Prices and Charts

Weaker Kiwi Boosts NZD Gold Price Over 3%

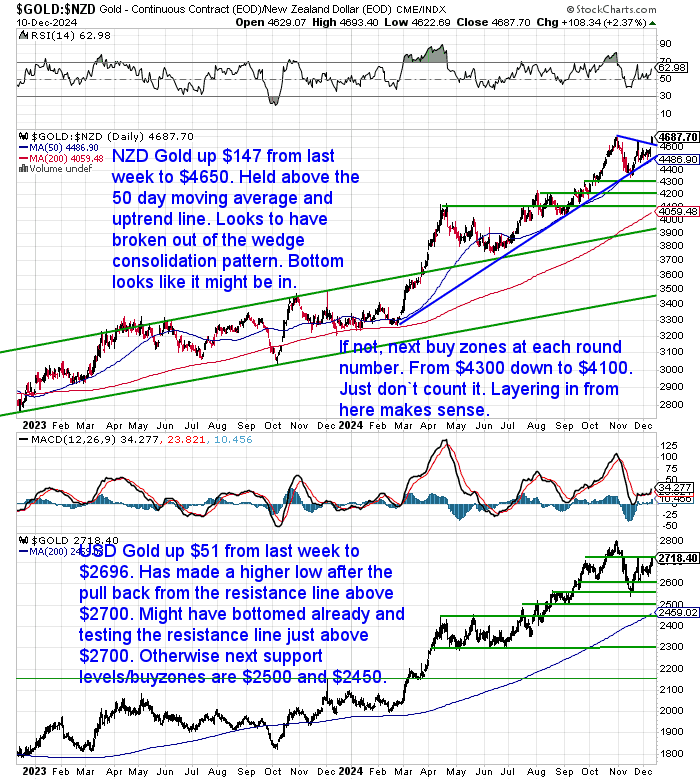

Gold in NZ Dollars was up a hefty $147 (3.3%) from last week to $4650. After holding above the 50 day moving average and the blue uptrend line, it looks like it is now breaking out of the wedge consolidation pattern (blue lines). It is looking like the bottom might be in at $4350. Much less chance of a dip down to the next support areas at $4300 and $4100.

In USD terms gold was up $51 to $2696. It has made a higher low after the pullback from the resistance line above $2700. Back testing this line again now. Our guess is gold has bottomed. But if we are wrong then the next buy zones are at $2500 and $2450.

NZD Silver Surges Over 4%

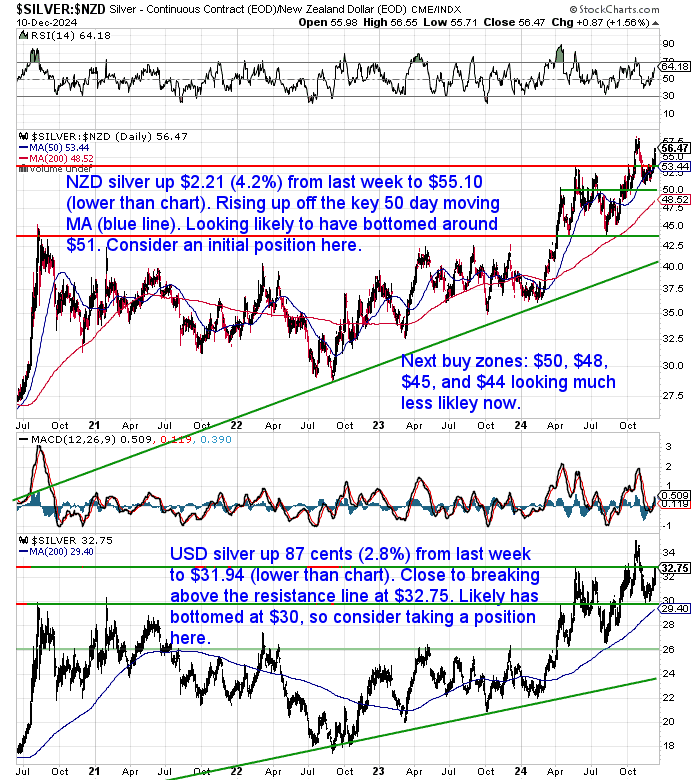

NZD Silver jumped $2.21 or 4.2% from 7 days ago to $55.10. It has risen up off the key 50-day moving average (blue line). It looks more likely that silver has bottomed around $51. Consider taking an initial position here as it’s likely to challenge the high above $57.50 next.

While in USD silver was up 87 cents (2.8%) to $31.94. It is close to breaking above the resistance line at $32.75. We’d say it’s likely USD silver has bottomed at $30. So good idea to take an initial position here.

