This Week:

Estimated reading time: 6 minutes

Weekly Price Overview – 20 August 2025

A quieter week: gold was flat-to-softer, silver eased from recent highs, and a weaker Kiwi helped cushion NZD metals.

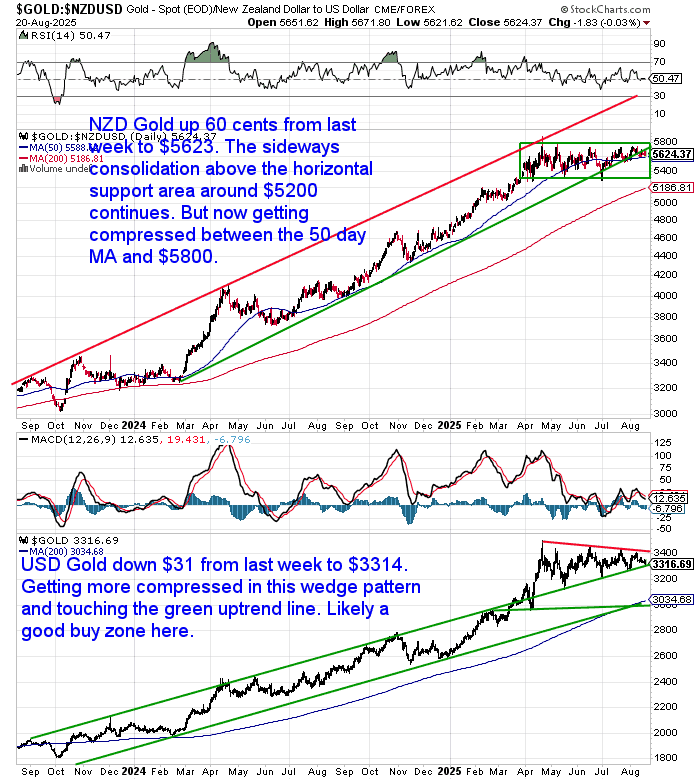

🟡 Gold:

- NZD gold edged up $0.61 to $5,623.05 (+0.01%). Sideways consolidation above $5,200 continues, now compressing between the 50-day MA and $5,800 resistance.

- USD gold slipped $31.13 to $3,314.23 (-0.93%) and touched the rising trend line — a potential buy zone if support holds.

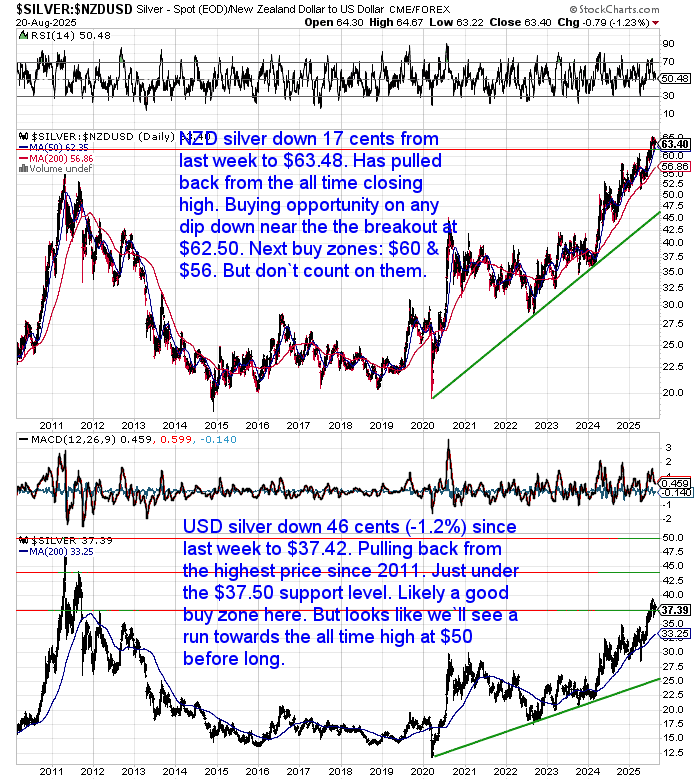

⚪ Silver:

- NZD silver dipped $0.17 to $63.48 (-0.27%), pulling back from an all-time closing high. First buy area sits near the $62.50 breakout; deeper zones $60 and $56 (lower odds).

