Gold Survival Gold Article Updates:

Jan. 9, 2014

This week

- 2013 in Review and Some Predictions on 2014

- NZ’s largest Gold miner announces hedging in place until Dec 2015

- China Also Cranking Out the Money

- Coming Housing Bottom for Canada? And Similarities to New Zealand

First up Happy New Year! Here’s hoping that this year is a better one for holders of gold and silver. Although perversely that would probably mean that other areas might not be doing so well. Remember precious metals are financial insurance after all.

The cliche of darkest before the dawn springs to mind. So keep your chin up – your gold and silver holdings will be worth hanging on to in the end.

So what has happened since our last weekly email before Christmas?

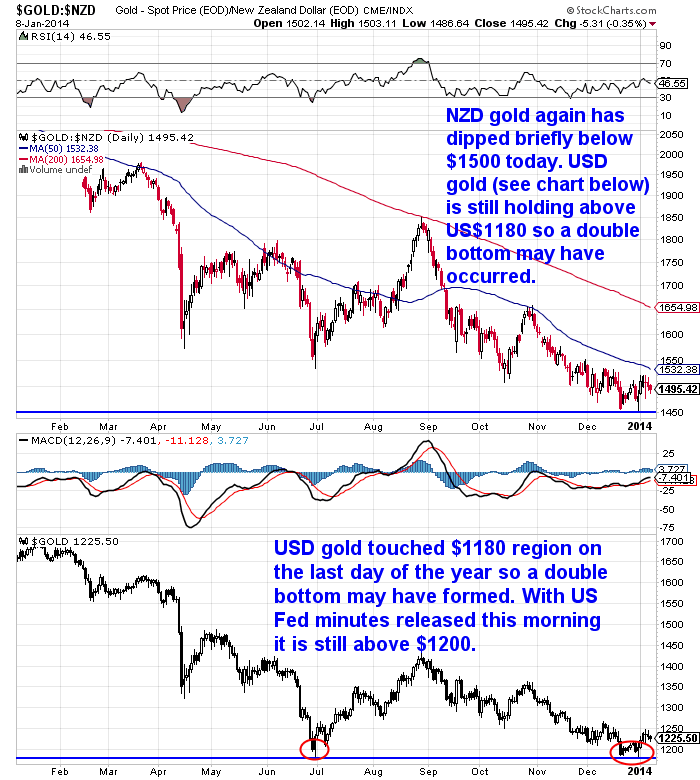

As we thought might occur over the low volume holiday period, gold and silver did drop lower on the last trading day of the year – just like the last couple years. However it was significant that gold touched the US$1180 level and bounced quickly higher. This was where it bottomed in June in US dollars. So it could be forming a double bottom here as seen in the lower half of the chart below.

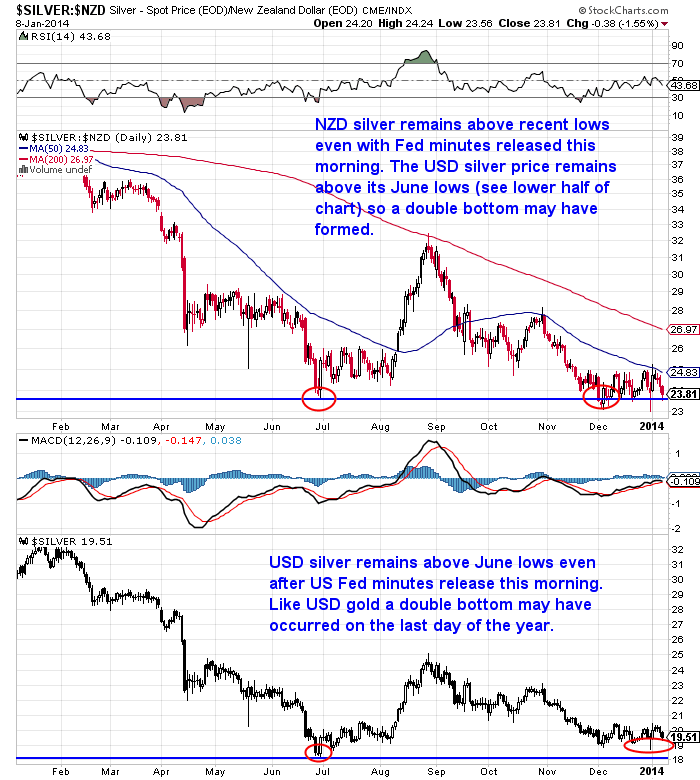

Silver too bounced off near the US dollar lows of June.

