Some news out of Australia relating to migration rates and the impact on the Australian economy got us thinking about how the same might apply in New Zealand.

The Daily Reckoning Australia yesterday discussed the risks to Australia if policy makers cut back on immigration rates. See: Australia’s Secret to Dodging a Recession:

“Australia’s population has grown 50% in the past three decades. And if it weren’t for the constant flow of migrants to our shores, Australia would’ve been broke four times over.”

Their Former Prime Minister Tony Abbott wants to cut annual immigration from 190,000 to 110,000. Minister for Home Affairs Peter Dutton is also calling to drastically cut back on the number of migrants.

They explain how Australia is only in its 27th recession-free year due to “blind luck and occasional intervention.”

First in the mid 1990’s there was a relaxation of lending standards and reinstatement of negative gearing.

The tiny Aussie tech sector meant the dotcom bust had little impact.

Then China’s rise caused Aussie exports of the likes of iron ore to soar in the 2000’s.

Then China saved Australia from the 2008 crisis by unleashing a “credit fuelled construction boom”.

So Aussie houses just kept on rising and while most of the rest of the world struggled, Australia came out of 2008 pretty much untouched.

Australia defied recession once again in 2015 after China’s yuan devaluation.

Then soon after when commodity prices dropped, and the construction sector struggled, the Aussie government launched massive nationwide infrastructure projects.

“But the only reason this blind luck and economic intervention worked was because of high migration numbers.

The definition of a technical recession is two consecutive quarters of declining GDP growth.

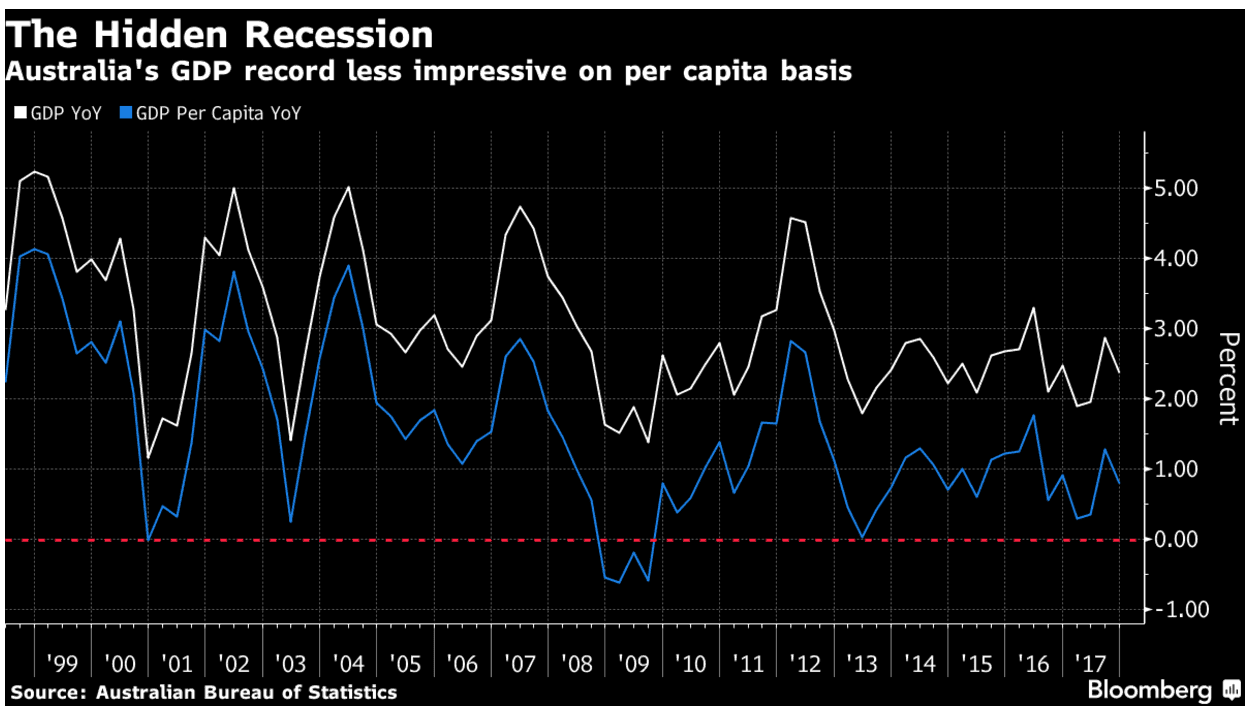

As you can see in the chart below, when you strip down the numbers to show economic growth per person (blue line), there are four periods in the past 15 years in which Australia faced the real prospect of recession.

Take a look:

Economic growth per person

Source: Bloomberg

The graph would’ve looked much worse if we didn’t have the influx of new migrants coming to settle in Australia permanently.

The point is, Australia’s booming population, at 25 million, is one of the few things keeping us out of recession.

The simple reason for this is that the more people there are, the more spending there is in the economy. That applies to both the public and private sector.

In addition, the waves of new workers settling in Australia should help balance out the 25% of the population retiring over the next decade. We simply don’t have enough young people to fill this gap.

