This Week:

- NZ Government $1 Billion Capital Spending Sign of Things to Come?

- Deflation Then Inflation

- The Screaming Fundamentals For Owning Gold

- How to Prepare for the Coming Collapse in Credit – Chris Martenson

|

LIMITED QUANTITY GOLD SPECIAL

***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars Green Packaging (Approx $1676) (6 green in Stock) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1582.74 | – $17.74 | – 1.10% |

| USD Gold | $1073.10 | – $1.30 | – 0.12% |

| NZD Silver | $20.94 | – $0.19 | – 0.89% |

| USD Silver | $14.20 | + $0.02 | + 0.14% |

| NZD/USD | 0.6780 | + 0.0067 | + 1.00% |

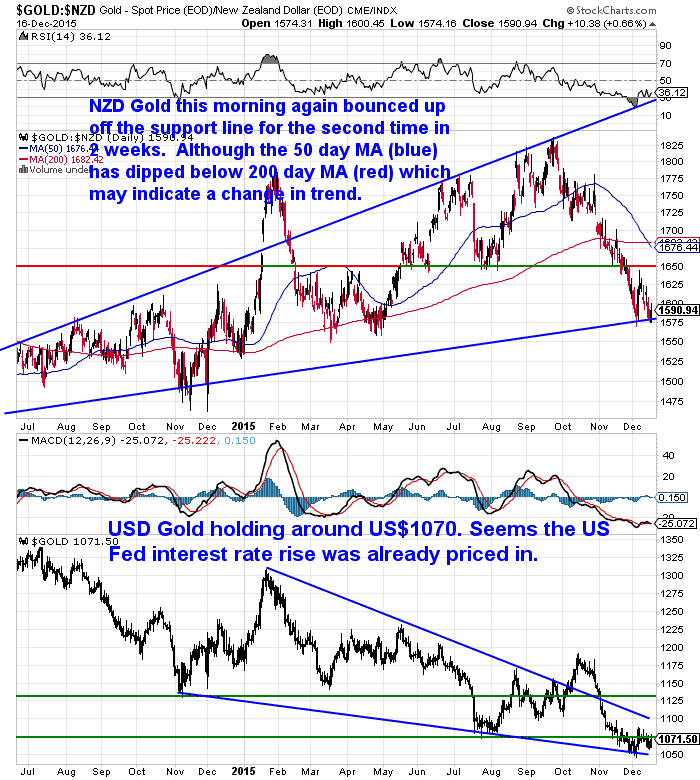

News this morning was that the US Federal Reserve finally edged short term US interest rates higher by 0.25% after 7 years. It seems that this move was already priced into gold and silver, as they are both higher today not lower as many had expected.

We’ve noted before how there is in fact historical precedence for gold to rise with interest rates anyway, but this is largely ignored by the mainstream anyway.

Gold in NZ dollars bounced sharply higher this morning after touching on the trendline for the second time in 2 weeks.

Of note the 50 day moving average (blue line) has crossed below the 200 day moving average (red line), which can be indicative of a change in trend (uptrend to downtrend).

However with the NZ Dollar getting overbought (more on that below), and the MACD looking to turn higher, we think the odds now favour a move higher from these low levels.

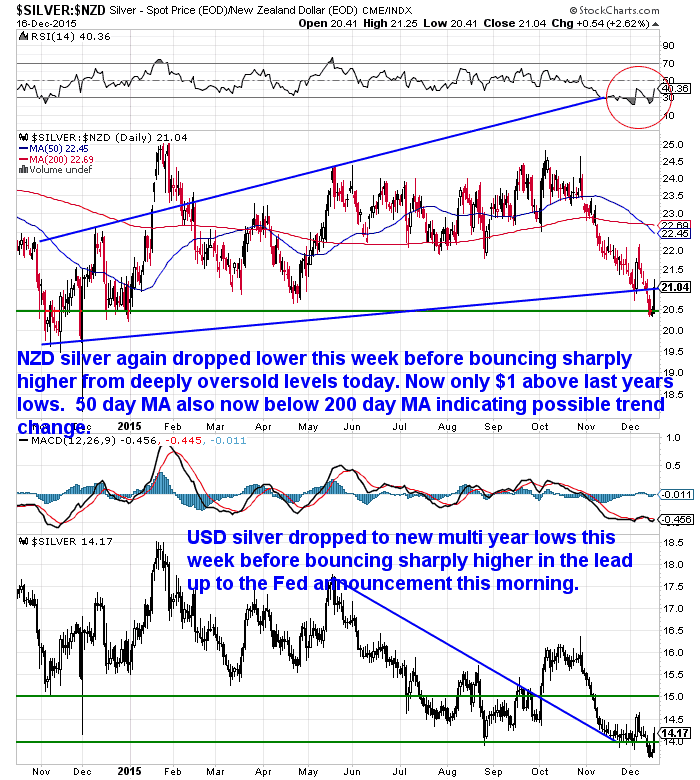

NZD silver also bounced sharply higher this morning. But that was after hitting a new multi-year low during the week. It is now only about $1.50 above the lows of a year ago.