Gold and Silver in NZ dollars: 2013, the Year in Review and Some Guesses for 2014

As we have done for the past few years, this week our feature article is our annual review of the past year and predictions (guesses!) for what the next year holds for gold and silver in NZ dollars. So check out this weeks feature article first up.

Gold and Silver in NZ dollars: 2013, the Year in Review and Some Guesses for 2014

NZ Gold Miner Announces Hedging in Place Until Dec 2015

In a press release yesterday OceanaGold announced they were reimplementing a hedging policy again until Dec 2015. Hedging around 2/3 of a years production over the next 2 years.

“The impact of this is that in the event the spot gold price on maturity of the option is less than NZ$1,500 per ounce, the Company will nevertheless effectively receive NZ$1,500 per ounce. Should the spot gold price on maturity of the option fall between NZ$1,500 and NZ$1,600 per ounce the Company will sell the gold at the spot price. Where the spot price of gold is above NZ$1,600 per ounce on maturity of the option, the Company will effectively receive NZ$1,600 per ounce.”

NZ$1600 is just over $100 an ounce more than the price is currently or around 6%. We wonder if they will get it wrong again just like many miners did in the first 10 years of this precious metals bull market?

Surely the better time to hedge something is when it is up at record highs not down at record lows? Could be a contrarian signal perhaps? Afterall Oceana and many other miners had hedging in place through much of the rise in gold price not reducing these until 2008.

But what else could they do you may ask?

They could just refuse to sell at lower prices and hoard instead as an alternative and sell when the price is higher. If enough miners did this it would likely move the price higher.

Actually this reminds us of something we wrote in a video we posted on the site yesterday.

When Gold and Silver Go into Hiding and Why the Gold Must Keep Flowing

When Gold and Silver Go into Hiding and Why the Gold Must Keep Flowing

This video looks at the interplay in the petrodollar standard, between gold miners, bullion banks and central banks. It worths a watch.

But anyway back to what we we reminded of. A comment from “Youtuber” Brother JohnF we noted was that:

…”China has been buying on average 150 tonnes of gold a month. This is not much less than the largest gold miner in the world, Barrick Gold’s, total yearly production of around 220 tonnes. That’s right China has been buying each month almost all that the biggest miner produces in a year! So as he said we are getting closer to the end game.”

So if enough miners just refused to sell at current prices and hoarded they could have an impact on price. Don’t reckon it’s that likely though. We noticed a few holding back on selling silver like First Majestic Silver did last year but it’s certainly not widespread.

New Trend Guarantees Higher Gold Prices

But it may not take miners withholding gold and silver from the market to raise the price. Because lower prices are actually leading to the mined gold supply shrinking and it’s expected to get worse. This article posted on the site this week looks at this in some detail and how it will lead to higher gold prices in the future

But it may not take miners withholding gold and silver from the market to raise the price. Because lower prices are actually leading to the mined gold supply shrinking and it’s expected to get worse. This article posted on the site this week looks at this in some detail and how it will lead to higher gold prices in the future

New Trend Guarantees Higher Gold Prices

China Also Cranking Out the Money

Over the holiday break China also cranked open the money spigots, pumping $5 billion into their banking system to ease yet another “credit squeeze”. In a nutshell the Chinese authorities have been trying to tighten things up but in doing so interest rates rose sharply and they were forced to pump this extra cash into the system to bring them back down again.

Sound familiar? The same thing happened last year when the US Fed first brought up ending money printing over the next year.

The Daily Bell does a good job of exposing this for what it is. The mainstream media is promoting the idea of reducing bond purchases and tightening while the Central Bank makes a small move but the printing continues nonetheless.

