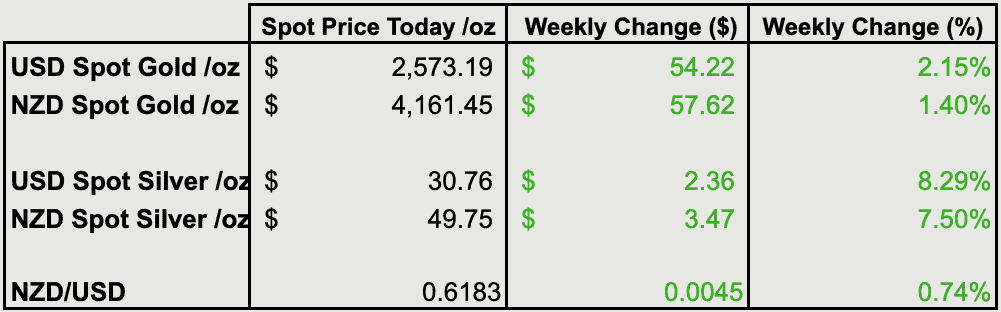

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3956 |

| Buying Back 1kg NZ Silver 999 Purity | $1480 |

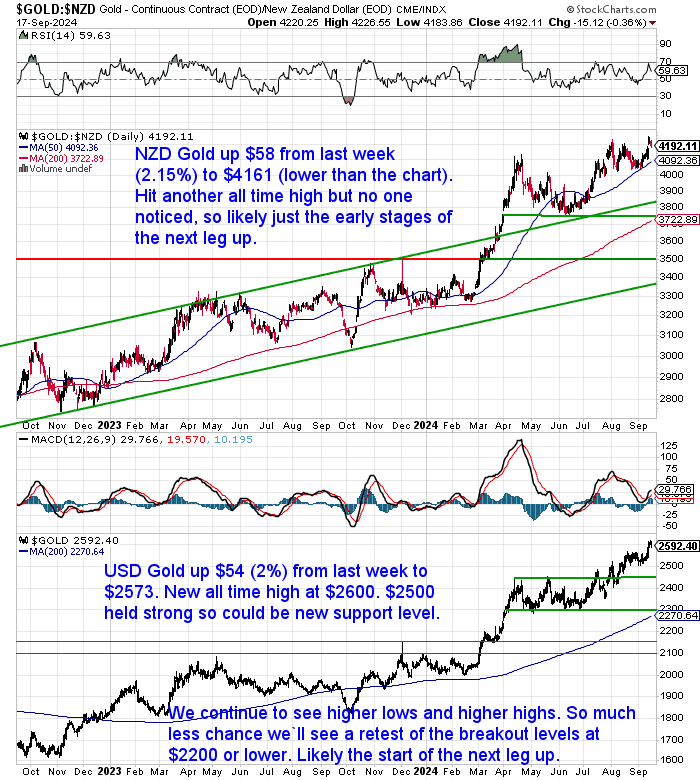

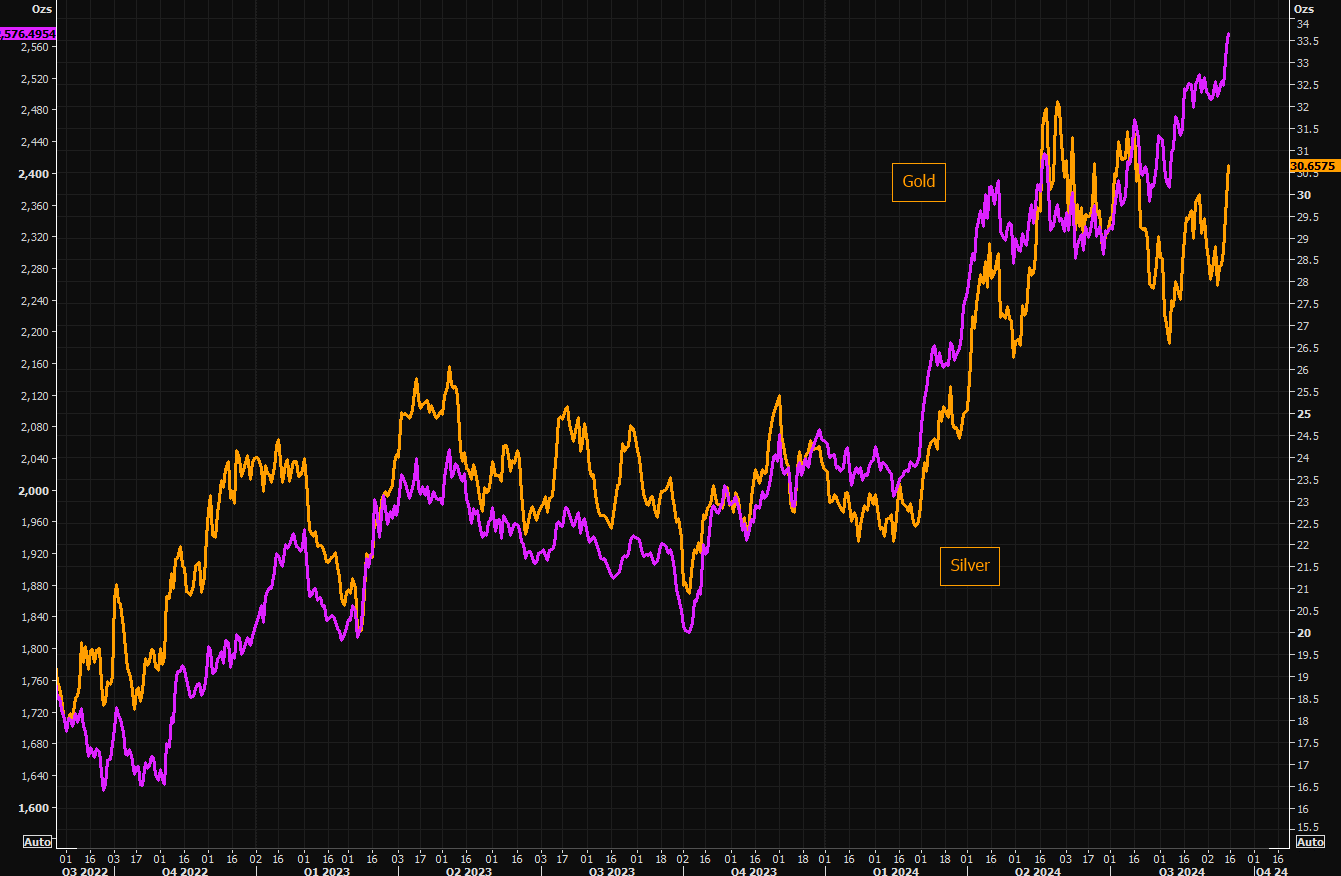

Another New All Time High for Gold in USD and NZD

Gold in New Zealand Dollars was up $58 (over 2%) from a week ago to $4161. It hit a new all time high on Monday just below $4200. But as we report further below, pretty much no one noticed. So our thinking is this is likely just the early stages of the next run higher. First buy zone on any dip looks to be the 50 day moving average (MA) around $4100.

USD gold is up $54 from last week to $2573 today. It also hit a new all time high turning down from near $2600. The $2500 level held strong to a series of tests, so that could be the new support level to watch for.

