This Week:

- Incrementum: End of Zero Interest Rates Will Lead to Inflation

- Gold Rose Last Time Fed Hiked Rates

- History Shows the End of the Year Great Time to Buy Gold and Silver

- Is It Possible to Take Advantage of a Price Dip Over the Holidays?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1641.17 | + $32.96 | + 2.04% |

| USD Gold | $1131.75 | + $11.20 | + 0.97% |

| NZD Silver | $23.15 | – $0.59 | – 2.48% |

| USD Silver | $15.96 | – $0.91 | – 5.39% |

| NZD/USD | 0.6896 | – 0.0211 | – 2.96% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1575 |

| Buying Back 1kg NZ Silver 999 Purity | $704 |

The trend of the past 2 weeks has flipped.

Silver is down sharply from a week ago while gold is up a couple of percent.

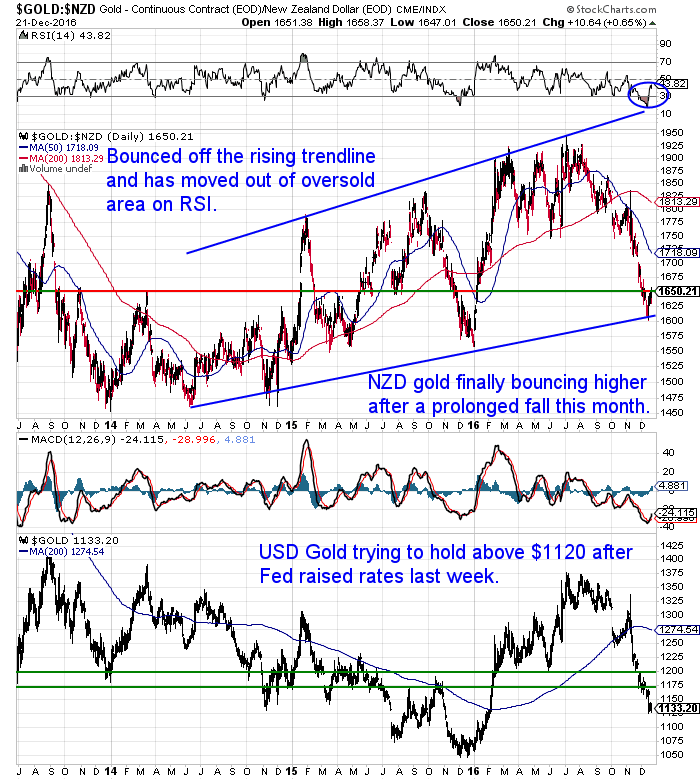

NZD gold dropped sharply just after the US Fed increased interest rates. But with the NZ Dollar plunging over 3 cents this week this has given a boost to local prices.

NZD gold bounced off the rising trendline and is back up close to the previous horizontal support. It is finally out of the oversold territory it has been in since November. As we’ll cover later, history says the price may head lower again before the end of the year though.