We wouldn’t blame you if you were about to give up on silver. After looking like being in an uptrend all year, it now looks likely it could close the year out pretty much flat. But the fact that many have given up on it is likely a good sign in the long run.

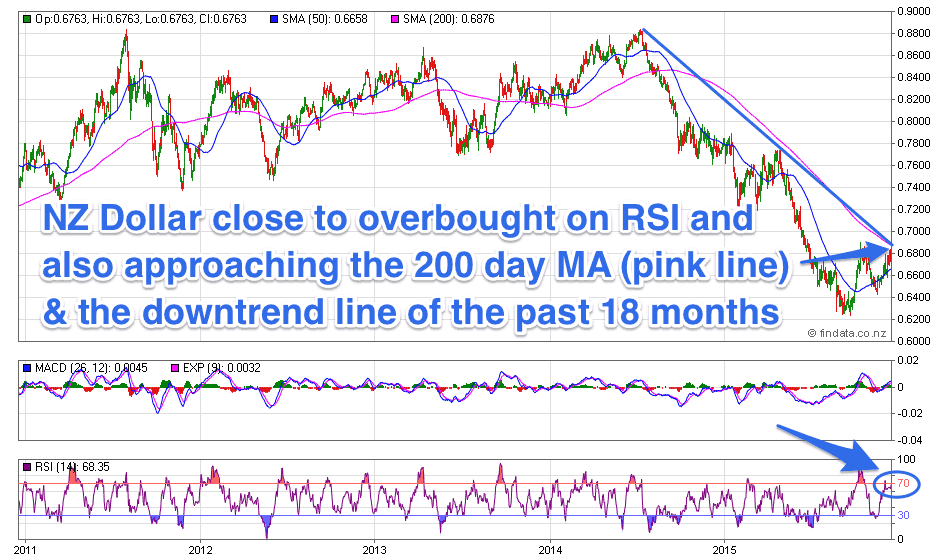

In contrast to the moves higher in precious metals this morning, the NZ dollar did back off a bit in response to the Fed announcement. With the Kiwi approaching the downtrend line since last year, along with the 200 day moving average line and also again quite overbought this is probably no surprise. It might be a surprise if it can continue to move too much higher from here and is due a decent pullback more than likely. As we mentioned earlier this could give local gold prices a boost in the short term.

What Will the Fed Do Next?

We wouldn’t want to take the other side of the bet that John Mauldin made in his email this morning.

“I think the Fed is going to be raising rates a lot more slowly than even they project. When you look at the “dots,” the median projection for the Fed funds rate is 3.75% in the much longer run.

Side bet? I think we see 0% again before we see 2%. “

We too think the odds are that before too long they will be cutting interest rates again.

Why’s that?

Well Jim Rickards believes the US Federal reserve is making a mistake in raising interest rates now and should have done it back in 2010. As this would have allowed them to begin cutting rates now.

Instead of raising rates as economies are growing, the Fed is lifting them while just the opposite is occurring – that being deflation. He also thinks they will have to go further than just cutting rates in the future:

Deflation also destroys tax collections. Taxes are imposed on nominal dollar returns, not real returns. When deflation causes prices and incomes to drop, less tax is collected, pure and simple.The combination of bank losses, higher real debt burdens and diminished tax collections is a government’s worst nightmare. For these reasons, central banks and governments will do whatever it takes to stop deflation.

Central banks have been trying to stop deflation and stoke inflation for seven years without success. They have been doing this by printing trillions of dollars of new money and injecting the money into the banking system through bond purchases. But this money printing bacchanal has failed.

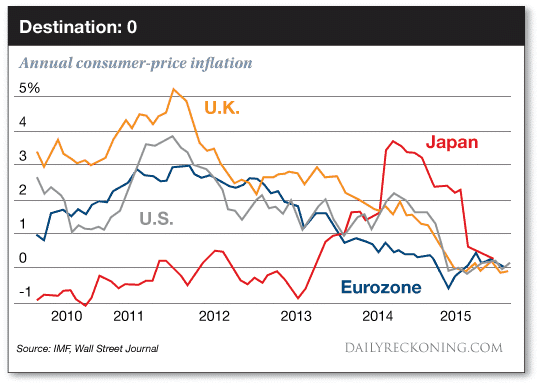

This chart shows that the path of inflation since 2009 in the major economies (despite some fluctuations) has converged on zero.

