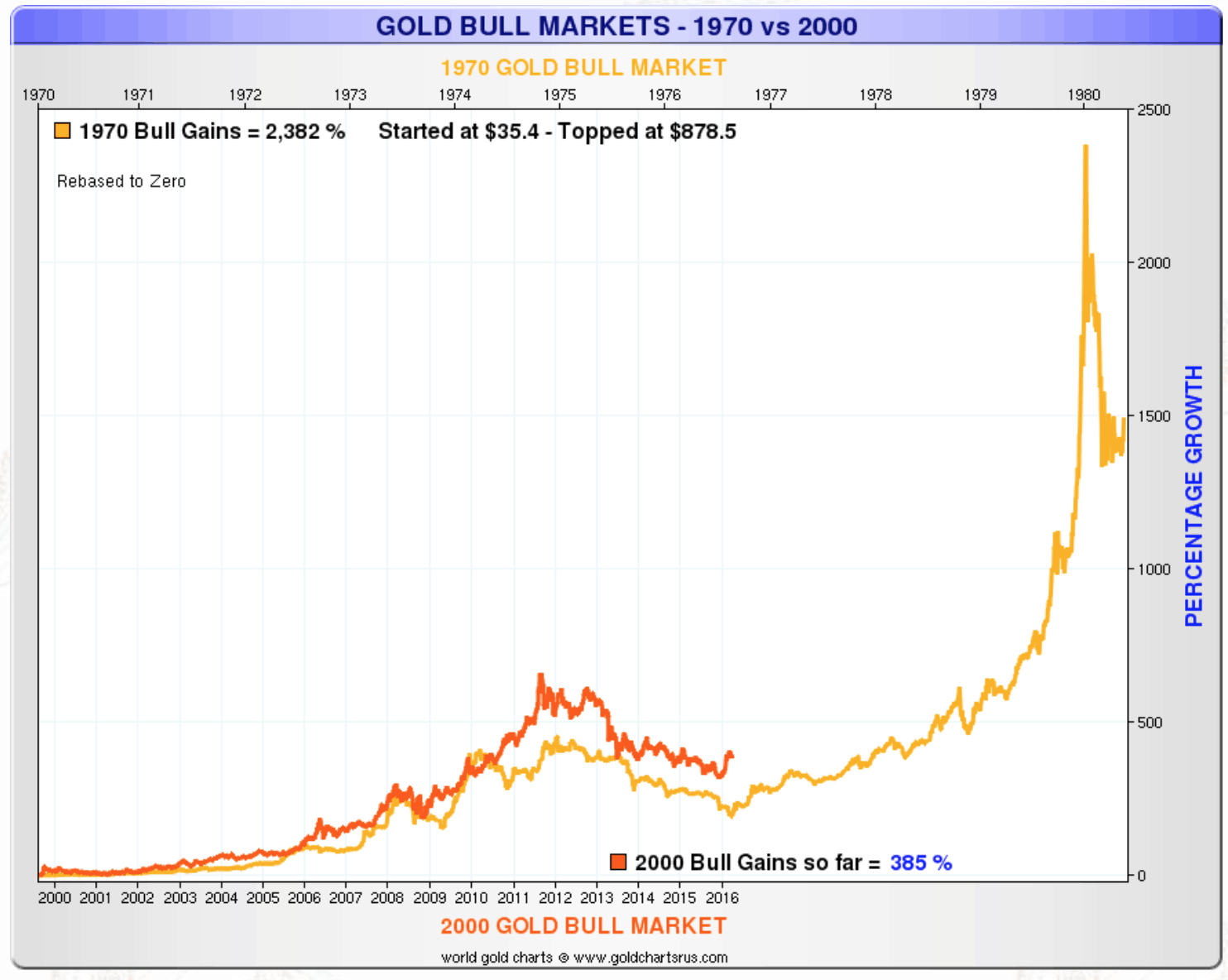

The late 1970’s stagflationary environment was a very good time to own gold. The chart below shows how the bull market in gold since 2000 might be mirroring the 1970’s.

Learn more: Could Stagflation Happen Again?

So now might be a good time to get some gold exposure in case we see a repeat. Buy Gold online.

So now might be a good time to get some gold exposure in case we see a repeat. Buy Gold online.

How might the central planners react if things go south? Read more: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis