Prices and Charts

Gold Bouncing Back This Week

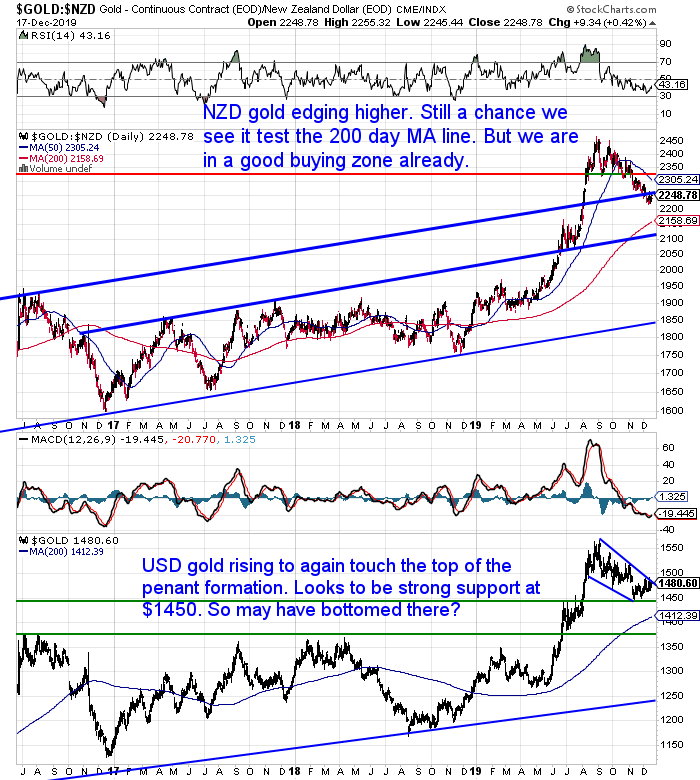

Gold bounced back this week. In NZ Dollars it’s now sitting around $2250 per ounce.

As we said last week, there is still the chance it dips down to the 200 day moving average. We could see such a move over the low volume Christmas New Year break. (In case you missed it at the start of December we pointed out how history shows in 8 of the last 10 years we have seen the gold price fall sharply around this time. Therefore also making it a good time to buy gold and silver near the end of the calendar year.)

However the only trouble with waiting for then, is that our local suppliers are closed until Monday 6 January. We are still “open” but will have access to limited stock over the holiday period.

Silver Also Jumping

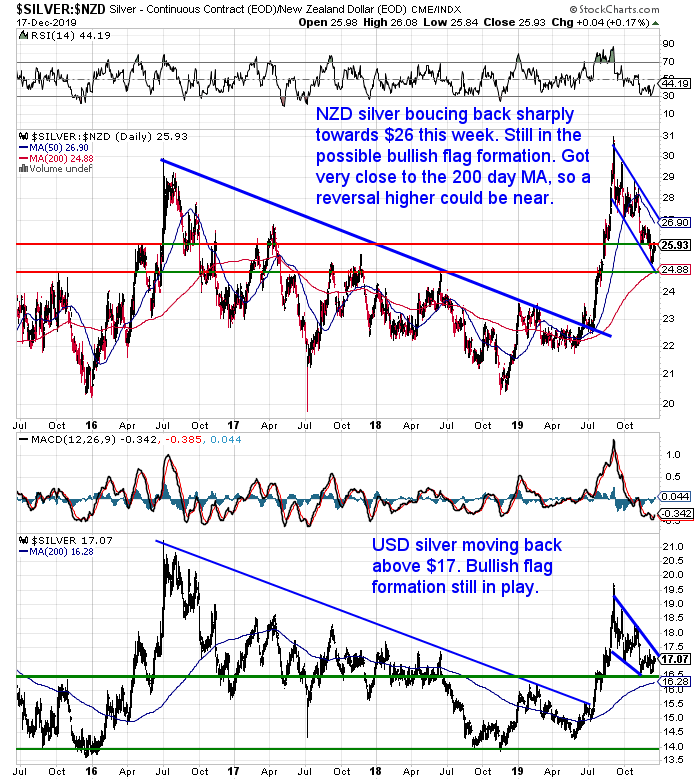

Silver was up too – more than gold in fact. Rising 1.49% compared to last week, to be back close to $26. It remains in the bullish pennant formation.

As we said a week ago, silver is very close to the 200 day moving average. So a reversal higher may not be far away now. We are in a pretty decent buying zone for silver. Like gold perhaps we’ll see the price dip a little lower. But there might not be much downside from here.

NZ Dollar Pulling Back?

While the NZ dollar has continued its rise against the US dollar. Although it has turned back down the past 2 days. With the US rate cuts the US dollar seems to be in a downtrend against many currencies now. More on that below from Graham Summers…

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Bank Capital Changes: What is the RBNZ Preparing For?

We’ve been reporting on the RBNZ’s plans to increase the amount of capital NZ banks must hold for a while now. Earlier this month the RBNZ made its final decision about how much extra capital and by when the banks will have to have it.