Actually on this topic we read a great piece on the Daily Reckoning yesterday showing just how impossible it will be for the new Fed head Janet Yellen to exit from the bond purchases it has made and how this will impact gold. The Best Bet Against a Reckless Fed

Coming Housing Bottom for Canada? (And Similarities to New Zealand)

We read this interesting interview on the Daily Bell on Tuesday with an advisor to a hedge fund looking to profit from a predicted fall or in fact collapse in the Canadian Housing market. This piqued our interest as Canada has many similarities to the NZ economy. While being natural resource based, it too is heavily dependent upon housing. Also much like here in NZ things, on the surface at least, appear relatively rosy. Earlier this week we saw a report quoting their finance Minister predicting a budget surplus in 2015. Just like here in NZ.

Anyhow we think it is worth a read to consider if something similar could play out here in NZ. Here’s a few paragraphs that really caught our eye – our comments are bracketed and in bold…

—–

Daily Bell: Doesn’t the State-owned CMHC insure most of the mortgages held by banks and other primary lenders? If so, what’s to stop the BoC from just bailing out the lenders in a time of crisis? Wouldn’t that cause a major depreciation of the Canadian dollar?

Seth Daniels: Yes. It seems likely that the government and the Bank of Canada will bail out CMHC and the big five banks. This will devalue the Canadian dollar. It’s not widely discussed, but the Bank of Canada, CMHC and the US Fed bailed out the big five Canadian banks in 2008. The BoC and the government would dispute this conclusion, but from an Austrian perspective I consider their actions in 2008-2009 to have been tantamount to a bailout. I see no reason why there wouldn’t be another bank bailout this next time around.

—–

Daily Bell: When do you expect this correction to happen?

Seth Daniels: Timing the collapse of credit bubbles is notoriously difficult. The nearly-global QE and likely Canadian-government response to a bust could drag this out. However, barring a global catastrophe or rate shock, and taking into account continued global QE, I’d expect this to play out over the next 2-3 years in Canada.

I think that 2014-2015 will be pivotal years for Canadian real estate, as both supply and demand will begin working against the industry. On the supply side, we have an unprecedented number of Toronto condominiums due for completion in 2014-2015. On the demand side, it appears that most of the marginal buyers are already long housing. Canadian home ownership rates, housing unaffordability, household debt and use of HELOCs meet or exceed that of the US at its peak in 2006-2007 [Here in NZ these measures are pretty similar].

The ability to purchase an asset on credit creates additional demand for the asset because it increases the pool of potential buyers. If Canadians were forced to pay cash for houses, the pool of potential buyers would be dramatically smaller because many Canadians have very little in the way of savings. But if the house can be purchased for a payment of a few thousand dollars a month, the pool of potential buyers will increase dramatically. Artificially increased credit availability leads to increased demand, which has been the case over the past decade or so in Canada [Seems to us pretty much like here in NZ as we commented a while back in this article: Housing Un-affordability: It’s Not Supply, It’s the Debt Stupid! ] and has been exacerbated by CMHC’s insurance. This phenomenon also works in reverse: When the availability of credit decreases, it detracts from the pool of potential buyers. As Austrians know all too well, this will also reveal the malinvestments that occurred during the artificial boom period.

As an investor in an asset, you would ideally want the pool of available buyers to be small, which implies less competition. The ideal time to buy real estate, in my opinion, is when interest rates are high, when banks are refusing to lend, when few investors have cash to invest and prices are inexpensive (relative to rents, replacement cost, etc). However, when lenders offer easy credit (e.g., 100+% financing) due to government-subsidized mortgage insurance, the lowest interest rates in 50 yrs, etc. – as has been the case in Canada over the past 5+ years [and in NZ] – this should represent nearly the maximum pool of potential buyers, as the market has become nearly saturated with credit.

