Prices and Charts

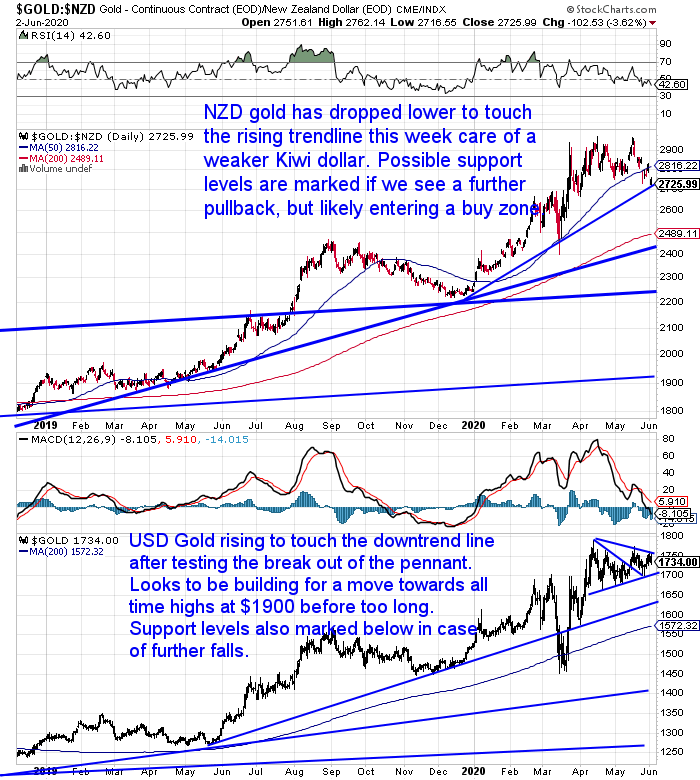

NZD Gold Dropping to Touch Uptrend Line

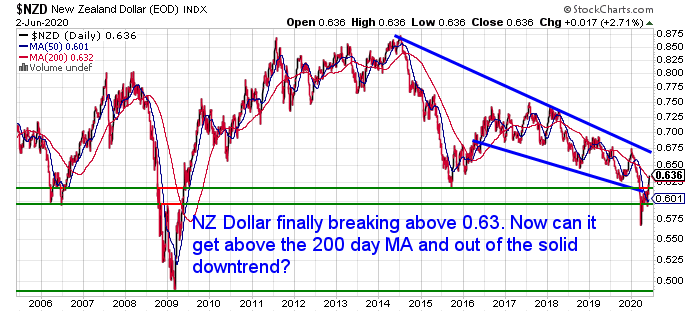

NZD gold is down just under 2% this week. Dropping to touch the same uptrend line that it hit during the COVID-19 market crash. A sharply higher NZ dollar was the main reason for this dip.

Now it remains to be seen if gold heads any lower or if this trend line from March will hold?

The RSI overbought/oversold indicator is neutral so that is of no real help currently.

But we’d hazard a guess that we are entering a decent buy zone for NZD gold. Anywhere between here and the 200 day moving average at $2489 is likely to be a good long term buy price.

USD gold looks to be building for a move higher. So if the NZ dollar now holds around these higher levels, but USD gold moves higher, we’ll still see rising gold prices here in New Zealand.