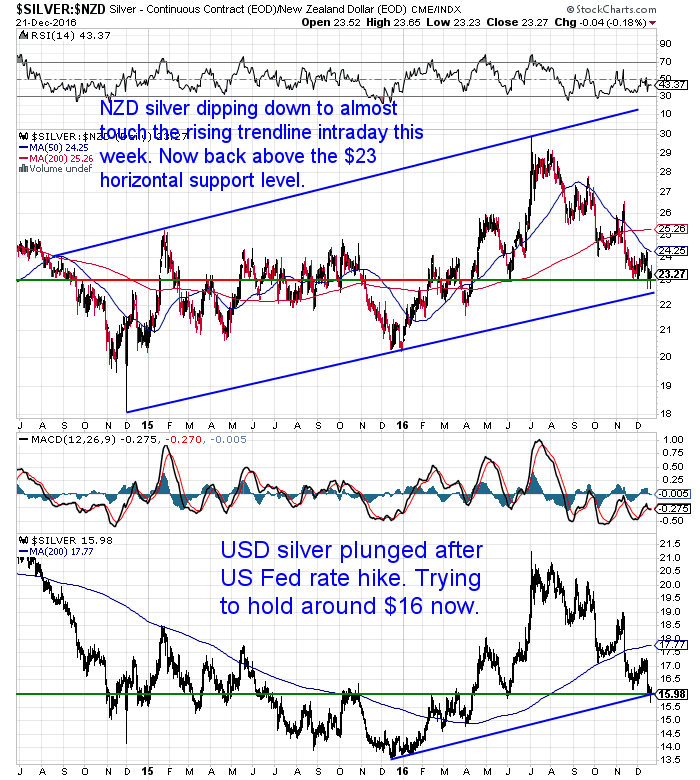

After being stronger than gold silver has reversed course. It too is now close to the rising trendline. Almost touching it intraday this past week, but back up above $23 again now.

The Kiwi dollar has really plummeted. As noted already it’s down over 3 cents post the Fed rate increase. But it is now right on the lower Bollinger band (blue shaded area) so odds favour a bounce higher from here. So this could send local precious metals prices lower into the year end.

Incrementum: End of Zero Interest Rates Will Lead to Inflation

Ronni Stoeferle of Incrementum sent out a Letter to Investors this week. We would highly recommend you at least skim through the update:

Incrementum Letter to Investors

But here are a few choice selections we think worth repeating:

Again they discuss the “Cantillon Effect”. As we reported back in May the Cantillon Effect:

“…describes the fact that newly-created money is distributed neither equally nor simultaneously among the population. This means that people handling money partially benefit from inflation and partially suffer from it. Monetary dispersion is never neutral. Market participants who receive the new money early and exchange it for goods benefit in comparison with those who get the newly-created money later. We can see a transfer of assets from late money users to early money users.

Friedrich von Hayek once pictured the cantillon effect with the process of pouring honey into a saucer. The honey dollops in the middle first and only later it spreads out to the periphery. Prices also do not rise evenly. Typically price levels are higher in regions, which directly or indirectly benefit from monetary inflation. If you happen to live in a financial center you may have noticed.”

Incrementum argue that:

“The regional election/referendum results in the USA and the UK, respectively, make a clear case for where the honey has been flowing first: generally speaking, urban areas have benefited significantly from the reflation of the money supplies. Subsidised regions have also been among those that have been given access to the honey trough on the back of the fiscal deviation of funds. Rising interest rates could slow down fresh supply and put a sudden end to the trickle-down bubble philosophy of recent years, and they could do so with grave economic consequences.

