Prices and Charts

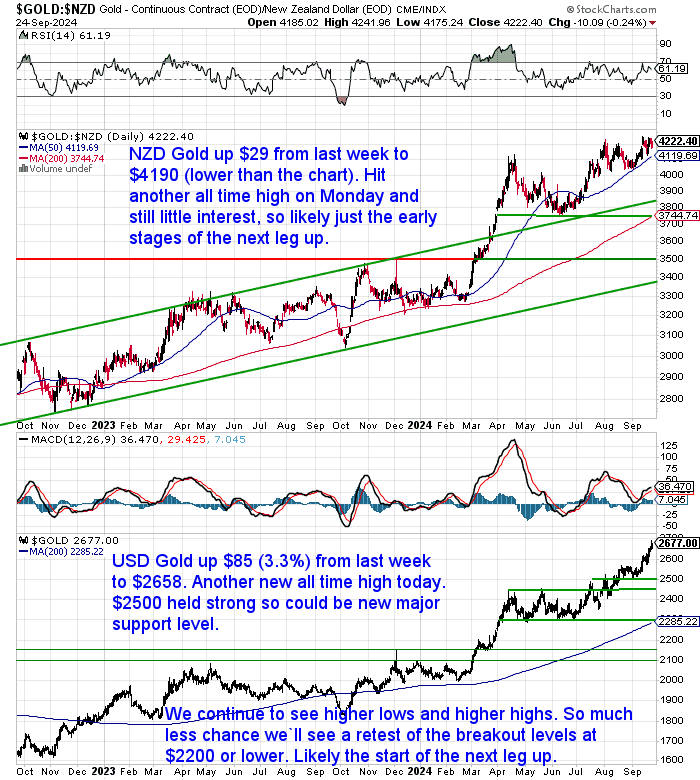

Gold – More All Time Highs

Gold in New Zealand dollar was up $29 this week. It hit another all time high on Monday but is down slightly from that to be at $4190 today (due to a stronger Kiwi dollar). There still remains little interest from the public so it’s likely just the early stages of the next leg up.

But USD Gold just keeps hitting all time highs every day. It’s up $85 or 3.3% from last week to $2658. US$2500 looks like being firmly in the rearview mirror now, with strong support there, could that now be the new floor for gold?

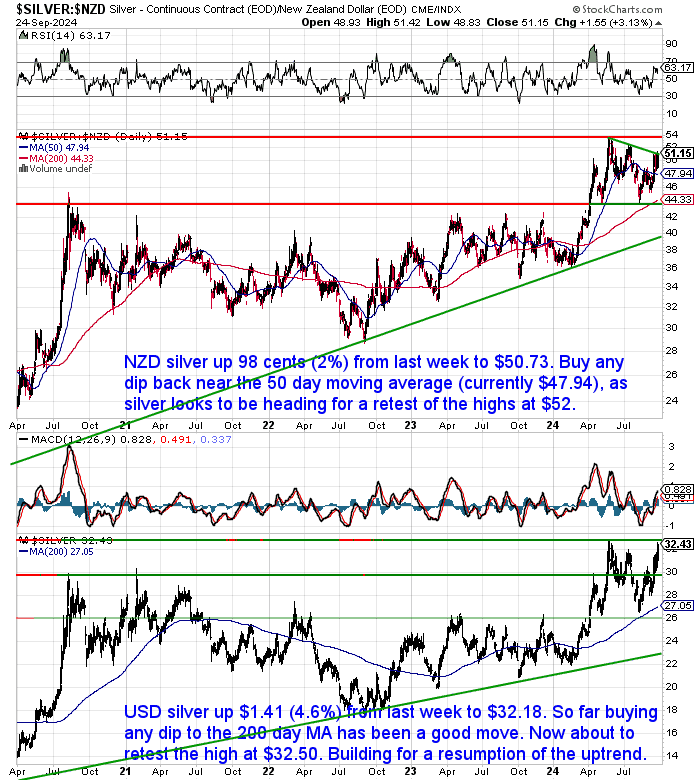

Silver Outperforming Gold

Silver again outperformed gold. In NZ dollars it was up 98 cents (2%) this week to $50.73. It looks likely to be heading up to retest the 2024 highs above $52 now. Looks to be a good move to buy any dip back down near to the 50 day MA (currently $47.94).