- USD silver fell $0.46 to $37.42 (-1.21%), sits just under $37.50 support — a logical spot for dip-buyers while the larger uptrend targets the $50 prior peak.

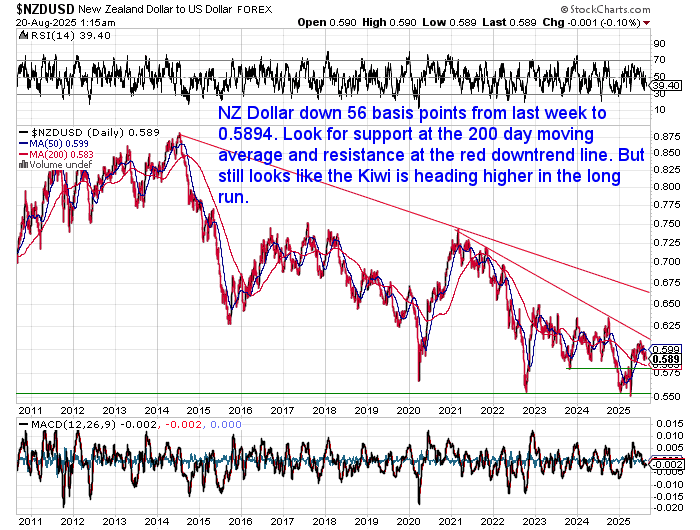

💱 NZD/USD:

The Kiwi slid -0.94% to 0.5894. Watch the 200-day MA for support and the long-term downtrend line as resistance; the bigger picture still looks higher over time.

📈 Takeaway:

Gold continues to base; silver stays in the lead even with this week’s pullback. With inflation pressures re-emerging, buy-the-dip opportunities remain attractive — particularly in silver, and in gold on tests of trend support.

Inflation Watch: Not Done Yet (U.S. + NZ)

U.S.: The story of the week was the re-emergence of inflation. Tavi Costa shared a chart showing ISM Services PMI Prices leading core CPI by about 12 months. If that pattern holds, price pressure may have more to run. Near term, that gives the Fed a reason to hold rates, even as markets price strong odds of cuts. Longer term, politics could push for cuts anyway—but that wouldn’t make inflation vanish.

U.S. ISM Services prices tend to lead core CPI by ~12 months – Source: Bloomberg, Tavi Costa / Crescat (15 Aug 2025).

Side note: Inflation isn’t just “prices going up.” As the Austrian economists remind us, it’s a monetary issue. U.S. money supply is back near record levels, which doesn’t help cool things.

U.S. money supply near record highs – Source: Bloomberg, Tavi Costa (25 Jul 2025).

New Zealand: Closer to home, food prices rose 5% in the year to July (Selected Price Indexes, Stats NZ). Westpac now says headline inflation could pop back above 3% before year-end. That keeps us at the top of the RBNZ target band and narrows any room for quick cuts here too.

Bottom line: Across both hemispheres, inflation looks sticky, not actually solved. In that kind of backdrop, we prefer simple, durable defence: own some real assets. That’s the thinking behind this week’s feature on gold revaluation and U.S. reserves.

Is a U.S. Gold Revaluation Back on the Table? What It Could Mean for You

The Fed just did something rare: it published on gold revaluation, moving the idea from fringe to policy. Our guide explains what revaluation is, why U.S. gold is still booked at $42.22/oz, and what it could mean for the dollar, debt, and investors. We also address the “$10,000 gold?” question and give simple steps to protect savings—without guessing on policy moves.