At the same time, the Canadian regulators are now reining in credit availability: The B-20 rules governing mortgage underwriting were revised to be more stringent over the summer, CMHC will begin levying a “risk fee” and CMHC is approaching its statutory balance sheet limit. If banks were forced to underwrite mortgages without government insurance via CMHC, mortgage rates would rise to reflect their true risk. The foregoing and future policy actions should decrease the pool of potential new buyers on the margin, which will cause asset prices to begin to fall as credit becomes less available, and the entire process goes into reverse – the bust phase of Austrian business cycle theory during which time the market clears the prior malinvestments. [Who knows if the RBNZ’s LVR policy will have a similar impact or what else they might try]

—–

Daily Bell: Are the trends you see in the Canada replicated elsewhere?

Seth Daniels: Yes, without a doubt. One of the best investors I know wrote an essay some time ago about an updated Triffin Dilemma that I think is applicable to your question. The US dollar is the reserve currency for the world. Our monetary policy affects everyone. At the same time, many of the other countries are pursuing the same types of policies independently.

The imbalances inherent to the Bretton Woods II monetary system, some of which are described in the Triffin Dilemma article – coupled with government and central bank policies post-2008 – have triggered a series of credit bubbles globally that are nearing collapse. Housing is the most leverageable consumer asset and therefore, housing bubbles are frequently symptomatic of these underlying credit bubbles. I believe that several of us started using the term Housing Bubble 2.0 contemporaneously, including Jesse Colombo at the Bubble Bubble.

—–

[He also discusses risks for the EU, China and Japan. Seems like we are in much the same boat.]

—–

Daily Bell: We believe there is a Wall Street party going on but the effect of market stimulation now will lead to a greater catastrophe. What can people do to take advantage of the current market stimulation as well as downward trends?

Seth Daniels: I am unable to provide investment advice for regulatory reasons, but in general terms if one were concerned about the unsustainability of market stimulation and/or a downward trend, the best course of action for an average investor would be to avoid the situation entirely. The question then is what to do with the proceeds. To protect against a potentially unlimited increase in the supply of dollars and/or bank or counterparty failures, I usually come back to physical gold.

More tools are available to take advantage of downturns for sophisticated investors such as shorting or employing derivatives, but I would caution against the use of these tools by the uninitiated – it’s treacherous enough even for professionals. Even if you prove to be fundamentally correct, you take on many risks including but not limited to counterparty risk.

—–

See the whole interview at the Daily Bell. It’s worth a full read.

Then later the same day we saw the same hedge fund mentioned on Mike Maloneys WealthCycles.com site. Alongside Canada they actually specifically mention NZ, along with the Scandinavian nations of Sweden, Denmark and Norway as being often quoted as those countries to get through 2008 in good shape. They go on to say:

—–

“…But a closer look tells a different tale: In all those shining examples, government and central policies to artificially suppress interest rates and inflate the currency supply are having the usual results: malinvestment and bubbles that threaten the banking sector and put taxpayers on the hook…”

—–

The article continues:

—–

“Like Canada, the Nordic countries of Sweden, Denmark, Finland and Norway have received high marks from observers such as Mark Thornton, the Austrian economist who predicted the U.S. housing crash at least as far back as 2004, for taking measures to lower government spending, cut taxes and reduce national debt. But there, too, housing bubbles have developed, frustrating central bank efforts to manipulate borrowing rates to control inflation, Bloomberg reported in late October.

–

‘In Sweden, the largest Nordic economy, a brief lull in the housing market after a series of measures to curb demand has been replaced by accelerating prices. Apartment prices rose 14 percent in the 12 months through August after more than doubling since 2000. That’s prompted Swedes to take on bigger mortgages to help finance their homes, driving debt relative to disposable incomes to a record high.’

–

In Norway, the housing market has cooled, after household debt levels reached 200% of disposable income, and analysts there expect the central bank to back off its plan to raise interest rates in 2014, Bloomberg reports.

Meanwhile in the U.K., while housing prices and sales volume have not yet returned to their pre-2007-2008 levels, swaths of the country, such as metropolitan London, are in bubble territory. Prime Minister David Cameron’s government-backed Help-To-Buy program to help buyers purchase homes with just 5% down has come under fire. The program would facilitate some £1 billion in new lending. Some economists warn that when interest rates are allowed to rise, projected by the U.K.’s Office for Budge Responsibility for 2015, the bubble or regional bubbles could burst, leaving a trail of bad loans, plummeting home prices and negative equity, the BBC reports.

