This week:

- A longer term view of NZD silver

- The Strengthening NZ Dollar and How This Affects Gold Bought in NZ

- Will the latest Euro bailout make a difference?

- Least reported news of the week

Talk again is of more central bank “stimulus” This time that the ECB will cut rates on Thursday Europe time. So commentators reckon that is why both share markets and precious metals are up today. Seems like a good guess. Oil has been rising too on the back of further worries about Iran, including the possible passage of legislation in Iran to blockade of the Straits of Hormuz.

With the Kiwi dollar not moving overnight the rise in gold and silver prices in US markets has seen the local prices also up significantly overnight too. With NZD silver back above $35 /oz and gold at $2016 /oz.

The overall trends in gold and silver seem to remain one of consolidation. As we have mentioned before this can go on for longer than anyone expects. And then also to surprise us the moves upwards can then happen much faster than anyone expects too.

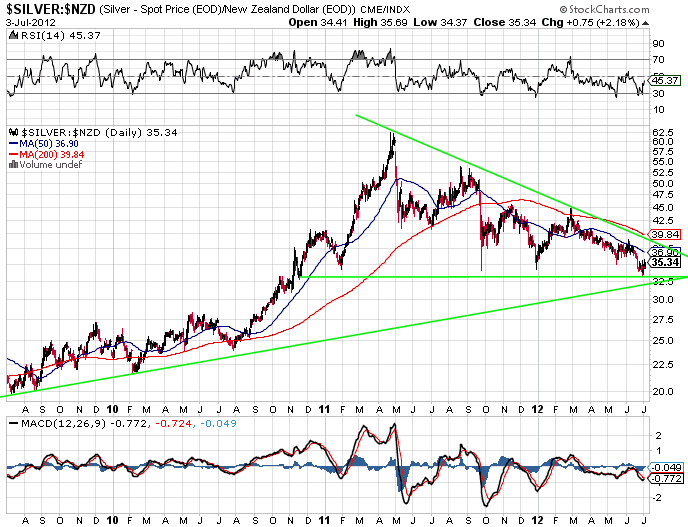

A longer term view of NZD silver

As we’ve discussed before we don’t place massive amounts of faith in technical analysis in this highly manipulated world. But it can still be useful in identifying at least somewhat slightly less risky entry points.

Above is a 3 year chart of silver in NZD. A pennant formation (or half flag) may be playing out here. There is support at around the $32 level with the lower highs descending toward this level. More often this descending pattern leads to a breakout to the upside. But of course no guarantees. While we expect much higher prices or rather much more devaluation of fiat currencies the world over in the long run, this consolidation could go on for a while yet. We don’t pretend to know anymore than anyone else, but odds are we are closer to a bottom than a top.

To repeat ourselves this is why we say not to go “all in” and to keep some powder dry for lower prices. In the past we’ve mentioned Chris Weber and his comments that when to be buying is dependent on how much bullion you already have. As he says if you have none it may pay to put a stake in the ground. It’s likely many people will sit on the sidelines and eventually be surprised when the monetary metals move higher.

The Strengthening NZ Dollar and How This Affects Gold Bought in NZ

Odds are that you could be looking at the strength of the kiwi dollar and its impact on the local precious metals prices, just like one of our readers was this past week. Our lead article this week is inspired by his comments: The Strengthening NZ Dollar and How This Affects Gold Bought in NZ. It looks chiefly at the question of what is the point in buying gold and silver bullion here in New Zealand if the NZ dollar remains strong or continues to strengthen even further?

Will the latest Euro bailout make a difference?

There seems a fair bit of confusion around about exactly what was agreed on by the Euro leaders at the end of last week. In simple terms the idea was that banks in the likes of Spain and Italy will be able to access funding from the ECB directly without it being directed through their national government. This would mean the state wouldn’t be affected by increasing interest rates due to the extra debt, as the debt would go straight to the bank. However from what we’ve read this is not due to come into effect until next year and supposedly Spain and Italy say they don’t need to tap into it yet anyway.