Whether some people care to admit, the ongoing prosperity Aussies enjoy now heavily relies on new migrants.

If policymakers put an end to that, the rug will be ripped out from under the Australian economy in time.

And it would almost surely take our record-breaking recession-free run with it.”

How Does New Zealand Compare?

When we look at the factors outlined above, New Zealand has a lot of similarities.

Following the recession in the early 1990s, the land tax was repealed altogether in 1992. This helped to boost real estate values. (This was a long standing tax dating back to 1878). Source.

Then there was the change from stamp duty to a higher GST which came into effect in 2001. This helped boost the economy following the dotcom bust.

These tax changes made residential property the even more favoured investment in New Zealand.

We now have twice as much capital invested into the land as we hold in financial assets, such as bank deposits and managed funds. (See: Land taxation: a New Zealand perspective – Jonathan Barrett and John Veal 2012).

New Zealand didn’t see the same sort of Government interventions following the 2008 crisis. So house prices did dip here more than Australia.

However the boost that China gave Australia was felt two-fold here. These two countries are New Zealand’s main export partners. So with Aussie and China doing well, we did okay too. Overall we sink or swim with Australia.

How Has Migration Impacted New Zealand’s Economy?

Just like in Australia, the New Zealand population also grew sharply over the past decade. Particularly over the last 5 years, fed by rising migration. Perhaps then this is no surprise that this period was when the New Zealand “rock star” economy was at its best?

source: tradingeconomics.com

New Zealand Migration is Already Slowing

Here in New Zealand the new government policy was to tighten up on migration.

But latest numbers indicate this is happening already without any government intervention.

“New Zealand’s years of record breaking migration appear to be over with the latest Stats NZ data showing annual net migration at its lowest since November 2015.”

Annual net migration eased slightly to 65,000 in the June 2018 year, as fewer migrants arrived and more left, according to Stats NZ.

That total is down by 7,400 from the peak of 72,400 in the June 2017 year. But monthly migrant arrivals also dropped in June – to 4,850 from 5,080 in May.”

“…Non-New Zealand citizen migrant departures were up by 21% year-on-year in the June 2018 year, while migrant arrivals dipped below 130,000 for the first time since the April 2017 year.

More New Zealand citizens are also now leaving the country long term than returning.

But ASB senior economist Jane Turner says the easing migration flow was largely due to the lift in non-New Zealand citizen departures.

Departures to Australia remain low and steady (which is where New Zealanders often head) while departures to Asia, Europe and the Americas are climbing, she says.

“This suggest the strong surge in arrivals seen in recent years is now boosting the level of departures as some of these ‘long-term’ residents head home, possibly after completing studies or the expiration of a two-year youth working holiday visa.”

At the same time, migrant arrivals appear to have peaked and are starting to show tentative signs of turning lower, Turner says.

“The Australia labour market has improved materially over the past six months, and this is likely to see more New Zealanders remain in Australia and, over time, also increase the number who move across the Tasman.”

This is another indicator that the New Zealand economy is entering a slow down. Refer back to what we wrote 2 weeks ago in: NZX50 Near Highs But This Indicator Says the NZ Economy is Slowing Sharply

Westpac senior economist Satish Ranchhod agrees, saying they expect that migration will continue to ease back over the next few years.

“Much of the increase in migration in recent years was due to people arriving on temporary work and student visas. We are now seeing many of those earlier arrivals departing.

“At the same time, economic conditions in many other regions are firming as growth in New Zealand slows. This is making us less attractive as a destination.”

Migration Affects House Prices and Economy. But Economy Affects Migration Too

There has been plenty of debate about the impact of foreigners buying New Zealand housing.

But there likely wouldn’t be too much debate that the increase in migrants in the past decade would have helped push N.Z. house prices higher. More people chasing the same number of houses increases prices.

So New Zealand would seem to be in a similar boat to Australia. Namely, if migration slows markedly here, the economy will likely slow and so will house price growth.

This could also be somewhat of a negative feedback loop too. If the New Zealand economy slows, migrants will be less likely to come here. But lower migration also means less demand in the economy and also less demand for housing, and so on.

It’s early days but migration flows are another indicator to keep an eye on.

Why Buy Precious Metals?

Precious Metals are negatively correlated with other asset prices. So in a recession (such as occurred in 2008) gold is likely to rise in price when the likes of property and the share market fall.

If the economy in New Zealand is in fact starting to slow now, then this would be a good time to take our some financial insurance and buy some gold and silver.

Read more: New Zealand in the News Around the World – For All the Wrong Reasons

Pingback: Rich Dad Poor Dad Author Robert Kiyosaki Warns Australia of ‘Biggest Crash in History’: Should You Listen? - Gold Survival Guide

Pingback: Rickards: The Lucky Country is Out of Luck - How About New Zealand? - Gold Survival Guide

Pingback: NZ Dollar Falls - Why has the NZ Dollar Weakened and Where to Now? - Gold Survival Guide

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide