Prices and Charts

Gold Dips Following Tariff Announcement

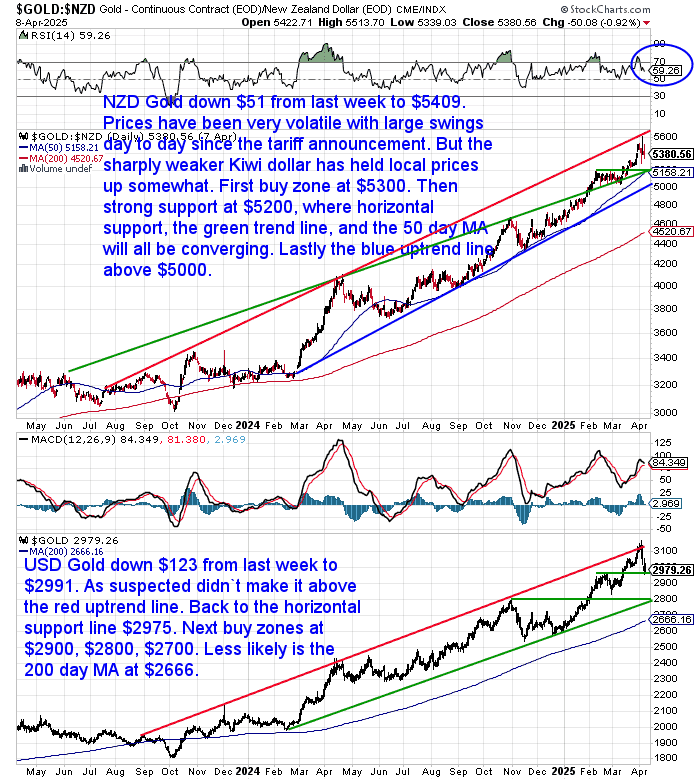

NZD Gold has dipped lower following Trump’s tariff announcements. Gold was due a correction anyway and the tariffs have been the catalyst for that. But the weaker Kiwi dollar (down 3%) has held the local price up.

NZD gold is only down 1% from a week ago versus 4% for USD Gold. See the chart below for buy zones to watch for next if gold heads any lower.

But Silver Tumbles With Stock Markets

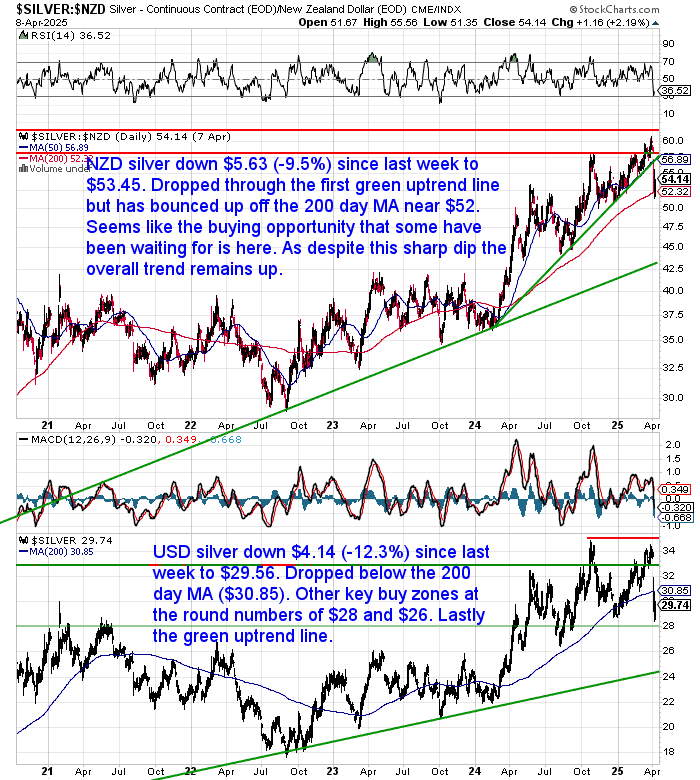

It was a different story with silver though. Down 9.5% in NZD terms, while USD silver dropped 12.3% from a week prior. As we outline in this week’s feature article below, we’ve seen this story before in times of trouble. Silver usually follows stock markets and industrial metals lower. But then bounces back faster and sooner too.

So for anyone watching this should be seen as a good buying opportunity. Consider averaging in with purchases over a period of time. As it is a tough job to try and pick the bottom.

