One premise of the following article is that in the USA the penny or 1 cent piece actually costs more to make than its value of 1 cent. But that the US government hasn’t removed it from circulation as this is an admission of the declining value of the US currency.

Well it seems the NZ government/Reserve Bank has no such qualms about admitting how much value the NZ Dollar has lost!

After all in 1990 the New Zealand 1 and 2 cent coins were removed from circulation. Then in 2006 the 5 cent coin was also removed from circulation. On top of this the 10 cent, 20 cent and 50 cent coins were all made smaller and lighter by using different metals different metals.

There were various cited reasons at the time for doing this such as: Of course these changes are explained away with rationale such as:

- “The 5c coin is now worth a third of what a cent was worth back in 1967, when New Zealand decimalised its currency.

- Surveys had found that 50, 20 and 10c coins were too large and could not be easily carried in large quantities. The original 50c coin, with a diameter of 3.2 centimetres, was one of the largest coins in circulation worldwide, and the original 20c coin, New Zealand’s second biggest coin at the time at 2.8 cm, is bigger than any current circulating coin (the biggest coin in circulation is the $2 coin at 2.6 cm).

- The size of the 10c piece was too close to that of the dollar – in fact, it was so close that it was possible to put two 10c pieces in a parking meter together and receive $1 worth of parking time, or jam the meter and make parking free anyway. The advent of pay & display metering in larger cities, whereby one is required to use another meter if the first one is jammed, has largely stopped this practice.

- The prices of copper and nickel used to mint the old coins were high and rising steeply, and the metal content of some coins exceeded their face value.”

However chiefly we’d say the last point is the most important. That being, the coins were not worth as much as the metal content of each coin. Or put another way, it cost more to make each coin than their face value.

Read on to see what this is indicative of…

Whoever Does Not Respect the Penny is Not Worthy of the Dollar

By Nick Giambruno

This definitive sign of a currency collapse is easy to see…

When paper money literally becomes trash.

Maybe you’ve seen images depicting hyperinflation in Germany after World War I. The German government had printed so much money that it became worthless. Technically, German merchants still accepted the currency, but it was impractical to use. It would have required wheelbarrows full of paper money just to buy a loaf of bread.

At the time, no one would bother to pick up money off the ground. It wasn’t worth any more than the other crumpled pieces of paper on the street.

Today, there’s a similar situation in the U.S. When was the last time you saw someone make the effort to pick up a penny off the street? A nickel? A dime?

Walking around New York City recently, I saw pennies, nickels, and dimes just sitting there on busy sidewalks. This happened at least five times in one day. Even homeless people wouldn’t bother to bend over and pick up anything less than a quarter.

The U.S. dollar has become so debased that these coins are essentially pieces of rubbish. They have little to no practical value.

Refusing to Acknowledge the Truth

It costs 1.7 cents to make a penny and 8 cents to make a nickel, according to the U.S. Government Accountability Office. The U.S. government loses tens of millions of dollars every year putting these coins into circulation.

Why is it wasting money and time making coins almost no one uses? Because phasing out the penny and nickel would mean acknowledging currency debasement. And governments never like to do that. It would reveal their incompetence and theft from savers.

This isn’t new or unique to the U.S. For decades, governments around the world have refused to phase out worthless currency denominations. This helps them deny the problem even exists. They refuse to issue currency in higher denominations for the same reason.

Take Argentina, for example. The country has some of the highest inflation in the world. In the last 12 months, the peso has lost over half its value.

I was just in Argentina, and the largest bill there is the 100-peso note, which is worth around $7. It’s not uncommon for Argentinians to pay with large wads of cash at restaurants and stores. The sight would unnerve many Americans, who’ve been trained by the government through the War on Cash to view it as suspicious and dangerous.

For many years, the Argentine government refused to issue larger notes. Fortunately, that’s changing under the recently elected pro-market president Mauricio Macri. His government has promised to introduce 200-, 500-, and 1,000-peso notes in the near future.