Will it make banks safer?

See what the RBNZ thinks.

What the Banks think.

And what we think…

Why Fractional Reserve Banking is Not the Problem

Spoiler alert – we don’t think the capital increases to NZ banks would help in a really major financial crisis. Why?

It’s down to the nature of the current fractional reserve banking system and its susceptibility to bank runs. However, you might be interested to know that fractional reserve banking doesn’t have to be the problem that it currently is…

Negative Yielding Debt Correlated to Gold Price

BullionVault today pointed out a note from the World Gold Council with a chart that shows just how correlated the gold price has been to negative yielding debt:

“Financial and geopolitical uncertainty combined with low interest rates will likely continue supporting gold investment demand,” reckons investment research director Juan Carlos Artigas at the mining-industry backed World Gold Council.

More importantly, “Global monetary policy has shifted by 180 degrees” in 2019, Artigas goes on, with the US Federal Reserve cutting its key rate 3 times after forecasting further hikes at the start of this year.

“This is further supported by the surge in negative real-yielding debt,” says the WGC analysis, “as evidenced by the strong positive correlation between the amount of debt and price of gold over the past four years.”

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Greatest Period of Currency Destruction Underway

Here’s an interesting note from Graham Summers. He dissects the recent US central bank statement:

“Last week, the Fed issued one of its most extraordinary statements in history.

The terms were laid out in Fed speak, but to paraphrase, the Fed stated the following:

1. Its current QE program of $60 billion per month will run at least into June 2020.

2. The Fed is aware that its current easing cycle is similar to the one of 1998 which induced the Tech Bubble.

3. The Fed needs to see a “persistent” rise in inflation before it raises rates again.

If you had to summate the above in one straight-forward sentence it would be:

“We are going to print a STAGGERING amount of money in the next 12 months.”

First and foremost, QE is the program through which a central bank prints new money and then uses it to buy debt from bank/financial institutions, in turn hoping to boost the financial system.

The Fed’s current QE program will run for another six months. That means we’re talking about AT LEAST $360 BILLION in new money being funneled into the financial system.

Regarding #2 in the list above… the Fed is effectively admitting it wants to create a massive stock market bubble. The last time the Fed cut interest rates three times while the economy was growing was in 1998. That was what caused stocks to go absolutely parabolic in the biggest stock market bubble of all time.

The Fed just admitted it is currently engaging in the same policies!

Which brings us to #3 in the list above… the really BIG admission… that the Fed won’t raise interest rates again until it sees a “persistent” rise in inflation.

“Persistent” is Fed speak for a LOOOONG time. We’re talking about AT LEAST four to six months. The Fed is effectively admitting it needs to see inflation run hot for roughly one-third to half of a year before it raises interest rates again.

And given that the Fed itself decides how it wants to measure inflation, what the Fed has basically admitted is that it won’t be raising interest rates any time soon – possibly EVER.

Again, the Fed has implicitly admitted that it is going to print a STAGGERING amount of money, allowing inflation to get out of control.

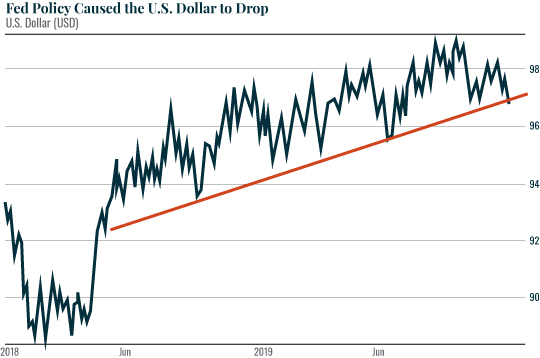

The effect of this announcement was immediate.

As you can see on the chart below, the U.S. dollar broke its bull market trendline to the downside.

We are about to enter the greatest period of currency destruction in history.”

Given that the US dollar and gold often trade inversely to each other, if the USD is about to fall, we could see gold make its next move higher.

You may ask, “But won’t that mean the Kiwi dollar will be rising too?”

Well, yes quite likely against the US dollar. But if history is any guide, gold will “rise” even more. So the local NZ dollar gold price may not rise as much percentage wise as the US dollar gold price. But it will still rise.

Over time all currencies are falling compared to gold. They just take it in turns as to who falls faster. This is where the saying the “best looking horse in the glue factory” is quite appropriate!

The US dollar has been that horse for the last few years. But now it might be the turn of other currencies.

As noted earlier, we’re into the last few days of buying from local suppliers for the year. So if you’re thinking of making a purchase don’t wait too long. They close on Friday.

Also this will be our last weekly newsletter for 2019. So we’ll take this chance to wish you a merry Christmas and all the best for the New Year. We’ll be back on our weekly publishing schedule Wednesday 8 January. We’re open for business over the holidays, apart from the odd statuary holiday where our offshore suppliers are closed.

So get in touch for a quote anytime. Or please let us know if you have any questions at all…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold and Silver Surging After Iranian Missile Attack on US Base in Iraq - Gold Survival Guide