ECB Gold Report, Silver Squeeze Signals & NZ Spotlight on Gold & Bitcoin | Weekly Wrap

This Week:

- Weekly Price Overview – 30 July 2025

- If the US Dollar Collapses, What Happens to Gold & Silver?

- ECB Mentions Gold 98 Times in New Report

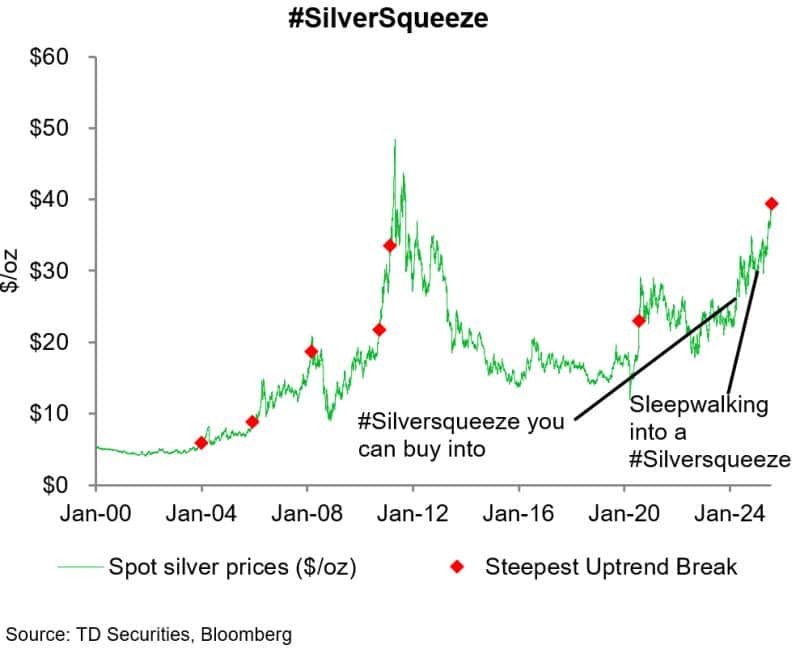

- Is a Silver Squeeze Getting Closer?

- Chart of the Week: Sleepwalking Into a Silver Squeeze

- Gold & Bitcoin: 27% Gains Get Media Attention in NZ

- Meme of the Week: Just Buy Gold

Estimated reading time: 5 minutes

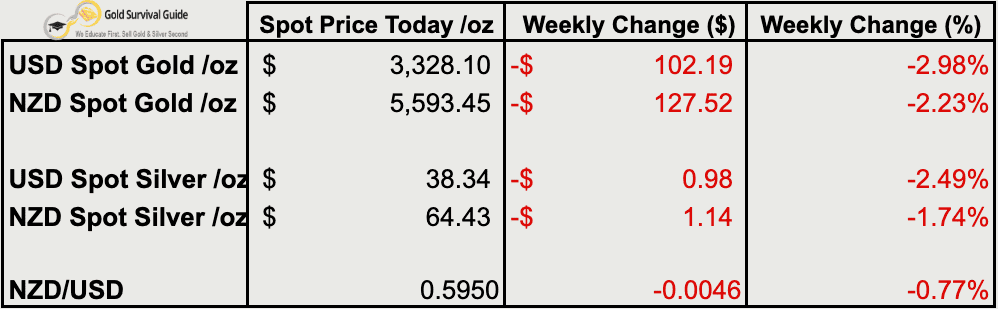

Weekly Price Overview – 30 July 2025

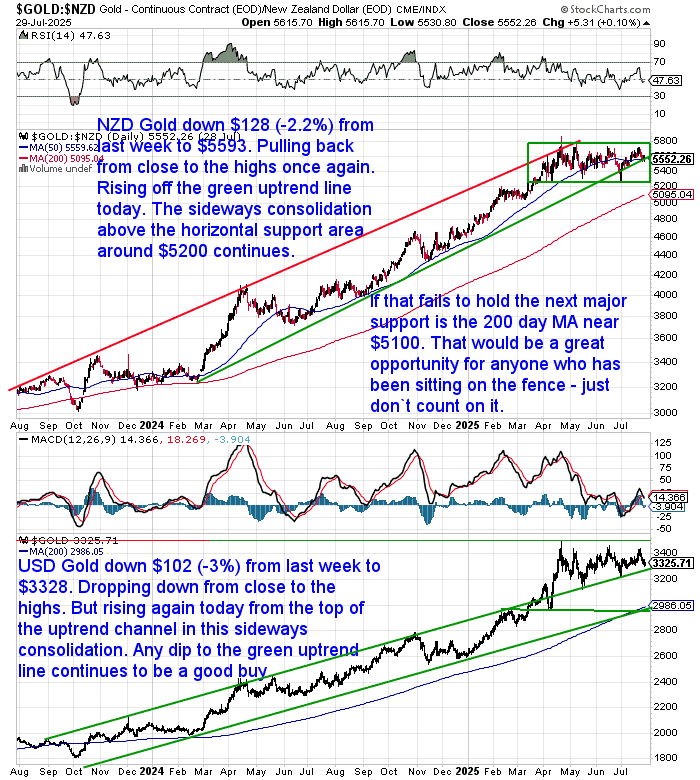

Gold and silver both pulled back this week after recently trading close to highs. The long-term uptrends remain intact, with pullbacks offering buying opportunities.

🟡 NZD gold fell $128 to $5,593.45 (-2.23%), consolidating above key support around $5,200. USD gold dropped $102 to $3,328.10 (-2.98%), retreating from the top of its uptrend channel but bouncing today from trendline support.