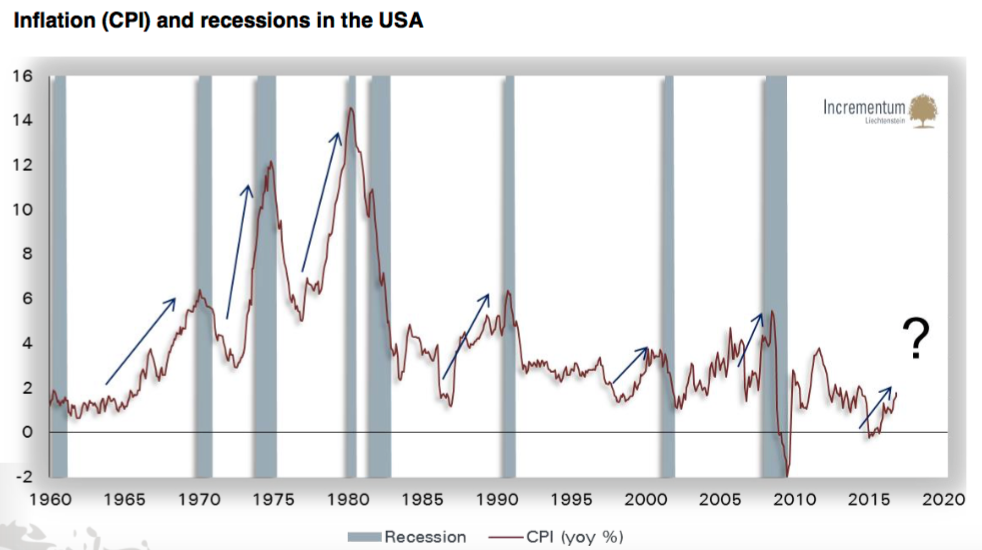

…At the end of the zero interest rate trap: inflation

The US dollar, i.e. the leading global currency, has been locked into a falling inflation and interest rate trend for more than three decades. Within this super-cycle, we can single out the following two observations: intermittently rising interest rates, driven by higher inflation expectations, have almost always

1) either led to a recession in the USA, or

2) triggered crises in excessively leveraged regions, at times with supra-regional implications and feedback effects for the USA.

We can also see that during this period the Fed set its Fed funds rate at lower levels after each cycle, and that overall debt (consisting of government, corporate, and private household debt) has increased exponentially. We do believe that this development is based on a crude, self-enhancing causality, which at its logical completion can only lead to a dead end with exactly one way out. Once an economy is chronically burdened by excessive debt and interest rates have reached the zero lower bound, there is de facto no alternative to “printing until inflation kicks in.”2

During the falling interest rate trend and with constantly rising debt, the process of the cycle looks roughly as follows. The question this time around will be: can the Fed orchestrate a significant hiking cycle without causing severe damage to the economy or the financial markets?

From our point of view we will see in the coming year – after the current, highly subdued cycle of interest rate hikes – whether the economy will stall and trend toward stagflation amid its debt cycle, or whether another “ordinary”, deflationary recession is looming at the horizon. We believe that the yield increase in the USA is likely the beginning of further frictions on capital markets, which ultimately may lead to the overdue recession in the USA.”

Finally they finish with a pretty ancient quote from a Greek general:

Trump Ideal to Lead Bankrupt USA

Jim Sinclair’s thoughts on Trump echo a discussion we had with someone recently about what Trumps real skills are:

Not only is the monetary system insolvent if called upon to perform in even a modesty percentage. The entire system would fail miserably. However, there is no lack of resources and productivity if incentivized to make the global system again functional and durable by making real, not pretend money the basis.

What is Mr. Trump’s real business background?

He is a builder of brick and mortar.

He is a negotiator.

He has zero lack of self worth or abilities.

He is a master of using the economic tool of bankruptcy to restructure and retreat and from the conditions of financial bankruptcy.

Today’s world is without any doubt a rolling bankruptcy whose foundation is pretend and extend. Inherently pretend and extend has shown no permanency anytime, anywhere. The “Great Flush” which must proceed the “Great Reset” has been, most disturbingly, war won or lost.

Therefore, the United States, one of the most powerful countries in the global system, is insolvent, that is true just on the factors of OTC derivatives and unfunded obligations. You need not be a genius to understand this.”…There is an axiom that “before a massive public will accept a new system as a way out, they must suffer severely.” This is proven by history in every national bankruptcy of a nations currency. An example of note is the Weimar Republic that gave rise to the socialist leader, Hitler. In this example the war had to be lost for a Reset to happen. The reason I anticipate the “Great Reset,” is that the experiment of Globalism has failed miserably with the world now imitating the recklessness of massive Western Debt creation.

This is not the end of the world but rather the means of change to a new world that in the end might be quite abundant and peaceful. Just like a great fall caused no injury if you have prepared a large foam mattress for your family.”Source.

So the inference is that Trump is the right man to lead America into bankruptcy and to “restructure” it out of it. This will likely involve a change in the global monetary system but first some pain to be suffered by anyone unprepared.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare? For just $290 you can have 4 weeks emergency food supply.

For just $290 you can have 4 weeks emergency food supply.

—–

Local NZ Interest Rates Rising With Fed Hike

As interest.co.nz reported local NZ wholesale interest rates and swap markets rose with the Fed rate hike last week.

