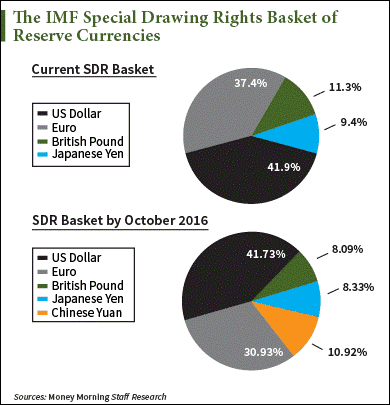

One of the worst kept secrets in global finance was confirmed on Tuesday when the IMF gave notice that it was to add the Chinese Renminbi to the basket of currencies that make up the IMF’s Special Drawing Rights (SDR). This will take place in October 2016.

“Under the new formula, the respective weights of the SDR currencies are: 41.73% for the U.S. dollar; 30.93% for euro; 10.92% for the Chinese renminbi; 8.33% for the Japanese yen; and 8.09% for the pound sterling. This basket of currencies will take effect on October 1, 2016.”

So all the existing currencies percentages have been reduced. The Euro has tumbled from 37.4% down to 30.93%. While Pound Sterling has dropped from 11.3% to 8.09%. Japanese Yen from 9.4% to 8.33%. Interestingly the US Dollar has only dropped from 41.90% to 41.73%. So a very tiny drop in comparison to the other 4 current currencies.

Does this mean the end of the dollar? Or does the fact it has been reduced such a small amount have significance?

The move was hailed by the New York Times as:

“…a milestone decision by the International Monetary Fund that underscores the country’s rising financial and economic heft.

The move will help pave the way for broader use of the renminbi in trade and finance, securing China’s standing as a global economic power. “

The Telegraph said:

“While being a part of the club carries no particular conditions, and is largely symbolic, the yuan will contribute to the value of the special drawing right – a weighted average of the currencies – which the IMF uses to price its emergency loans.

More significant is the diplomatic legitimacy that inclusion grants the yuan, whose value is carefully managed by Chinese authorities. Officials devalued it over the summer in a shock move to respond to slowing growth, but it is still seen as tightly controlled with the country’s central bank lacking transparency.

Being included in the IMF basket will draw additional scrutiny and see officials encouraged to open up the currency at the same time that China faces economic slowdown, which could put the brakes on reform.”

Remember that statement that the IMF uses the SDR “to price its emergency loans” as that has significance and we’ll come back to that later.

If you’ve been reading us for a while we take the view that the “death of the dollar has been greatly exaggerated”.

We think that while the US Dollar is undoubtedly on a downward spiral, it is more likely to be the last currency to fall.

However this process can take a long time to play out. Just as the Pound Sterling did not disappear but slowly lost ground as the global reserve currency back in the early 20th century, the US dollar will likely do the same.

Back then it was the US dollar taking over from a Great Britain whose empire had stretched too far.

The US Dollar’s role as the “young upstart” this time round, is being taken by the Chinese Renminbi.

But also just because the Chinese may be on the rise doesn’t mean there can’t be various stumbles along the way. Just as the US suffered from the Great Depression early in its transition to number one.

So what is the significance of this move other than gaining “broader use of the renminbi in trade and finance,” and “securing China’s standing as a global economic power”?

Here’s a summary of a few opinions we’ve read in the past few days:

Steve Suggerrud from DailyWealth:

“So what does this mean? In short, it’s a vote of confidence in China’s drastic reforms by the world’s major powers.

This move is largely symbolic (as none of us actually use the IMF’s currency). What it means is far more important in the long run… It means that China’s currency “passes the test.” China’s currency is finally considered to be as legit as the other four, in the eyes of the world’s superpowers.

Most folks are blowing off the significance of this. I think that’s a mistake…

After today, hundreds of billions of dollars will likely flow into China’s currency in the coming years, and from a variety of sources… As a reserve currency for central banks… as a way for investors to diversify outside of the U.S. dollar… as a speculation… as a medium of exchange in global trade… etc., etc.”