While USD silver jumped 4.6% or $1.41 to $32.18. It is very close to retesting this year’s high at $32.50. Buy any dip to the 200 day MA but it looks like silver is close to resuming the uptrend from the first half of this year.

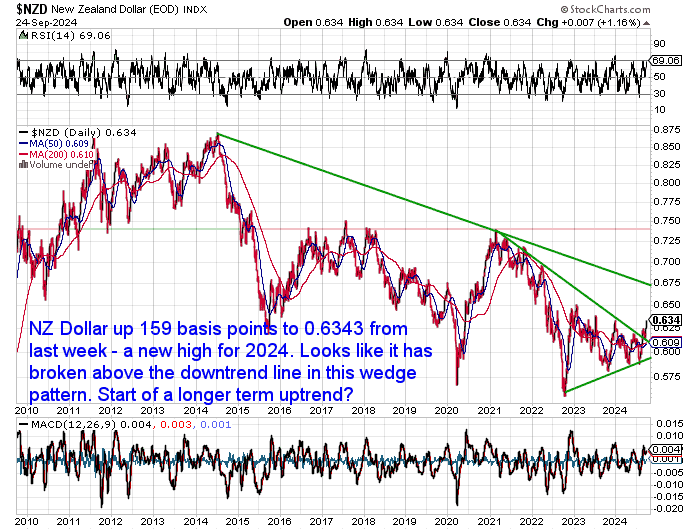

NZ Dollar Hits New High for 2024

The New Zealand dollar was up 159 basis from last week. With almost half that move overnight taking it to 0.6343, a new high for this year. It looks like this is the start of a longer term uptrend for the Kiwi. As we’ve been saying, expect bigger gains for USD priced gold and silver compared to NZD prices – the opposite of what we’ve seen for the last few years.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The Future of Money: A Glimpse into Potential Shifts in the Global Monetary System

The way we handle money today might not be set in stone. This week’s newsletter explores the concept of a changing global monetary system.

The article delves into:

- The potential factors that could lead to a transformation in how the world conducts financial transactions

- Different theories about what a future monetary system might look like

- How central banks and governments might react to these changes, leading to a revamped global monetary system

Feeling curious about the whispers of a future financial landscape unlike what we know today? This article explores various possibilities and the potential implications for gold and other assets, and the evolution of money.

Important Note: It’s important to acknowledge that predicting the future of the global monetary system is complex and uncertain. The article discusses possibilities and speculations, not guaranteed outcomes.

As highlighted in this week’s feature article above, there are risks facing China currently. Evidence of this was that overnight the Chinese central bank joined in the rate cuts occurring around the world. ASB:

“Yesterday the People’s Bank of China announced that it would cut the reserve requirement ratio (RRR) (i.e. the amount of cash that banks must hold) by 50bp to 9.5%. The PBoC also cut the 7-day reverse repo rate by 20bp at the same time. Bloomberg note that this is the first time in at least a decade both rates were cut on the same day, suggesting a degree of urgency behind the moves. There was also an unusual degree of forward guidance provided by the PBoC, noting that there could be another 25-50bp cut in the RRR by year end. There was also a host of other measures announced including lowering mortgage rates on existing mortgages, easing lending rules for second properties and allowing brokers to use PBoC funds to buy stocks. Whether or not the policy easing is enough to put the economy back on track to meet its ‘around 5%’ 2024 growth target remains to be seen. Our CBA colleagues are still of the view that monetary easing needs to be supplemented by more fiscal policy support to defend the growth target.”

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

All Eyes on the Fed

But the big news just after we published our weekly update last week was the US central bank cutting interest rates by more than most analysts predicted.

Charles-Henry Monchau of Swiss private bank Syz Group commented straight after:

“BREAKING 🚨 The Federal Reserve has cut interest rates by 50 basis points in their first rate cut since March 2020

The long awaited “Fed pivot” has officially begun… By starting their#monetarypolicy easing cycle with an aggressive 50 basis points rate cut it seems that the#fed decided to focus on the labor market part of their dual mandate rather than the#inflation one…

Here’s a summary of #Fed decision:

- Fed cuts interest rates by 50 bps for first time since 2020

- Fed sees 2 more 25 basis point rate cuts in 2024

- Fed governor Miki Bowman dissented in favour of a smaller 25 bps cut. It’s the first dissent by a *governor* since 2005.

