This Week:

- Update on Rising Silver Premiums in New Zealand

- GREECE, GUNS, BANKERS & GOLD

- Why the Silver Price is Not the Price of Silver

- Gold’s Downside Risk vs. Upside Potential

- China and It’s US Dollar Peg

- China And The New World Disorder – [and impacts on NZ]

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1670.36 | + $21.43 | + 1.30% |

| USD Gold | $1085.40 | – $11.80 | – 1.07% |

| NZD Silver | $22.55 | + $0.22 | + 0.98% |

| USD Silver | $14.65 | – $0.21 | – 1.41% |

| NZD/USD | 0.6498 | – 0.0156 | – 2.34% |

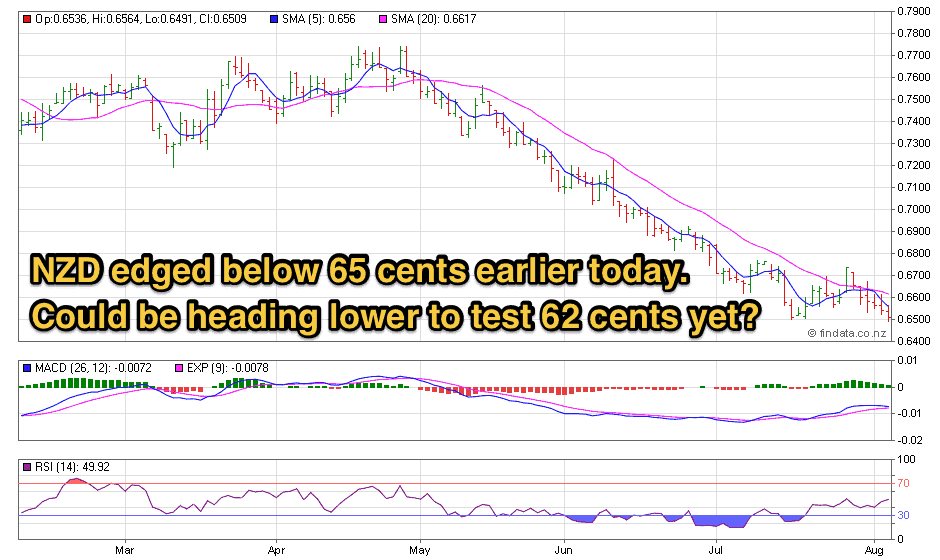

The NZ Dollar is looking weaker again today. This morning it dipped below 0.65 cents and is down 2.34% on last week.

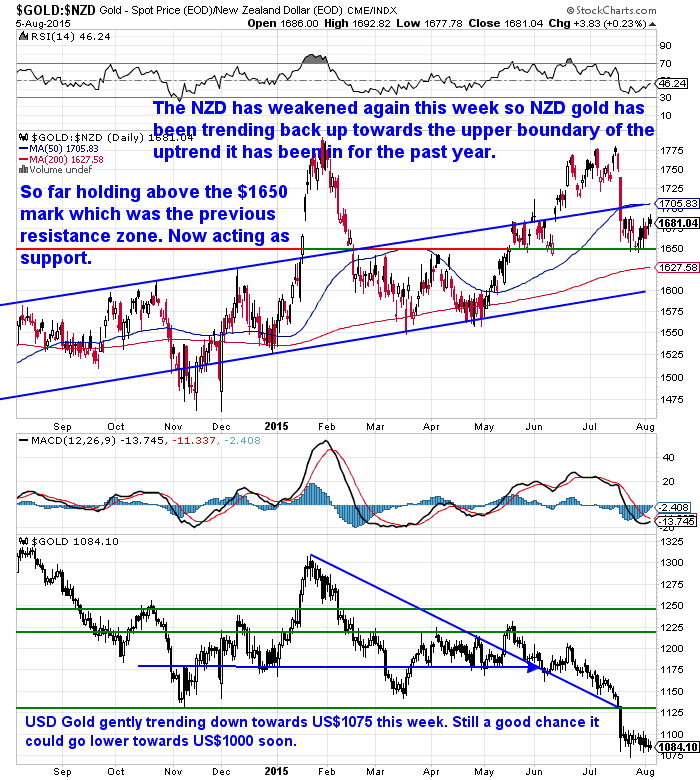

This has buoyed local gold and silver prices. As can be seen below gold in NZ dollars is up 1.30% while in US Dollars it is down over 1%.