This is the opposite of what’s happening in the U.S., where the $100 bill is the largest bill in circulation. That wasn’t always the case. At one point, the U.S. had $500, $1,000, $5,000, and even $10,000 bills. The government eliminated these large bills in 1969 under the pretext of fighting the War on Some Drugs.

The $100 bill has been the largest ever since. But it has far less purchasing power than it did in 1969. Decades of rampant money printing have debased the dollar. Today, a $100 note buys less than a $20 note did in 1969.

Even though the Federal Reserve has devalued the dollar over 80% since 1969, it still refuses to issue notes larger than $100.

Pennies and Nickels Under Sound Money

For perspective, consider what a penny and a nickel would be worth under a sound money system backed by gold. From 1792 to 1934, the price of gold was around $20 per ounce. Under this system, it took around 2,000 pennies to make an ounce of gold. At today’s gold price, a “sound money penny” would be worth about 55 modern pennies. A “sound money nickel” would be worth about $3.

I don’t pick up pennies off the sidewalk. But I would if pennies were backed by gold. If that were to happen, I doubt there would be many pennies sitting on busy New York sidewalks.

Ron Paul said it best when he discussed this issue…

“There is an old German saying that goes, ‘Whoever does not respect the penny is not worthy of the dollar.’ It expresses the sense that those who neglect or ignore the small things cannot be trusted with larger things, and fittingly describes the problems facing both the dollar and our nation today.

Unless Congress puts an end to the Fed’s loose monetary policy and returns to a sound and stable dollar, the issue of U.S. coin composition will be revisited every few years until inflation finally forces coins out of circulation altogether and we are left with only worthless paper.”

There’s an important lesson here.

Politicians and bureaucrats are the biggest threats to your financial security. For years, they’ve been quietly debasing the country’s currency… and inviting a currency catastrophe.

Most people have no idea how bad things can get when a currency collapses… let alone how to prepare.

How will you protect your savings in the event of a currency crisis? This just-released video will show you exactly how. Click here to watch it now.

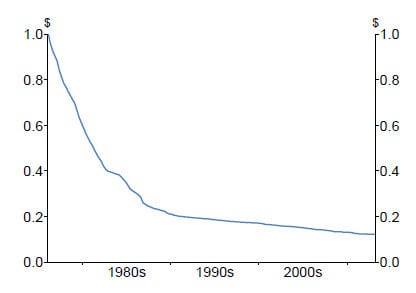

GoldSurvivalGuide Editor: Think the NZ dollar can’t be as badly affected? Think again. If you need a more graphical indicator of the NZ Dollars loss of purchasing power, the RBNZ is kind enough to include one on its website since 1967…

(Does this site support blockquotes in comments?)

As an American who’s dying to visit Russia and Japan soon, two other things I find woefully stupid about the American monetary system are these:

1. In 1982, the U.S. Mint switched the penny from real copper to copper-plated zinc. It’s 97.5% zinc and 2.5% copper. I’ve even heard that, if one swallows a penny, he/she runs the risk of having his/her stomach lining damaged because of the zinc, choking hazard aside. Even if they used a safer material such as aluminum instead, a more competent U.S. government would have discontinued the penny and promoted the dollar coin.

(A quick look at the Wikipedia page shows that the New Zealand 10-cent pieces are copper-plated steel. Have there been similar incidents in New Zealand regarding coin poisoning, or is it just an American thing?)

2. If the nickel is to go the way of the penny, then what will go next – the dime or the quarter?

When Denmark removed the 5-øre piece from circulation, they also removed the 10-øre pieces as well, keeping the 25-øre. When Sweden and Norway got rid of their 5s, they, on the other hand, eliminated their 25s and kept their 10s. It appears that recently Ukraine has followed Norway’s example and discontinued the 25-kopek piece along with the coins for 5 kopeks.

The main beef I have in this case is not so much the presence of a 25-cent coin as the lack of a proper half-dollar coin in general circulation. Regular production of the hefty half-dollar stopped in 2002 and now it’s relegated to collectors’ pieces, leaving Americans bereft of a proper coin to bridge the gap between the dime/quarter and the dollar.