Matt Badiali in Growth Stock Wire said:

“…the U.S. is facing an enormous $59 trillion debt problem. The only way for the U.S. government to pay its incredible debt is to print more and more dollars… and debase an already devalued currency. (Every time the Fed prints a new dollar, the value of every dollar in circulation declines just a little bit.) This doesn’t make the dollar all that appealing to investors.

But soon, investors will have a new, more appealing reserve currency to invest in. China is the world’s second-largest economy. In a few years it could be the world’s largest economy. And China has a huge hoard of gold. From January to September, the country added around 1,171 metric tons of gold to its hoard. That’s more than the Swiss government has in its vaults. And in October, China bought another 14 metric tons of gold. China has spent about $70 million buying gold over the past two years.

While it’s probably impossible for China to have a completely “gold-backed” currency, this gold allows the yuan to offer a guarantee more substantial than the dollar, which is only backed by the “full faith and credit of the U.S. government.”

That’s why investors are soon likely to diversify out of the dollar and into the yuan.

So how do you protect yourself from a decline in the U.S. dollar? Follow China’s lead and buy gold…

…I recommend safeguarding your own wealth against the dollar by buying and holding gold bullion.”

Greg Canavan from the Daily Reckoning shared some excerpts from Jim Rickards:

“As Jim Rickards writes in the latest issue of Strategic Intelligence:

‘The list of prominent international monetary elites calling for greater use of SDRs as world money keeps growing. It is critical for investors to understand this new world money. The SDR has the power to reduce the dollar to the status of a local currency no different than the Mexican peso. Investors who understand SDRs can avoid losses from inaction, and profit from new investments that will be created by their use.’

With Jim’s help, let’s try and gain a greater understanding of the SDR…

…Not surprisingly, the IMF’s agreement to include the yuan is a political one. Back in August, the IMF said that it would take more time for the yuan to join the SDR club. The fact that the yuan was not freely tradable was a major drawback…

…Why the need to see the yuan join the SDR league? If the currency has problems, why let it in?

I hope Jim’s subscribers will forgive me for publishing the following. But I think this knowledge is extremely important for everyone to understand. These events are sometimes so abstract that the layperson misses their significance.

Don’t let the significance of this event pass you by. Over to Jim…

‘Why the political urgency to include the yuan in the SDR if China does not meet the usual requirements? The answer is that the a new global financial panic comes closer by the day. These panics happen every seven to eight years almost like clockwork. Look at the financial panics in Mexico (1994), Russia-LTCM (1998), Lehman- AIG (2008), and you get the idea. Another panic in 2018, if not sooner, is a near certainty.

‘The next panic will be bigger than the central banks’ ability to put out the re. The only source of bailout cash will be the SDR. But a massive issuance of SDRs will require cooperation by China.

‘This is not because of IMF voting (China’s vote is not that large). It’s because SDRs are only useful if they can be swapped for other reserve currencies to prop up banks, and liquidate panicked sellers of stocks. (The IMF runs a secret trading desk where these SDR swaps are conducted.) When your neighbours are in full panic mode, they won’t want SDRs from Citibank, they’ll want dollars.

‘Who will swap dollars for the SDRs printed by the IMF? The answer is China. The PBOC and SAFE would love to dump dollar assets in exchange for SDRs. But there’s a catch. China will only engage in SDR/Dollar swaps if the yuan is included in the SDR. China does not want to pay club dues unless it’s a member of the club.’

If I understand Jim’s thesis correctly, this is China trying to protect themselves from the massive hoard of US dollars they own as reserve assets. In market parlance, they are massively ‘long’ on the US dollar.

They want to use the next global crisis as a way to offload dollars without crashing their value. But after the dust has settled on the crisis, China’s actions will make it apparent to everyone that the greenback is no longer the undisputed currency king.

In the same way that the dollar challenged the British pound for global dominance after the First World War, so too will the SDR come to challenge the dollar.”

Okay, so some common themes amongst those comments mainly being that the Renminbi’s inclusion in the SDR is but another sign of the US dollar’s diminishing role in global finance.