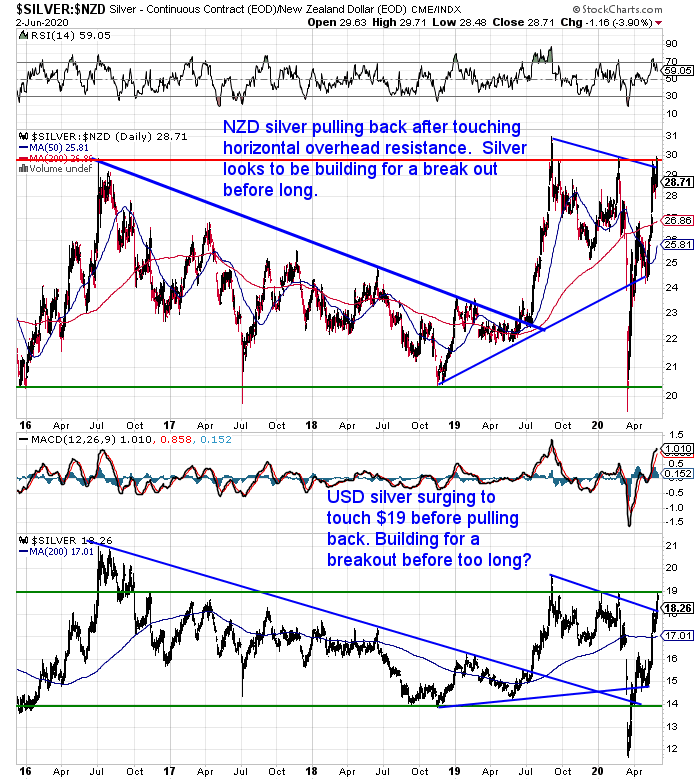

Silver Charging Higher

Silver continues to be the star this week – up 2.54% and continuing to out-perform gold.

NZD silver touched overhead horizontal support at $30 this week before pulling back today. Silver looks to be building for a breakout before too much longer.

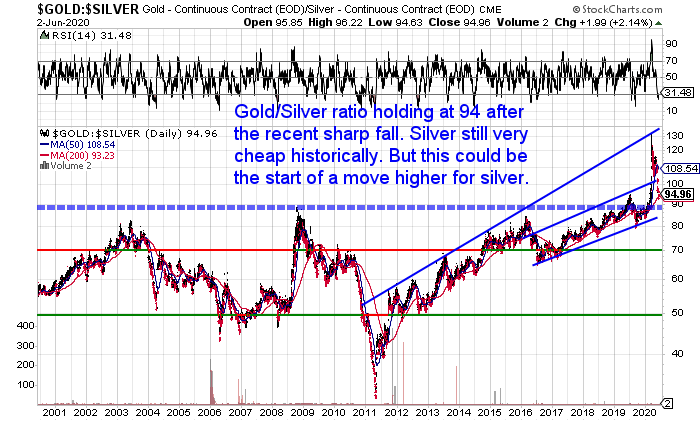

Gold Silver Ratio Has Plunged Lower

This outperformance of silver has pushed the gold to silver ratio sharply lower. It now takes 94 ounces of silver to buy one ounce of gold. Down sharply from the all time highs around 130 in March when silver crashed.

However current levels are still the highest they’ve been since 1994. So silver is still very cheap despite the recent rises. There could be much larger moves to come yet.

NZD Jumping Higher

The Kiwi dollar moved sharply higher this week. Today it is above 0.63 for the first time since March. Basically the NZ dollar is back to where it was before the lockdown.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

New Zealand GDP Down by Almost 16%?

Can the Kiwi continue to fly and stay up at these levels?

New Zealand appears to be in a better position than most countries. Because we are closer to being back to open. However it seems likely our borders will be closed until there is no sign of the virus anywhere in the world. That could be a long way off. We are much more reliant upon tourism than say even Australia.

We read a report that said the economy may “only” fall 5% as a result of the lockdown. 5% doesn’t sound too bad. It means we’re at 95% strength doesn’t it?

However, consider that during the 2008 crisis New Zealand GDP only fell 0.3% quarter on quarter. New Zealand emerged from recession in mid-2009 one of the shortest and shallowest at the time. Source.

So a 5% fall is huge. Maybe it won’t be this bad. Our GDP numbers are very slow to come out so they report old news. However there is a new tool called GDP Live which is a:

“…collaboration between a team of Massey University researchers, partnering with NZ businesses and government agencies in the quest to develop a machine learning based solution to estimating GDP in real-time, using data from multiple and diverse sources.”

(Hat tip to our friend Louis Boullanger for sharing GDP Live with us).

So what do these “live” GDP numbers say?

The quarterly change in New Zealand GDP currently is -15.8%. Annual at -2%.

