GSG Weekly Market Wrap – 14 May 2025

This Week:

Estimated reading time: 4 minutes

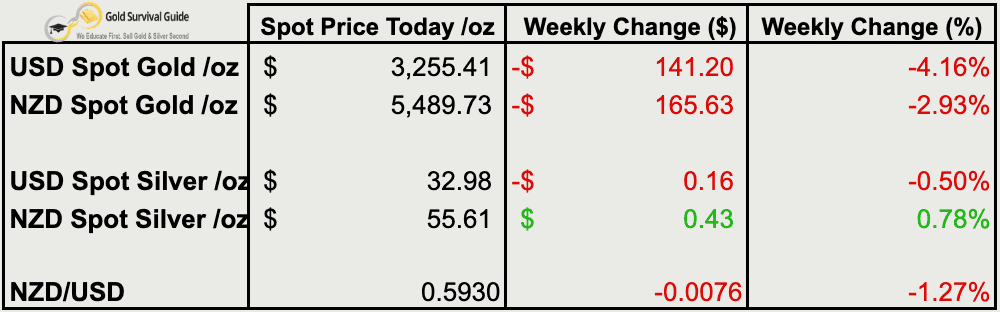

Weekly Price Overview – 14 May 2025

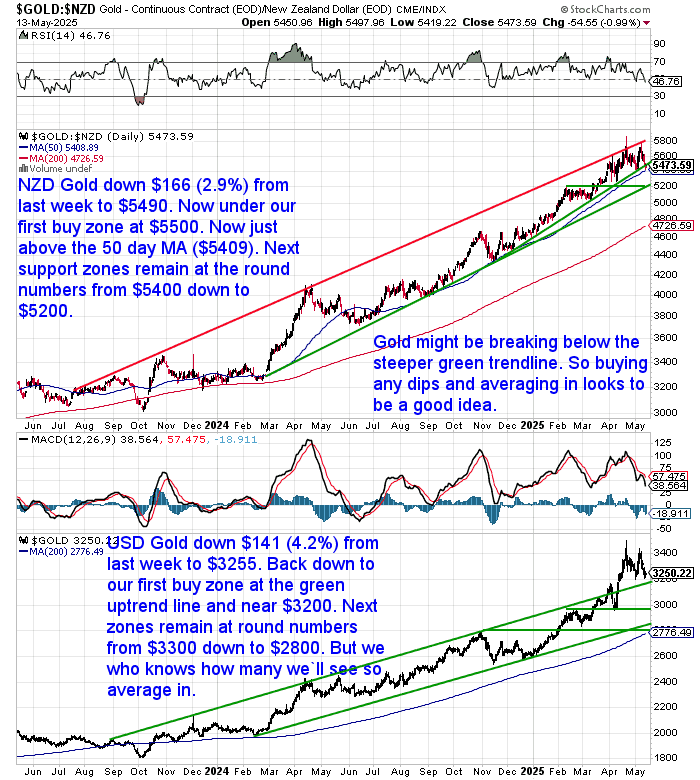

Gold retreated sharply this week, with USD gold down 4.2% and NZD gold falling 2.9% — both pulling back to key technical support zones. USD gold is back near the top of its uptrend channel, while NZD gold dipped just below $5500 and its 50-day moving average. As we covered in this week’s feature, dips like this may be less breakdown than buying opportunity.

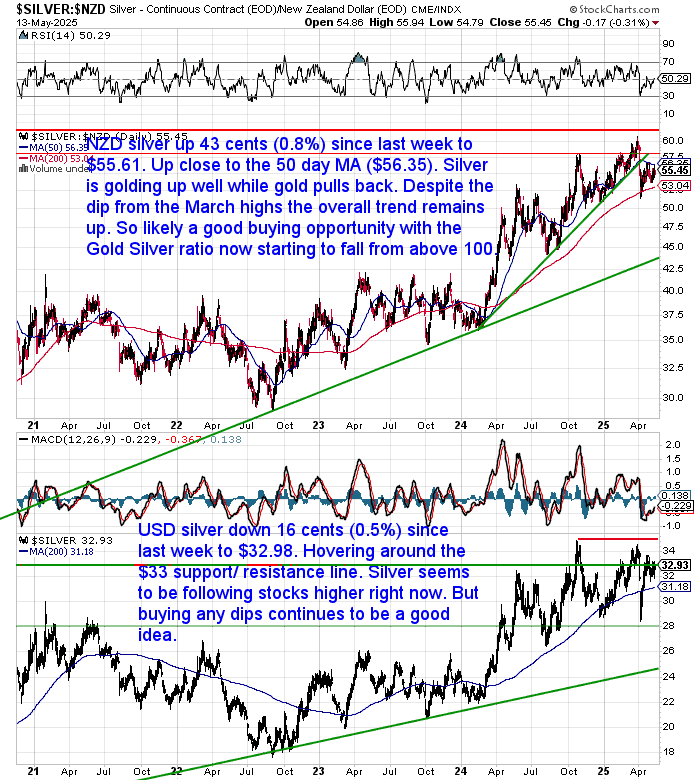

Silver held up far better. NZD silver rose 0.8%, while USD silver dipped just 0.5%, continuing to show strength relative to gold. With the gold–silver ratio still falling from 100, silver looks increasingly attractive on a relative basis.

