Prices and Charts

Gold Hovering Just Below All-Time High

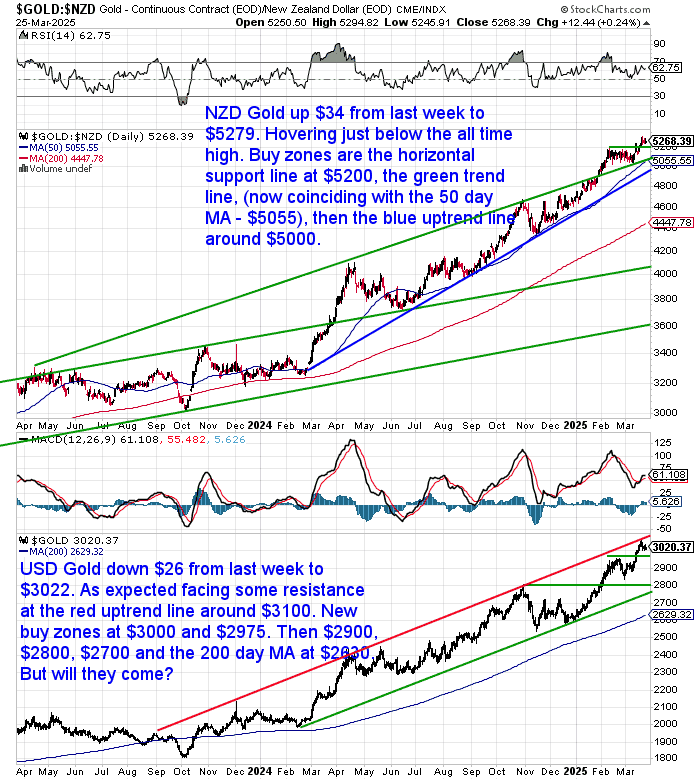

Gold in New Zealand dollars was up $34 from last week to $5279. It’s hovering just below the all-time high.

Buy zones are:

- Horizontal support line at $5200

- The green uptrend line and 50-day moving average around $5055

- Blue uptrend line around $5000

While in USD gold was down $26 to $3022. As we expected it is facing some resistance at the red uptrend line around $3100.

USD buy zones are:

But to date any pull backs in gold have been shallow.

Another Higher Low For Silver

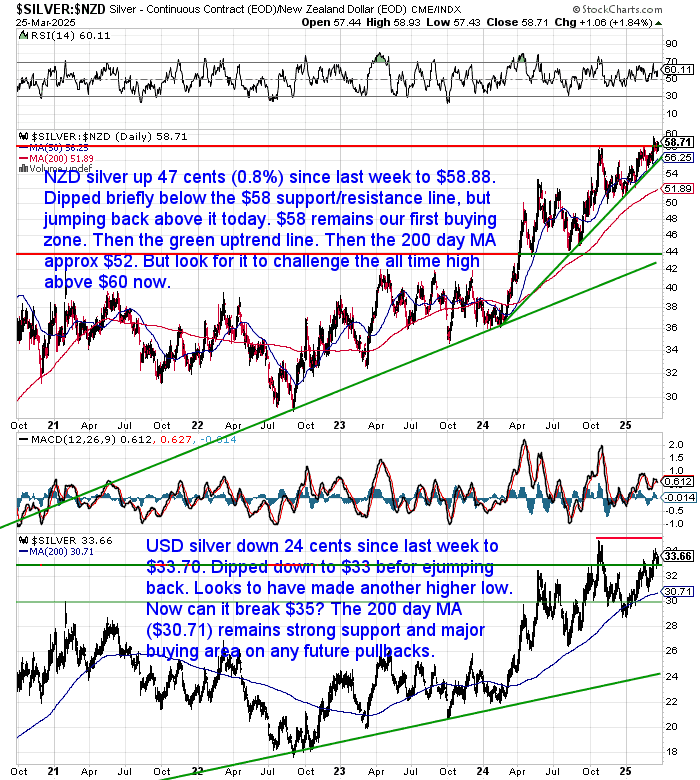

NZD silver was up 47 cents to $58.88. It dipped just briefly below the $58 support/resistance line but it jumped sharply back today. That remains our first buying zone. Then a little below that the green uptrend line. Further down is the 200 day MA at $52. However silver as we note in today’s feature article silver has been holding up well compared to global stock markets.

While USD silver was down 24 cents to $33.70. But it looks like it has made a higher low around $33. Now can it move up to break the key $35 mark? This week’s feature article covers factors that could push silver higher.