NZ Dollar Hits 1-Year Low

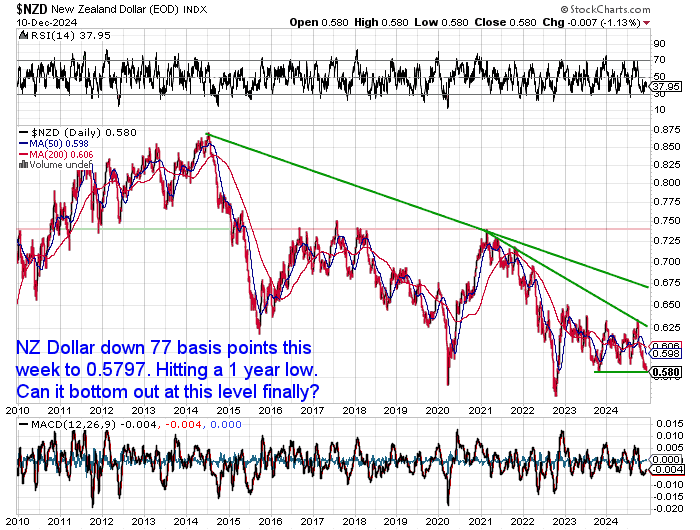

The NZD dollar was down 77 basis points from last week to 0.5797, after the release of weaker-than-expected NZ trade data. That is a 1 year low and so the Kiwi is right on the support line now. Can it finally bottom out here?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Gold or Silver? Making Informed Choices Using the Gold-Silver Ratio

In this week’s feature article, we explore the gold-silver ratio, which indicates how many ounces of silver are needed to purchase one ounce of gold. This ratio helps investors assess the relative value of these metals. A higher ratio suggests silver is undervalued compared to gold, while a lower ratio indicates the opposite. By analyzing historical trends, we can gain insights into current market conditions and offer guidance on whether to invest in gold or silver.

Discover how this ratio can assist your investment decisions and what it reveals about the current market landscape. Whether you’re a seasoned investor or new to precious metals, this analysis offers valuable perspectives on optimising your portfolio.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way! We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support. Interested? Contact us today to learn more!

Fed Chair: Bitcoin is a Competitor With Gold, Not the US Dollar

“BREAKING: Jerome Powell says “Bitcoin is a competitor with Gold, not the US Dollar” – CNBC

Bitcoin is quickly being recognized as gold 2.0, even by traditional finance and the government.”

Source.

But as our friend Louis Boulanger rightly points out:

“Deceitful and hypocritical assertions from someone who knows better, but endlessly needs to maintain faith in the fiat non-system in whatever way it can or, as they say, must do whatever it takes to ensure delusion prevails.

That being said, gold is the true competitor of the fiat dollar as a reserve asset. His predecessors have said it themselves multiple times. Volcker even called gold the enemy in his memoirs. So, if bitcoin is a competitor with gold, then the fiat dollar now has more enemies than ever.

That should not be a surprise to anyone. The US has abused its exorbitant privilege for so long; the greenback now has to deal with the blowback.”

That is how we look at things too. That gold and BTC are enemies to the dollar and centralisation, rather than the competitors that Powell would prefer us all to believe.

So instead of hard money advocates arguing about which is best, buy some of each. Here’s how we do it.

Why Gold Remains the Cornerstone of Global Reserves

While there have recently been more and more mentions of some countries creating a bitcoin reserve, governments and central banks continue to buy gold as one of their main reserve assets.

Speaking of which, here’s a great post from Ronnie Stoeferle on why gold is still a cornerstone of global reserves.

Ronnie’s points are timely with the Chinese central bank this week once again reporting buying gold after a (supposed) six-month pause.

Supposed because Jan Nieuwenhuijs recently highlighted how the People’s Bank of China (PBoC) has during this time been covertly buying very large amounts of gold via UK gold exports to China: “…the PBoC has made it overtly clear what they did in September: buy 60 tonnes of gold from bullion banks operating in the London Bullion Market.”

Source.

So even when central bank reserves aren’t being officially added to, they likely are still being increased.

Why Gold Remains the Cornerstone of Global Reserves – a little thread… 🥇

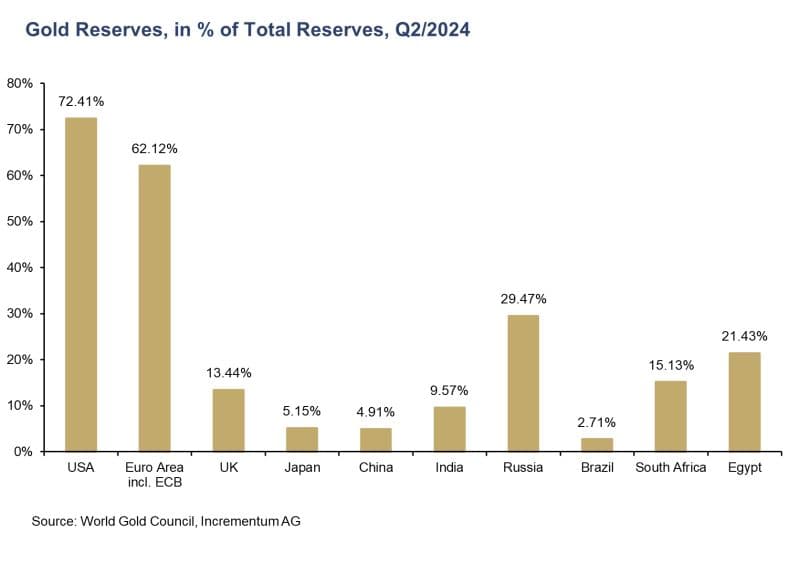

1/11 Most major central banks still hold a significant percentage of their reserves in gold. Let’s dive into the gold reserves dynamics!

