This Week:

- Bond Market Warning

- The Simple Reason To Expect A Gold Price Upturn Very Soon

- Be Careful Out There

- Indeed the world is awash with debt

- London house prices have nothing on Auckland

- Bank Economists Now Expect NZ Interest Rate Will Drop to 2%

|

LIMITED QUANTITY GOLD SPECIALS GOLD KIWI 1 oz COIN

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Mint. Through us: Packaged Gold Kiwis: (Approx $1709) (30 in Stock) ***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars In Green Packaging Approx $1727 (7 green in stock; black sold out) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1630.73 | – $30.41 | – 1.83% |

| USD Gold | $1070.90 | – $0.20 | – 0.18% |

| NZD Silver | $21.64 | – $0.41 | – 1.85% |

| USD Silver | $14.21 | – $0.01 | – 0.07% |

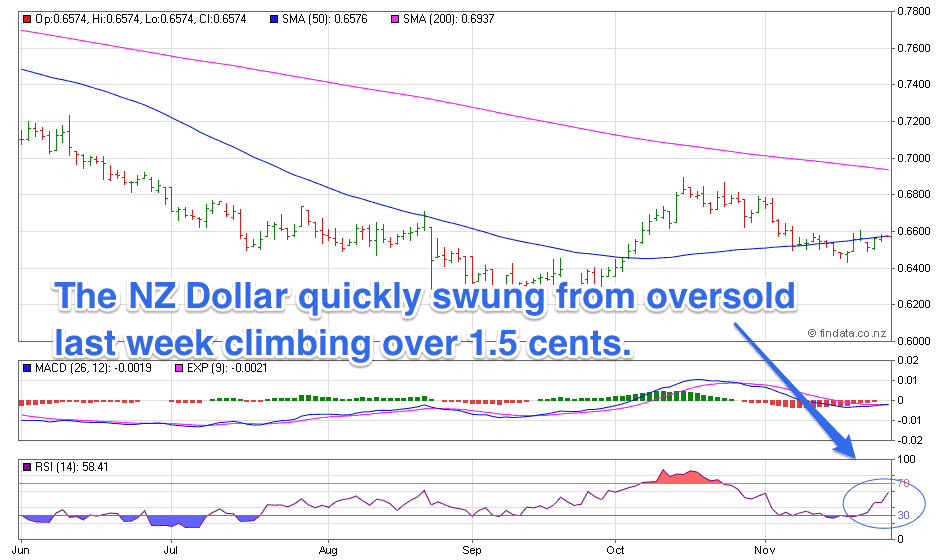

| NZD/USD | 0.6567 | + 0.0119 | + 1.84% |

The rising NZ dollar has been the only thing affecting local precious metals prices this week.

As you can see in the table above the Kiwi is up 1.84% against the US Dollar, which is almost the same percentage that gold and silver in NZ dollars are down this week.

