This week:

-

Chart of the Week: Why the Miners have Sucked

-

Fiscal Cliff/Debt Ceiling Solution?

-

Student Loans – Another Great Idea

-

Even the Believers are Worried

We’ve had another decent dip down in silver and gold prices today. And these have been compounded by a stronger kiwi dollar also.

Gold priced in NZ dollars has dropped to NZ$2061. You can see in the chart below that we are back down just under the 200 day moving average only a month after the last time. With the RSI heading again towards oversold the odds favour this being a good area to accumulate especially if you missed out on the lows in July and August of NZ$1980.

Silver also fell quite sharply from above NZ$41 per ounce down to NZ$40.07. Silver in NZ dollars has somewhat surprisingly held up a little better than gold during the corrective action that’s been going on the past couple of months.

We also noticed this morning when checking the prices of some of our favourite mid to large cap gold and silver shares, that most of them went up slightly overnight and for those that dropped it wasn’t by much. So that is a very positive sign for not only the miners but also likely for the physical metals prices too. As for them to go up when the price of gold and silver falls quite sharply is not the usual reaction.

Our guess is we are very close if not at the bottom of this current correction.

Chart of the Week: Why the Miners have Sucked

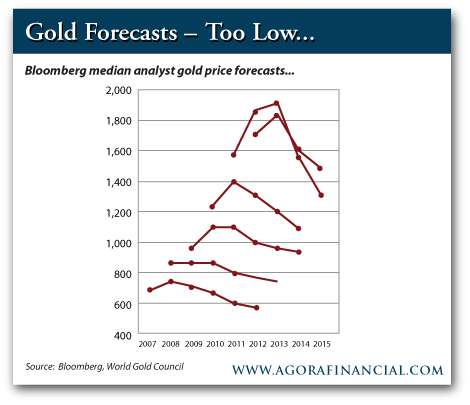

Speaking of the miners, this chart provided by ex-head of Newmont Mining Pierre Lassonde, is perhaps the best explanation we’ve seen as to why the shares of gold and silver miners have, well to put it technically, sucked so badly over the past couple of years in the face of rising metals prices.

Source: ResourceHunter.com

You see gold and silver analysts share price projections are dependent upon their projections for actual gold and silver prices. This really interesting chart shows the median analyst gold price forecast since 2007.

But, while they are picking the gold price to rise in the short term to almost $1800, by 2015 they predict it will be back down at $1300. Scary! Although maybe not, as these same analysts have predicted the gold price to fall within 2 or 3 years every year since 2007. So rather, we’d say to be worried when they predict the price to rise for the next 10 years!

Fiscal Cliff/Debt Ceiling Solution?

The fiscal cliff dominates the airwaves still. We heard on the morning news that the Demopublicans may not come to an agreement before the end of the year. Recall that the “Cliff” is of their own making. The agreement to end tax cuts and make spending cuts was a compromise reached when the US debt “ceiling” was last raised in 2011. So even if they come to an agreement on just what taxes will be raised and what expenses will be cut, early in the New Year they are going to have to go through it all again to reach another agreement on raising the debt ceiling.

The fiscal cliff dominates the airwaves still. We heard on the morning news that the Demopublicans may not come to an agreement before the end of the year. Recall that the “Cliff” is of their own making. The agreement to end tax cuts and make spending cuts was a compromise reached when the US debt “ceiling” was last raised in 2011. So even if they come to an agreement on just what taxes will be raised and what expenses will be cut, early in the New Year they are going to have to go through it all again to reach another agreement on raising the debt ceiling.

Which is why it comes as no surprise that “little” Timmy Geithner has come up with the cunning plan to effectively avoid having an impasse over the ceiling again. Our understanding of his plan that is “so reasonable, nobody could possibly disagree” (as we saw inanely reported at the businessinsider.com), is that while Congress could still decide to block an increase to the debt limit, the President could veto this and it would require a 2/3 majority to override.

So something along the lines of, if you keep maxing out your credit card – easy solution, just get rid of the limit – problem solved, and you can head back on out to the mall for the Christmas specials!

Last year when the debt ceiling was being focussed on, stock markets fell sharply but gold rallied from US$1600 to over $1900. So could we see a repeat before long?

Of course the upshot of whatever happens is that the US deficit will continue to widen and necessitate the Fed to fund the deficit by printing the difference. Jim Sinclair’s QE to infinity.

And emerging nations will likely feel the effects of this with an appreciating currency. As Bernanke pointed out at an IMF meeting back in October, for developing nations (and likely for us here too), it’s a case of let your currencies rise or import the USA’s inflation. So he pretty much said which flavour crap sandwich do you want to choose.

The net result is a loss of purchasing power in fiat currencies the world over regardless of what we do.

Student Loans – Another Great Idea

This week the idea was also raised for a $1 Trillion Bailout for Delinquent Student Loans in the US.