2/11 Recent gold purchases have largely come from emerging markets. These nations are bolstering their reserves amidst global economic shifts.

3/11 Despite this trend, developed nations still hold significantly more gold—both in absolute terms and relative to their total reserves. 📊

4/11 📜 A recent World Bank paper recommends a gold allocation of up to 22%. Many central banks are following this guidance, holding substantial gold reserves or actively increasing their positions.

5/11 🚨 The opposite trend is observed among private and other institutional investors, who remain under-allocated in gold!

6/11 In our recent special publication we showed that the optimal gold allocation lies between 14-18%—a level that balances risk and returns.

7/11 A rising gold price effectively serves as a covert mechanism for recapitalizing central bank balance sheets, strengthening their financial foundations and resilience.

8/11 🚀 Based on our 2030 price target of $4,800, the relative share of gold reserves in developed markets would climb to an impressive 50%!

9/11 Contrary to appearances, developed markets have as much—if not more—interest in maintaining a stable and robust gold price as emerging markets, which are actively expanding their gold reserves. This alignment underscores the strategic importance of gold globally.

10/11 🔍 For more insights into the gold market and quantitative analyses, visit 👉 https://lnkd.in/dPANm2Rz

11/11 For investment solutions, check out 👉 https://www.incrementum.li

Source.

All images available on LinkedIn.

Ray Dalio: How to Navigate the Changing World Order

Ray Dalio, founder of the world’s largest hedge fund, Bridgewater associates, this week stated:

“I urge you to understand how and why the world order is changing so you can navigate it well. If you are watching what is happening, you are now seeing more fighting within countries, more fighting between countries, and more debt excesses than at any time since the 1930-45 period. The U.S., France, Japan, Germany, the U.K., Korea, Japan, China, Russia, the Middle East, and many more are plagued by these problems, and they are spreading. To understand why and where we are likely headed, I urge you to watch this 40-minute video in the comments below or read my book Principles for Dealing with the Changing World Order. Then we can exchange thoughts about what’s happening here on social media.”

Source.

Dalio’s video from 2 years ago remains a great guide for navigating what lies ahead.

Buy Gold and Bitcoin

Dalio recently said he would:

“…invest in “hard money” like gold and bitcoin while avoiding debt assets, as most major economies face rising indebtedness problems.”

“I believe that there would likely be a pending debt money problem,” he said in a speech at a financial conference in Abu Dhabi on Tuesday. “I want to steer away from debt assets like bonds and debt, and have some hard money like gold and bitcoin.”

…He added that the indebtedness seen in the US, China and all major countries except Germany has increased at “unprecedented levels” and the amount will not be sustainable.

“It is impossible for these countries to be able to not have a debt crisis in the years ahead that will lead to a great decline of [money] value,” Dalio said.”

Source.

Russell Napier: America, China, and the Death of the International Monetary Non-System

Here’s a very interesting read on China and the USA and what may lie ahead in terms of a new international monetary system.

“With austerity, default, hyperinflation, or very high real GDP growth unlikely to be the solution, a new global monetary system will have to be created that offers a path of moderation toward reducing debt‑to-GDP levels. That path of moderation is likely to take the form of financial repression—such as that imposed upon savers in the aftermath of World War II, to force their savings to fund the investment needed for postwar reconstruction, but at interest rates that did not reward them for the current and expected levels of inflation. That is a world in which bankers will create more credit and more money and more inflation than they have in recent decades. Higher nominal GDP growth combined with imposed purchases of low-yielding debt securities will, over time, reduce debt-to-GDP levels, just as it did in the decades following World War II. Whatever the new international monetary system looks like, it will have to accommodate the financial repression that will finally begin to reduce debt-to-GDP levels.”

…The distortions to credit, money, asset prices, and the economy that arose under the non-system cannot be unwound quickly. A rapid reversal could probably only be accomplished via deflation and depression or, alternatively, a hyperinflation—events that would bring huge socioeconomic disruption and likely political dislocations. To prevent such an outcome, governments will increasingly see their role as managing the wealth of the nation to ensure that the imbalances of the non-system are unwound gradually.

This greater government action will make it very difficult for savers to preserve the purchasing power of their wealth.”

Source.

The emphasis added at the end of the above quote is our own. So we’d suggest the 2 assets that Ray Dalio recommended earlier as the most obvious ways to preserve purchasing power.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|

| |

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

|

Note:

- Prices exclude delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as a monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options are available so you can purchase from USD, AUD, EURO, GBP

- Plus we accept BTC, BCH, Visa and Mastercard

|

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2024 Gold Survival Guide.

All Rights Reserved.

|

|