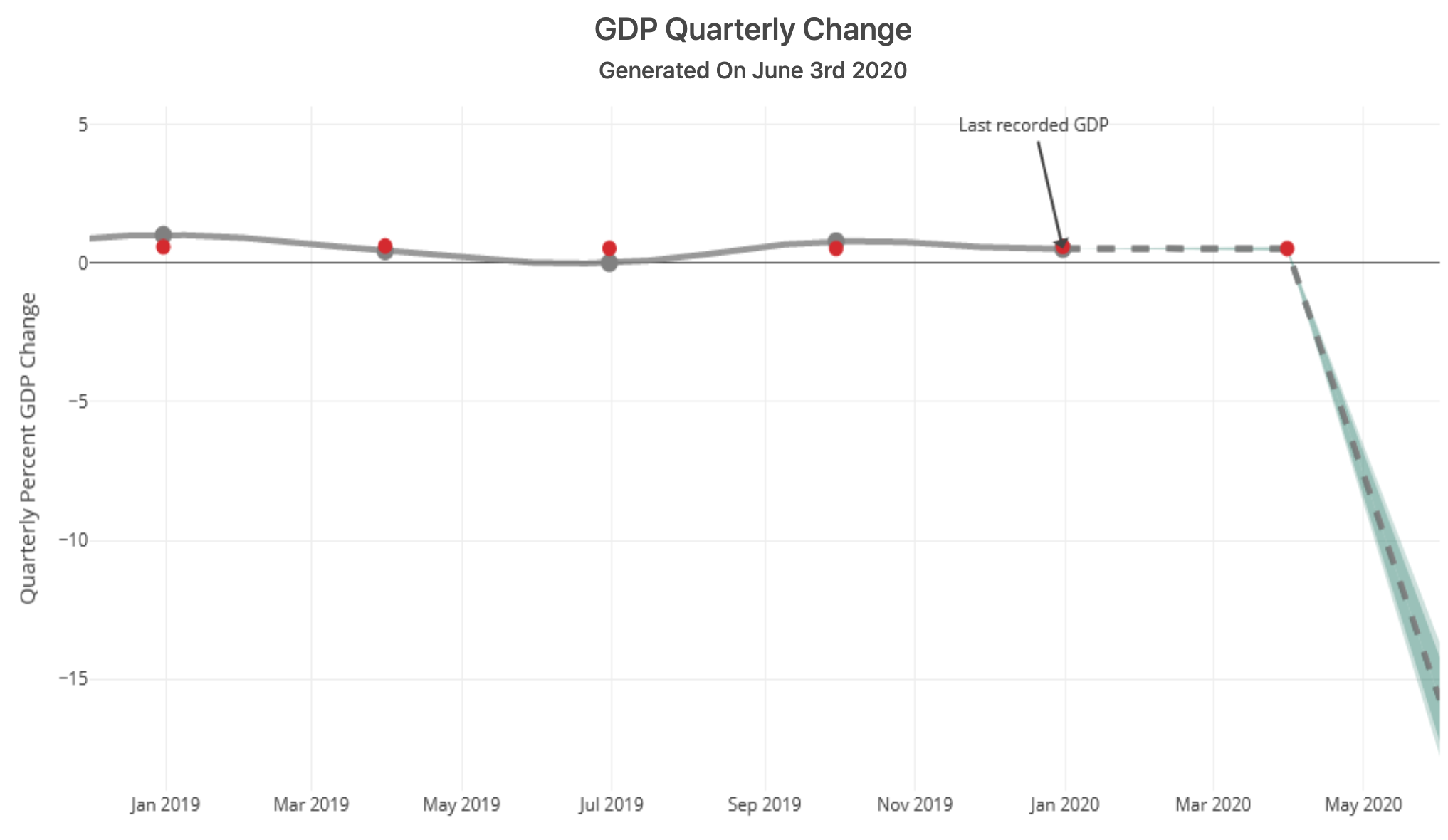

In chart form the drop is substantial:

So the impacts of the lockdown will be far reaching and long lasting.

A blog post from GDP live makes some good points about unemployment:

“Treasury forecasts estimate unemployment reaching a peak 9.8 percent by September this year, but dropping to just 5.7 percent by 2022 but this looks increasingly optimistic with many businesses in the retail and tourism sector unable to trade at anywhere near previous levels. Those on the jobseeker benefit alone jumped from 145,000 before the lockdown to over 184,000 at the start of May, higher than the peak of the GFC at 174,630.

It is hard to see how the economy will absorb all of the jobs lost due to whole industries essentially disappearing overnight. According to MBIE’s latest Jobs Online Report… “Online advertisements fell by 6.4 percent during the March 2020 quarter, and by 12.5 percent between March 2019 and March 2020.”

