Prices and Charts

Gold Steady

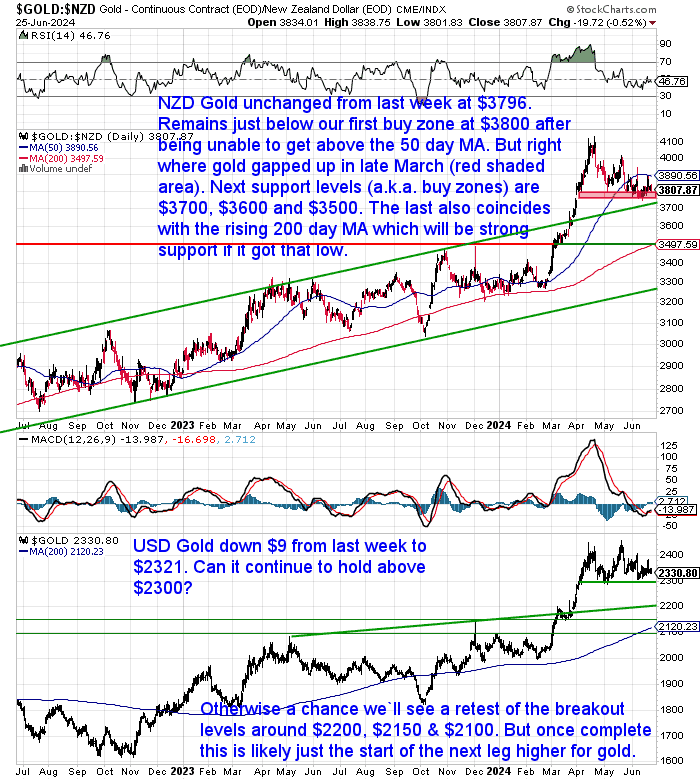

Gold in New Zealand dollars was unchanged from a week ago. Despite jumping up to the 50-day moving average (MA) it is back to where it was this time last week at $3796. It sits just below our first buy zone at $3800. There are decent odds it might dip a bit lower yet. The next levels to watch for are $3700, $3600 and $3500. $3500 also now coincides with the 200-day MA. So we’re likely to see strong support if it gets down to there.

While in USD dollars gold was down $9 from 7 days ago to $2321. So far it is holding above $2300. But there’s a chance we’ll see a return to the various breakout levels such as $2200, $2150, and $2100.

However, once this consolidation is over, this is likely just the start of a larger move higher for gold.

But Silver Down Close to 2%

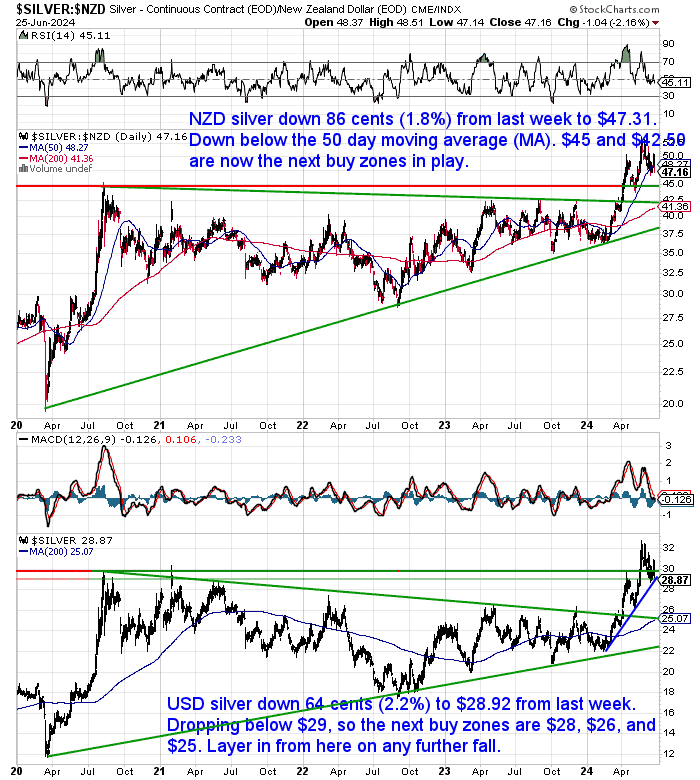

In contrast, NZD silver was down 1.8% to $47.31 over the past week. It has now dipped just below the 50-day MA. So $45 and $42.50 are the next buy zones that are now in play.

