This Week:

- Gold and the US Dollar to Rise Together?

- What is a Troy Ounce? Troy Ounce vs Standard Ounce

- How Gold Could Go Up 650% from Here

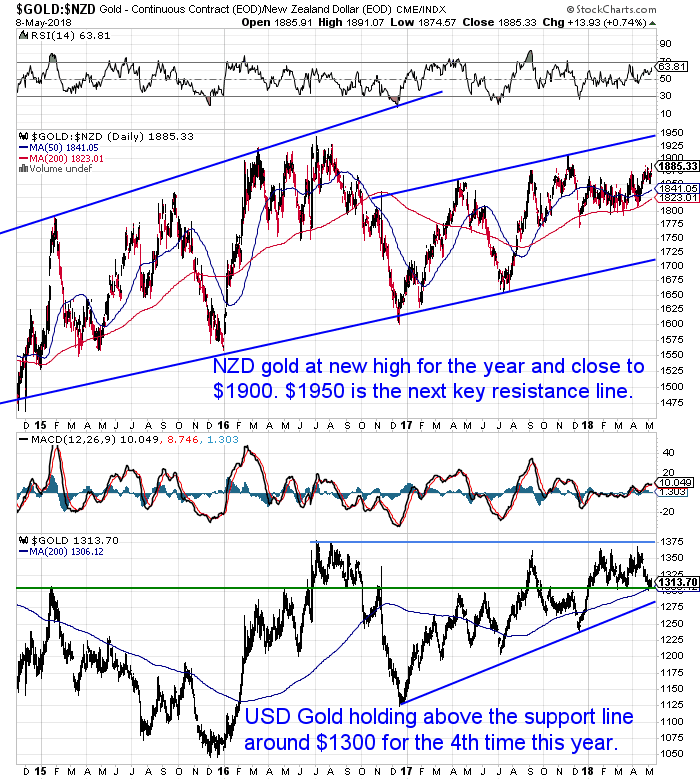

Prices and Charts

NZD Hits New 2018 High

NZD gold is at a new high for the year at $1892 today. Having broken through the $1875 level, NZD gold is getting very close to the round number of $1900. This was also the high from 2017.

$1950 is the next resistance level. This price coincides with the high from 2016 and also the current uptrend line. It’s not that far away now.

So NZD gold continues its steady rise since late 2014.

Silver Also Close to Break Out Level

Meanwhile NZD silver was up over 2.5% for the week. It is once again getting close to the downtrend line in this almost 2 year wedge pattern silver has been in.

This wedge is getting narrower and narrower. But perhaps this pattern can continue for another month or two, before the wedge gets so narrow a breakout must happen.

NZ Dollar Below 0.70

The NZ Dollar has dipped clearly below the 0.70 mark today. The November post election low of 0.68 doesn’t look that far off now. However with the RSI so oversold – well under 30 – a bounce higher is looking overdue.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Gold and the US Dollar to Rise Together?

Common wisdom says that gold and the US Dollar are inversely correlated. In case you failed school cert maths, that simply means when gold goes up the US Dollar is going down and vice versa.

Currently this is happening. Local gold prices here in NZ dollars are up. But that is due to the falling US Dollar against the Kiwi Dollar. As USD gold has been falling lately.

However there are times when both gold and the US Dollar can rise together.

We could be about to enter one of these periods according to this report…

“A commodity bull market is forming and gold has a big part to play, according to one Bank of America Merrill Lynch (BAML) strategist.

This year, gold prices will rise past the $1,350-$1,375 resistance level, BAML technical strategist Paul Ciana told CNBC on Saturday. And from there, Ciana added, the yellow metal could hit $1,450, where it hasn’t traded at since May 2013.

“As soon as this $1,350 to $1,375 area goes, which I do think it will later this year mostly when the dollar rally kind of tempers itself and neutralizes, that puts gold on the path to $1,450 so plenty of room there,” Ciana said.

“Gold prices have been forming a six-year long base,” Ciana said. “In the technical world we like to say, the bigger the base, the higher in space. That’s what gold is doing.”

The yellow metal’s prices have faced significant downward pressure from the firming U.S. dollar these past few weeks, even ending last week in red for the third consecutive time.

…But, Ciana is confident that the U.S. dollar will not be a hurdle for much longer, as he sees both the greenback and gold going up at the same time.

“When U.S. financial conditions are tightening, like they are today, compared to 2015, very early 2015, gold prices actually rallied about 12 percent and the dollar index had rallied about 6 percent,” explained Ciana. “There are situations where they both can move in tandem for a short period of time.”

Gold’s upward trajection alongside the U.S. dollar will however be only temporary and then the inverse relationship will once again overpower other factors, Ciana added.

Source.

This would be significant for NZ based gold holders.

Why?

Because if gold rises while the US Dollar strengthens, NZ holders will enjoy a turbo boost in prices. The weaker Kiwi dollar will boost the already rising gold price. Make sure you’re on board before this happens.

Back to Basics

Gold and silver are always (or at least should always be) priced in troy ounces.

Do you know the difference between a troy ounce and a standard or avoirdupois ounce?

Do you know how the troy ounce came to be used? What was the history behind it?

In this week’s featured post we also have the formula for easily converting kilograms and grams into troy ounces.

We’ll have more of these basics covered in the coming weeks. In the meantime you can check out the “Gold and Silver Market” category on the blog.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

How Gold Could Go Up 650% from Here

Two weeks ago we featured a video which looked at the price gold would need to be in order to balance out the US Debt. See: Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $21,000 Gold

This article below looks at how to value gold from a different angle. This time using the US money supply to arrive at a potential price…

Gold and silver both are close to break out levels. While this may not happen tomorrow, their respective breakouts look to not be too far off.

Make sure you are on board before they do to maximise the returns on your wealth insurance with upside.

Give us a call to discuss options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|