The moves were quiet significant and they note:

“If you are a borrower, you should be aware that changes of this magnitude will probably affect how banks price their fixed rate mortgage offers. By the time you come back from holiday, there is the possibility that fixed mortgage rates could be noticeably higher.”

So as we’ve been saying, even though the RBNZ may be cutting their overnight cash rate, it is the offshore markets that will likely have the biggest impact on the “price of money” here in New Zealand.

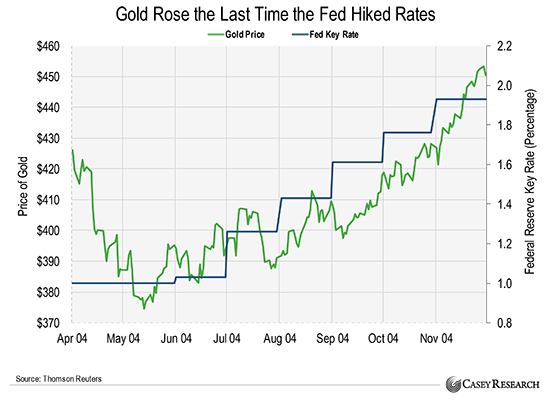

Gold Rose Last Time Fed Hiked Rates

As noted already the price of gold and silver fell sharply following the US Central Bank interest rate hike last week, even though this was widely expected. Why?

Casey Research notes that:

Of course, regular readers know the conventional wisdom about gold and interest rates is dead wrong. As we’ve pointed out many times, the price of gold has actually increased after the last four Fed rate hikes.

You can see in the chart below that the price of gold jumped 20% in just six months when the Fed started raising rates in 2004.

• Now could be a good time to own physical gold for the long term…

After all, we don’t think gold will stay cheap for long.”

Last year gold fell initially too after the first Fed rate hike. Of course there’s no guarantee we will see an exact repeat, but there certainly to us seems to be as much pessimism towards gold now as there was a year ago.

There is certainly very little buying going on currently compared to earlier in the year. Maybe everyone is right to wait for gold and silver to go lower? But maybe this is a good contrarian indicator of a possible bottom forming?

History Shows the End of the Year Great Time to Buy Gold and Silver

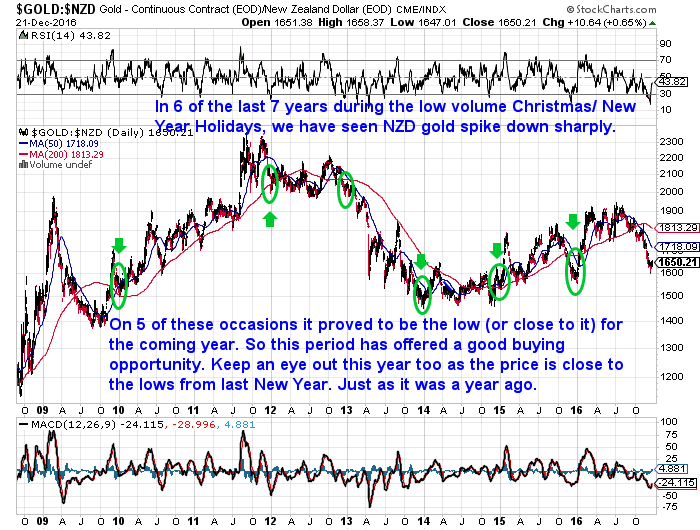

History also shows why a bottom could be forming now.

Last week we posted a chart that showed the last days of the year are often a good time to buy. Possibly because the price is forced lower in low volume holiday trading. Here’s the chart again in case you missed it.

You can see that in each of the last 3 years the NZD gold price did spike lower over the holiday period. But also in each of these years that proved to be the low for the upcoming year.