- Fed gained “greater confidence” that inflation is moving to 2%

- Fed will “carefully asses incoming data” and evolve outlook

- Fed sees 100 bps of rate cuts in 2025 and 50 bps of cuts in 2026

This is a CLEAR Fed pivot and the Fed is signaling that they believe the disinflation trend remains in place but also that they now see making unemployment their top priority as the labor market has weakened. Their decision sounds almost like a risk management one. “

Source.

He also had some interesting statistics on the history of 50 basis point cuts:

“Last 2 times the Fed’s first cut was 50+ bps:

🔸Jan 3, 2001

– S&P 500 fell ~39% next 448 days

– Unemployment rose another 2.1%

– Recession

🔸Sep 18, 2007

– S&P 500 fell ~54% next 372 days

– Unemployment rose another 5.3%

– Recession

🔸Sep 18, 2024

– ?

– ?

– ?

Source: @Geiger_Capital”

Comments from one of the Fed members via ASB backs up the fact that the Fed is now worried about US unemployment:

“Fedspeak: Federal Reserve Bank of Chicago President Austan Goolsbee said interest rates need to be lowered “significantly” to protect the US labour market and support the economy. “As we’ve gained confidence that we are on the path back to 2% [inflation], it’s appropriate to increase our focus on the other side of the Fed’s mandate — to think about risks to employment”. Meanwhile Federal Reserve Bank of Minneapolis President Neel Kashkari said he expects to lower interest rates by smaller, quarter-point moves at the two remaining meetings this year. “After 50 basis points, we’re still in a net tight position so I was comfortable taking a larger first step,” Kashkari said yesterday.”

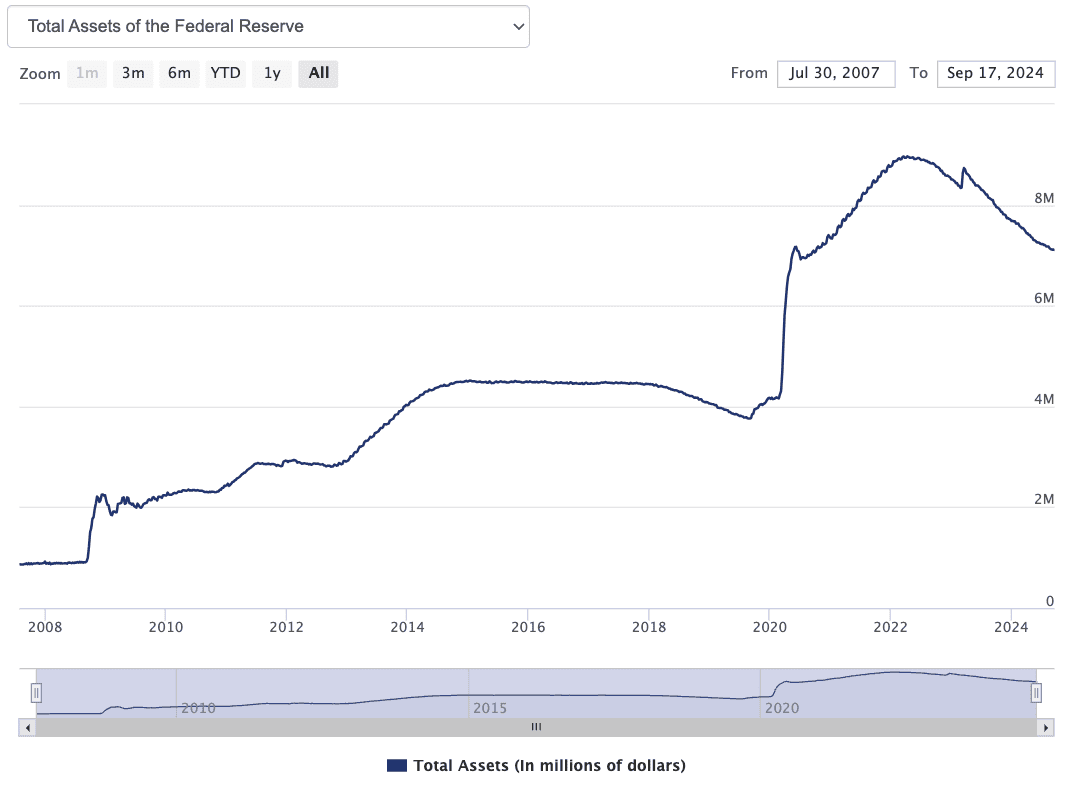

Easing While Tightening?

