Darryl Schoon compares the action of gold at $1900 now to 2008-09 when it was $1000 that was being defended. He argues that $1900 will also fall before too long just like $1000 did…

The bankers have drawn a line in the sand at $1900 for gold. The sand, however, is far more important than the line.

In 1949, in his classic treatise, Human Action, Ludwig von Mises, the noted Austrian economist wrote: All present-day governments are fanatically committed to an easy money policy. As has been mentioned already, the British Government has asserted that credit expansion has performed “the miracle…of turning a stone into bread.”

The British government’s belief that credit expansion can produce the economic equivalent of turning stone into bread is similar to heroin’s amazing ability to turn pain into pleasure; and, while both may do so, the use of such miraculous powers is not without serious consequence.

The difficulty of addicts in curing their addictions is a function of the benefits of the addiction. Those beset by overwhelming emotional problems and/or pain find it difficult to face life without heroin after being addicted—a not too different experience from those addicted to credit’s ephemeral gifts.

The U.S., in fact, is…an addict whose habit extends beyond weed or cocaine and who frequently pleasures itself with budgetary crystal meth.

Bill Gross, PIMCO, October 2, 2012

NO ONE WANTS THE GOOD TIMES TO END

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up and the breakdown of the whole monetary system.

Ludwig von Mises, 1949

Von Mises’ predictions about capitalism’s accelerating addiction to credit—and, consequently, debt—have now been realized. When Reagan replaced Paul Volker with ‘Easy Al’ Greenspan as head of the Federal Reserve in 1987, easy credit and the demise of capital markets were as certain as Christ’s crucifixion when he entered Jerusalem.

Today, only the final act in capitalism’s three-hundred year run at the table of luck remains to be played out.

When stocks lose their value

That’s a terrible thing

When homes lose their value

That’s a terrible thing

But when money loses its value

That’s the most terrible thing of all

Time of the Vulture, DRSchoon

(3rd edition 2012)

In capitalist economies, money is a function of credit and debt; and, in the endgame when debt overwhelms credit’s ability to expand, money succumbs to excessive issuance and the crack up and the breakdown of the whole monetary system ensues.

The current ills of the euro—the ill-conceived attempt of the EU to compete with the faltering US dollar—are clear signs the monetary system is now breaking down as von Mises predicted; a breakdown that began in 1971 when the convertibility of the US dollar to gold ended and all currencies became fiat.

Note: Those curious about the euro’s launch would do well to read Debt & Delusion – Central Bank Follies That Threaten Economic Disaster by Peter Warburton. Written in prose unequaled in financial commentary, Warburton’s first printing sold out and was not reissued until later; in the interim becoming a classic among economic apostates in search of truth.

Warburton’s observations regarding central banks makes this work the seminal book it has become. When central bankers’ transferred the financing of sovereign debt from commercial banks to capital markets, capitalism achieved a much needed gain in longevity—a gain that has now run its course.

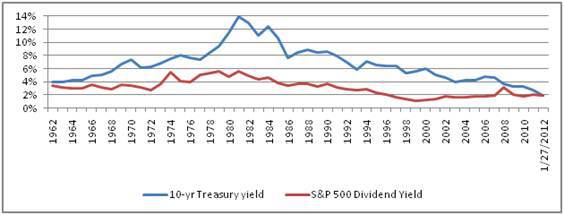

Beginning in the 1980s, central banks led by the Fed provided virtually risk-free returns to bond investors as US Treasury yields moved steadily lower, increasing the value of previously issued bonds held by investors.

This allowed governments and especially the US to feed voraciously at the now apparently bottomless trough of sovereign debt. Today, however, Treasury rates are now close to zero and the punch bowl is almost empty. The central bankers’ bond party is over.

Central bankers are, in truth, more jugglers than magicians in the arena of finance; and their ability to juggle is being questioned as never before as the last act in capitalism’s big tent gets underway. The crack up and the breakdown of the whole monetary system has begun.

PAPER MONEY’S BIRTH, RESURRECTION AND ITS OFT-REPEATED DEATH

The Chinese invented gunpowder and paper money; both would become weapons of mass destruction in the West.

Ralph T. Foster, in Fiat Paper Money: the History and Evolution of our Currency, traces the rise and fall of paper money from its birthplace in China to its spread to the West and back again.

Like the Sirens of Sirenum, paper money’s fatal lure proved irresistible to governments everywhere seeking to spend what they didn’t have; and, bankers, by embedding debt into paper money, achieved unspeakable fortunes by indebting governments and their citizens beyond their ability to repay.

In whose interest is interest?

When gold was removed from the bankers’ paper money in 1971, governments’ latest attempt to pass off paper money as money was doomed; because in a confidence game, confidence is absolutely necessary, irrespective of the game being played.

