Yesterday Jim Rickards wrote in the Daily Reckoning Australia that Australia (the lucky country) is out of luck. He explained how Australia hasn’t had a recession since 1991! But how this could be about to change. The resources boom and house prices are what has driven the Australian economy.

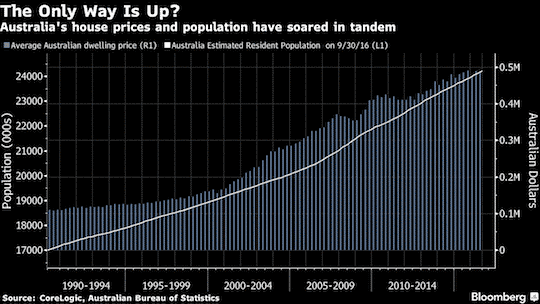

“Housing data is not the full measure of economic success, but it’s a good proxy for wealth creation and general prosperity. The chart below shows Australian population growth and the increase in housing prices since Australia’s last recession.

Source: Bloomberg Two features stand out. The increase in population has been material — up 35% overall with only a few dips along the way — and the increase in housing prices has been continuous with no material dips, up $500,000 per home on average. The second feature is the high degree of correlation with population and home prices driving higher hand-in-hand.”

However in the past 5 years the Australia population increase has not been driven by increased birth rates. But instead by immigration mostly from Asia. Ring any bells?

NZ Migration and Property Prices Highly Correlated

Here’s a chart we found for NZ migration and property prices. Unfortunately the chart is only up to 2014. However it shows a pretty good correlation between net migration and change in house prices.

Source. Migration rose further from 2015 to 2017, peaking above 70,000. This year it is down to 65,000. As we wrote back in July: Net Migration Falling – Could This Tip NZ into Recession? Perhaps it should also come as no surprise that house prices are also easing back in New Zealand too. Rickards next points out:

“That’s fine [migration growth] for Australia, and accounts in part for the record-setting recession-free stretch, but it begs a question: What happens if inflow of Chinese migrants and capital dries up?”

He believes an Australian recession is looming.

“What happens if China slows down and China’s binge on Australian exports slows with it? Unfortunately for Australia, China is slowing down. Chinese purchases of Australian exports are slowing with it and China has tightened its regulations on outbound immigrants and capital account outflows. Australia’s ‘Lucky Country’ status became centred on one nation, China, which has now changed the rules of the game. An Australian recession may be in the offing after all, with predictable effects on Australian fiscal and monetary policy. Anticipating those policy changes presents a huge profit-making opportunity for investors.”

China Closes Its Capital Account and Falling Australian House Prices

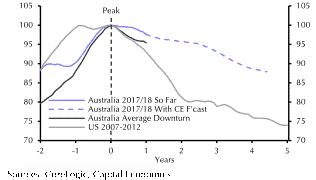

He goes on to explain how the Chinese closed their capital account in 2016 which cut off Chinese capital outflows. This has had a negative impact on Australian house prices where they started falling in mid 2017 as shown in the below chart:

Source: CoreLogic; Capital Economics “It shows the actual and potential paths of Australian house prices using 100 as a normalised cyclical peak. The solid blue line shows actual prices. The grey line is the US downturn after 2007. The black line is the average Australian downturn over the past 35 years. The blue dotted line is a projection of the existing trend from Capital Economics. As you can see, investors are making a long-shot bet that the actual path will be better than the average, the forecast, and a US-style worst-case scenario. In any case, this housing reversal in Australia will put the ball firmly in the Reserve Bank of Australia’s (RBA) court. The RBA uses the same flawed models as the Fed and, as a result, has the same flawed forecasts. As recently as 9 August 2018, RBA officially forecasted stronger growth, rising inflation, and gradually rising interest rates. This forecast has given some strength to the Aussie dollar and to the Australian stock market generally. Yet the RBA forecast gives no weight to a failing China. Real data, as opposed to model-based forecasts, tells the tale. China is slowing and Chinese capital outflows have practically stopped. This pulls the rug out from under Australian asset values. The asset value decline has already started in housing. The Lucky Country is running out of luck. I believe that it’s a matter of when, not if, the Australian economy enters a recession.”

How Does New Zealand Compare to Australia?

As noted already it appears migration is falling in New Zealand too. Like Australia this also seems to be coinciding with a pull back in house prices. Much like the RBA, the Reserve Bank of New Zealand (RBNZ) also likely operates upon flawed models. As we wrote earlier today the expectation in New Zealand now seems to be switching from a potential interest rate hike next year to an interest rate cut. This is a marked turnaround. If Rickards is right about Australia entering a recession before too long, then this also won’t be good news for New Zealand. As China and Australia are our 2 largest trade partners. On top of this we also have the yield curve also getting close to indicating a pending recession in the USA. So we could be heading for a global slowdown within the next couple of years. With the NZ dollar continuing to weaken that would make now a good time to grab some financial insurance. Check out what gold you can buy today. >> Related:Australia Has 80 Tonnes of Gold, How Much Gold Does New Zealand Have?