It’s a similar situation in USD silver. Down 64 cents (2.2%) to $28.92 from last week. It also dropped below the first support line at $29. Although now right on the short-term blue uptrend line. The next buy zones below that are $28, $26 and $25. It makes sense to layer in on any further dips that happen from here. In the medium term USD silver is likely heading to retest the all-time high at US$50.

NZ in Wedge Consolidation Pattern

The NZ dollar was down 24 basis points from last week to 0.6113. The Kiwi sits just below the downtrend line in this wedge consolidation pattern. As this gets more and more compressed, the Kiwi could do either way from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

Gold vs Paper: Why Does the Shiny Metal Outshine Mere Paper?

We all know gold is valuable, but why exactly is it worth more than a piece of paper? This week’s feature article dives into the historical and practical reasons behind gold’s enduring appeal.

The article explores:

- The unique properties of gold that make it a desirable and long-lasting form of wealth

- How historical factors have shaped the perception of gold as a store of value

- Why paper money, despite its convenience, lacks the intrinsic worth of gold

Intrigued by the age-old allure of gold and curious how it compares to modern forms of currency? This week’s feature article sheds light on the factors that have cemented gold’s place as a valuable asset throughout history.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Gold Survival Guide Q&A Call Recording: Analysing the Silver Breakout

In case you missed our recent Q&A call there is a recording available.

The theme was: “Analysing the silver breakout”.

We delved into various charts and looked at:

- Why this current breakout in silver is so significant

- What levels to look for as possible buying zones in the current consolidation or pullback

- Some potential price targets to look towards in the future

- Timing for these targets

- Plus we answered over 30 questions from our readers

Canada: An Indicator of What’s to Come For NZ Too?

Two weeks ago we reported how the Canadian central bank had cut interest rates (along with the ECB).

We highlighted some comments that they were likely wrong in their thinking that inflation was in the rearview mirror.

The latest numbers from Canada may show this is happening already. ASB today notes:

“In Canada, inflation printed at 0.6% mom (compared to expectations for a 0.3% rise), which pushed annual inflation higher to 2.9% [estimate was 2.6%]. The lift was driven by increases in the price of cars and recreational goods and services. The unexpected rise in annual inflation comes just after the Bank of Canada cut interest rates. Interest rate markets have pulled back expectations for a follow-up cut in July after the stronger than expected CPI print. Markets now see a 50% chance that the BoC goes again in July. There are almost two cuts in total priced for 2024.”

Peter Spina of GoldSeek thinks:

“Just as they start cutting rates, the next wave of inflation hitting Canada.

In the end, the Canadian peso will return to its intrinsic value. Backed by a strategic reserve of maple syrup and no gold.”

Source.

As we featured 2 weeks ago New Zealand also has no strategic gold reserves.

We’re yet to cut interest rates here, but when we do, will we see a similar outcome to Canada? With inflation soon bouncing higher? In the long run will the “Pacific Peso” also return to its intrinsic value as well?

Did the Saudis Just Kill the Dollar?

Following on from the “rumors” we mentioned 2 weeks ago about Saudi Arabia “ending” their agreement for the petrodollar. As suspected this is likely to be somewhat overblown. Although there will likely be less oil bought in US Dollars. Jim Rickards gives what seems a pretty reasonable summary of what is happening here: Did the Saudis Just Kill the Dollar?

