Prices and Charts

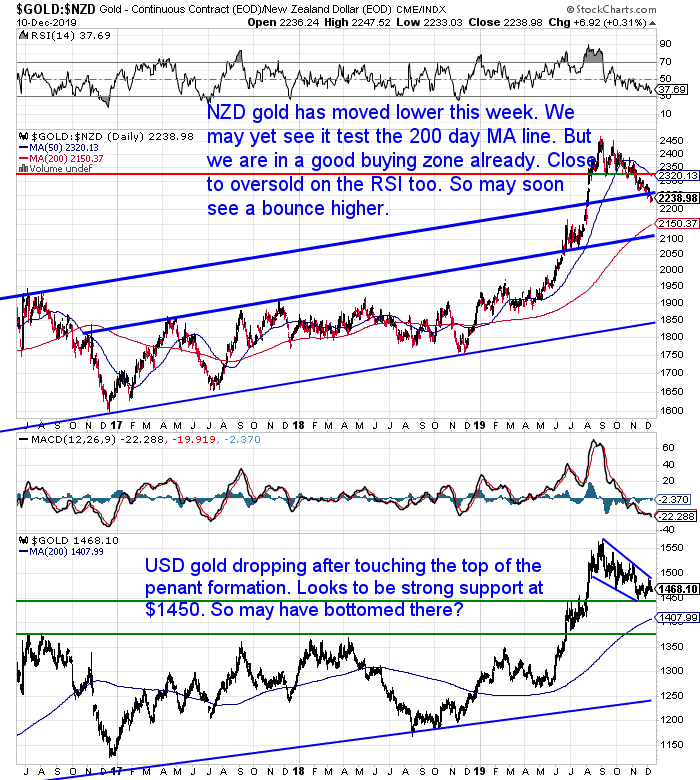

NZD Gold Down This Week

NZD gold has moved lower this week. Dipping below the upper rising trendline. It’s less than $100/oz from the 200 day moving average (MA) line now. So we could yet still see it test that line.

But the overbought/oversold RSI indicator is now close to oversold levels below 30. So a solid bottom could well be getting close. That would make this a pretty good buying zone for gold.

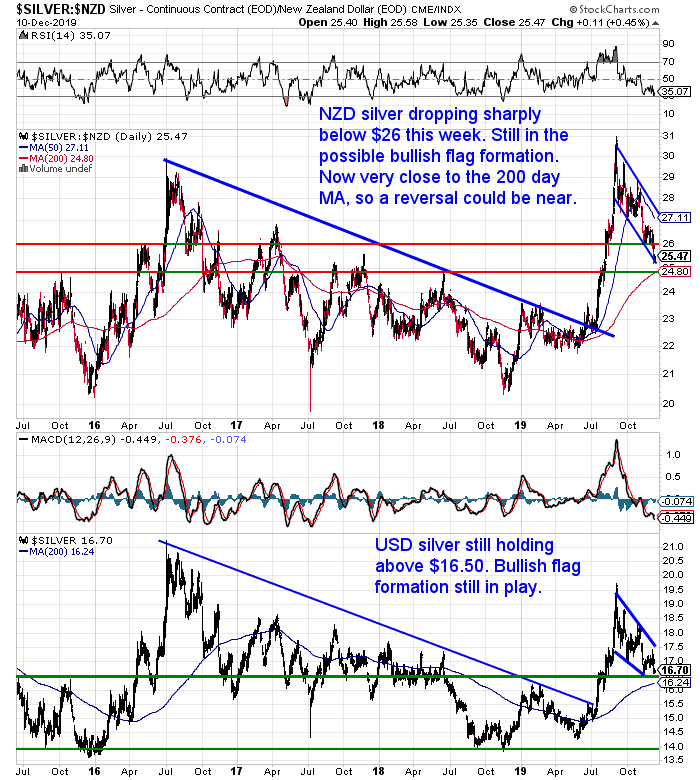

Silver Down Sharply

NZD silver took a hit this week – down over 3%. It fell through what had been strong support at $26. But now silver is just a stones throw from the 200 day MA at $24.80.

Silver is still sitting inside the bullish flag formation. We could be very close to a reversal with the RSI also approaching oversold levels. So this also looks like a very good buying zone from here down to $24.80.

