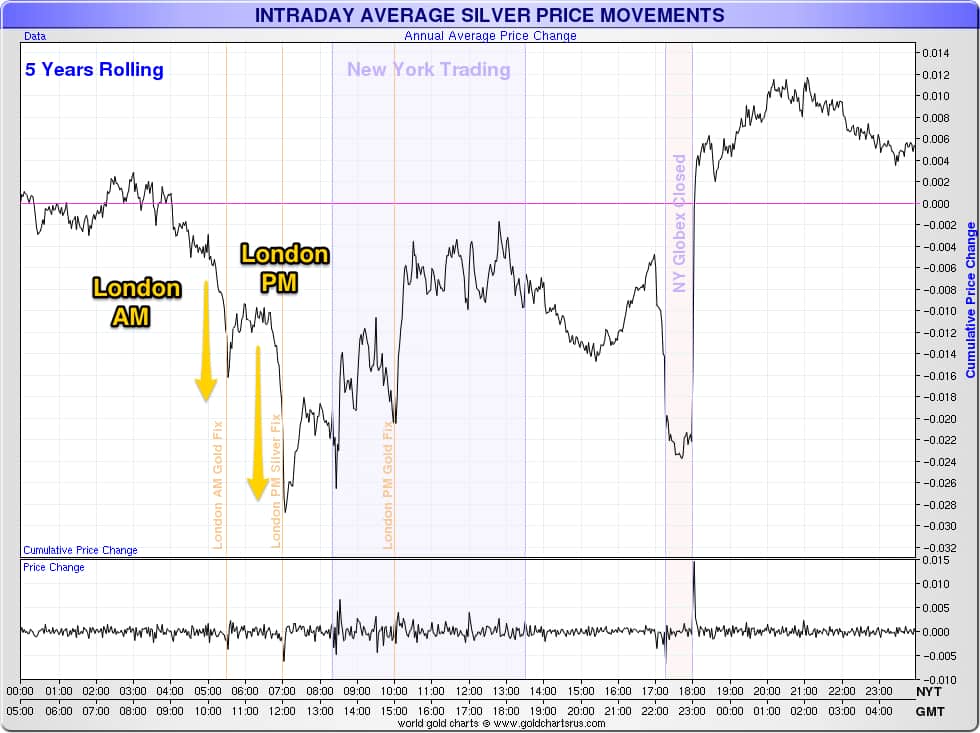

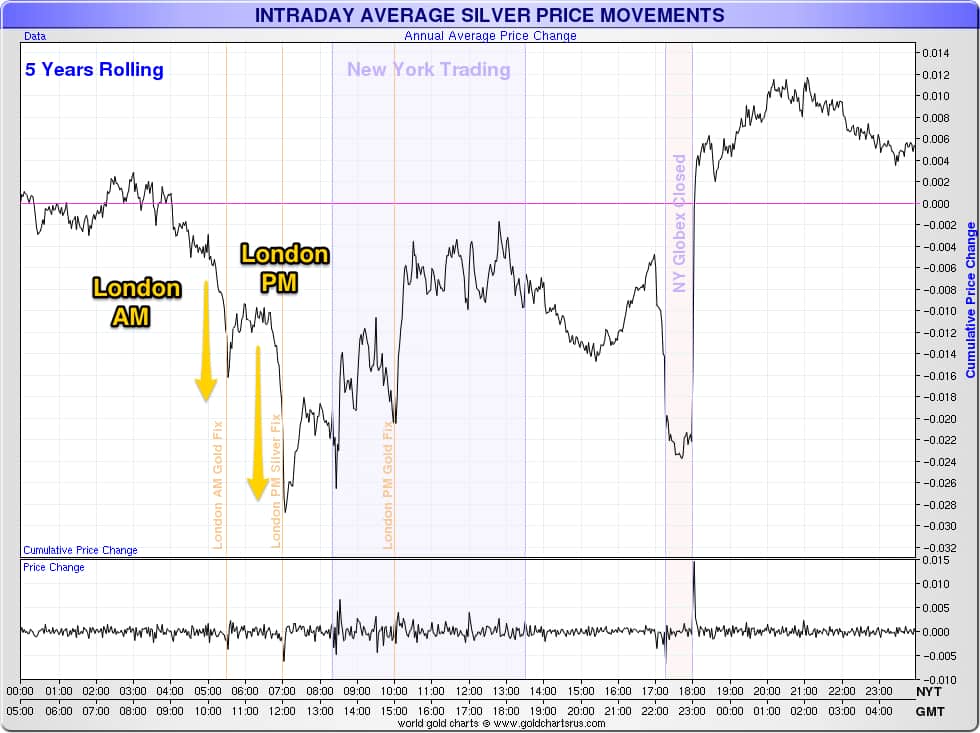

Here’s JS Kim of SmartknowledgeU’s theory as to why the London Silver Price fix is being shut down as of this August. His view is in direct contrast to that expressed in the mainstream by a Reuters columnist yesterday in COLUMN-Are London’s precious metals fixes fixable?: Andy Home. But it’s worth reading/watching both to get both sides of the story. However given a picture is worth a thousand words, we think Nick Laird of Sharelynx’s chart below is very informative. It is a 5 year chart which averages out the intraday silver price. The result is we get to see where movements commonly happen. And we can see the biggest moves down happen at the London AM and PM fixes.

Anyway over to JS Kim for his views…

After a longer than century history of manipulating silver prices through the London AM/PM silver price “fix”, the LBMA announced yesterday that it will effectively end this fix as of 14 August 2014, shutting down the fixers: HSBC, Deustche Bank and the Bank of Nova Scotia. Undoubtedly, this surprise announcement has a lot to do with the intensified German regulator BaFin’s scrutiny of corrupt price fixing and manipulation in precious metal markets as of late. In fact, BaFin has stated that initial evidence points to price rigging of gold and silver, as well of Forex markets, to be potentially much greater than even the banks’ rigging of LIBOR interest rates. Upon reflection this makes perfect sense as the strength of the USD and the Yen have direct bearing on gold and silver prices so both would be rigged by bankers to strengthen the USD and weaken gold and silver prices.

Furthermore, it is no coincidence that after the private banking families that own the US Federal Reserve only returned 5 tonnes of the 1528.2 tonnes (or an insignificant 0.327%) of Germany’s gold they hold in 2013 after Germany’s request for gold repatriation, BaFin started to tighten the screws on the very banks that have been manipulating gold and silver prices heavily downward in 2012 and 2013. No doubt, those politicians that actually care about Germany’s sovereignty realize that having ample gold reserves is key to maintaining sovereignty and are privately fuming over the private bankers’ refusal to hand over their gold. A more likely explanation for the 0.327% repatriation of Germany’s gold last year was not a refusal of private bankers to hand over their gold, but an inability to hand over the gold after leasing it out into the open market for decades to suppress the price of gold. Germany’s realization that their gold may forever be gone is far more stomach-churning than the snail-like pace in retrieving their gold, and this has caused the backlash of scrutiny into the fraudulent operations of gold and silver paper derivative markets.

