Very apocalyptic indeed was the title of Egon von Greyerz of Matterhorn Asset Management’s presentation at the Sydney Gold Symposium…

“A Return to the Dark Ages”

However given his gloomy title he had a collection of somewhat edgy but humorous slides to lighten the mood.

We’ve seen von Greyerz perform pretty well on CNBC in the past and he was just as entertaining at the Symposium.

His first slide was a painting depicting a cliff. At the bottom were the Fed, Bank of England, European Central Bank, and the IMF holding an old fashioned fireman’s rescue mat. A car going right through the mat was Greece. Still falling were Italy, Spain, Ireland, and Portugal.

At the top of the cliff were the cars labelled USA and UK.

His point: “The ones that can print USA, UK etc are the ones who still haven’t fallen off the cliff.”

I think a “yet” may have come after that too.

Three kinds of money

His next slide was headlined “Three kinds of Money”.

It bore the images of a Zimbabwean One Hundred Trillion Dollar note, a USA One Hundred Dollar note, and a 100g Gold Bar.

He didn’t have much to say about this except “there are 3 kinds of money:

- Worthless

- To become worthless

- Real money

He left it to us to determine which was which. No prizes offered for the right answer here either.

According to von Geryerz, all currencies have lost 95% to 97% of their purchasing power in the past 100 years and the Federal Reserves creation in 1913 has been integral to this loss.

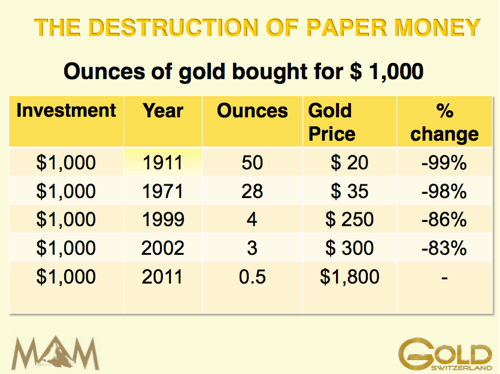

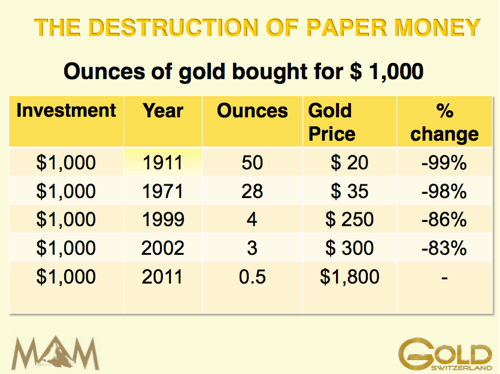

But he then flipped this around as we’ve heard him do before and quite rightly pointed out that the way to look at gold and dollars is how many ounces of gold a fixed amount of dollars will buy you over the years. (See the table above right)

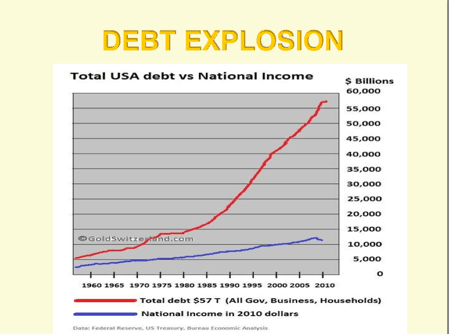

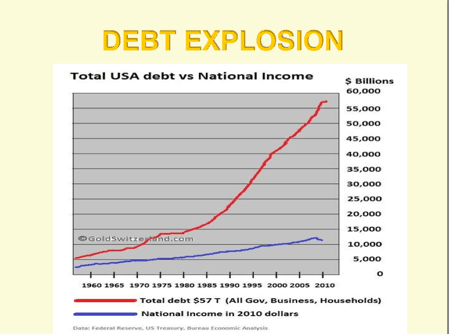

We’re probably all aware of the massive rise in debt over the last 40 years. But it’s not just the debt explosion that we should pay heed to but importantly how rises in income have not come close to keeping pace with this. Von Greyerz had a telling chart that demonstrated how the massive rise in debt has not actually created a proportionate rise in income.

Even the well informed and educated don’t have any gold yet

He recently spoke to an audience of 250 “Family Office” managers in Europe. In case you didn’t know a Family Office manager is responsible for the management of generational wealth. An NZ example could say be the Todd Family. He asked the question, who holds any gold for their clients? The astounding answer was – none had gold in their portfolios. These are not uninformed people either so just goes to show how low the “penetration” is.

Which further backs up his theory that “At $1800 it’s still very cheap” (Must be even cheaper at the moment then at less than $1700 we guess). The past 10 years has been a stealth bull market with very few people participating.

He made the point (and one that we commonly espouse too) that “You should always look at gold in your own currency. It’s ridiculous to look at the US dollar price if you don’t live there”. So don’t be ridiculous! Follow the Australian dollar price (or in our case the NZ dollar price or whatever you local currency is).