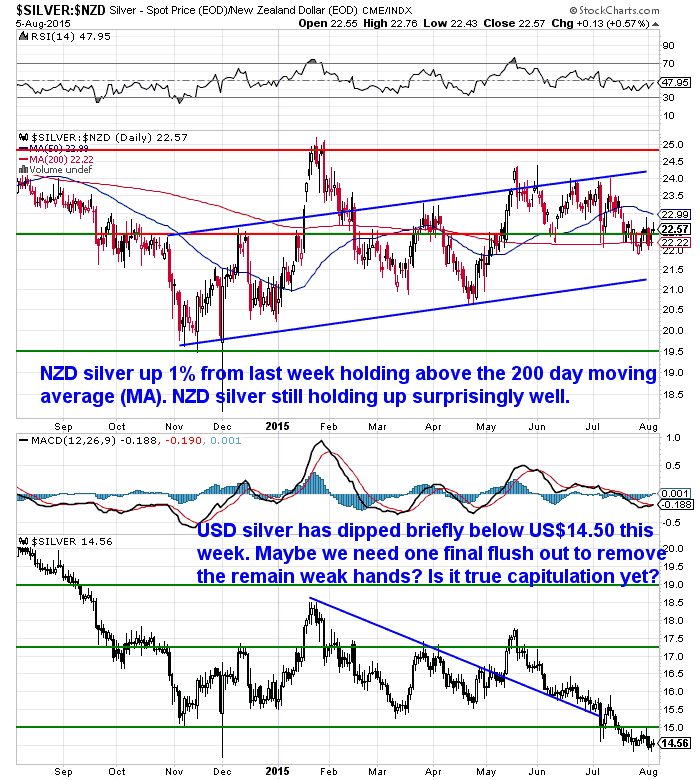

NZD silver up about 1% while USD silver is down 1.41% on last week.

Where to From Here?

Our 2 cents best guess even if you didn’t ask?

While there have been many gold negative articles in the past few weeks, a number of which we shared last week, we still wonder if true capitulation is here yet?

There are still reports of plenty of buying demand and so we just wonder whether we need a further plunge down below US$1000 to wash out all remaining hope?

So on one hand that might sound like the chance to buy more gold at lower levels.

However as mentioned earlier with the NZ Dollar dipping below 65 cents (possibly on the back of another almost 10% plunge in the dairy auctions yesterday), further falls in the Kiwi could well temper any losses in NZ dollar gold terms.

The other unknown factor is if prices do fall further what premiums will refiners and mints charge above spot price?

The other unknown factor is if prices do fall further what premiums will refiners and mints charge above spot price?

We’ve had another look at this topic in this weeks feature article on the back of another local refiner raising their premium above spot for locally refined silver.

Update on Rising Silver Premiums in New Zealand

Why the Silver Price is Not the Price of Silver

We’ve heard many recent reports in the US of “junk silver” (being US dimes, quarters, and half-dollars that were minted in the US before 1964 and contain 90% silver) not selling for anything less than a 30% premium above spot. Previously these have often been available for below their “melt value” i.e. the total value of silver in them based upon the spot price.

So what this is saying is that dealers are valuing the silver in the coins for 30% or more above the current spot price. So at current prices that is more like just under US$20 an oz.

Or put another way the market thinks the real price of silver should be closer to US$20 per ounce.

Or a different way again is to say that silver prices are so low that no one is selling actual silver for anywhere near the spot price.

So check out this weeks feature article as we also discuss a few other news items on this topic of silver and gold supply that we’ve seen this week.