The fallout began with Germany’s own Deutsche bank announcing the rescinding of its seats on the London gold AND silver price fixing committee this past January (although their surrender of their seat to fix silver prices is moot now that the LBMA is permanently disbanding the price fixing committee). The fallout intensified with Deutsche’s bank subsequent failure to find anyone to purchase their seats. Of course, their failure to find anyone to purchase their seats on the gold and silver price fixing committees is a consequence of BaFin’s intensified investigation into gold and silver price suppression as no one wants to walk straight into the spotlight of an investigation into the daily fraud that occurs on these two fixing committees.

Although it may seem odd to some that German BaFin’s hammer has fallen down so hard on Germany’s own Deutsche Bank, this is only odd to those that don’t understand the relationship between banks and sovereignty. When it comes to global bankers, they care nothing for the well-being of their own country’s citizens, as their only goal is to transfer the wealth of their citizens to themselves. Therefore, by hammering Deutsche Bank, BaFin is actually fulfilling their fiduciary duty to protect their citizens from all enemies, even when these enemies are domestic. As another example, the families that own the US Federal Reserve have gleefully destroyed the savings of hundreds of millions of Americans and act against the best interests of all American citizens day in and day out.

This is why Deutsche bank asked for the resignation of Matthew Keen, the head of their precious metals group last month, after which he promptly fled to Dubai, far away from BaFin’s inquiring minds. Resignations, disbanding of rigging groups, key banking executives moving to far away lands…it all sounds like a Hollywood movie plot! So what does it all mean and what effect will the end of the London Silver Price Fix have on silver prices for 2H 2014? We consider this question and much more in the below video:

About the author: JS Kim is the Founder & Chief Investment Officer of SmartKnowledgeU. Learn to invest in gold and invest in silver as insurance during the second phase of this global monetary crisis and global currency race to the bottom. Follow us on Twitter at @smartknowledgeu and Like Us on Facebook. Article may not be republished on other websites unless reproduced exactly as is, with all text, links and author acknowledgements intact in their original state.

Learn More: How to Buy and Invest in Silver in New Zealand