This Week:

- China’s Devaluation – a different perspective

- The Impacts for New Zealand

- The Next Silver Bull May Have Already Started

- The (Silent) Summer Silver Spike

- Will China Play The ‘Gold Card’? (Devalue the Yuan Against Gold)

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1703.13 | + $32.77 | + 1.96% |

| USD Gold | $1125.60 | + $40.20 | + 3.70% |

| NZD Silver | $23.55 | + $1.00 | + 4.43% |

| USD Silver | $15.56 | + $0.91 | + 6.21% |

| NZD/USD | 0.6609 | +0.0111 | + 1.70% |

The talk this week on the financial newswires has been all about the Chinese Yuan devaluation. Why it was done and what it means. We’ll come back to that shortly. But first our usual look at gold and silver and the NZ Dollar.

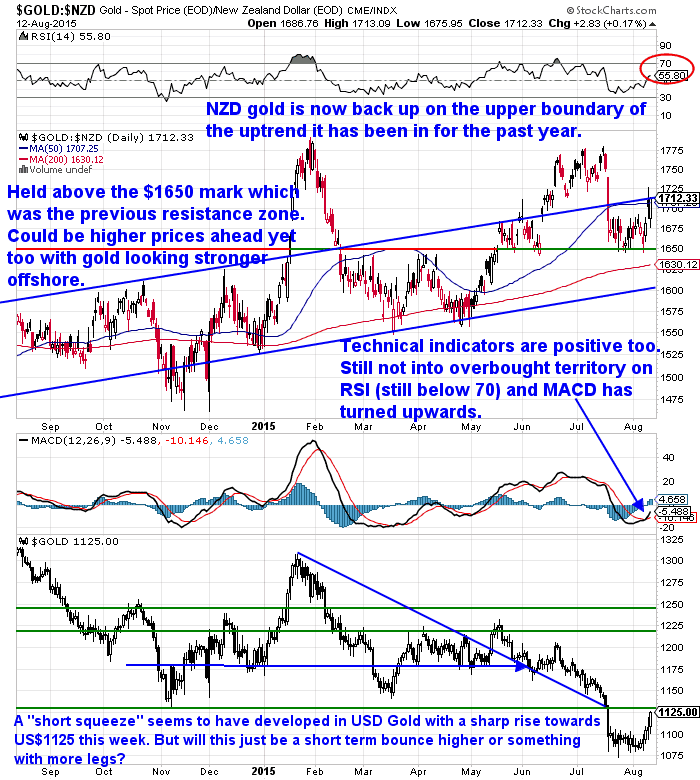

It seems a short squeeze might have finally developed in both gold and silver this week. We’ve seen both metals move steadily higher over the past few days in US dollar terms.

Gold is up 3.70% in US Dollars but not quite so much here in NZ with a stronger Kiwi from last week.

However as you can see in the chart below gold in NZ Dollars is again bumping up against the overhead trendline of the uptrend it has been in all year. Of interest is that the technical indicators are not looking too bad either. The RSI (top of chart) is not overbought yet and the MACD indicator has turned up which is generally a positive.

So for all the negativity we could well see higher prices ahead yet.

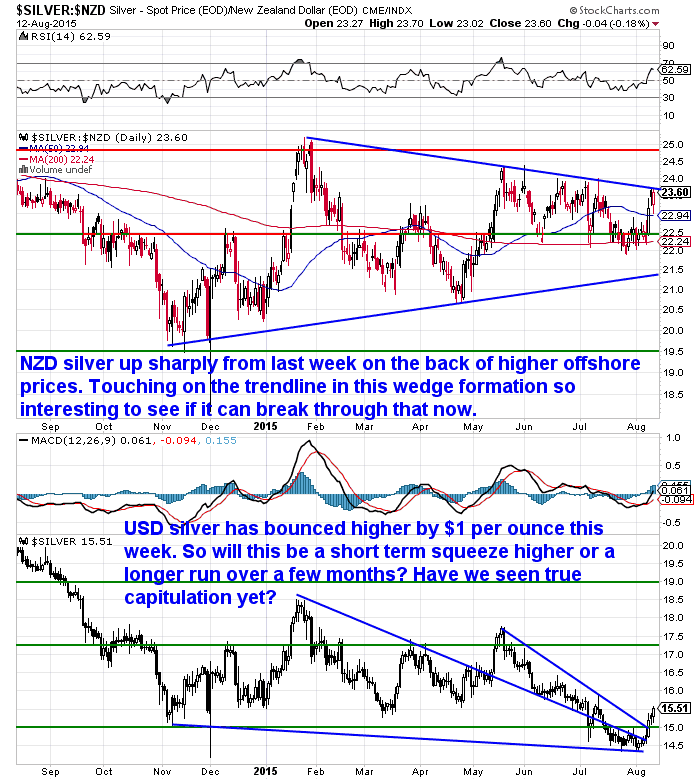

Meanwhile NZD silver has also bounced higher this week. Today it sits right on the down trend line of the narrowing wedge formation it has been building since January. Before long it will have to break out of this one way or the other. Given how negative sentiment is, we guess it might well be up.