Read the full explainer: Gold Revaluation & U.S. Gold Reserves

IGWT25 Spotlight: From Dollar Milkshake to a Golden Anchor

A chapter in this year’s In Gold We Trust report argues the global system is splitting into blocs, with more countries leaning towards gold to rebuild trust. It outlines a proposed “Mar-a-Lago Accord” (tariffs + security guarantees + gold-backed bonds) aimed at fixing persistent dollar imbalances without detonating the system (we discussed the Mar-a-Lago Accord in more detail back in February). IGWT reminds us that previous currency pacts (Plaza/Louvre) were messy — and gold outperformed after each. In other words: when the reserve currency structure alters, gold tends to matter more. Full chapter here: ingoldwetrust.report

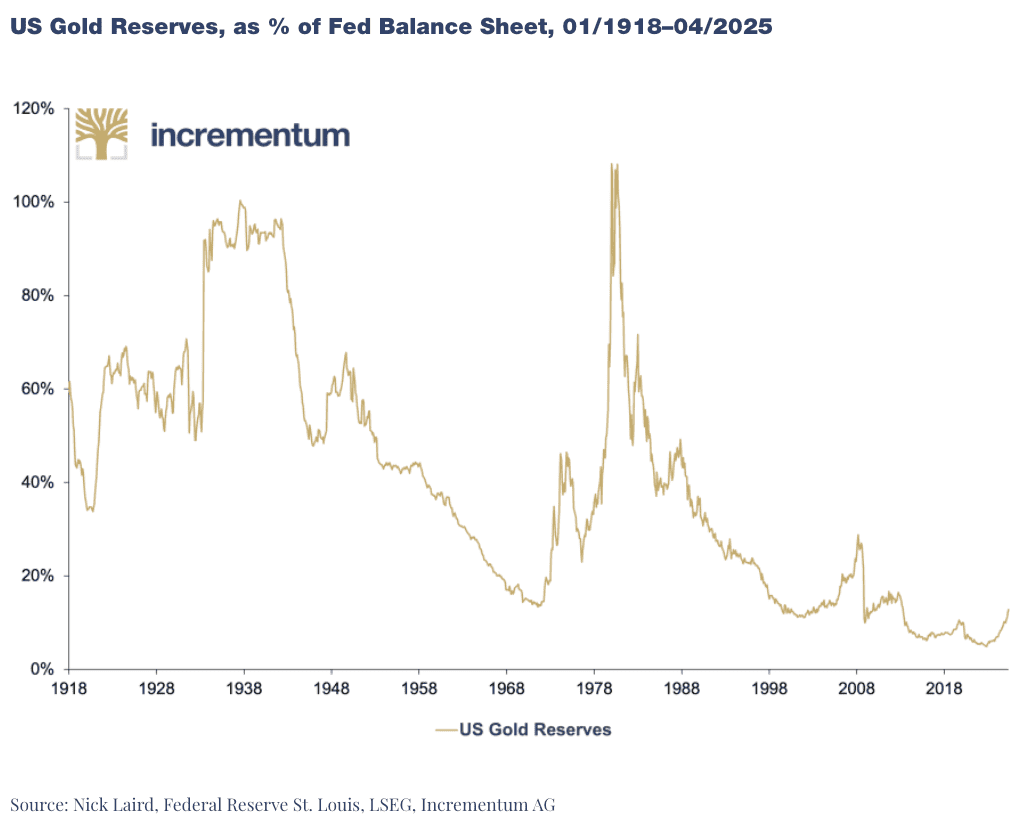

Chart of the Week: U.S. Gold Reserves as % of the Fed Balance Sheet (1918–2025) — now near historic lows. That’s one reason policymakers are again floating gold-anchored ideas — and why our feature on gold revaluation & U.S. reserves is timely.

Meme of the Week: Unhappy Anniversary, America… and World

This week marks the “temporary” end of sound money—when President Nixon shut the gold window in 1971. Five decades on, we’re still living with the fallout. And now the Fed is openly discussing gold revaluation. Different era, same lesson: when trust in fiat gets shaky, gold endures.

Credit: Lobo Tiggre

If policymakers are revisiting gold, maybe it’s time we all did. Questions? Hit reply or call—we’re here to help.