As he concludes, the USA likely doesn’t need the Saudis to kill the dollar, as US policymakers are doing a pretty good job of it on their own.

Chinese Central Bank Paused in May But Rest of China Didn’t

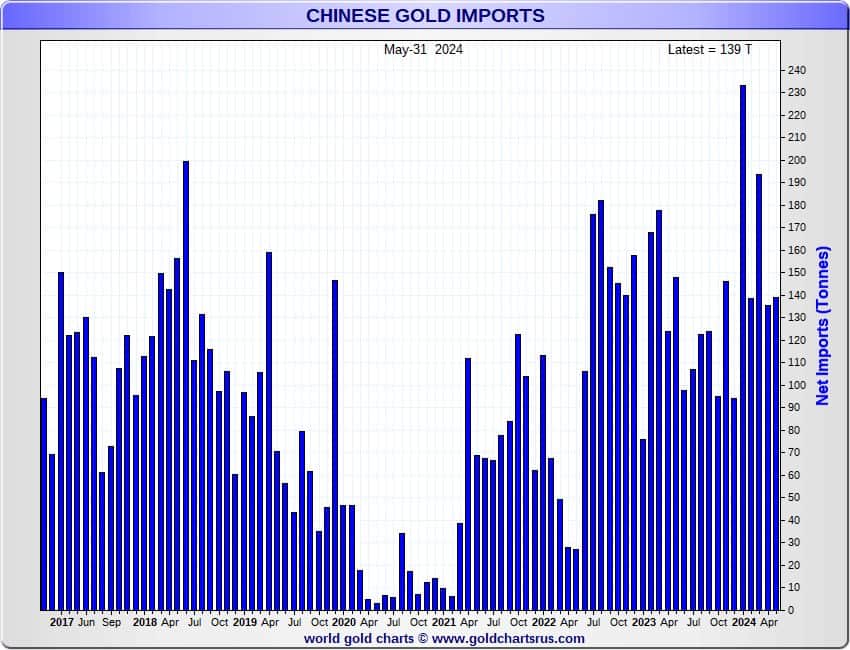

Earlier this month we reported that the Chinese central bank had paused their gold purchases in May.

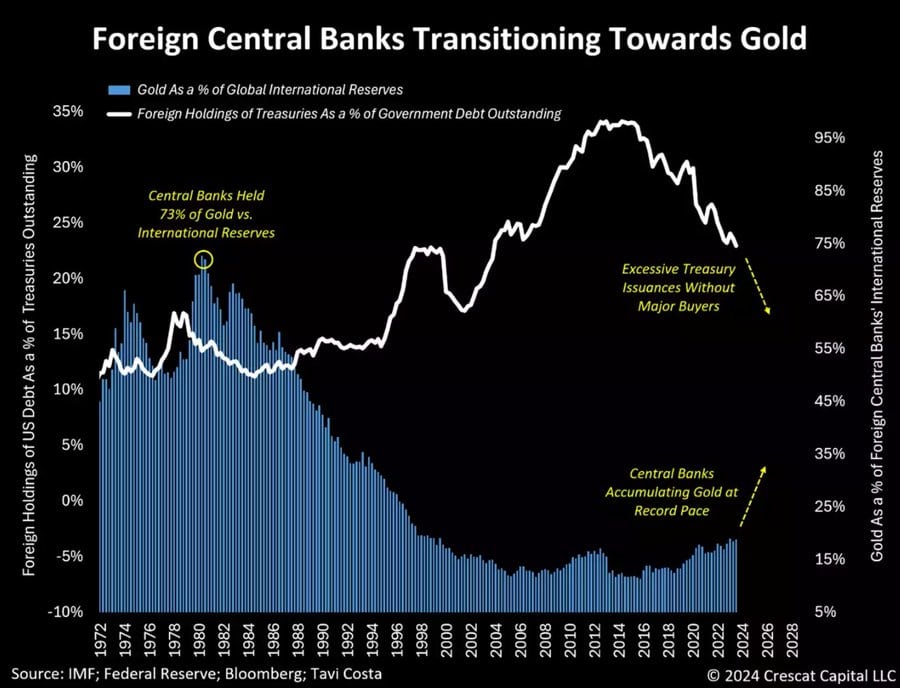

Tavi Costa thinks this one-month report means little:

“I love these Western media claims that the PBOC has stopped buying gold.

