The Push for a Full Audit Could Reveal Shocking Truths About America’s Gold Reserves

For decades, the U.S. government has assured the public that Fort Knox holds 147.3 million ounces of gold—but has never provided a full, independent audit to prove it. Now, with Donald Trump and Elon Musk publicly calling for an investigation, the mystery of Fort Knox may finally be unraveled.

Could a full audit expose depleted reserves, lower-purity gold, or even missing bullion? If so, what would that mean for the U.S. dollar and global financial stability?

This article will dig into the controversy surrounding Fort Knox’s gold, why it still matters today, and what could happen if the truth is finally revealed.

Table of contents

- The Push for a Full Audit Could Reveal Shocking Truths About America’s Gold Reserves

- Fort Knox Gold Reserves: Why the U.S. Won’t Allow an Audit

- Is Gold Still Important? Why Central Banks Keep Buying Gold

- How Much Gold is in Fort Knox? Is the U.S. Hiding the Truth?

- What Happens If Fort Knox Has No Gold? The Global Economic Fallout

- Will Trump & Musk Force a Fort Knox Gold Audit? What Happens Next?

Estimated reading time: 8 minutes

Fort Knox Gold Reserves: Why the U.S. Won’t Allow an Audit

When Was the Last Time Fort Knox’s Gold Was Audited?

Despite US government claims, there has never been a proper gold audit process of Fort Knox’s gold reserves.

The last supposed “audit” in 1974 was little more than a public relations stunt. A group of journalists and politicians were given a brief, highly controlled tour, but no full accounting of the gold’s quantity, weight, or purity was conducted.Before that, the last significant inspection of federal gold holdings was in 1953, shortly after President Eisenhower took office. However, this was far from a full audit—only a fraction of the reserves were counted, and no independent verification was performed.

“There has never, ever, been a full audit and assay of the gold reserves at Ft. Knox.” – Chris Weber (Author of Good as Gold? How We Lost Our Gold Reserves and Destroyed the Dollar. This book was a key reference in writing this article. Highly recommended and available on Amazon.)

Why Are People Questioning Fort Knox’s Gold Reserves?

The lack of transparency has fueled speculation about the true state of America’s precious metals reserves. For example:

- Some believe much of the gold has been secretly sold off or leased to bullion banks

- While others worry that what remains may be of lower purity than expected. If the reserves are not “good delivery” standard (99.5% pure minimum), their market value would be far lower than official figures suggest.

Is Gold Still Important? Why Central Banks Keep Buying Gold

Why Does the U.S. Keep Gold If It No Longer Backs the Dollar?

In 1933, the U.S. government under Franklin D. Roosevelt confiscated privately held gold. Back then, every dollar was directly tied to a fixed amount of gold, so the government needed to devalue the dollar by increasing the price of gold from $20.67 per ounce to $35. This move was designed to boost economic growth but also revealed how critical gold was to monetary policy.

Countries Are Hoarding Gold Right Now

Even though the U.S. no longer operates under a gold-backed monetary system, central banks continue to hoard gold. Central banks stockpile gold as a hedge against currency devaluation and gold price stability concerns.

Why a Gold Confiscation Won’t Happen Today

Some people might be concerned that if US reserves were found to be less than reported, the government may again force a confiscation from citizens in order to bolster its reserves.

However, a modern gold confiscation is unlikely.

“A gold confiscation now is not at all likely because gold has been demonetized ever since then [1933].” – Chris Weber

Instead, governments today create inflation through quantitative easing—a process where central banks print money and buy assets like government bonds. This method has been used extensively since the 2008 financial crisis and again during the COVID-19 pandemic, effectively creating trillions of dollars out of thin air.

So, if the Federal Reserve can simply print money, does gold still matter? Absolutely. The world’s central banks are still buying gold, indicating that even they do not fully trust their own paper currency.

How Much Gold is in Fort Knox? Is the U.S. Hiding the Truth?

Did Fort Knox Really Hold 702 Million Ounces of Gold?

At its peak in 1949, Fort Knox held 702 million ounces of gold, making up 83% of global gold reserves. If that gold were still there today, it would be worth over $2 trillion.

How Much Gold Does Fort Knox Hold Today?