When we step back and look at this it seems like more hocus pocus. Just more trying to cure too much debt with even more debt. Of course it could likely buy them some more time, but will it be more than a few weeks or a few months?

Our guess remains that with all the negativity pervading the markets they may surprise in the other direction in the shorter term. Markets have a way of surprising the most people possible.

And as Doug Casey notes in our other article this week, when discussing that while he thinks “A Eurocrash Is Baked in the Cake“, just because something is inevitable does not mean it’s imminent.

Least reported news of the week

The past couple of days have seen the LIBOR scandal and the resignation of the head of Barclays Bank hit the headlines. No great surprises, just more evidence of the corruption at the core of the current monetary system. Here’s a short article that summarises that if you haven’t read much about it yet.

But the big news in our opinion that remains totally unreported in the mainstream is…

“In what might be the most underreported financial story of the year, US banking regulators recently circulated a memorandum for comment, including proposed adjustments to current regulatory capital risk-weightings for various assets. For the first time, unencumbered gold bullion is to be classified as zero risk, in line with dollar cash, US Treasuries and other explicitly government-guaranteed assets. If implemented, this will be an important step in the re-monetisation of gold and, other factors equal, should be strongly supportive of the gold price, both outright and relative to that for government bonds, the primary beneficiaries of the most recent flight to safety.”

We mentioned the murmurings of this a few weeks back, but we think it bears repeating. While it is not due to come into force until Jan 2013 it is very big news. And as John Butler goes on to say, the current rules for gold could also be a reason why it hasn’t been behaving like a safe haven recently…

“…a key reason why gold has not been acting like a safe-haven asset in recent months is because banks are so capital impaired that they are scrambling to reduce their holdings of risky assets in favour of so-called “zero-risk-weighted” assets, against which they needn’t set aside any regulatory capital. As it stands, gold has a 50% risk-weighting. But some government bonds, including US Treasuries, German Bunds and British gilts, are zero-risk-weighted.

However, in the report, I speculated that perhaps that would change in future, and that:

“- if it happens, it will be an important step toward the re-monetisation of gold. Gold would be able to compete on a level playing field with government bonds. While the playing field could be levelled in this way, there would be a gross mismatch on the pitch. On the one hand, you have unbacked government bonds, issued by overindebted governments, yielding less than zero in inflation-adjusted terms. On the other, you have gold, the historical preserver of purchasing powerpar excellence.”

In simple terms gold is not a tier 1 asset under Basel III bank regulations and so banks are only allowed to have it on their books at 50% of its value. So Butler reckons they have been selling it of late in exchange for “less risky(!)” assets like certain government bonds.

So if you want to do the opposite of banks and instead swap some monopoly money for a zero counterparty asset, David is twiddling his thumbs waiting for a call.

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz

This Weeks Articles

New RBNZ Governor from the World Bank

2012-06-27 22:40:57-04 This week: Gold and silver bouncing around previous lows Is the consensus trade bearish and therefore wrong? Reader Question: Why is Gold More Valuable Than Worthless Paper? Excellent! New RBNZ Governor from the World Bank Contrarian sign of a bottom in gold and silver? Gold and silver bouncing around previous lows As we mentioned to […] read more…

Doug Casey: A Eurocrash Is Baked in the Cake

2012-07-02 21:49:39-04 If you haven’t yet signed up for the Free Conversations with Casey Newsletter that comes out every Thursday, you should go and do so now. It is one of our must reads every week, simply because Doug Casey is such a free thinker that he really bends your mind. Even if you donâ™t always agree […] read more…

The Strengthening NZ Dollar and How This Affects Gold Bought in NZ

2012-07-03 05:33:13-04 Gold, Silver and NZ Dollar Exchange Rates: Another Reader Question Another question/comment we had from a reader again this week was what is the point in buying bullion here in New Zealand if the NZ dollar remains strong or continues to strengthen even further? We’ve reprinted the full comment from the reader below and then have […] read more…

The Legal Stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Ever lower interest rates? | Gold Prices | Gold Investing Guide

Pingback: Big Changes Ahead: Gold Just Became Money Again | Gold Prices | Gold Investing Guide