The common thread to these whack-a-mole eruptions of housing bubbles is government and central bank intervention in the marketplace. Political leaders and government economists remain convinced that “this time is different,” that their cleverness and scientific understanding so exceeds that of previous generations that they can, this time, pull the levers here and apply more pressure there and end up with the inflation rate/employment rate/debt levels/Gross Domestic Product exactly where they want them—no matter how many times they are proved wrong.”

—-

Sound familiar? Our Central Bank is trying it’s hand at cooling things off down here with it’s LVR policy after heating them up with it’s record low interest rate policy.

Odds are we are on the same track as these other nations, we are just a little further back on the track. As we’ve said before New Zealand is likely close to the best of a bad bunch, but that’s not to say we will escape unharmed. Rather we are likely to be one of the last dominos to fall. It’s the picking of when the dominos fall that is the really hard part. Which is why it pays to be a year or two early rather than a day late when it comes to getting at least some of your wealth out of the system.

Insurance remains cheap at the moment when most aren’t interested in buying it. But if you are get in touch.

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| The (mini) taper finally occurs |

2013-12-19 06:11:09-05This week… The mini taper Don’t miss out on NZ bullion tips and news… add info@goldsurvivalguide.co.nz to your address book (Learn how) Having trouble viewing this email? Can’t see pictures? Click this link. ABOUT | ORDER GOLD & SILVER NOW | […]read more… 2013-12-19 06:11:09-05This week… The mini taper Don’t miss out on NZ bullion tips and news… add info@goldsurvivalguide.co.nz to your address book (Learn how) Having trouble viewing this email? Can’t see pictures? Click this link. ABOUT | ORDER GOLD & SILVER NOW | […]read more… |

| New Trend Guarantees Higher Gold Prices |

2014-01-05 23:30:57-05You’re no doubt aware that gold mining shares have been hit hard by the much lower price of gold over the past 2 years. And while this lower price has been bad news to the share prices of mining stocks of late, it is starting to have broader impacts to the industry that will be felt […]read more… 2014-01-05 23:30:57-05You’re no doubt aware that gold mining shares have been hit hard by the much lower price of gold over the past 2 years. And while this lower price has been bad news to the share prices of mining stocks of late, it is starting to have broader impacts to the industry that will be felt […]read more… |

| Gold and Silver in NZ dollars: 2013, the Year in Review and Some Guesses for 2014 |

2014-01-07 18:12:30-05With another year over it’s time to look back at how gold and silver performed in New Zealand dollars during 2013. And to see how we did with our predictions. Then we’ll offer the opportunity for more egg on our face by hazarding a guess as to what might lay ahead for 2014. And of […]read more… 2014-01-07 18:12:30-05With another year over it’s time to look back at how gold and silver performed in New Zealand dollars during 2013. And to see how we did with our predictions. Then we’ll offer the opportunity for more egg on our face by hazarding a guess as to what might lay ahead for 2014. And of […]read more… |

| When Gold and Silver Go into Hiding and Why the Gold Must Keep Flowing |

2014-01-08 00:03:42-05This is a very informative video. It is a summary of much of the content talked about by the likes of mystery blogger FOFOA. Just some of the content covered includes: How the Elite still use gold as means of payment even though the dollar is supposedly unbacked. How the petrodollar system functions The interplay […]read more… 2014-01-08 00:03:42-05This is a very informative video. It is a summary of much of the content talked about by the likes of mystery blogger FOFOA. Just some of the content covered includes: How the Elite still use gold as means of payment even though the dollar is supposedly unbacked. How the petrodollar system functions The interplay […]read more… |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $ 1481.03 / oz | US $ 1224.46 / oz |

| Spot Silver | |

| NZ $ 23.58 / ozNZ $ 758.09 / kg | US $ 19.49 / ozUS $ 626.93 / kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$824.96

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

“Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: New Zealand Almost Losing the Race to Debase | Gold Prices | Gold Investing Guide