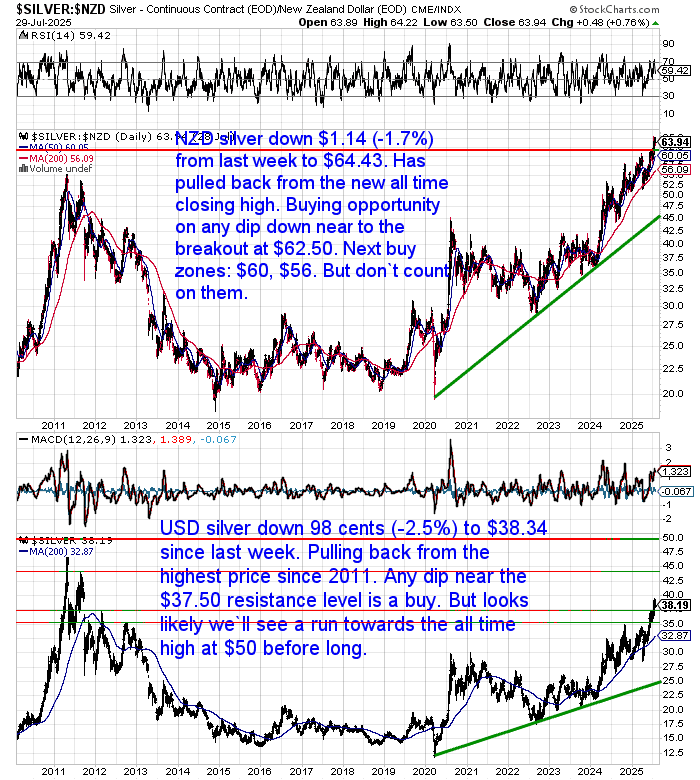

⚪ Silver also corrected. NZD silver slipped $1.14 to $64.43 (-1.74%), easing from a new all-time closing high. USD silver fell $0.98 to $38.34 (-2.49%) but remains strong; dips toward $37.50 are buy zones with $50 still in sight.

💱 The NZD weakened 0.77% to 0.5950, pulling back from resistance along its downtrend line.

📈 Gold remains in a sideways consolidation, while silver has only just pulled back from breakout levels. As before, pullbacks in both metals — particularly silver — continue to present attractive buying opportunities.

If the US Dollar Collapses, What Happens to Gold & Silver?

If the US dollar’s global dominance is slipping, what comes next?

This week we dig into one of the biggest “what if” questions out there:

What happens to gold – and silver – pricing if the US dollar were to collapse?

Our 2025 guide covers six scenarios, why silver could become “everyday money”, and an IMF chart showing the dollar’s shrinking share of reserves.

If you hold precious metals (or are thinking about it), this is essential reading.

ECB Mentions Gold 98 Times in New Report

The European Central Bank is talking about gold… a lot.

Just three months after warning of €1 trillion in derivatives risk, tCB has released another major report – The International Role of the Euro – with 98 references to “GOLD”he E across 63 pages.

The report confirms what gold advocates have long said: gold is back as a core reserve asset.

Key insights:

- Over 1,000 tonnes of gold bought by central banks in 2024 – almost double the decade average

- Gold now makes up 20% of global reserves, surpassing the euro’s 16%

- Reserve managers highlight gold as:

- ✅ A hedge against inflation

- ✅ A safe-haven during crises

- ✅ Protection against geopolitical risk

- ✅ A hedge against inflation

- Gold demand is being driven not just by fear, but by structural shifts like sanctions, deglobalization and currency weaponization

(Source: ECB report, highlighted by Ronni Stoeferle).

Full report here:

Is a Silver Squeeze Getting Closer?

Silver may be heading for a squeeze – this chart says it all.

Two weeks ago we reported on TD Securities strategist Daniel Ghali’s “Illusion of Liquidity” in silver. His view: a series of rolling mini-squeezes could be the mechanism that finally drives prices sharply higher.

This week, Ghali has doubled down:

- “For years, pressure for the ‘#silversqueeze you can buy into’ has been building. Markets have been sleepwalking into this set-up.

- The clock has been ticking. The illusion growing.

- This theme may finally be culminating towards its final chapter, with silver now breaking out of the trend channel that has contained prices over the last several years. Historically, this has been associated with the melt-up phase of a bull market.”

The chart below (TD Securities / Bloomberg) shows previous uptrend breaks in silver — and why $35/oz could be a tipping point to $50/oz if history rhymes.

Chart of the Week: Sleepwalking Into a Silver Squeeze

Gold & Bitcoin: 27% Gains Get Media Attention in NZ

Gold and Bitcoin are sharing the spotlight in New Zealand this week.

Chris Smith, GM of CMC Markets NZ, wrote in The Post that both assets are up 27% year-to-date, well ahead of equities like the S&P 500 (+6%).

“Central banks’ increasing gold reserves and persistent geopolitical uncertainties are driving the demand for safe-haven assets… Costco has had to limit gold purchases by its members due to demand.

On our platform, we’ve observed a 70% increase in local gold trading activity over the past few years, while crypto transactions have been on a consistent upward trajectory annually.”

ASB also highlighted both assets in its market wrap this week.

They noted that gold dipped 1.2% on improved risk sentiment, while Bitcoin eased 1.2%. The first time we recall both being mentioned together in an ASB report.

Of course, derivatives exposure to gold on a trading platform like CMC is not the same as physically holding gold for wealth insurance.

Sometimes even the most complex hedge funds come to the same conclusion – in the end, they just want gold itself…

Meme of the Week: Just Buy Gold

Source: USAGOLD via Matt Oliver

After all the derivatives and exotic instruments… the simplest form of wealth insurance hasn’t changed: owning physical gold and silver.

If you’re ready to make that step – or add to your holdings – we’re here to help.