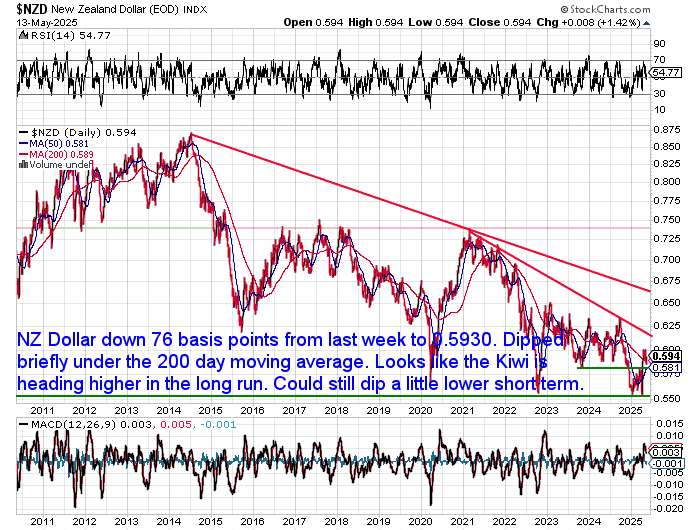

The NZ dollar dropped 76 basis points to 0.5930, briefly under its 200-day moving average before rebounding. The longer-term outlook remains positive — even if short-term volatility continues.

Trade Truce Signed. Gold Dips. Bigger Questions Remain

📉 Last week, markets rallied on rumours of a US–China deal.

This week, the deal is done. Tariffs slashed. Optimism everywhere.

But not everyone’s celebrating.

Ray Dalio says we’re now past the ideal time to prepare for what’s coming — and gold investors may want to zoom out before worrying too much about short-term dips.

We unpack it all in this week’s featured article: the deal, the reaction, and why the reset still isn’t over.

👉 Read the full breakdown here

Advisor Confusion on Gold: Most Still Don’t Get It

Gold hit all-time highs recently — but according to a new survey, most financial advisors still haven’t changed their view.

- 🟡 42% said their view on gold “hasn’t changed”

- ✅ Only 17% are increasing allocations

- ❌ 13% are actively decreasing exposure

- 🛑 Some even called gold “stupid” and “not an investment”

Source: Financial Planning

James Anderson of SD Bullion put it bluntly:

“Most adult financial experts are gold illiterate… They either self-educate or sound like clowns when commenting on the market.”

Meanwhile, central banks keep buying (China has announced it’s 6th consecutive month of adding Gold. Their total is now around a Quarter Trillion USD worth of Gold.) — and gold keeps trending up.

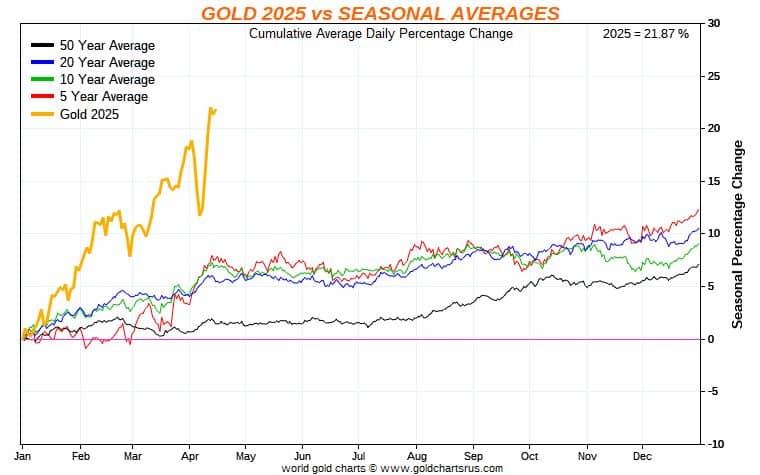

We’ll let the chart speak for itself:

While Wall Street debates if gold is ‘still relevant,’ it’s quietly outperforming every seasonal average on the board…

NZ’s Depositor Compensation Scheme Starts Soon — But Mind the Gaps

On July 1, the government rolls out its new Depositor Compensation Scheme (DCS) — promising to cover up to $100,000 per depositor, per institution.

For many it’s a welcome step. But as we’ve outlined before, there is some fine print.

Here’s what many don’t realise:

- ❓ KiwiSaver deposits are not covered.

The Reserve Bank has now confirmed that managed funds, including KiwiSaver, fall outside the scheme.

📎 Source: rbnz.govt.nz/dcs - 🏦 The DCS doesn’t eliminate the Open Bank Resolution (OBR) — which still allows for large depositors to take losses in a crisis.

- ⚠️ As we explored in our full breakdown:

Government guarantees can create a false sense of security, while doing little to address systemic risk.

📖 Read: Does NZ Really Have Deposit Insurance?

🛡️ True diversification means holding assets outside the financial system — like physical gold and silver.

📞 Talk to us today or learn more about how to buy gold and silver during these pullbacks.