As Foster notes in Fiat Paper Money, when the Mongols conquered China in the 13th century, they had backed their paper money with silver. The penalty for not accepting Genghis Khan’s paper money was death. To instill confidence—even the Mongols knew force only goes so far—stabilization bureaus were established where paper money could be exchanged for gold or silver.

pp. 21-25, Fiat Paper Money: the History and Evolution of our Currency, Ralph T. Foster

But, then, as today, military expenditures bankrupted the Mongol’s treasury, the stabilization bureaus were closed, money-printing rapidly increased and the Mongol’s paper money soon became as worthless as the paper notes previously issued by the Sung, Chin and Southern Sung dynasties.

Another government using paper money had bit the dust.

Note: Fiat Paper Money can be ordered directly by emailing Ralph T. Foster at tfdf@pacbell.net A discount is available if you mention my name.

BANKERS, PAPER MONEY AND GOLD

Time is what the bankers are playing for and time is running out. The rising price of gold is an inverse indicator of how much time the bankers have left.

Central bankers are in retreat. Like Hitler’s and Napoleon’s armies after their defeats in Moscow, today the bankers’ strategies resemble those of soon-to-be defeated armies playing for time, not victory.

The antipathy of central bankers to gold is misunderstood by most; as most do not understand the underlying reasons for the bankers’ war on gold. In his book, Gold Wars, Swiss banker Ferdinand Lips, reveals the depth of the bankers’ distaste for monetary gold, i.e. gold tied to currencies.

The IMF.. explicitly states in its Articles of Agreement that member countries are prohibited from tying their currencies to gold.

Gold Wars, Ferdinand Lips, Foundation for the Advancement of Monetary Education (2001)

A Chairman of the Federal Reserve Bank of New York has declared that “final freedom from the domestic money market exists for every sovereign national state where there exists an institution which functions in the manner of a modern central bank, and whose currency is not convertible into gold or into some other commodity.

Human Action, Ludwig von Mises, 1949

Bankers want no constraints on their ability print money in order to extend credit and indebt others ad infinitum. Monetary gold, the only such constraint on the bankers’ insatiable appetite, ceased to exist after 1971 when the ties between money and gold were cut

That bankers successfully extricated themselves from gold’s constraints will be the cause of their undoing; for their success in doing so is no different than if astronauts were to successfully ditch their safety harnesses during take-off.

Sometimes, there are reasons for constraints

BANKERS, THE LINE IN THE SAND AND GOLD

The bankers have drawn a line in the sand at $1900 for gold. The sand, however, is far more important than the line.

When a line is drawn, it’s a sign that macro-economic events are about to drive the price of gold far higher and central bankers will move aggressively to defend the line they have drawn.

In 2008 when the global economy collapsed, the price of gold reached $1,000 in mid-March. Gold, however, ended the year at $870; and although the demand for gold had skyrocketed in the midst the greatest crisis since the 1930s, gold would not reach $1,000 again until September 2009.

Demand for gold rose to $102 billion in 2008, an increase of almost a third on the previous year.

February 18, 2009, the Telegraph UK

The central banks had drawn a line in the sand at $1,000 and defended that line by looting national treasuries of member countries such as Switzerland, increasing the supply of gold sufficiently to absorb the exploding demand and successfully kept gold prices virtually unchanged during the year.

In March 2009 in Gold Buying Opportunity of a Lifetime, I wrote about how central bankers had kept gold below $1,000:

When gold made its run in the fall of 2007 from $680 to $1,033 in spring 2008, the Swiss National Bank sold 22 tons of gold to cap gold’s rise…One year later (after the collapse of global stock markets in the fall of 2008), gold made another run at $1,000; but this time when gold hit $1,009 on February 20th , LeMetropole reported central banks sold 220 tons of gold to force gold below $900.

Last year, in September 2011, central bankers drew another line in the sand at $1900. In July and August, gold had risen from $1480 to $1923 and the euro crisis was threatening to push gold even higher even faster; and, in my article, Gold’s Coming Rise I explain how central bankers forced gold prices down to $1600 despite growing demand.

IN THE END, NO LINE WILL BE VISIBLE NOR WILL BANKERS

Like the $1,000 line in the sand, the bankers’ $1900 line will also be taken out. When market forces grow too strong for central bankers to resist, market forces will break through the bankers’ defenses with sufficient momentum to force the bankers’ to abandon their defenses and flee.

After they do, markets will again be free—and so will we.

My current youtube video, The Real Story of Paper Money, is now available on my website at www.drschoon.com.

Buy gold, buy silver, have faith.

Darryl Robert Schoon

Pingback: Silver and Gold in NZD: Performance Year to Date 2012 | Gold Prices | Gold Investing Guide