Consumer price inflation has converged on zero in all of the major developed economies. The persistence of low inflation and the inability of central banks to achieve their inflation targets have baffled economists. Traditional models such as the Phillips curve have been called into question.

We are left with a conundrum. Governments fear deflation and will do anything to avoid it.

Yet central bank monetary tools have failed to produce inflation and will likely continue to fail. What else can a government do?

The answer is debt monetization. This is also known as “helicopter money” or “people’s QE.” A more technical name for it is “fiscal dominance.” It all amounts to the same thing. If the people won’t spend money, the government will.

Governments will pick spending programs to stimulate growth and then incur huge deficits to support the spending. The deficits will be financed with government debt. Then the central banks will print money to buy the debt.

The difference between debt monetization and quantitative easing is that the money does not just sit in the bank. It goes directly into whatever spending programs the government chooses. The spending is guaranteed to happen, and in theory, that will get the economy moving and produce the desired inflation.

Understanding this dynamic requires the ability to consider two completely opposite states of the world at the same time.

On the one hand, there is no doubt that the natural state of the world is deflationary, due to demographics, technology and debt.

On the other hand, governments cannot tolerate deflation and will do whatever it takes to produce inflation.

Right now, price signals are flashing deflation, and investors are reacting accordingly. But those same signals are telling governments to speed up the debt monetization and produce inflation sooner than later.

When the deflation turns suddenly and unexpectedly into inflation, most investors won’t see it coming. They’ll be on the wrong side of the trade. The result of this deflation-inflation paradox is potential whiplash for investors.

…Our basic hypothesis is that the world is dangerously close to deflation. This is apparent from the recessionary trends in Japan, Brazil, Russia and elsewhere described above.

Based on the fact that deflation is intolerable to governments, we look for evidence that governments are taking steps in the direction of increased deficit spending (debt monetization). We then update the hypothesis based on actual steps taken by policymakers.

Such steps are already happening. Two months ago, the U.S. Congress and the White House agreed to bust the spending caps that had been in place for the past three years. Large new spending programs are also getting underway in France, China, Japan and Canada. This will take time to play out, but the direction is clear.

It’s a little too early to jump into a pure inflation play (although some gold in a portfolio is always a good idea both for inflation protection and as catastrophe insurance).

Yet those betting big on deflation may be caught on the wrong side of the trade if inflation kicks in sooner than expected.”

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Gluten Free Emergency Food

Are you or is anyone in your family gluten intolerant?

Have you had trouble finding suitable long life emergency food options?

Now in stock: Gluten Free Emergency Food Bucket…

For just $325 you can have 1 months long life gluten free emergency food supply.

Learn More.

—–

NZ Government $1 Billion Capital Spending Sign of Things to Come?

Speaking of spending programs. Looks like we are following along with most everyone else as well – with an extra $1 Billion in “capital spending” to “boost” the NZ economy just announced.

The consensus of course is that government spending is just what is needed when an economy starts to slow. The TVNZ business editor thinks so:

“Now as far as the economics go, spending the extra one billion dollars next year makes a lot of sense and is – in my view – a good move.

The economy is going to slow in 2016 to just over two per cent. Unemployment is set to rise to 6.5 per cent, and extra stimulus is called for in these circumstances.

Borrowing is also cheap at the moment, while the government’s books are in good shape.”

It seems to us that New Zealand is a bit behind most other economies in the world. But that said we are trending the same way.

Canada for example looks likely to be heading to zero interest rates. Casey Research reports:

“The Bank of Canada (BoC) – Canada’s version of the Fed – has already cut rates twice this year. Its key rate is now 0.5%.

The Bank of Canada might drop its key rate to zero soon…

Last month, Carolyn Wilkins, the BoC’s number two official, said, “It’s more likely that policy rates will fall to zero than in the past.”

Even so, more rate cuts are unlikely to help Canada’s economy. Last month, Bloomberg Business reported that the Bank of Canada is already considering other options.

“What’s clearly evident is governments have attempted to fill the void left by the household sector’s reluctance to take on new debt.

Australia is all but locked into a path of growing deficits and ballooning public debt.

As China continues to slow, I expect our household debt levels will fall into line with the rest of the world [they will rise]. Without significant tax increases and meaningful expenditure cuts, balancing the budget is nothing more than a pipe dream. Both measures (raising taxes and curtailing entitlements) are political hot potatoes — nothing meaningful is going to happen overnight. Therefore the public debt meter will continue to tick higher.

Which means the RBA will also follow the well-worn interest rate path of the northern hemisphere and reduce interest rates to near zero. Reducing the servicing cost on higher levels of public debt will be one way of providing some temporary expenditure relief for the government of the day.

Lower interest rates may help those with debt but does precious little for those with savings…like boomer retirees. Investors looking to earn a dollar or two on their savings are forced to go in search of ‘opportunities’ paying a higher rate of return.”