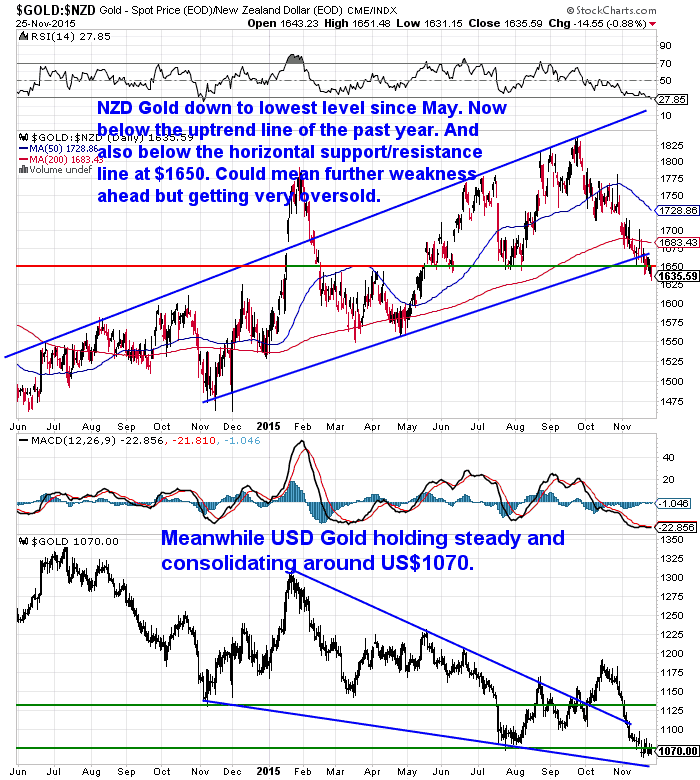

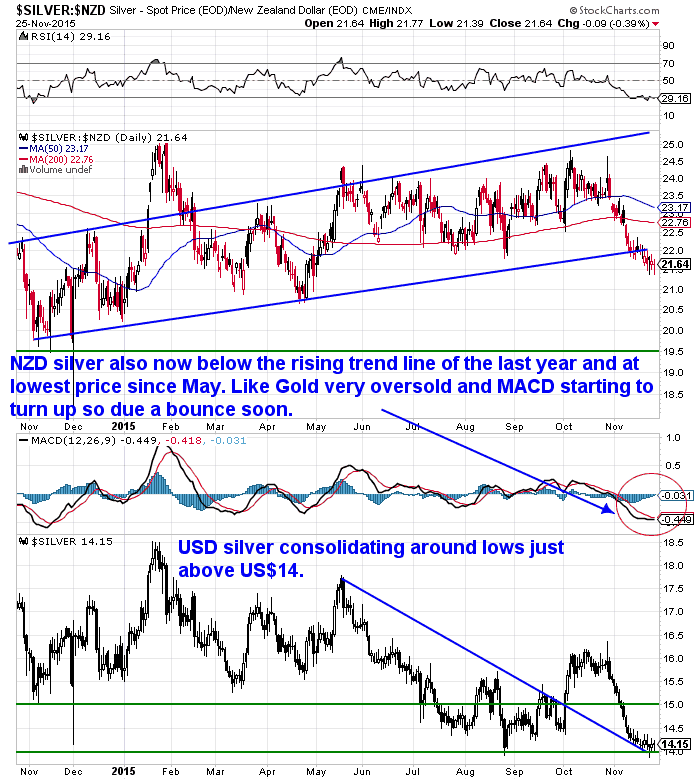

The lower half of the 2 charts below show that in US dollars the metals have been consolidating all week. Virtually unchanged from a week ago.

However the stronger Kiwi has pushed both metals to the lowest prices in NZ dollar terms that they have been since May of this year.

They have both fallen below the lower trendline. At a glance this might make it seem like lower prices are due now. However with both metals so oversold (below 30 on the RSI indicator – see the top of both charts), and the MACD indicators finally looking like turning up a decent bounce from here is to be expected.

On top of this Jason Goepfert at SentimenTrader reports that sentiment towards gold has moved to “one of the most historically excessive pessimistic sentiment setups in the past 25 years.” Also he notes that commercial hedgers (the smart money in gold futures who are actual users, producers, dealers in gold) have built their most bullish positions in some time in gold.

While it is just the opposite with the speculators. Where the latest data on speculative betting in Comex futures and options says more traders were bearish on gold last week than bullish. Something now seen only 3 times since 2001.

So the odds favour a sharp rise in gold pretty soon with these set ups.

The Simple Reason To Expect A Gold Price Upturn Very Soon

We saw another article this week – by Peter Cooper – out of Dubai – that outlined a number of reasons why we should “Expect a Gold Price Upturn Very Soon”. With sentiment so bad you might find that hard to believe!

“Since the lows of August, the gold price and gold shares have started to outperform the S&P500 index, despite the exit of capital from gold exchange-traded products.

You can see this from two perspectives. First, there is a slow-motion train wreck in progress in the US stock market. Second, there is a rotation into gold and gold stocks, although that theory was challenged by price movements last week (or perhaps confirmed by an obvious double bottom).

Cooper discusses the upcoming Wall Street crash/correction; higher interest rates slated for December; the canary-in-a-coal mine message of the widening gap between junk and sovereign bonds; an imminent Minsky moment (a sudden collapse of asset values that is part of the credit cycle, resulting from long periods of prosperity and increasing value of investments leading to increasing speculation using borrowed money); and the folly of a buy-and-hold strategy as it currently relates to the stock market.”

Bank Economists Now Expect NZ Interest Rate Will Drop to 2%

We’ve seem both Westpac and ASB pick that the RBNZ will cut the current Official Cash Rate (OCR) from 2.75% to 2% next year.

ASB this week said:

“We now expect the RBNZ to cut the OCR to 2% in 2016 due to persistently weak inflation pressures.

In addition to our long-held call for a December cut, we have pencilled in two cuts for June and August 2016.

We expect unemployment to rise and for the fall in the NZD to be less inflationary than the RBNZ expects.

We have changed our OCR view. We now expect the RBNZ will cut the OCR three more times: at the upcoming December MPS, then again in June and August 2016, bringing the OCR to a low of 2%. For some time we have had substantially weaker inflation forecasts than the RBNZ. The downside risks to inflation have been growing consistently. We have been warning of the growing risk that the RBNZ will have to cut further in 2016.

It’s important to note, low inflation is a global problem. The RBNZ’s dilemma is not unique – everywhere central banks have been forced to cut rates to unprecedented levels. And to be stingy with rate cuts when inflation is still barely positive is a risky strategy. We don’t think the RBNZ will tolerate that risk and hence we now believe a 2% cash rate is now the most likely outcome.

Compared to the RBNZ, we have a different view of the world – and in particular our forecasts of inflation. We expect the unemployment to rise over the next 18 months. This will keep wage inflation, and in turn, domestic inflation pressures subdued. But most importantly, we do not expect the fall in the NZD to be as inflationary as the RBNZ expects. We expect some pick up in inflation, but it will be much more limited than the RBNZ expects and it will only be transitory.