This is one of the most premature conclusions I’ve seen in a long time.

How can anyone confidently assert this based on a single report showing unchanged monthly holdings?

Moreover, China isn’t the only central bank eagerly buying gold.

The global trend of accumulating gold to enhance the quality of international reserves is undeniable.

As a reminder, in the 1980s, central banks allocated 74% of their balance sheet assets to gold.

Today, with allocations below 20%, this trend is likely just beginning.”

Source.

However, interestingly, despite the Chinese central bank reporting it purchased no gold in May, China overall still imported a significant 139 tonnes of gold last month. So overall demand there obviously remains robust.

Source.

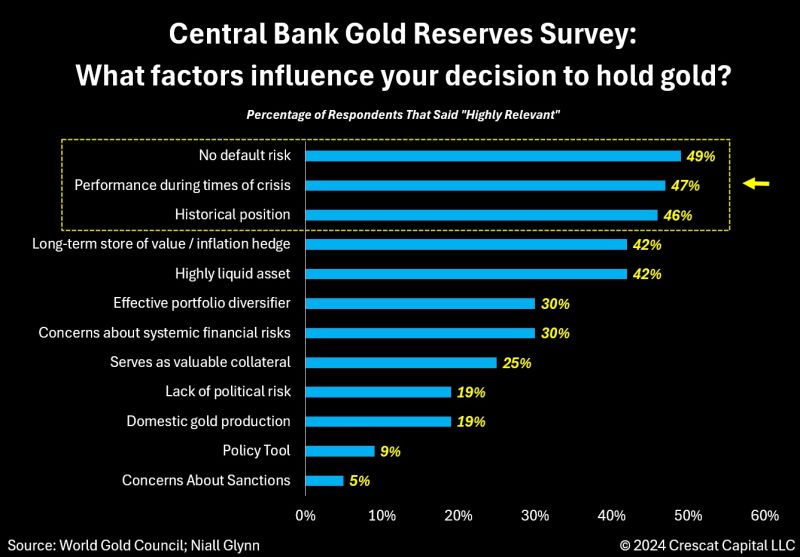

Central Bank Survey: 69% Say Gold’s Share of Reserves Higher in Five Years

Following our recent report on the OMFIF survey of 75 central bank reserve managers, the World Gold Council also just released a survey of a record-high 70 central banks.

“The survey shows that Central bank sentiment towards gold remains very high, with 29 per cent saying they will add more gold in the next 12 months and 81 per cent saying that official sector gold reserves overall will grow in the same period.

Optimism towards gold’s future role in global reserves continues to grow, with 69% saying that gold’s share of reserves will be higher in five years compared to 62% last year, the WGC survey said.”

Source.

Those numbers are significant. However, it’s also interesting to see their reasons for buying gold:

“Central banks were recently asked why they buy gold.

Their responses were not surprising but reassuring.

Almost 50% of respondents cited three main reasons:

No default risk.

Strong performance during crises.

Historical significance.

In reality, no other asset matches gold’s neutrality, resilience, and centuries-long role as a monetary alternative.

It’s remarkable that gold still has one of its lowest global allocations in history, especially during a time of significant debt and fiscal irresponsibility.

Markets and asset allocations follow long-term cycles, and today’s conditions present one of the best opportunities to invest in metals that I’ve ever seen.”

Source.

To us, 8 of these 12 responses also look like great reasons for the average person to be increasing their own gold reserves. How are yours looking?

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|