Then on breakfast news this week we saw some NZ student loan numbers that we hadn’t come across before. As it happens the numbers are actually a couple of months old. A quick Google turned up this article from September where the tertiary Education Minister Steven Joyce was re-Joycing (sorry couldn’t resist) that student loan write offs had fallen to 39 cents in every dollar borrowed from 48 cents in every dollar when Labour took interest off student loans

Wow – so writing off 39 cents in every dollar borrowed is actually an improvement!!!

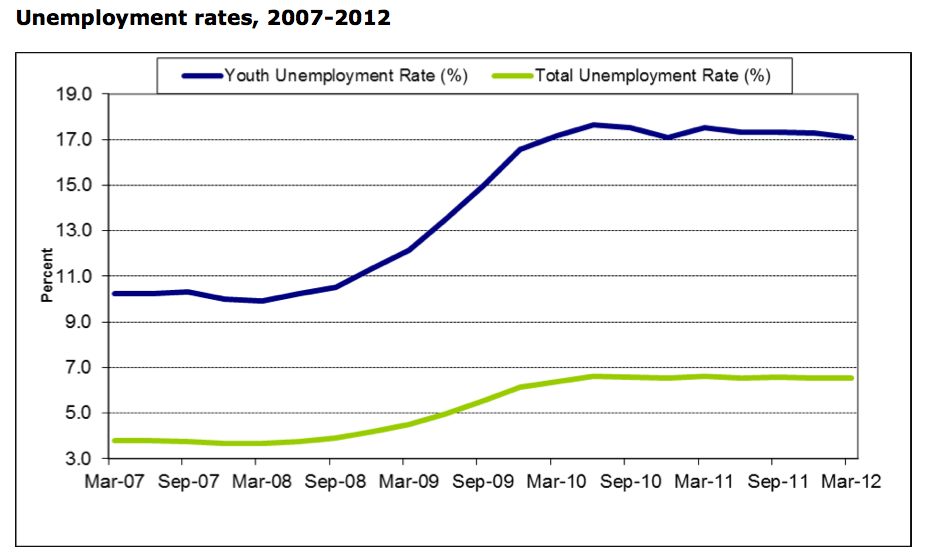

This is just another area they’ve managed to “indebtify” for no net benefit. Tertiary education costs more today, has more people involved and yet we still have record high youth unemployment of 17%.

And yet the perennial answer to high youth unemployment is to get more of them into further education, spend more across the board on what is already failing and reward the system and bureaucrats for failing by not only increasing funding, but then writing off (i.e. funding via taxes) close to half of the rest of the cost. [head scratch]

Even the Believers are Worried

This morning an email from “Mr Gold” Jim Sinclair said he was getting drowned in emails from people worried about whether a top was in for gold. And these are from gold followers! We reckon this could be a sign of a bottom when even the “believers” are doubters of the gold bull!

If you’d like silver then our main local silver supplier has a delay on their silver out to approximately the week of the 14th January 2013 due to Christmas rush from jewellers and the fact their refinery is closed down for 2 weeks over the holidays. So with lower prices today, now could be a good time to lock in a price with just a 20% deposit and keep it stored with M&W until you come back from your holidays. Remember for 5kgs or more it’s only 5% above spot + $13.80 ingot charge per bar. Get in touch if you have any questions about this:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

goldsurvivalguide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Reserve Bank of Australia Already Printing Money? |

2012-11-27 23:53:08-05 This week: Japan to buy much more gold? Reserve Bank of Australia already printing money? NZD Gold and Silver Charts Feature Video: Choosing between PAMP and local NZ gold and silver We’ll be a bit briefer than normal this week. David is down country so today so we’ve gotten a bit behind. Plus we haven’t […] This week: Japan to buy much more gold? Reserve Bank of Australia already printing money? NZD Gold and Silver Charts Feature Video: Choosing between PAMP and local NZ gold and silver We’ll be a bit briefer than normal this week. David is down country so today so we’ve gotten a bit behind. Plus we haven’t […]read more… |

| How Do the Chinese View the Gold Market? |

2012-11-28 18:08:32-05 We’ve been commenting on China’s gold buying habits from as far back as 2009. The below piece is an interesting comparison of China and the USA’s gold buying habits. New Zealand doesn’t feature in any of the World Gold Council Statistics so we can’t really know, but our guess is we’d be even further down the […] We’ve been commenting on China’s gold buying habits from as far back as 2009. The below piece is an interesting comparison of China and the USA’s gold buying habits. New Zealand doesn’t feature in any of the World Gold Council Statistics so we can’t really know, but our guess is we’d be even further down the […]read more… |

| The Silver Saga |

2012-12-03 21:46:56-05 We posted a video almost a year ago now which looked at “the crime of 1873“. At the time we mentioned that Professor Fekete was likely referring to the shenanigans in silver around this period of time, when he said he had been doing a bit of research on the topic of silver and he […] We posted a video almost a year ago now which looked at “the crime of 1873“. At the time we mentioned that Professor Fekete was likely referring to the shenanigans in silver around this period of time, when he said he had been doing a bit of research on the topic of silver and he […]read more… |

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: A Short Term Kicking of the Can | Gold Prices | Gold Investing Guide