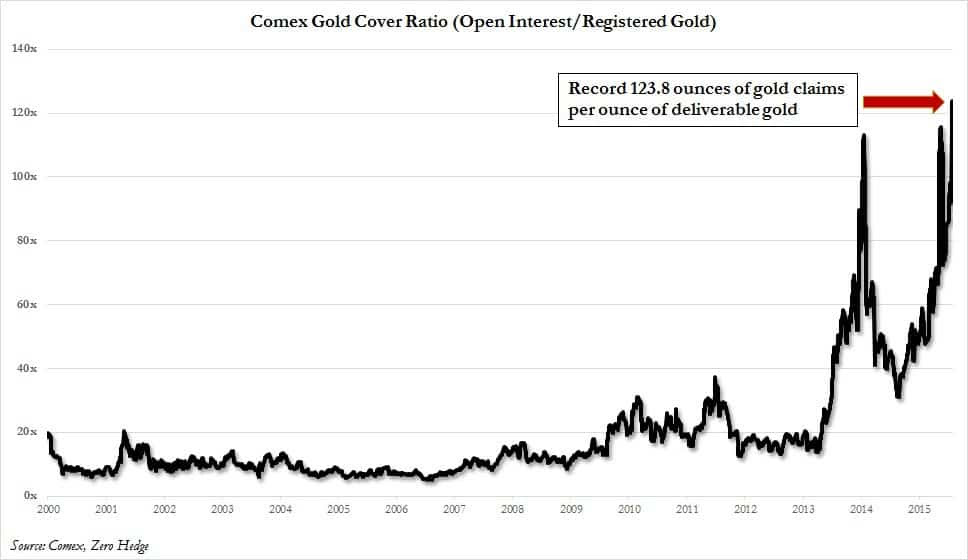

COMEX Gold Cover Ratio

In that feature article just mentioned there is an item about some very large draw downs of COMEX silver stocks.

This week we also saw a great chart from the National Inflation Association (NIA) comparing COMEX gold stocks to paper gold currently in open futures contracts. This had dropped to a record low.

The paper gold price is being manipulated and does not reflect the true supply/demand for physical gold. A major shortage of physical gold is developing. Look for a huge short squeeze in the paper gold price to soon occur.”

Source.

They likely have a good point as the previous couple of times we have seen record low gold stocks, a pretty decent rally in the gold price has occurred soon afterwards such as following December 2014.

Gold’s Downside Risk vs. Upside Potential

While on the topic of the NIA, they also had another interesting series of charts comparing the US real money supply to gold. So if you want to contemplate what the downside risk might be versus the upside potential then check that out too here…

http://inflation.us/golds-

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $285 you can have 1 months long life emergency food supply.

Learn More.

—–

GREECE, GUNS, BANKERS & GOLD

Speaking of articles on our website, we’d also recommend you check out the latest we have from Darryl Schoon.

Speaking of articles on our website, we’d also recommend you check out the latest we have from Darryl Schoon.

We reported a month ago how Greece has one of the best funded militaries in Europe, where they have a military budget of 4.3% of GDP. In this piece Darryl outlines how for all the talk of bailouts, cuts and austerity, Greece has not been allowed to reduce its military expenditure.

He also believes Greece is merely one of the early dominoes to fall in what will be a wave of sovereign defaults across the planet as futurist Buckminster Fuller foresaw decades ago. But how this will be the “door to a better tomorrow”.

We had a great discussion with Darryl in Australia a few years ago on the subject of “Bucky” Fuller. We were reminded of this last week when we watched a decent presentation from Robert Kiyosaki of Rich Dad Poor Dad fame called “The Man Who Could See the Future”. This featured Buckminster Fuller’s predictions for “Spaceship Earth” as he called it. Check out “Grunch of Giants” by Fuller (GRoss Universal Cash Heist) for his angle on the monetary system. It’s available free online if you Google it.

China and It’s US Dollar Peg

We’ve seen a lot of volatility in currencies over the past year. Greg Canavan at the Daily Reckoning Australia reports this week on how there is likely more ahead if/when China ends its US dollar peg:

“–A key signal of the building stresses in the global economy is the unrelenting strength of the US dollar.

–…the US dollar index is going through a consolidation period after peaking in March this year. But the two moving averages tell you the trend is undoubtedly bullish.

–How long will it be before the strong dollar starts to impact on US economic growth? The dollar bull is now one year old. You’d think it would have an effect soon.

