This Week:

- NZ interest rates more likely to fall?

- US Interest rates also not going up anytime soon

- Even more on China, Gold and the SDR

- Are you ready for the big global monetary reset?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1588.45 | + $32.95 | + 2.11% |

| USD Gold | $1205.00 | + $17.06 | + 1.43% |

| NZD Silver | $21.88 | + $1.14 | + 5.49% |

| USD Silver | $16.60 | + $0.76 | + 4.79% |

| NZD/USD | 0.7586 | – 0.0051 | – 0.66% |

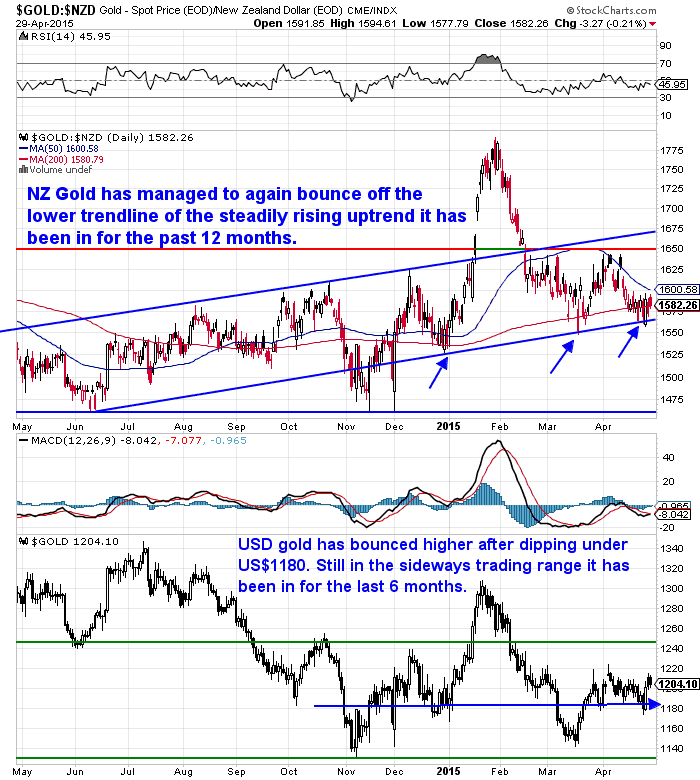

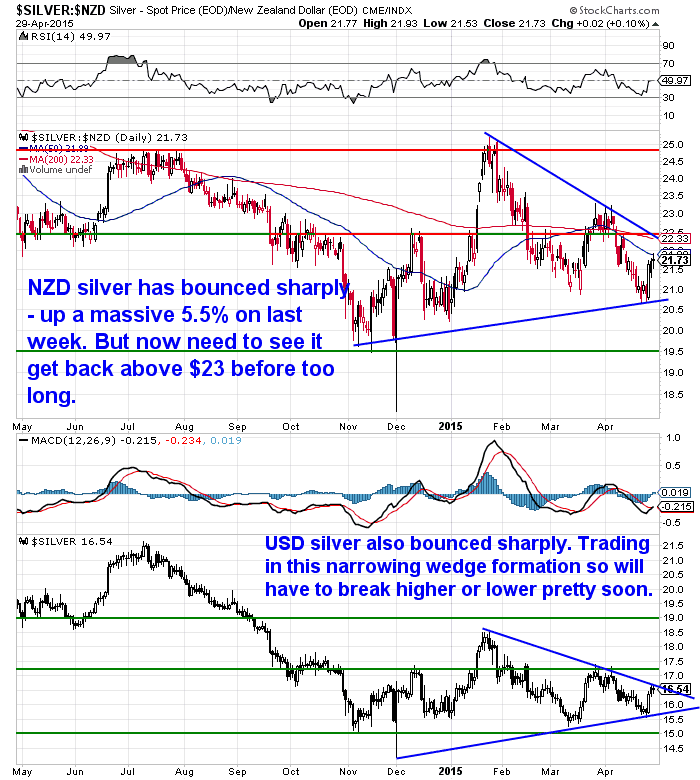

It has been quite a volatile week for both gold and silver. With prices getting low last week it was tempting to think they could both break down further. However just the opposite has happened and we’ve seen significant rallies. Especially in silver with it up 5% from last week!