It was nice to see Von Greyerz had also had taken the time to have some stats ready for the “down under” audience.

Gold in Australian dollars is up 4.5 times since 1999 – a compound annual return of 13% (Not too dissimilar to here in NZ where it has gone up 3.6 times over this period).

Shares and housing down against gold

He showed that against gold the ASX (Australian Stock market index) is down 70% since it’s peak in 2007. He believes the US version of this ratio, the DOW to Gold ratio, will go down to 0.5 or even less in the future as this will overshoot past previous downside lows during the 1930’s depression and the 1970’s.

One of our favourite measures was also featured. That being housing priced in gold, for the Australian market (see here for our local

NZ housing to gold ratio). According to this ratio there has been an Australian house price collapse already with the median house price to gold ratio down 40% since peak in 2005. Even though it’s only this year that house prices in Australia in nominal dollars have dropped. The key point though was that from 1968 – 1979 Australian Houses dropped 90% when priced in gold. So it looks like they could have a way to fall yet by that measure.

“Who wants to buy a fat woman for $22 million?”

The punch line to this joke was visual so we’ve found the images concerned.

It was a painting that sold a couple years back for $22 million (actually Wikipedia say $33 million) titled “Benefits Supervisor Sleeping”.

Probably “to a Hedge fund manager”, he quipped.

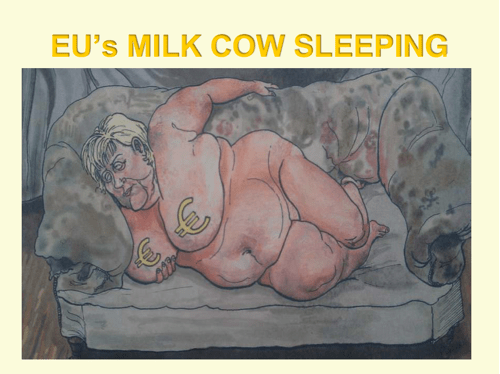

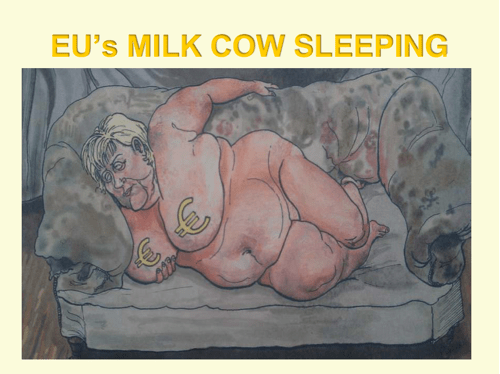

Then the painting below was on the next slide titled “ EU’s Milk Cow Sleeping! A non too flatering image of Angela Merkel. Von Greyerz outlined that Merkel’s dilemma is that they (the Germans) don’t want to help all of Europe but if they don’t their banking system will fail due to the massive loans the German banks have made to the profligate European nations.

So simply put it’s a “situation that cannot be solved” and that will “eventually lead to money printing” by the ECB or if not the US Fed will print instead.

Again he made the point that it’s the debt that is the problem and that Government debt will never be repaid. He also stressed that due to the interconnectedness of the financial system, even a better managed bank such as an Australian Bank, will fail if a bank in the US fails.

Inflation or Deflation: Lose – Lose

The big debate has often been between the deflationists and the inflationists as to what the end result of the crisis will be. Von Greyerz rightly points out that either way the end result is Lose – Lose.

The choice is between austerity, causing deflation, resulting in a collapse of the financial system. And no bank would survive this. So many would lose out.

Versus Inflation via “quantitative easing” or money printing. This weakens the currency and can create hyperinflation eventually.

His call is that inflation is what the governments will choose, simply because austerity is too harsh a medicine for the populace to take.

The impacts of this inflationary policy will be many…

- Government deficits with explode (which we are witnessing already the world over).

- All currencies will fall.

- Interest rates will surge 10-15% in the next few years he believes but inflation will be higher than interest rates so gold will continue to do well.

- Unemployment will also surge.

- Assets that were financed by the debt bubble will fall -such as housing.

- Governments will enact exchange controls to stop capital fleeing offshore.

- The financial system will fail causing social structures (welfare etc) to break down.

- And the end result will be wars will break out.

(We did warn you at the start that his thesis is a tad apocalyptic!)

“So buy gold, do what you can to prepare, then live life. Family and friends will be most important”.

Not Wealth Protection

And that the following in his opinion is not wealth protection:

- Gold or silver ETFs in the banking system

- Unallocated or allocated gold/silver in a bank

- COMEX gold

- Futures Gold

- Bank safe deposit box

- Storing gold at home

We couldn’t argue with too much of that ourselves.