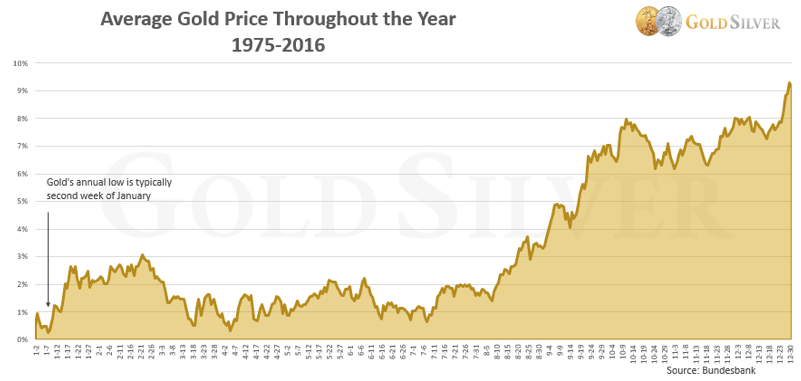

As it happens Jeff Clark of GoldSilver published some research this week that backs up our assertion.

The Best Time to Buy Gold and Silver in 2017 Is in 2016

In preparation for the new year, I thought I’d look at the historical data to see if I could identify the best time of year to buy. I suspected January would be best, but what I found was interesting.

We calculated the average gain and loss for every day of the year since 1975 (when it was legal to buy gold again in the US) and put it in a chart. Here’s what it looks like.

You can see that on average, there’s a nice surge the first couple months of the year. The price then cools down through the spring and summer, and takes off again in the fall.

You can also see that the gold price, on average, does not historically revisit its prior year low. The low of the year is indeed in January—but it’s the low of that year, not the prior year.

All this means that you are likely to be better off buying in 2016 than in 2017.

Obviously there were years where the gold price did fall. But there were also years it soared. Smoothing out all those surges and corrections and manias and selloffs, investors are, on average, better off buying the prior year than waiting for a downturn the following year. Prices are indeed seasonally weaker in the summer, but they still don’t touch the prior year’s price. Meaning, you are likely to pay more even then than now.

The conclusion is simple:

- On average, you’ll get a better price on gold now than in 2017.

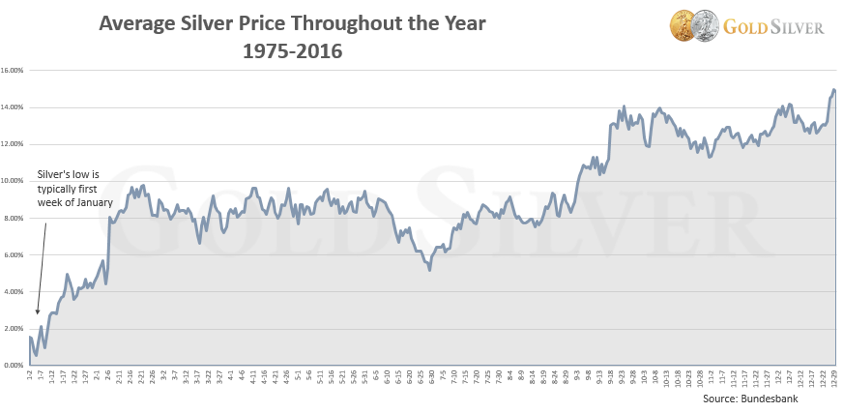

We ran the same data for silver and here’s what we found.

It’s easy to see silver’s higher volatility. What also sticks out is that historically, silver doesn’t come close to touching the prior year’s price.

As with gold, there were certainly years where the silver price fell below where it started. But the historical data says that on average, it rises more often in the following year than it falls.

We are thus much better off buying silver now than waiting for a dip in 2017. If you wait, history says you will likely pay a higher price.

The conclusions here are obvious. While there are always corrections along the way…

- On average, it is cheaper to buy gold and silver the year before.

Whatever you want for 2017, you will likely be better off making those purchases now than waiting until next year.

Combine this data with the current correction and you have the perfect Christmas gift for yourself: gold and silver on sale, with much higher prices coming over the next few years.