The local prices of both metals also got a boost today by the NZ dollar dropping sharply after the latest RBNZ statement holding the Overnight Cash Rate (OCR) at 3.5%. More on that shortly.

The NZ dollar gold chart shows that it looks to have bounced up off the rising trendline for the third time in recent months. With the Kiwi dollar possibly getting near the top of its range and dropping lower today this slow but steady uptrend may well continue.

But as already noted silver has been the star performer this week. With a massive rise over the past few days. You can see in the chart below that silver (especially in US dollars) is trading within this narrowing wedge formation.

So what?

Well, this means it has to break out of this pretty soon as it is running out of room. So we could see even sharper changes in price before long.

As ever it’s just a question of in which direction?

NZ interest rates more likely to fall?

As mentioned already the RBNZ held the OCR yet again at 3.5%.

However the statement from the RBNZ head certainly has shifted away from thoughts of a rate hike, stating:

Going even further now and saying:

This sent the kiwi dollar down a cent in a hurry.

In an ASB economic note just out they really have changed their tune from only months ago. From being all but certain of rate rises to now stating:

Our punt, as you might recall, has been that there is more likelihood of rates globally going down rather than up in the near term.

Interestingly the ASB perspective seems to be that New Zealand will continue steadily chugging along and that the low inflation rates, which are the result of NZ “effectively importing the price impacts of weak demand in developed economies”, are the main worry.

But that the RBNZ has room to cut further and bring inflation back up yet if required.

However these mainstream economists have consistently expected growth worldwide to be picking up. However news from the likes of Europe continues to be just the opposite and even China’s likely very doctored numbers show growth there is slowing too.

So NZ may well continue to “import” this low inflation for a bit yet. But if many countries globally continue to struggle it will also have an impact on how much they buy from us.

Our guess is the world will stay in the sludge for a while yet. But at some point a nasty surprise comes its way.

US Interest rates also not going up anytime soon

The US central planners also had a statement out today. It was the usual indecipherable nonsense. (To give some credit to our central bankers at least their statements don’t require you to read each paragraph 10 times to work out what they mean!) But we guess that is the point of them. After all Central Banking is a “very complex business” or so we are all supposed to think.

Interestingly gold dropped sharply with the Fed statement. Who knows why but there didn’t seem to be much in it to be negative for gold.

The mainstream media consensus seems to be that the Fed won’t raise rates until September now. Those goal posts seem to be constantly being shifted further and further down the field!

We read an interesting piece last week that clearly shows how the expectations of a rate rise diminish the closer you get to the date in question. This is using actual data from the “Feds Funds Futures Market”, where traders can bet on when the Fed will raise rates.

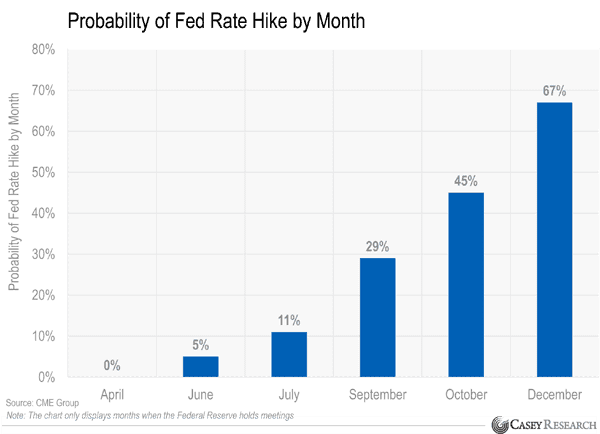

“Current fed funds futures prices imply the following probabilities of a rate hike:

There won’t be a rate hike at the April meeting. Probably not in June, July, or September either. October is a coin toss.

For now, the market thinks the long-awaited hiking will begin in December.