Gold Price Targets

For those wondering if it was too late to jump on the gold bandwagon his answer was an emphatic no and he had a number of gold price projections to back this up…

- $7,000 would equal the 1980 peak price of $850 adjusted for real inflation (not phony government CPI)

- $10,000 would equal gold valued at 5% of world financial assets

- $11,000 is equal to the 111 year average of 16% for US public debt to gold reserves

- $29,000 would equal the 1913 Gold reserves to debt ratio of 52%

Vaults are filling up

There’s still roughly the same mount of gold there has been for the past century and yet the world is running out of vault space so where’s it coming from?

His answer is that it’s being lent by Central Banks. So gold is leaving their vaults and entering private hands and private vaults instead.

Who would have thought the apocalypse could be so much fun!

Von Greyerz finished his entertaining key note adress with these final words:

“Gold is not an investment. You are buying because of the possibility of hyperinflation and you don’t know how many zero’s there will be after the gold price. You won’t get rich but you will protect your wealth.”

He left it to us to determine which was which. No prizes offered for the right answer here either.

According to von Geryerz, all currencies have lost 95% to 97% of their purchasing power in the past 100 years and the Federal Reserves creation in 1913 has been integral to this loss.

But he then flipped this around as we’ve heard him do before and quite rightly pointed out that the way to look at gold and dollars is how many ounces of gold a fixed amount of dollars will buy you over the years. (See the table above right)

He left it to us to determine which was which. No prizes offered for the right answer here either.

According to von Geryerz, all currencies have lost 95% to 97% of their purchasing power in the past 100 years and the Federal Reserves creation in 1913 has been integral to this loss.

But he then flipped this around as we’ve heard him do before and quite rightly pointed out that the way to look at gold and dollars is how many ounces of gold a fixed amount of dollars will buy you over the years. (See the table above right)

We’re probably all aware of the massive rise in debt over the last 40 years. But it’s not just the debt explosion that we should pay heed to but importantly how rises in income have not come close to keeping pace with this. Von Greyerz had a telling chart that demonstrated how the massive rise in debt has not actually created a proportionate rise in income.

We’re probably all aware of the massive rise in debt over the last 40 years. But it’s not just the debt explosion that we should pay heed to but importantly how rises in income have not come close to keeping pace with this. Von Greyerz had a telling chart that demonstrated how the massive rise in debt has not actually created a proportionate rise in income.

The punch line to this joke was visual so we’ve found the images concerned.

It was a painting that sold a couple years back for $22 million (actually Wikipedia say $33 million) titled “Benefits Supervisor Sleeping”.

Probably “to a Hedge fund manager”, he quipped.

The punch line to this joke was visual so we’ve found the images concerned.

It was a painting that sold a couple years back for $22 million (actually Wikipedia say $33 million) titled “Benefits Supervisor Sleeping”.

Probably “to a Hedge fund manager”, he quipped.

Then the painting below was on the next slide titled “ EU’s Milk Cow Sleeping! A non too flatering image of Angela Merkel. Von Greyerz outlined that Merkel’s dilemma is that they (the Germans) don’t want to help all of Europe but if they don’t their banking system will fail due to the massive loans the German banks have made to the profligate European nations.

So simply put it’s a “situation that cannot be solved” and that will “eventually lead to money printing” by the ECB or if not the US Fed will print instead.

Again he made the point that it’s the debt that is the problem and that Government debt will never be repaid. He also stressed that due to the interconnectedness of the financial system, even a better managed bank such as an Australian Bank, will fail if a bank in the US fails.

Then the painting below was on the next slide titled “ EU’s Milk Cow Sleeping! A non too flatering image of Angela Merkel. Von Greyerz outlined that Merkel’s dilemma is that they (the Germans) don’t want to help all of Europe but if they don’t their banking system will fail due to the massive loans the German banks have made to the profligate European nations.

So simply put it’s a “situation that cannot be solved” and that will “eventually lead to money printing” by the ECB or if not the US Fed will print instead.

Again he made the point that it’s the debt that is the problem and that Government debt will never be repaid. He also stressed that due to the interconnectedness of the financial system, even a better managed bank such as an Australian Bank, will fail if a bank in the US fails.

Interesting that he said that storing gold at home is not wealth protection. Can you expand on that? What was his list of things that ARE wealth protection?

We imagine he sees it as too risky holding it at home. Chance of theft, risk of loss in a fire for example. Bear in mind though that he is the owner of Gold Switzerland. They specialise in physical Gold and Silver which he explained as: – Stored outside the banking system, – Gold/Silver bars owned directly by investor , – Personal access to metals, – Ultimate form of wealth preservation. i.e. his list of wealth protection. His company is aimed more at larger investors who want someone to purchase and then look after storage for them too. So storing it at home for them would be much riskier than a smaller holder. Guess you could also argue there is an element of “talking his book” where he was encouraging people to buy via Gold Switzerland. Our thoughts on storage are to “spread your eggs” – don’t have it all in one place.

Pingback: Is it too late to buy gold? | Gold Investing Guide