In our opinion, a rate cut in the December MPS is now a done deal. The RBNZ had already factored in one further cut. The ongoing strength in the NZD and the recent weakness in dairy prices (we have revised our Fonterra milk price forecast lower – read more here) are likely to be sufficient to convince the RBNZ to watch and wait no longer. Furthermore, the December MPS is a good opportunity for the RBNZ to foreshadow the risk of further cuts next year.”

So the consensus is for even lower interest rates here in NZ. The bank economists are usually late to the party. We expect they’ll be late again when the tide turns and inflation surprises everyone some way down the track.

Because as was pointed out somewhere this week by someone we can’t remember, monetary inflation is not linear. The effects can take some time to appear in everyday life.

As for whether the US Federal reserve will hike interest rates next month. We’d go along with this conclusion from the daily bell as being the most likely path for the US fed to take:

Source.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

London house prices have nothing on Auckland

Global news agency Bloomberg is reporting that ‘London house prices have nothing on Auckland’ after a two-bedroom home on Devonport’s Kerr St sold for just over $1 million when it went to auction in September.

Bloomberg states that:

They also quote a recent 1st NZ Capital report which said:

The article finishes up with an opinion from economist Shamubeel Eaqub.

“This boom that we’ve had has been huge, it’s just been extraordinary in terms of the scale of the price increases,” said Shamubeel Eaqub, an independent economist in Auckland, who co-authored Generation Rent, a book on the decline of home ownership in New Zealand. “For a young couple to buy a modest home in Auckland, it’s 60 percent of their income on mortgage payments. We’re going to run out of fools to buy houses — it can only be the landed gentry.”Source.

A Landlords article headed “Market faces sharp correction risk” also discusses the 1st NZ Capital report. You could argue that it’s in 1st NZ Capital’s interest to get people out of property and into shares – their business afterall. However the report makes some good points about past cycles and corrections that followed. They estimate that house prices are over-valued by 30% to 40%.

This comes as the same time that Trade Me Property rental data reveals that New Zealand’s rental market is slowing down with the national median rent staying at $360 for the third month in a row.

There are of course plenty (maybe the majority?) who believe that because something happened in the past it will continue to always be so…

“…NZ Property Institute chief executive Ashley Church doesn’t believe a sharp market correction, particularly in Auckland, is likely.

He said that, historically, the Auckland market flattens rather than corrects – as was the case following the global financial crisis in 2007-08.

“So price growth is likely to simply ease off and flatten for a few years and then it will lift again when the next boom starts.”

While the factors that drive and end property booms and downturns are always different, Church said.

“In my view, it would take a massive downturn in the world economy for Auckland’s housing market to suffer a sharp correction.”

Church also pointed to a recent article by BNZ chief economist Tony Alexander which suggested it would take an apocalyptic situation for the Auckland housing market to correct in a way that would threaten New Zealand’s economy.”

The number of cranes on Auckland’s skyline is also perhaps an indicator that we are getting closer to the end of the current cycle.

See: Liam Dann: Counting cranes with the kids

While we don’t profess to know where exactly the Auckland and New Zealand property market is heading, it seems to us that the odds of “a massive downturn in the world economy” or an “apocalyptic situation” aren’t exactly infinitesimal. Those maxed out on debt would do well to consider this. Even ultra low interest rates can’t eliminate the fact that there is a limit on how much debt can be supported by the same level of cashflow.

Plus there is plenty going on in the world that leads us to still believe that 2008/09 wasn’t the last of the financial problems the world will face.

Be Careful Out There

In John Mauldin’s “Outside the Box” the guest writer this week was Michael Lewitt, author of The Credit Strategist.

He gets right to the point on why you should “be careful out there”. Here’s the opening paragraph:

The fact that “The high yield credit markets are sending distress signals” is actually the topic of this article posted on the website this week. It looks at what is going on in the high yield (a.k.a. Junk) bond market. Something we’ve been reading a bit about lately and so thought worth sharing.

The fact that “The high yield credit markets are sending distress signals” is actually the topic of this article posted on the website this week. It looks at what is going on in the high yield (a.k.a. Junk) bond market. Something we’ve been reading a bit about lately and so thought worth sharing.

Why Isn’t This Incredibly Bearish Development Making the News?

Indeed the world is awash with debt

The “Godfather” of the Investment Newsletter business Richard Russell passed away this week.

The excerpt above from Michael Lewitt where he states “The world is drowning in more than $200 trillion of debt that can never be repaid”, ties in well with a common quote of Russell’s on this gargantuan debt build up:

Sadly Richard Russell didn’t get to see the greatest bull market in gold ever seen. Well maybe just the first half of it. Our guess is the second and likely much more significant half of it remains ahead of us. Perhaps not too far ahead now either.

Free delivery anywhere in New Zealand

Premiums have edged slightly higher this week on Silver Maples, but prices are still pretty low. We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,770 and delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

[GREAT XMAS GIFT] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit. Excellent for camping and tramping too.

Plus, it’s waterproof so you can use it in the water.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|