Perhaps one of the most significant points is that the Fed is now “easing” with interest rate cuts, but they are continuing to tighten by reducing their balance sheet by US$60 billion per month.

From ASB:

“The US$60bn monthly pace of quantitative tightening (including US$25bn of US Treasuries) was maintained, with US$35bn of mortgage-backed securities reinvested in US Treasuries.”

They have been reducing their balance sheet since 2022 and are now back to where it was after the initial huge jump in response to Covid19.

Source.

The Fed releases these numbers every Thursday. You can follow along with them here.

Hmmm… Tightening one valve in the monetary system while loosening another?

We’d say, rather than worrying so much about unemployment, the Fed is more likely concerned about the size of the US net interest bill. They simply can’t afford to pay such high rates on their ballooning debt. That is the likely main driver of the interest rate cuts

They’ll likely continue to reduce their balance sheet until something breaks – maybe a decent stock market fall? Or maybe another bank failure? Then we reckon we’ll see the currency printer cranked back up again.

Aggressive Fed pricing

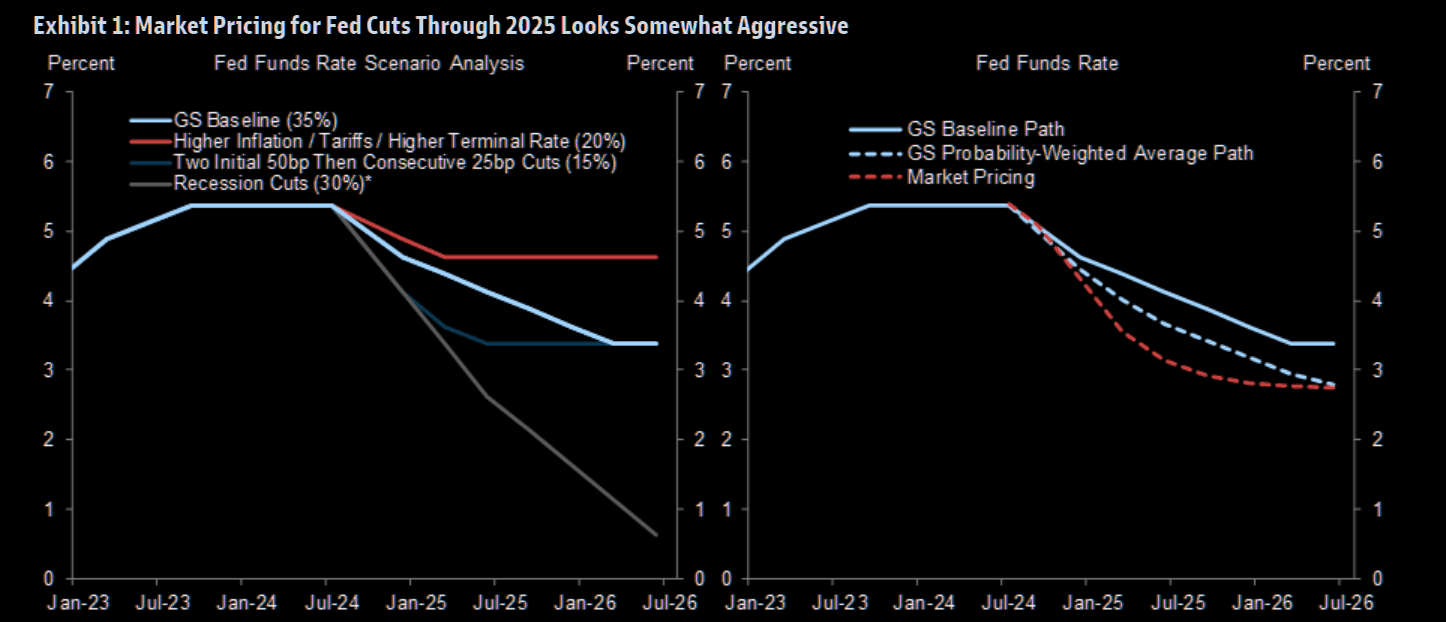

Here’s an interesting point from none other than Goldman Sachs [emphasis added is ours]:

“We continue to forecast a terminal Fed funds rate of 3.25-3.5%, with risks in both directions . A deeper trough is possible if the economy weakens more sharply and/or inflation undershoots the 2% target. But there is also an upside scenario in which the Fed pauses after the first few cuts because inflation proves stickier, perhaps because of higher tariffs. In our view, markets are putting too much weight on the first risk scenario and not enough on the second.“

Source.