–The other very big issue here is China’s currency peg to the dollar. As the US dollar strengths and the US loses competitiveness, so does China. A break of the dollar-yuan peg is coming.

–And that will send another deflationary impulse through the global economy.

–One of the best ‘big picture’ strategists going around, Russell Napier, discussed this in his latest research. He believes we’re heading towards a ‘great reset’.

China And The New World Disorder – [and impacts on NZ]

We haven’t read The Automatic Earth Blog for a while but came across this very interesting article this week from over there.

It has a very negative view on China but also on the impacts for commodity producing countries like Canada, Australia and New Zealand.

Warning – it is pretty lengthy but has some interesting conclusions

Some “brief” (well “brief compared to the full article anyway) excerpts:

“Vulnerable Commodity Exporters

Commodity exporting nations, which were insulated from the effects of the 2008 financial crisis by virtue of their ability to export into a huge commodity boom, are indeed feeling the impact of the trend change in commodity prices. All are uniquely vulnerable now. Not only are their export earnings falling and their currencies weakening substantially, but they and their industries had typically invested heavily in their own productive capacity, often with borrowed money. These leveraged investments now represent a substantial risk during this next phase of financial crisis. Canada, Australia, New Zealand, are all experiencing difficulties:

“Yesterday, the Reserve Bank of New Zealand slashed borrowing costs for the second time in six weeks even as housing prices continue to skyrocket. A day earlier, its counterpart across the Tasman Sea (already wrestling with an even bigger property bubble of its own) said a third cut this year is “on the table.”

Just one year ago, it seemed unthinkable that officials in Wellington and Sydney, more typically known for their hawkishness and stubborn independence, would join the global race toward zero. But with commodity prices sliding, China slowing and governments reluctant to adopt bold reforms, jittery markets are demanding ever-bigger gestures from central banks. Even those presiding over stable growth feel the need to placate hedge funds, lest asset markets falter. When this dynamic overtakes countries such as New Zealand (growing 2.6%) and Australia (2.3%), it’s hard not to conclude that ultra-low rates will be the global norm for a long, long time.”

“Less than a decade after a housing/derivatives bubble nearly wiped out the global financial system, a new and much bigger commodities/derivatives bubble is threatening to finish the job. Raw materials are tanking as capital pours out of the most heavily-impacted countries and into anything that looks like a reasonable hiding place. So the dollar is up, Swiss and German bond yields are negative, and fine art is through the roof.

Now emerging market turmoil is spreading to the developed world and the conventional wisdom is shifting from a future of gradual interest rate normalization amid a return to steady growth, to zero or negative rates as far as the eye can see….Indeed, the major monetary powers that are easing — Europe, Japan, Australia and New Zealand — have all suggested rates may stay low almost indefinitely. Those angling to return to normalcy, meanwhile — the Federal Reserve and Bank of England — are pledging to move very slowly. Even nations with rising inflation problems, like India, are hinting at more stimulus….

….So…the central banks will panic. Again. Countries that retain some control over their monetary systems will see their interest rates fall to zero and beyond, while those that don’t will be thrown into some kind of new age hyperinflationary depression. Not 2008 all over again; this is something much stranger.”

Some quite dire warnings to our trans tasman neighbours and also to us in there. The sentence we have put in bold is a point we have made before ourselves.

Low interest rates may not be able to be maintained in NZ if the situation was to deteriorate globally. Given we run a current account deficit we need capital coming in each and every month to fund this. So might it then take higher rates in order to attract it? That would likely be quite a surprise for most given the now pervading view that rates will be low for a long time to come yet.

Most people we talk to are still oblivious to the risks to not just New Zealand but the global economy as well.

If you’re after some financial insurance then you know where to find us. As we’ve stated a lot lately consider splitting up your purchases rather than trying to pick the bottom. It worked well back in 2009 and will probably work well again now too.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,005 and delivery is now about 7-10 business days.

** Urgent Message for All Car Owners **

A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these. One for each car in your family or give one to someone you care about.

Click here to get yours now.

—–

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

![China And The New World Disorder - [and impacts on NZ]](https://goldsurvivalguide.co.nz/wp-content/uploads/2015/08/nz.jpg)