This week silver in US Dollars broke out of the sharp downtrend it has been in since May. Now the question is whether this is just a short term bounce or something that might have longer legs and last a few months at least?

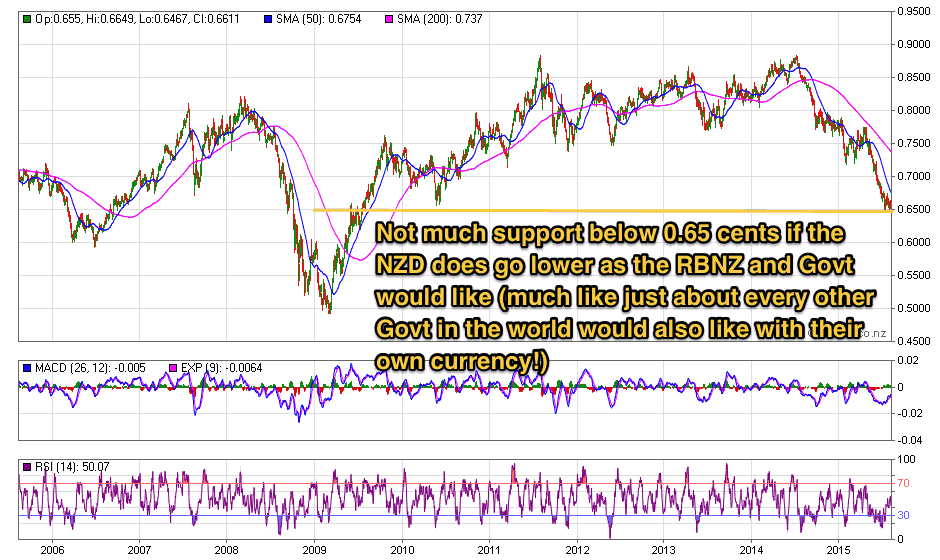

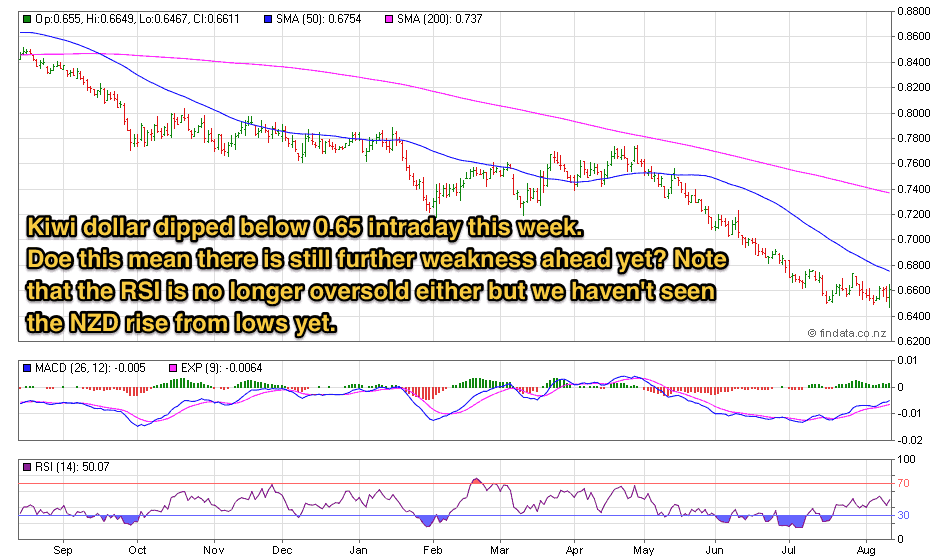

Turning to the Kiwi dollar, it sits at a key level still at 0.6609. So still holding just above the 0.65 level which as you can see in the longer term chart below is where the last line of support is.

Our Reserve Bank and just about every other one on the planet wants their currency cheaper. But they can’t all be cheaper at once. Given the US Dollar Index has been going sideways for the past few months perhaps we are nearing a change in trend?

For now we are well out of the oversold territory in the Kiwi. But we still haven’t seen it move much higher yet. So who knows where from here. It will need to hold above 0.65 or it is going even lower still most likely.

A Few Angles on the Chinese Devaluation

Over the previous 2 weeks we’ve shared a couple of articles that discussed the ending of China’s currency peg to the US dollar. See last week here and the week here before where we discussed the implications of this for New Zealand.