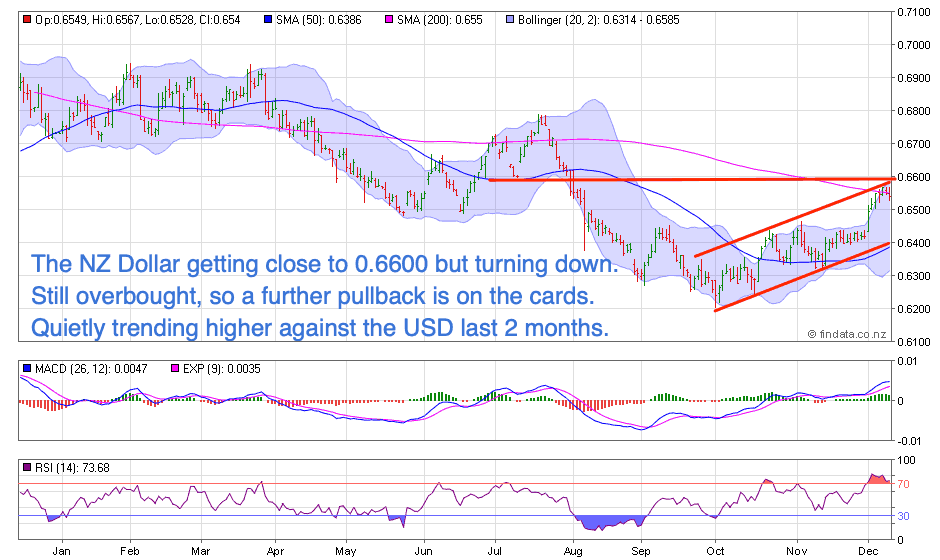

NZ Dollar Has Broken Out of Sideways Trading Range

The New Zealand dollar continued to rise early in the past week. But has turned down in the past couple of days. It’s still overbought above 70 on the RSI. So a further pullback could be on the cards. Nonetheless, the Kiwi looks to be in a short term uptrend against the USD for now.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

European Central Banks Are Slowly Preparing For Plan B: Gold. You Should Too.

Jan Nieuwenhuijs pointed out last week, that European Central Banks Are Slowly Preparing For Plan B: Gold…

“When reading the mainstream media, one can be persuaded to think all central banks are willing to “print” money to infinity and lower interest rates as far as they can—or launch a variety of the same—pushing us further into the abyss. Some of them, though, aren’t that ignorant and are actively preparing for when paper currencies are forced to be devalued by the weight of debt issued in said currencies.

…after the GFC, not only have Western central banks [such as Sweden, France, Germany, Finland, Netherlands] changed the way they talk about gold—that is, they have become more honest regarding gold’s function as a safe haven—but, as a sector, central banks have also become net buyers. Many central banks have redistributed their gold, carefully considering all possible future risks and developments. A few central banks have upgraded their gold to current industry standards to be able to trade frictionless in international markets. One central bank, BDF, [Banque de France] has even enhanced its entire vaulting infrastructure. And this is just based upon publicly available information.

We’re all too familiar with central banks in the East openly buying gold, stimulating citizens to buy gold, setting up new gold exchanges, and de-dollarizing. In the West, these subjects are more sensitive for political reasons. As a result, since the GFC, Western central banks gently started moving towards gold, not to cause any shocks in the market. In 2015, I called this “the slow development towards gold,” and it’s continuing still.

It’s beyond the scope of this article to discuss every probable international monetary development and attribute a percentage chance to each of them. I think it’s clear though, that many central banks are preparing for gold to play a resolving and pivotal role in future global finance. Why else buy, redistribute and upgrade gold, next to enhance trading facilities, increase transparency and then advertise gold’s financial features? Keep in mind what Pericles said around 500 BC, “the key is not to predict the future but to prepare for it.”

Currently, Exter’s Pyramid has grown too big and is unstable. The moment the pyramid falls, “gold will do its job.” History teaches us gold protects its owners through all types of weather, and central banks know this. Ever wondered why virtually every central bank owns gold? Because gold is physical. Immutable, yet divisible. Independent and without counterparty risk. It is the ultimate store of value—as it retains its purchasing power through time—and works as an eternal payment instrument.”

However unlike the Swedish, Franch, German, Finland, and Dutch central banks, our New Zealand Reserve Bank, has not been upgrading their gold vault. It also hasn’t been talking about gold in more positive terms.

Why?

Because the RBNZ has no gold reserves at all.

Not only that, past correspondence from them shows, they likely have no intention of buying gold.

In this newly updated post we cover where New Zealand sits compared to about 100 other nations and their gold reserves. Along with some correspondence direct from the RBNZ on gold.

Will Gold Once Again Fall Over the Holiday Period?

After reading the above you’ll realise that there’s no point in relying upon the RBNZ. Instead you should become your own central bank. However, even if the RBNZ did have significant gold reserves, the post below outlines why you still need to have your own.

It also explains what we can learn from some central banks in terms of how to go about purchasing gold.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

As mentioned at the top, silver has dropped quite sharply this past week. But with it now sitting close to the 200 day moving average line, we are in a pretty good buying zone.

Why? Because the 200 day MA is generally considered a bull market indicator. So when the price is above this, we are in an uptrend. Now with the price approaching that marker, the odds favour silver turning higher off it.

Therefore, this could be a great time to grab one of the only 2 remaining Perth Mint 10kg silver boxes left. These can be bought for the same price as local silver. Quite a steal.

Get in touch for a quote. Or please let us know if you have any questions at all…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Greatest Period of Currency Destruction Underway - Gold Survival Guide