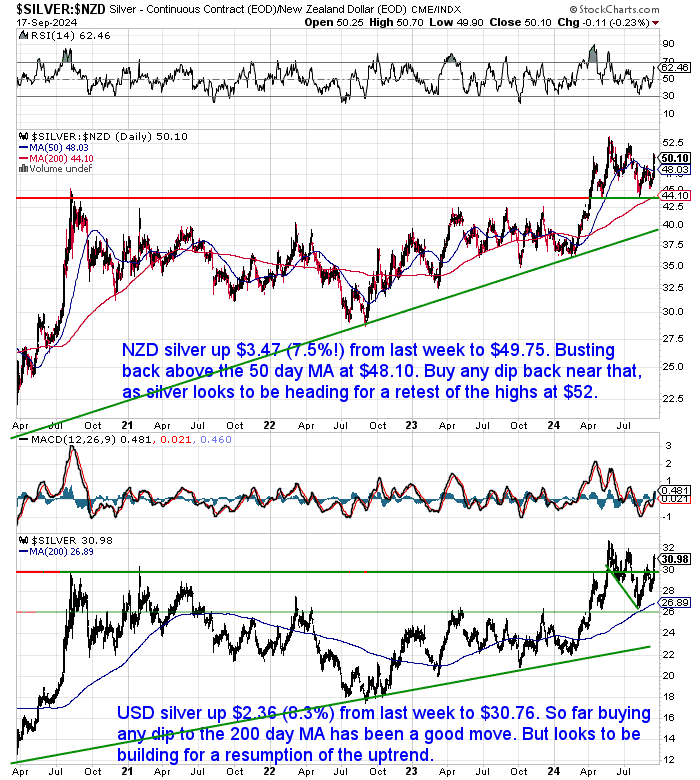

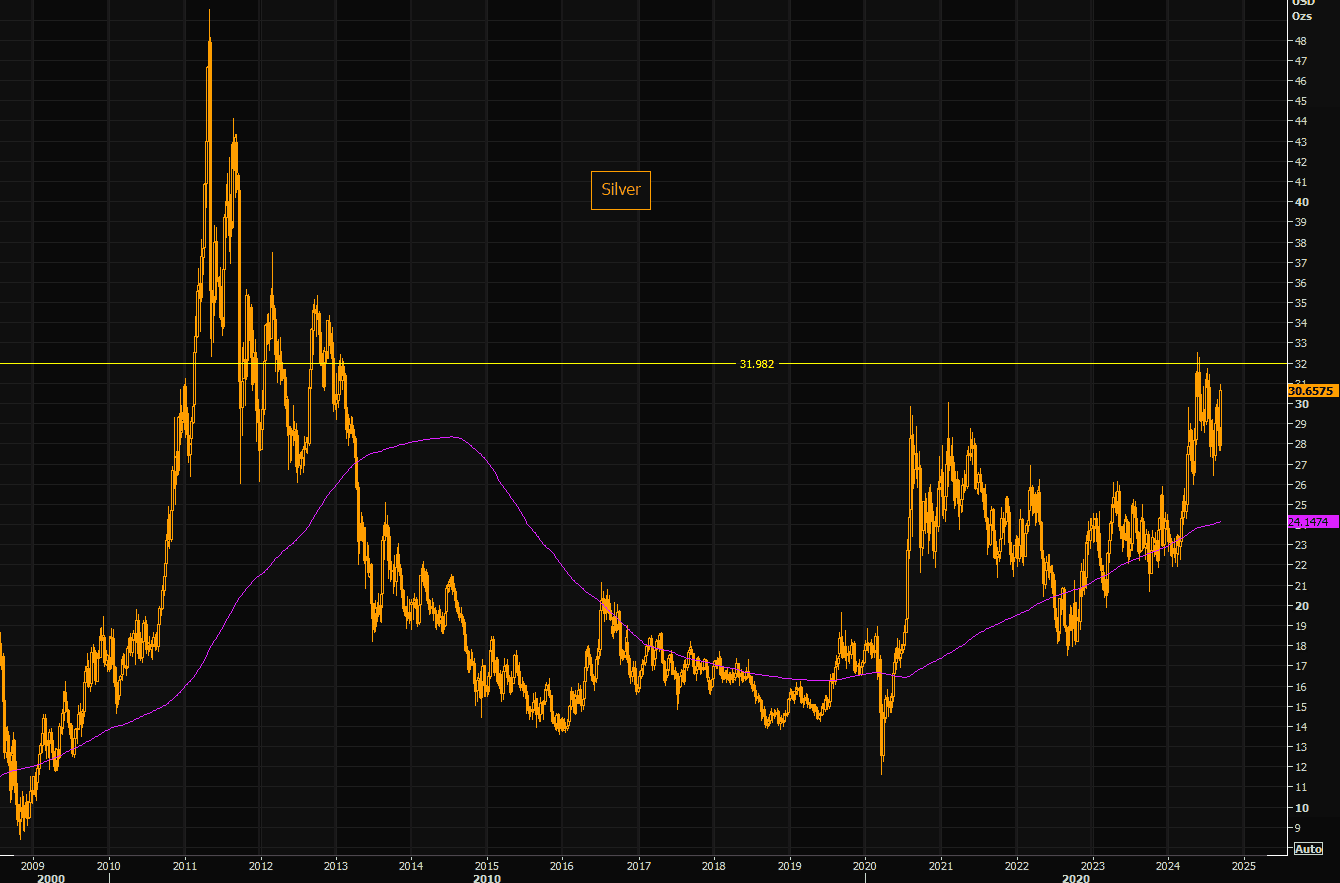

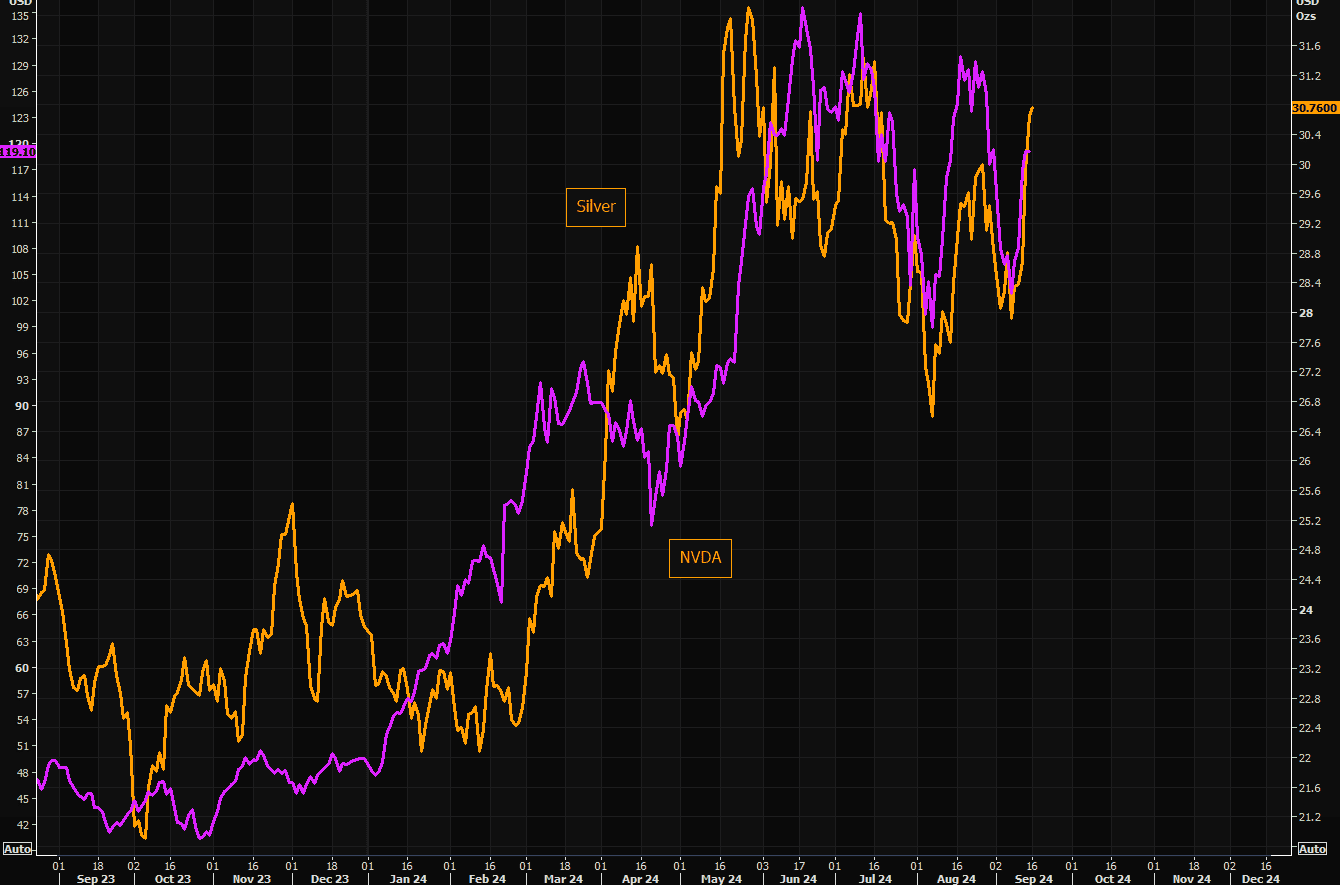

Silver Cranking Higher

Silver was the big mover this past week. In NZ dollars it was up a whopping 7.5% to $49.75. Busted back above the 50 day MA and kept going. It looks likely to be heading to test the $52.50 highs again soon. So any dip back to the 50 day MA should be a good buying zone.

While USD silver shot up 8.3% or $2.36 to $30.76. So far buying any dip down to the 200 day MA has been a good move. But silver looks to be heading back to retest $32. Building for a resumption of the uptrend from earlier this year.

More on the case for the upside in silver further down the page.