(The Australian 50-cent piece is slightly larger and yet it sees wide usage. Vending machines and payphones there even support it! Why can’t America follow this example?)

Side note 3: Australia removed their 1- and 2-cent pieces from circulation in 1991, a year after New Zealand did with theirs. Unlike in New Zealand, Australia still considers their denominations to be legal tender. I dunno about you, but I feel this is one thing that Australia does right at least. What’s your opinion regarding the legal tender status of withdrawn coins?

Side note 4: I’ve noticed a few Britons who blame inflation of the British pound on its decimalization in 1971. Somehow I feel this is a tad fallacious; even if Britain still kept using pounds, shillings and pence, it’d still inflate to the point where pence would become obsolete. Have those guys not heard of the Bretton-Woods system?

Hi Josep, Yes we accept block quotes in comments. I’ve not heard of any coin poisoning in New Zealand. A quick search didn’t show up any news items on this either.

Here in New Zealand the 10 cent coin was also removed and demonetised in 2006. Our other coins were also altered in size and material they were manufactured from.

We’d agree that it isn’t fair to make the removed coins no longer legal tender. But then again many things about the monetary system are not fair!

The odds are that while we remain under a fiat monetary system we will see ongoing debasement and therefore the need for all nations to remove coins or change what they are manufactured from, as the cost to produce the coins increases compared to their face value.

Thanks for your comments.

Hi. Me again. Sorry for the long gap. Some other thoughts:

Did you mean the 5-cent piece? Typo?

What bothers me about the Australian dollar is how the coins are so large and heavy compared with the American coins. For instance, the US quarter (25 cents) is smaller and lighter than the old florin (now the 20-cent piece). Unlike the American, Canadian, Hong Kong, Malaysian and Singaporean dollars, the Australian and New Zealand “dollars” weren’t based off of the Spanish silver dollar unit and instead were equal to 10 shillings of the old pound currencies. From what I remember reading, the name “dollar” was chosen so it could be slightly above the American currency unit. A nasty side effect of the US dollar being the world reserve currency.

Until WWII the pound sterling traded for 4 to 5 US dollars. From the creation of the Bretton Woods system onward, the pound-to-dollar exchange rate narrowed to the point where, by the system’s abolition in 1971, one pound was exactly US$2.40. Neither Britain, Australia nor America changed the sizes of their respective coins to accommodate the change.

What wasn’t mentioned was how, until 2006, New Zealand 5-, 10- and 20-cent pieces could be used in Australia and vice versa. Since the New Zealand dollar was lower in value, the coins could be used as slugs in Australia. The 2006 redesign not only put an end to that, but also meant the coins no longer wore down your pockets.

And while we’re still on the subject of pennies, I have the notion that three other factors contribute to the USA’s refusal to eliminate the penny, implement cash rounding, and introduce higher denominations:

1. Some Americans are rather anal about tradition and would autistically scream “socialist” or “communist” whenever changes are to be made, such as metrication. In other words, tradition is upheld at the expense of sustainability and efficiency.

2. The zinc lobby profits from continued minting of pennies. It’s a sad reality that in America, corporations have more power than people.

3. The US dollar is currently the global reserve currency. By continuing to mint pennies, the US govt. creates the illusion of stability, making their inflation look less serious. This is also why dollar bills are still used instead of coins. It’s all made worse when the USA forces other countries at gunpoint to use US dollars, and any entity that tries to move away from dollars gets gunned down via “regime change”; for instance, Saddam Hussein was executed after he started selling oil in euros instead of dollars.

Hi Josep, Yes good spotting that was a typo – it should have read “the 10 cent coin was also removed and demonetised in 2006”. Thanks for your other points added. Particularly about the loss of ability to use NZ and Aus coins interchangeably in both countries. Can’t disagree with any of your notions about the USA penny. Keeping up appearances of the reserve currency sounds like a pretty good reason to us why the penny hasn’t been removed yet.