Even Goldman Sachs analysts are pointing out that there is a risk for inflation to rear its head again before too long.

Gold’s Reaction to Fed Cuts: More All Time Highs

Perhaps not surprisingly gold has risen sharply to multiple new all time highs this past week. As noted already, today it is above US$2650 for the first time ever.

Gold – Institutional Investors Arriving – Retail Still to Come?

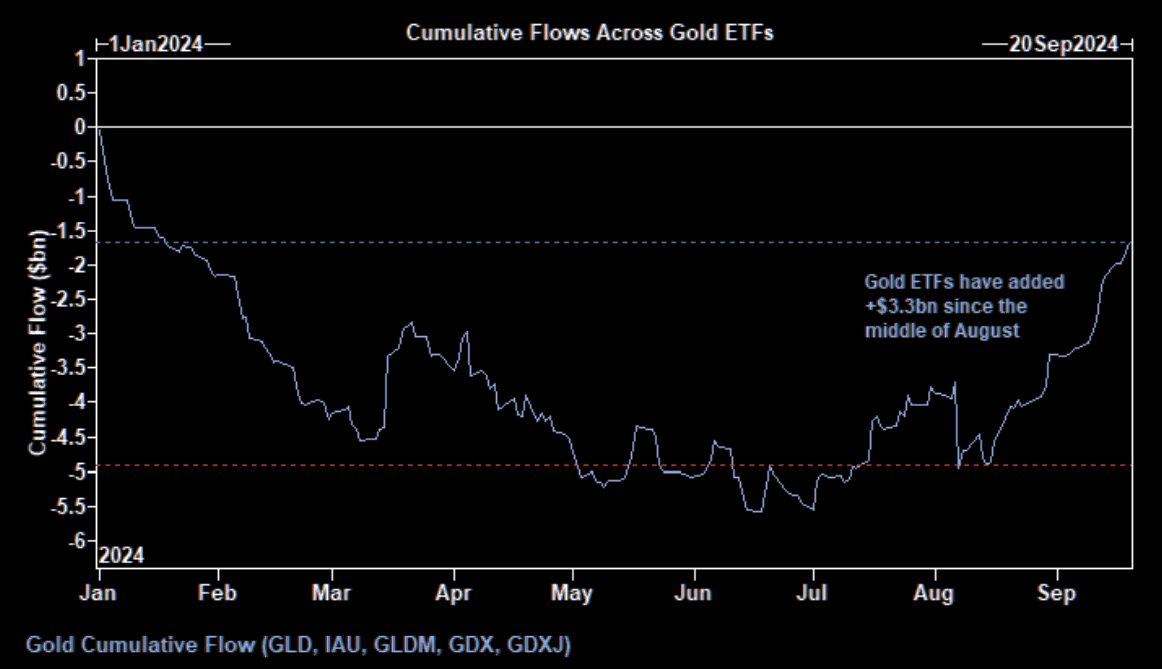

In terms of Exchange Traded Funds (ETFs), this chart from Goldman shows they have added $3.3 billion to their holdings since the middle of August. Also there have been no outflows in over a month.

Gold- Immune to outflows

Source.

So institutional demand (ETFs are a good proxy for this) looks to now be starting to follow the central bank demand we’ve been reporting on in recent years.

But we are not seeing retail demand picking up – yet. Premiums above spot price on gold and silver coins continue to be around record lows

Our guess is that it is only a matter of time before this next sector of the precious metals market also heats up. But we’d also say this is likely a contrarian indicator that prices have much further to run in this leg up yet.

So if you’re sitting on the fence, there is a danger we’ll see prices just continue to climb the “wall of worry” steadily higher. Get in touch to get on board.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|