That has proven quite timely this week. As while China hasn’t removed the peg they have certainly wiggled it around and loosened it up a bit!

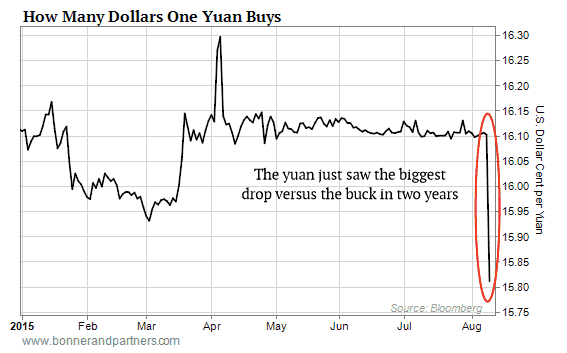

You see, 2 days ago they forced a 2% devaluation against the USD which is the Yuan’s biggest in 20 years. As can be clearly seen in the chart below from Bill Bonners daily letter:

And an even more precipitous race to the bottom for the world’s major fiat currencies…”

So this was meant to be a one off but it’s also important to note another change to their policy. Moneymorning.com reports:

Source.

So the Yuan could see a more steady decline against the dollar from here. Why?

Because the price will now be set based upon the close the previous day. So if the market pushes the Yuan lower each day, the next days price will be based upon the previous days lower close. So we could see it steadily walk down the staircase so to speak.

The mainstream headlines seemed to take this as a real shock. But as reported the last two weeks this was definitely on the cards as far as we were concerned.

The headlines seem to be mainly focused on the slowing Chinese economy and the need to lower the Yuan ands boost exports. a.k.a. a competitive devaluation.

The PBOC says it is “an improvement in the exchange rate system” which is what the IMF has recommended. This is perhaps one of the reasons why reports in the past week have said the China currency won’t be allowed into the Special Drawings Rights (SDR) this year.

So perhaps this move was in response to that? You could also argue it was China thumbing its nose at the West.

Adrian Ash outlined a number of other possibilities:

Or how about deflation hitting neighbouring Thailand and south-east Asia? Or the Shanghai stock market’s 25% crash this summer? Or the pain hitting China’s huge gold mining and retailing industries as lower Yuan prices hit profit margins and deter fresh demand…?”

But there is also another completely different angle. We’ve posted an article covering this on the website this week. Check that out below…

But there is also another completely different angle. We’ve posted an article covering this on the website this week. Check that out below…

Another Strong Signal Yesterday to Own More Physical Gold

Somewhat coincidentally we also posted another article prior to the Chinese announcement by Mexican billionaire Hugo Salinas Price. Where he poses the question…

Somewhat coincidentally we also posted another article prior to the Chinese announcement by Mexican billionaire Hugo Salinas Price. Where he poses the question…

Will China Play The ‘Gold Card’? (Devalue the Yuan Against Gold)

They haven’t done that but perhaps we are just seeing the first steps? It is a very interesting article with a theory we haven’t seen elsewhere.

A US interest rate rise looks even less likely now.

Why’s that?

Because a lower Chinese Yuan will mean it’s cheaper for the US to import Chinese goods. Or put another way China will be exporting lower prices to the US. Lower prices are generally not what leads to a rise in interest rates. So we could well see the US economy slow down. While it’s dollar remains high it’s exports remain expensive and so US companies like Apple etc will continue to struggle and report lower earnings.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $285 you can have 1 months long life emergency food supply.

Learn More.

—–

Impact of the Chinese Devaluation on Gold

Another under reported angle is the impact on the gold price but also on premiums in China.

Even though China disappointed many with it’s recent lower than expect gold reserves announcement, perhaps it has put a “bid” under gold with this devaluation? Coincidentally the gold price seems to have headed higher following the devaluation.

According to Bullionvault…

That is the question indeed.

If they have any sense they will see a lower currency ahead, a stock market likely to fall further and a property bubble likely ending and they will turn back to gold and silver.

What are the Implications for New Zealand of the Chinese Devaluation?

Well, we discussed this in the last 2 weeks so we’d recommend you go back and read them if you haven’t, Found here and here.

But in a nutshell the global race to the bottom is continuing. Everyone is trying to out-cheapen each other.

We still believe in the long run this will be very beneficial to holders of gold and silver. Silver in particular looks to have a lot of upside from here. (Check out the 2 articles on silver below for more on this).

Who knows if the bottom is in? But we are probably not too many percent from it. And in NZ dollars terms it may well be.

So it’s likely a good time to take a position and add to it in coming months.

Please get in touch if you have any questions.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $14,755 and delivery is now about 7-10 business days.

** Urgent Message for All Car Owners **

A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these. One for each car in your family or give one to someone you care about.

Click here to get yours now.

—–

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|