However a significant comment we think is that of Jim Rickards saying:

“The next panic will be bigger than the central banks’ ability to put out the re. The only source of bailout cash will be the SDR. But a massive issuance of SDRs will require cooperation by China. “

Recall earlier the statement that the IMF uses the SDR “to price its emergency loans”. So effectively the SDR will be used not just to loan some money to a struggling developing nation, but effectively to “bail out” the entire world.

It would seem to us that taken one step further this would be the means to move us toward a global super currency such as the Bancor proposed decades ago by John Maynard Keynes.

This was a view we stated while discussing the pending SDR changes back in April:

“NIA makes the argument that China and Russia are working together to dethrone the USD as the worlds reserve currency. It certainly looks that way.

However another angle and one we favour is that this might all be a game on the surface.

If you’ve ever read the Creature from Jekyll Island you’ll know how the money masters have been behind just about every war in the past century or more. Often financing both sides, so they win whatever the result. Even some you’d not expect like playing both sides in the Russian Bolshevik Revolution.

So this other argument is that there is not a “war” between the USA and China/Russia. But rather they are all part of a steady movement to a global currency using the IMF’s Special Drawing Rights (SDR).”

(For more on how this move to a global currency would play out see: Are you ready for the big global monetary reset?)

The DailyBell alludes to this in a piece titled What’s Really Behind the IMF’s Elevation of the Yuan?

“Over the past decade, Brazil, India and China in particular have grown at a tremendous rate. One could argue that there is a tremendous “evening out” taking place that would make an eventual world currency (the dream of our banking elite) far easier to implement. It probably helps to have the yuan as part of the SDR basket as well.

As Europe and the US continually descend as economic and industrial powers, so the BRICS have risen. To see this “larger picture” is difficult, but we would suggest that it is no coincidence. When great powers have parity, economic integration is a good deal easier.

We do not see rivalry here as so many jingoistic pronouncements would have it. We see – behind the scenes – a common cause. More worrisomely, we have the nagging suspicion that a world of equals takes the next step toward globalization via an economic and investing catastrophe.

Conclusion:

In other words, a leveled-out global prosperity will eventually give way to an inevitable worldwide fiscal and monetary catastrophe that paves the way for a truly international economic system. Congratulations, China, and good luck …”

So the inclusion in the SDR is likely just another sign post along the way to the elites plan for a global currency and more centralised power.

Before we get too depressed about an increase in centralisation and bureaucracy there is a possible flip side. Simon Black at Sovereignman outlines how China is also in bad shape, so we may see a change in how the whole system operates:

“[China has] a looming debt problem, credit crisis, and a financial morass that could turn into a major depression.

So while the dollar may be in its twilight, the real change we’ll see is the financial system itself.

Today, unelected bureaucrats and central bankers conjure money out of thin air and manipulate asset prices in their sole discretion.

OK, maybe three centuries years ago when most of the world was illiterate and few people traveled more than ten miles from their homes, this might have been an understandable way to set up a financial system.

But today? Give me a break.

This system is so outdated that the head of the IMF might as well have gone to her press conference by horse and buggy.

All the technology already exists to make the overlords of our financial system totally irrelevant.

And what’s even more exciting is that they know it.

The Bank for International Settlements, which can be thought of as the central bank of central banks, released a report last week saying that cryptocurrencies and emerging financial technologies essentially make them an endangered species.

This system is changing.

Whether you like it or not, whether you realize it or not, and whether you’re prepared or not– it’s happening.

You can either have a front-row seat to enjoy the show and benefit from these developments, or you can choose to do nothing and become another victim of history.”

So we too hope for decentralisation of modern society including the monetary system and government. We also continue to believe that gold and silver will be the most likely beneficiaries of these changes regardless of the outcome. With gold and silver in NZD dollars at multi month lows now might be good time to check them out.

Related: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

Pingback: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand? - Gold Survival Guide

Pingback: Rickards: Gold Price Has Been Locked to SDRs and Global Monetary Reset is Under Way - Gold Survival Guide