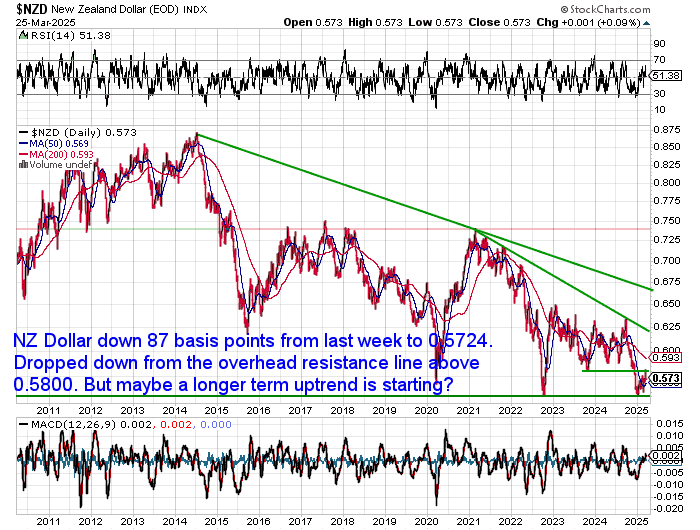

Weaker Kiwi Boosts Local Metals Prices – But Longer Term Uptrend Starting?

The Kiwi dollar was down 87 basis points from a week prior to 0.5724. It’s beginning to look like a longer term uptrend in the NZ dollar is starting. Although we first have to see if it can break through the overhead resistance line just above 0.5800.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver Is Rising—But Is Something Bigger Coming?

With silver outperforming the stock market this year, more eyes are on the metal. But behind the price action, it seems something deeper is brewing: tight supply in major market places, massive short exposure, and growing tension between physical and paper silver.

In this week’s feature article we dig into the data at the London Bullion Market (LBMA), COMEX futures and silver ETFs. Trying to answer the question: Is a squeeze around the corner?

The last time retail traders tried to squeeze silver in 2021, it fizzled. But see why this time, dare we say it, might be different…

There’s a fair bit to sink your teeth into, so we’ll keep the rest of today’s newsletter brief. Read the full analysis below.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way! We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support. Interested? Contact us today to learn more!

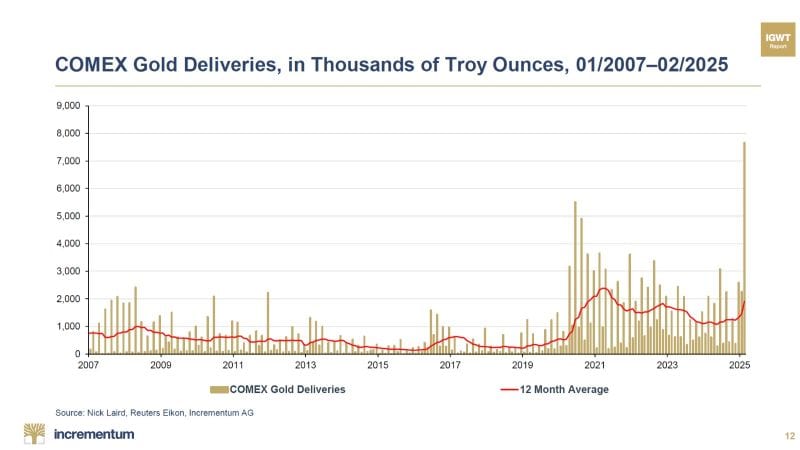

COMEX Gold Deliveries Hit All-Time High

We cover COMEX silver futures in this week’s feature article. But Ronni Stoeferle shared this chart on Comex Gold and stated:

Wow!

COMEX Gold Deliveries going through the roof!

Source.

What is the significance of this chart?”

Well, COMEX is the main market for gold futures and they almost always settle in cash or get rolled into the next month. But in January there were almost 8 million ounces of gold deliveries. An all time record. Or said another way, someone wanted (a lot of!) physical gold not cash.

Further evidence that something is changing in the gold market.

Brief Silver Correction: Ready to Push Higher?

Tavi Costas silver chart adds weight to our thesis in this week’s feature article that a silver squeeze could finally be coming. He says:

“After a healthy 5% correction, silver looks ripe for another push higher in my view.

Gold continues to hold well above its critical $3,000/oz level, and I believe we could experience a major catch up in silver prices.”

Source

Due to all the silver that has been sold in the past number of months we still have the deals going on previous issue silver coins and Various Brands of 1kg Silver bars. (Note: The 1kg bars are not listed on the site and are a subscriber only deal so email or phone for those).

So now might be a good time to order before a potential next move higher for silver.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|