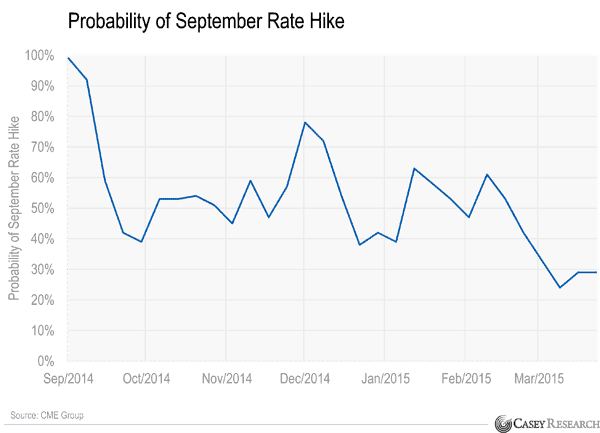

Now here’s where this gets really interesting. We can chart these probabilities over time to study how expectations have changed.

In September 2014, the fed funds futures market was convinced that the Fed would raise rates by September 2015.

Convinced!

Back then, fed funds futures prices indicated a 99% probability that the Fed would hike rates in September 2015.

Today, that probability is just 29%.

This has become a reliable pattern. The market tends to believe the Fed’s jawboning as long as the date in question is still a ways off.

But as the date draws near, the market gets skeptical. For good reason. The Fed talks a big game about raising rates. But every time the moment of truth approaches, it chickens out.

The Fed wants us to think it might raise rates at any time, to discourage speculation in US stocks and bonds. But it’s not actually going to raise rates anytime soon.

Glance up to the first chart again. See the “67%” that implies the Fed will finally hike in December? I bet that will decline to less than 50% by June, and less than 25% by October. The fed funds futures market will call malarkey on the Fed once again. And the first rate hike will be put off until 2016.

But the thing about 2016 is it’s an election year. Can’t risk upsetting the apple cart for Hillary.

So first rate hike in 2017, I guess.

Most of the financial media, by the way, are still predicting a June or September hike. That’s why you shouldn’t listen to them. Instead, listen to people with skin in the game, like the traders who comprise the fed funds futures market.

And ignore anyone who talks about investing but doesn’t actually, you know, invest.”

That seems like good advice to us. Best not pay any attention to the mainstream financial reporters.

Even More on China, Gold and the SDR

Since we wrote on this topic 4 weeks ago there have been more and more articles popping up that we’ve seen.

[Note: If you need a bit of “back story” check out these previous newsletters of ours:Announcements Due: China Gold Reserves and SDR Inclusion

Gold-Backed SDR “Is Quite Likely To Happen”

Why are the IMF & Jamie Dimon warning of the next crisis]

But in a nutshell we are talking about a pending change in to the global monetary system. With a rebalancing of currencies and quite likely of gold coming up.

Alasdair Macleod of GoldMoney has also weighed in, looking at the likelihood of gold being included in the upcoming restructuring of the International Monetary Funds Special Drawing Rights (SDR).

He also notes that if gold doesn’t break into the SDR along with China’s currency, the monetary metal might be incorporated into a similar international currency created by the New Development Bank, an institution being established by developing countries.

We’ve also seen a few more reports of the meeting conducted by The Official Monetary and Financial Institutions Forum (OMFIF), that took place during the International Monetary Fund and World Bank Group spring meeting in Washington.

Intriguingly titled “Gold, the Renminbi, and the Multicurrency Reserve System.”

Filip Kanja from Birch Gold Group wrote “If there’s any indication of how critical this meeting was, the European Central Bank (ECB) actually moved their scheduled meeting on monetary policy from Thursday to Wednesday just so they could be in attendance. You’d think that should be enough to get a few mainstream reporters asking questions.

“Yet the mainstream media completely missed the story.”

Indeed. Despite trawling through Google we haven’t seen any reports on the meeting, apart from alternative news sites and gold sites in the lead up to it.

Jim Rickards on Laissez Faire Today gives a solid take on the significance of it though.

And what the financial elite have in store for us…

Are you ready for the big global monetary reset?

“Since Federal Reserve resources were barely able to prevent complete collapse in 2008,” Rickards writes in his New York Times best-seller, The Death of Money, “it should be expected that an even larger collapse will overwhelm the Fed’s balance sheet.”

Everyone knows that the powers-that-be never allow a good crisis go to waste. That’s why, when the next bust takes place — without missing a beat — the global currency will slide in like a cool Tom Cruise in Risky Business. Rickards goes on:

“The specter of the sovereign debt crisis suggests the urgency for new liquidity sources, bigger than those that central banks can provide, the next time a liquidity crisis strikes.