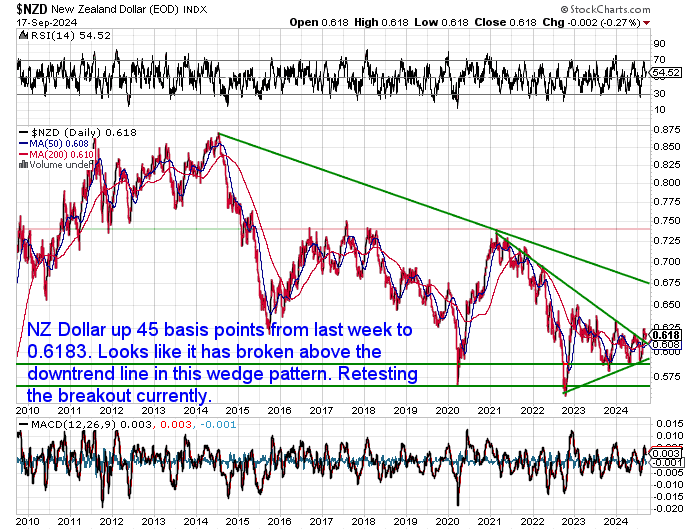

Kiwi Dollar Up After Retesting the Breakout

The New Zealand dollar was up 45 basis points from last week to 0.6183. It’s up from retesting the breakout above the downtrend line. Seem likely that it will trend higher from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

How Much Gold (and Silver) is Right for You? Finding Your Portfolio Allocation Sweet Spot

Ever wondered how much of the precious metals pie you should take a bite of? This week, we tackle the question of allocating gold and silver within your investment portfolio.

The article explores:

- Factors to consider when deciding how much precious metal exposure is right for you, such as your risk tolerance and investment goals

- Different allocation strategies employed by investors, ranging from conservative to aggressive approaches

- Whether gold and silver should be viewed as complementary assets within your overall portfolio

Intrigued by the idea of adding precious metals but unsure about the ideal percentage for your unique circumstances? This article delves into allocation strategies and helps you determine the potential sweet spot for gold and silver in your investment mix.

What Percentage of Gold and Silver Should Be in My Portfolio in 2024?

Become a Gold Survival Guide Partner

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

The Most Unnoticed All-Time High Ever – Yet Again

As noted already gold hit new all time highs in both USD and also NZD terms this past week. But we weren’t the only ones to notice that hardly anyone had noticed! Much like the other all time highs this year, of which there have been quite a few, this one went completely under the radar.

Ronnie Stoeferle pointed out:

“The Most Unnoticed All-Time High Ever.

#GOLD”

While Jim Rickards said:

“Did anyone notice that gold hit a new all-time high today? A few of us did. It’s fascinating how mainstream business media ignores the story. Could it be because the rally in gold is actually the collapse of the dollar?”

It could be. Although it likely also just shows that this is incredibly early in the current bull market for gold, and even earlier for silver – more on poor man’s gold below.

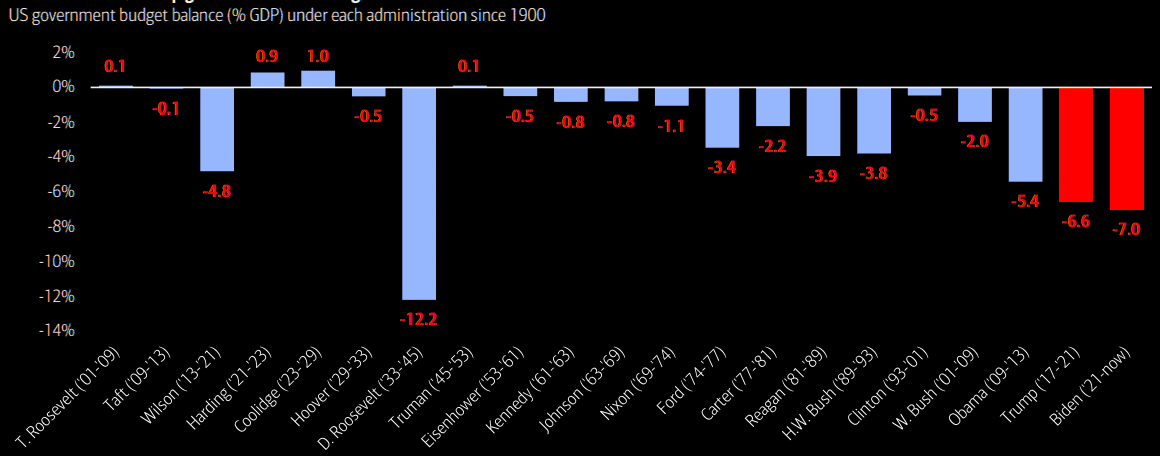

Steph Pomboy wondered if gold was flying due to the massive US budget deficit:

“Holy budget deficit, Batman! August Deficit comes in $90b ahead of estimate. Looks like we won’t get the details until 2pm est….but this is f-ugly! QE infinity coming soon. No wonder gold is flying.”