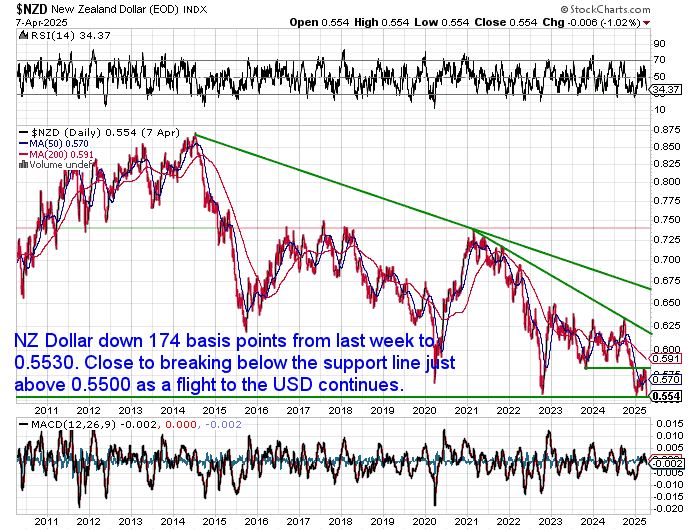

USD Strength in Times of Strife

As noted already the Kiwi dollar took a tumble too. Down over 3%. The US dollar has strengthened as is usually the case when markets fall. As investors sell other assets and move into the dollar. Gold is very liquid so it is easy to sell and fund margin calls when other prices fall. So that is why even gold often takes a dip initially.

Gold and silver prices are very volatile (along with just about everything else right now!) Spot prices are jumping up and down throughout the day. So if you want to buy, just be aware that quotes may not be valid for very long.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—- OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Trump’s Tariffs and Precious Metals: Exemptions, Risks, and What Comes Next

Trump’s sweeping new tariffs spared gold and silver bullion—but that’s not the whole story.

In this week’s feature article, we dig into what the exemption really means, how it impacted gold and silver prices in the short term, and why legendary investor Ray Dalio believes tariffs signal much deeper economic shifts ahead.

Plus: Why silver got hit hard, why gold held up, and why it might just be the calm before the next storm.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

NZ Not Spared: How Trump’s Tariffs May Hit Our Exports

While gold and silver investors got a tariff exemption, Kiwi exporters didn’t.

ASB warns that Trump’s new 10% base tariffs will hit around $9 billion worth of NZ exports—mostly meat, dairy, and wine. That could shave up to 0.5% off NZ’s GDP, with meat and wine producers expected to take the biggest initial hit.

But there may be silver linings: NZ wine could gain an edge over higher-taxed European competitors, and any retaliatory tariffs on U.S. beef or dairy may open the door for NZ exporters to fill the gap.

Much will depend on how China and other key trading partners respond. Some, like South Korea, are already offering emergency support, and China is likely to roll out more stimulus. ASB notes that governments and central banks won’t sit idle. The RBNZ is expected to cut interest rates today.

It will take time to see where the chips fall—but NZ businesses will need to stay nimble.

Download the full ASB Economic Note (PDF)

Flashback: The Gold Standard: Generator and Protector of Jobs

With all the talk of tariffs, trade wars, and economic rebalancing, it’s worth revisiting what the gold standard once did so well: create balance and protect jobs.

We’ve dusted off a powerful insight from Mexican billionaire Hugo Salinas Price, written over 15 years ago, that seems more relevant than ever today.

Actually it doesn’t just show his insight but foresight too where he wrote:

“In today’s great world financial crisis of false money, we are likely to see countries around the world resort to protectionism”.

Salinas Price points out:

“Under a restored gold standard… industries and new jobs will spring up like mushrooms.”

Could a return to real money restore order to trade—and jobs to the West? Have a read below and then you decide.

The Rest of the World to Pay to M.A.G.A.?

It’s looking more and more like the Trump administration is following Stephen Miran’s Trade Policy Blueprint we outlined back in February.

However, it certainly is a bit rough for the USA to make the rest of the world (including its allies) pay for the privilege (a reserve currency) that the US has had for 50+ years!

Maybe it is just a negotiating tactic. Currently it looks more like turning into a full on trade war. Only time will tell.

But it does appear like team Trump is trying to walk a very difficult tightrope in attempting to rebalance the current imbalances – regardless of whether they acknowledge who or what caused them. (See the Hugo Salinas Price article above if you need educating on what the cause of these imbalances was).

It seems they realise that it is pain either way. And that maybe it’s better to take some sooner by choice rather than later without any?

Maybe they are trying to get things at least a little less imbalanced before a return to a world where something shiny and yellow is once again used to “balance trade”?

Regardless of how this all plays out, unfortunately it is impossible to do without some level of pain for the average Joe (regardless of which country Joe resides in)…

It is going to be a very interesting experiment to watch. But it might be a lot more stomachable if you have enough gold and silver in hand.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|