The announcement of the infrastructure spending by the NZ government also contained a statement from Bill English that:

“… the Government had adjusted its targets so as not to strictly target continued surpluses and had loosened its target of reducing net debt to below 20% of GDP by 2020.”

So this spending program here in New Zealand may just be the first phase. Perhaps we will see more spending driven by more borrowing, with wider government deficits and increased government debt? Just as has been happening in most other countries in the west as as Vern thinks is very likely to happen in Australia.

Deflation Then Inflation

The Jim Rickards piece we referenced above, made mention of deflation being present now but that inflation will likely surprise. We made a similar comment in last week’s newsletter (Inflation and Interest Rates – A different Take) that inflation will likely take everyone by surprise when it comes.

This view is also one shared by Chris Martenson who we’ve featured a bit of over the years. This week we have a very comprehensive article of his on gold along with a couple of excellent interviews with him (scroll down to check them out).

He has a new book out with the worthy tile: Prosper! How to Prepare for the Future and Create a World Worth Inheriting. These interviews touch on some of the content and are well worth listening to. We’ve just downloaded the audiobook so we will report back on that after the holidays most likely. But you might want to grab a copy or get the audio version for the summer road trips!

Megalomaniacs at the RBNZ

An interesting opinion piece from head economist at infometrics yesterday on the “megalomanical” Reserve Bank of New Zealand. Here’s the an extract:

“Unelected megalomania

What is most concerning about the increasingly heavy-handed role that the Reserve Bank is taking on is that it does so from a place of unelected authority. The independence of the Bank from political interference in its day-to-day operations is unquestionably important, in terms of both its monetary policy and financial stability mandates. The Bank also unquestionably has more expertise in either of these areas than any politician is ever going to have, so being delegated these responsibilities makes sense. But that being the case, the Bank has a duty of care to undertake those responsibilities as “correctly” as possible. Seemingly misrepresenting the facts to pursue its own ideological aims is certainly not best practice.

In our view, the Reserve Bank has adopted an increasingly superior attitude about its own understanding of the New Zealand economy, monetary policy, and financial stability over recent years. The assertion that “we know better” has meant that the Bank has been reluctant to engage in much debate, and instead has been quick to dismiss those who disagree with its viewpoints.

But economics is not an exact science – the most cynical observers would argue it’s not a science at all – and there is always significant scope for wrongly interpreting the way the world works and what the data is telling us.

By choosing to limit the amount of high-LVR lending to an arbitrary level of 10% of all mortgage lending, and by questionably singling out property investors as a source of heightened financial risk, the Reserve Bank has shown itself to be increasingly paternalistic in its pursuit of financial stability. It seems the Reserve Bank has a belief that it better comprehends the financial risks, either on a personal basis for individual borrowers, or on a systemic basis for banking institutions.

In the wake of the GFC, almost everyone would argue that increased monitoring of banks and a greater availability and transparency of financial system information were desirable and necessary. But the increasing number of levers being pulled by the Reserve Bank to try and actively manage parts of the economy beyond its core focus of monetary settings and the financial system is concerning. When combined with the Bank’s superior assessment of its own abilities, the whiff of megalomania emanating from Number 2 The Terrace is inescapable.”

Of course this is probably not that surprising.

Our central bank is just following the lead of the major central banks of the world.

They believe just like their co-horts overseas that they can pull levers at will and maintain a state of permanent elevation of the economy.

Ignoring that it is really human action that drives an economy.

And human nature means there will be ups and downs.

Cycles of a short and longer term nature.

All this “fiddling” does is cause larger and larger distortions that one day will likely have to undergo a correction back to the norm.

For now confidence remains in central bankers. But we get the impression this is starting to wane. This loss of confidence is when gold and silver will perform the best.

And if Chris Martenson is correct you’ll need to make sure you have some before then. As by the time the rush is on it may be hard to come by. See “Hard Assets To Evaporate Almost Instantly To Retail Investors” for more on this idea.

It still remains very quiet in terms of buyers from our perspective. Experience shows this is often a good time to be buying – when most are afraid to. Get in touch for a quote.

Free delivery anywhere in New Zealand

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,375 and delivery is now about 3 weeks away.

*****

Survival Gift Ideas for Your Loved Ones

Having trouble deciding what to give the man or woman who has everything this Christmas?

How about something they might actually use (or even save their life) Here’s a few ideas… LEARN MORE

DICTIONARY HOME DIVERSION “BOOK SAFE”

JUST $34.95

This home diversion book safe looks just like a real dictionary.

Place it on a book shelf and it will blend right in with the rest of your books.

Hide valuables and important documents like wills and passports

where thieves won’t think to look.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|