Source.

Is It Possible to Take Advantage of a Price Dip Over the Holidays?

The short answer is yes (assuming we get one). While local NZ suppliers are officially closing up shop tomorrow, we do have options available to purchase both local and imported gold and silver. But local gold and silver will only be for purchase in amounts up to $50,000 and these won’t be shipped out until 19 January.

So we’re not actually “closed” over the holidays, there may just be restrictions on what exactly is available for purchase.

If you see a spike lower in the lead up to New Year you can still buy. Just get in touch via phone, email or the website.

If you subscribe to our daily price alert we may still send these out on occasion over the holidays if we see significant moves in the prices of gold and silver. It would not surprise us to see the price pushed back down to the recent lows around NZ$1600. So we’ll let you know if they are. (You can sign up here for that service if you’re thinking of buying over the coming weeks).

This will be our last weekly newsletter until mid January. So we wish you and your family all the best for the holiday season. Be safe on the roads and on and in the water and we’ll see you in the new year!

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

Why India’s War on Cash is a War on Gold, But May Boost SilverTue, 20 Dec 2016 3:59 PM NZST  In this video JS Kim of SmartKnowledgeU discusses Modi’s war on gold, disguised as a war on cash and a war on corruption. He also discusses the latest banker raid on gold and silver, and how low gold prices will go before rebounding. He believes this recent fall in gold and silver will be a […] In this video JS Kim of SmartKnowledgeU discusses Modi’s war on gold, disguised as a war on cash and a war on corruption. He also discusses the latest banker raid on gold and silver, and how low gold prices will go before rebounding. He believes this recent fall in gold and silver will be a […]

|

The World’s Biggest Financial Bubble Is Coming to an End… Here’s How to Keep Your Money SafeTue, 20 Dec 2016 11:35 AM NZST  See how bonds, inflation and commodities might all be in the process of changing trends… The World’s Biggest Financial Bubble Is Coming to an End… Here’s How to Keep Your Money Safe By Justin Spittler Doug’s absolutely right. The bond market isn’t safe. Yesterday, we shared a recent essay by Casey Research founder Doug Casey. […] See how bonds, inflation and commodities might all be in the process of changing trends… The World’s Biggest Financial Bubble Is Coming to an End… Here’s How to Keep Your Money Safe By Justin Spittler Doug’s absolutely right. The bond market isn’t safe. Yesterday, we shared a recent essay by Casey Research founder Doug Casey. […]

|

Doug Casey: “Sell All Your Bonds”Tue, 20 Dec 2016 10:35 AM NZST  Doug Casey gives his thoughts following the election of Trump, not only on bonds, but on property, stocks and gold too… Doug Casey: “Sell All Your Bonds” By Justin Spittler Editor’s note: If you read the Dispatch often, you know we like to share insights from Casey Research founder Doug Casey as much as we […] Doug Casey gives his thoughts following the election of Trump, not only on bonds, but on property, stocks and gold too… Doug Casey: “Sell All Your Bonds” By Justin Spittler Editor’s note: If you read the Dispatch often, you know we like to share insights from Casey Research founder Doug Casey as much as we […]

|

What Might Happen Now After Fed Rate Hike?Thu, 15 Dec 2016 6:45 PM NZST  This Week: Silver Still Outperforming Gold What Might Happen Now After Fed Rate Hike? ‘Bond God’ Gundlach: Trump rally is ‘losing steam’… Gold headed higher The Full Details on Silver Manipulation Exposed Not Long Until the “War on Cash” Comes to New Zealand Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly […] This Week: Silver Still Outperforming Gold What Might Happen Now After Fed Rate Hike? ‘Bond God’ Gundlach: Trump rally is ‘losing steam’… Gold headed higher The Full Details on Silver Manipulation Exposed Not Long Until the “War on Cash” Comes to New Zealand Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |

Pingback: The End of the Year Was a Great Time to Buy Gold and Silver