US Banks Getting Bullish on Gold

US Banks continue to be bullish on gold. First Bank of America, where again we are hearing about the US debt and deficit. Currently the second worst deficit only behind the US great depression era..

BofA continues their bullish gold thesis and say “buy dips…gold heading to $3000/oz as neither Harris/Trump gamechangers for trajectory of US government debt & deficit”.

Next UBS. Although we think their target and (if you read this week’s feature post) their percentage allocation are both too low:

UBS on more gold upside

1. Gold has risen by 23% this year, driven by macroeconomic and geopolitical uncertainties, lower US yield expectations, and central bank USD diversification.2. Gold is recommended as a hedge against risks, especially during volatile periods when it has outperformed equities.

3. A mid-2025 target for gold is set at USD 2,700/oz, with a suggested 5% allocation in a balanced USD portfolio.

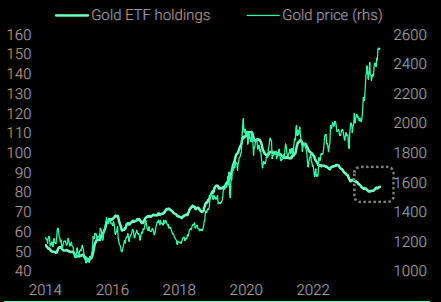

Retail Waking Up? Maybe More Like Just Stirring From Their Slumber

The retail market is waking up from the dead, but there is a heap of catching up to do. The below chart is just comparing ETF holdings to the gold price. TTF holdings are just ticking higher. To us it feels like retail bar and coin purchases have been even less. So more catch up to happen there yet. But we might be close to a shift where the western retail buyer joins in with the Eastern central banks.

Retail waking up in gold?

There is a lot of catching up to do…

Speaking of Eastern Central Banks

Jan Nieuwenhuijs dives into numbers that seem to show Saudi Arabia, like China and Thailand, has moved from being a price taker to a price driver. Meaning that previously they bought when the gold price dipped. Now their buying is likely contributing to the gold price rising:

Saudi Central Bank Caught Secretly Buying 160 Tonnes of Gold in Switzerland

The Saudis have joined other Asian countries in ditching their long-term sensitivity to the gold price. Evidence suggests the Saudi central bank has been covertly buying 160 tonnes of gold in Switzerland since early 2022, contributing to the current gold bull market.

Although the Saudis played a key role in the birth of the global dollar standard in the early 1970s, this time around they might even become a lynchpin for its dissolution.

Even More Upside in Silver

Retail buying might boost gold higher still. But it looks like even more upside in silver – and this is according to Goldman Sachs. With the big banks starting to get on board this could get a little more mainstream attention on poor man’s gold…

The case for silver

$32 is the big resistance to watch. Chart shows the weekly long term version with the 200 weekly moving average. GS sees silver as one of the best trades on the board. Main bullets:1. AI buildout

2. boosts from a more dovish Fed

3. lower positioning than Gold…catch-up trade logi

4. on the verge of a multi-month breakout

Silver and AI

You need silver to make AI work. Chart shows SLV and NVDA [chip maker Nvidia ] moving in pretty much perfect tandem.

Big Brother

Can silver manage to catch up to the gold squeeze?

The difficult thing with silver is timing these runs. Silver often lags gold and then plays a short but sharp catch up. We get the feeling we are approaching one of these times for silver. Safer just to be on board with some silver and wait patiently we reckon. How is your precious metals allocation looking? Do you have enough?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

What Percentage of Gold and Silver Should Be in My Portfolio in 2024?

Mon, 16 Sep 2024 3:05 PM NZST

Once you’ve decided to buy some gold or silver, a common question to then ask is: How much should I […]

The post What Percentage of Gold and Silver Should Be in My Portfolio in 2024? appeared first on Gold Survival Guide.

Read More…

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1473.50 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $28,061.10

Backdated coins: $27,980.41

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.