…The social costs of losing this connection to work is very high. A review of research in Quartz magazine points to evidence that long term unemployed are five times more likely to be living in poverty than their employed counterparts. Even when they find a new job they tend to earn less than they were previously and often take a step down the career ladder.

There is no doubt the wage subsidy scheme was necessary and hopefully will have flattened the potential unemployment curve just as New Zealand’s actions on the public health front have effectively squashed the pandemic curve. The final tally though, in terms of the implications for businesses and workers, is so far unclear but will be felt for years to come.”

Source.

We wouldn’t agree with just how “necessary” these interventions were. However the impacts for sure will be felt for years to come. The cure is likely to be much worse than the disease.

RBNZ Q.E. Will Increase the Gap Between the Haves and Have Nots

Something else that will be felt for years to come is the impact of the RBNZ’s quantitative easing or currency printing that was launched during the lockdown. It might take a while to filter through but this could eventually lead to an inflationary surge. Something that seems highly unlikely right now. Q.E will also lead to the gap growing between the haves and have-nots.

Why? Dan Denning earlier today pointed this out:

“Nearly all of the emergency liquidity provided by central banks since the beginning of this crisis has gone to support stock prices or the bonds of heavily indebted corporations. It’s worked like a charm. The losses were reversed. And now?

Now we find out if you can have one country and two economic systems in places like the UK, the US, and Australia. Can you have a monetary and financial system which rewards a narrow slice of the work force and the population? And can you keep the rest of the people pacified with free money from the government? Failing that, can you keep them from assembling in the street to protest to burn the whole thing down?”

In the USA, if the last few days of riots are anything to go by, it seems most likely not. (Although have you seen the photos of the pallets of bricks left conveniently along the path of the planned protests that then “morphed” into riots? Hmmm.)

Anyway, a reader Chris asked recently:

“I am doing your e-course and enjoying it. I have a question: does NZ have a similar system of money creation that the US has? And with recent pandemic actions, by how much has the amount of NZ$s increased?”

The short answer is yes we do have much the same system in terms of money creation.

We’ve written about this very topic this week and you can see just how much the New Zealand M3 money supply has increased recently.

It’s likely that this money will go into the real estate market here in New Zealand. As well as the share and bond markets. And hence increase the gap between the haves and the have nots.

Which in turn will get blamed upon “capitalism” and the “free market”. Neither of which do we have…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Jim Rickards on 3 Reasons Gold Could Move Higher From Here

The US Dollar is the only currency where gold has not made a new all time high. We’ve been saying in our daily price alerts recently that gold is likely getting ready to challenge the all time high in US dollars of $1900.

Jim Rickards today identified 3 short-term catalysts that could push gold to $3,000… and why gold’s long-term price could rocket to $14,000…

“Right now gold’s trading at over $1,700. What could push it firmly over $2,000 per ounce and headed higher? There are three main drivers:

The first is a loss of confidence in the U.S. dollar in response to massive money printing to bail out investors in the pandemic. If central banks have to use gold as a reference point to restore confidence, the price will have to be $10,000 per ounce or higher. Any lower price would force central banks to reduce their money supplies to maintain parity, which would be highly deflationary.

The second driver is a simple continuation of the bull market. Using the prior two bull markets as reference points, a simple average of those gains during those durations would put gold at $14,000 per ounce or higher by 2025.

The third driver is panic buying in response to a new disaster. This could take the form of a “second wave” of infections from the Wuhan Virus, a failure of a gold ETF or the COMEX exchange to honor physical delivery requirements, or a victory by Joe Biden in the presidential election.

The gold market is not priced for any of these outcomes right now. It won’t take all three events to drive gold higher. Any one would do just fine. But, none of the three can be ruled out.

These events (and others) would push gold well past $2,000 per ounce, on its way to $3,000 per ounce and ultimately much higher along the lines described above.”

Rickards possible targets tie in nicely with those we recently covered in: Is it Too Late to Buy Gold?

This current pull back in gold in NZ dollars looks to be a great “buy the dip” opportunity if a bigger move is indeed on the way as Rickards predicts.

Keep a close eye on what prices do in the coming days and please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: RBNZ QE Ahead of Plan - Chart Proves There’s More to Come - Gold Survival Guide