The logic leads quickly from one world to one bank to one currency for the planet…”

“To ensure the plan works out, all the IMF has to do is stand in the right place with its glove out when the dollar starts to crash.

“The task of re-liquefying the world,” Jim Rickards goes on, “will fall to the IMF because the IMF will have the only clean balance sheet left among official institutions. The IMF will rise to the occasion with a towering issuance of SDRs, and this monetary operation will effectively end the dollar’s role as the leading reserve currency…”

And here’s how the SDR “works,” as explained by Jim: “Any inflation caused by massive SDR issuance would not be immediately apparent to citizens. The inflation would show up eventually in dollars, yen and euros at the gas pump or the grocery, but national central banks could deny responsibility with ease and point a finger at the IMF.”

But, as one design upgrade, the IMF may back the SDR, fractionally, with gold…

“Since the SDR already exists,” Rickards says, “it is a perfectly suitable candidate for new global money. But this new SDR would be gold backed and freely convertible into gold or the local currency of any participant in the system. It would not be the paper SDR that exists today.

“In order to participate in the new gold SDR system, a member nation would have to have an open capital account, meaning that its currency would have to be freely convertible into SDRs, gold, or currencies of the other participating members.”

However in order for the SDR to be widely implemented a couple of things would need to happen.

- China would need speed up the Yuan’s convertibility. That is make it freely tradable with other currencies

- China would need a much larger pile of gold

So the argument is that it is in both the US and China’s best interests to keep the gold price low until this rebalancing is complete. He guesses that could be in 2015.

What does a gold-backed SDR mean for the price of gold? Back to Jim Rickards:

“Dividing the money supply by the gold supply gives an implied, nondeflationary price for gold, under a gold-backed SDR standard,” Rickards calculates, “of approximately $9,000 per ounce.

“The inputs in this calculation are debatable, but $9,000 per ounce is a good first approximation of the nondeflationary price of gold in a global gold-backed SDR standard. Of course, nothing moves in isolation. The world of $9,000-per-ounce gold is also the world of $600-per-barrel oil, $120-per-ounce silver, and million-dollar starter homes in mid-America. This new gold standard would not cause inflation, but it would be a candid recognition of the inflation that has already occurred in paper money since 1971.

“This one-time price jump,” Rickards goes on, “would be society’s reckoning with the distortions caused by the abuse of fiat currencies in the past forty years. Participating nations would need legislation to nominally adjust fixed-income payments to the neediest in forms such as pensions, annuities, social welfare, and savings accounts up to the insured level.

“Nominal values of debt would be left unchanged, instantaneously solving the global-sovereign-debt-and-

But in the meantime, says Rickards, the central banks are “out there making the San Andreas Fault bigger so we can have even bigger earthquakes in the future.

“That’s exactly what’s going on.”

It’s all a question of what will happen first. An uncontrollable collapse of the monetary system, or a new world currency backed, in part, by gold. Or both. Those appear to be our options. Jim doesn’t recommend you stand by and hope that the global currency will “fix” what ails us.

“I would say two things about the monetary collapse,” says Jim. “It could happen very suddenly — and likely it will — and we won’t see it coming, so investors need to prepare now.

“Investors almost say to me, ‘You know, Jim, call me up at 3:30 the day before it happens and I’ll sell my stocks and buy some gold.’

“First of all, it doesn’t work that way… you might not be able to get the gold and that’s very important to understand. When a buying panic breaks out, you know, and the price starts gapping up, not $10.00, $20.00 an ounce per day, but $100.00 an ounce then $200.00 an ounce and then all of sudden, it’s like up $1,000.00 an ounce and people say oh, I got to get some gold. You won’t be able to get it. The big guys will get it, you know, the sovereign wealth funds, the central banks, the billionaires, the multibillion-dollar hedge funds, they’ll be able to get it, but everyday investors won’t be able to get it.

“You’ll find that the mint stops shipping it. That your local dealer has run out so there’ll still be a price somewhere. You’ll be able to watch the price on television, but you won’t actually be able to get the gold. It’ll be too late.”

If you want to get in before this happens, we’re happy to help. Get in touch if you have any questions or if you’d like a sample quote.Free delivery anywhere in New Zealand and Australia

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|