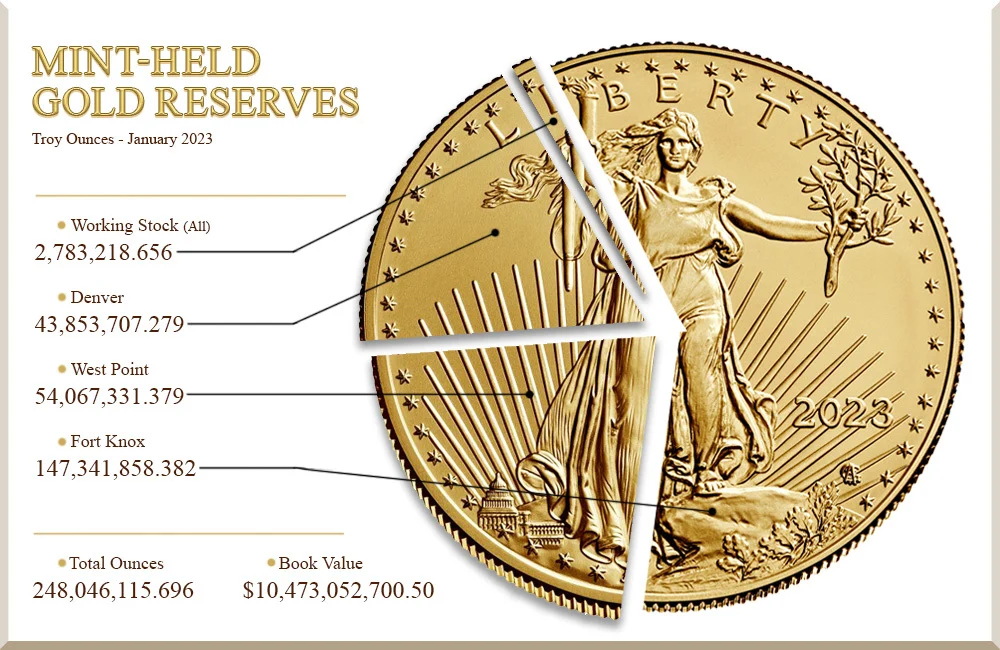

However, official figures show the U.S. gold reserves at Fort Knox have dwindled to just 147.3 million ounces.

So not all of the 261.5 million ounces of US gold reserves are held at Fort Knox. Some reserves are stored at West Point and the Denver Mint. The Federal Reserve Bank of New York also holds some gold for the US government at its New York gold vault.

Any future gold audit would need to be conducted at all these locations simultaneously. Otherwise, gold could be moved from one vault to another to “make up the numbers.”

But another concern is what type of gold remains?

Is Fort Knox’s Gold Low Purity? The Coin Melt Controversy

Many suspect that much of the gold in Fort Knox is only 90% pure coin melt, rather than the high-purity 99.99% bullion that meets “good delivery” standards for international trade. If this is true, at least 10% of the reported reserves would be copper, not gold. These were bars produced from the gold coins that were taken from private citizens in 1933.

Has the U.S. Secretly Sold or Leased Its Gold Reserves?

Could the U.S. government have secretly been selling or leasing its gold? If so, who has been benefiting? The likes of GATA has long held that central bank gold worldwide has been re-hypothecated and used to artificially suppress the gold price. So a key part of any audit would be to ascertain if there are potentially multiple owners of any bars.

Without a full audit, the lack of gold reserve transparency continues to raise concerns.

Side Note: Could either of the two above reasons potentially be why over 400 tonnesof “good delivery” gold bars have been drained from London to New York in the last month or two?

What Happens If Fort Knox Has No Gold? The Global Economic Fallout

How Would the Gold Price React to a Shocking Audit?

If an independent audit revealed that Fort Knox’s gold reserves are lower than claimed—or of lower purity—it could have serious consequences:

- Loss of Trust in the U.S. Dollar – The U.S. dollar is still the world’s reserve currency, but if trust erodes, global confidence in the U.S. financial system could weaken.

- Gold Prices Could Skyrocket – If the U.S. has far less gold than reported, demand for physical gold could surge.

- A Currency Crisis? – Countries like China and Russia are already pushing gold-backed currency alternatives to reduce dependence on the dollar.

The Strategy Behind Trump and Musk’s Call for a Fort Knox Audit

Despite these risks, Trump and Musk’s call for an audit makes strategic sense. If they uncover irregularities, they could place the blame on previous administrations while presenting themselves as champions of transparency.

“This is a smart move. They could not be blamed if any irregularities appeared in a full assay/audit.” – Chris Weber

For decades, past presidents have ignored calls for a full audit. Even Eisenhower, one of the first to question the reserves, was met with confusing and incomplete answers.

Now, Trump and Musk have the power to push the issue further than ever before.

For safe offshore storage, check out our vaulting solutions in New Zealand.

Will Trump & Musk Force a Fort Knox Gold Audit? What Happens Next?

The Fort Knox gold mystery remains one of the greatest financial enigmas of modern times. The U.S. government claims the gold is there, but without a full audit, how can we be sure?

If Trump and Musk succeed in their push for an investigation, we may finally get an answer. But whether that answer reassures the public or exposes a shocking truth remains to be seen.

Do you trust the official gold reserve numbers? Join the conversation below! And if you’re serious about protecting your wealth, get our latest gold investment strategies here.

Key Takeaways:

- Fort Knox’s last audit was in 1974—and it wasn’t a real audit.

- The U.S. gold reserves at Fort Knox have dropped from 702 million ounces in 1949 to 147.3 million today.

- Much of the remaining gold may be low-purity coin melt, not high-quality bullion.

- There are questions surrounding whether the gold may have been leased out and therefore have multiple owners (re-hypothecated).

- If an audit reveals less gold than expected, it could shake global confidence in the U.S. dollar.

- Trump and Musk want an audit—will they succeed where others have failed?

🔍 Frequently Asked Questions (FAQ)

Officially, Fort Knox holds 147.3 million ounces of gold, but many believe a full audit could reveal less gold or lower purity reserves.

Not fully. The last inspection in 1974 was a highly controlled media tour, not a legitimate audit.

Yes. If an audit reveals missing or impure gold, gold prices could skyrocket due to panic buying and loss of trust in U.S. reserves.

No. The gold standard ended in 1971 under Nixon. Since then, the U.S. dollar has been a fiat currency, backed by faith in the government rather than physical gold.

Great artical to the Fort Knox reserves

Thanks for reading Paul.It is amazing to see some of these things that have been discussed in the gold community for a long time potentially starting to happen.