How China Will Blow Up Australia (and NZ?)

We’ve been keeping an eye on China over the past year or 2 in particular as New Zealand (like Australia but to a lesser extent than them) has its wagon firmly hitched to China in terms of exports.

As Mike Maloney discusses in the video below, Australia is likely heading for some troubles with China making up over 36% of their exports.

He believes that with China’s own real estate boom driving the economy in Australia, now that China is slowing down this will reduce the level of exports to Australia, send Australia into a recession, and pop Australia’s real estate bubble.

He also discusses that while New Zealand is also likely to be in a good position in the long term, like Australia is likely to suffer in the short term. Check out the short 7 min video below and then read on below it for our take on the video and some comparisons to Australia.

Our Thoughts on How China Will Blow Up Australia (and NZ?)?

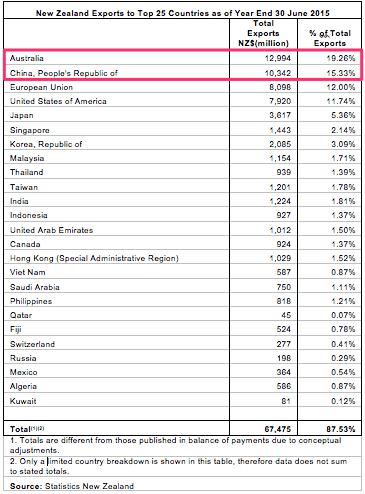

While similar to Australia, New Zealand has some key differences when looking at China. Our exports are not as concentrated to China as those of Australia. We’ve grab some numbers from Statistics NZ as shown in the table below. As of the year ending June 2015 New Zealand had around 15% of its exports going to China (Note: The numbers below only show the top 25 export destinations, but calculated as a percentage of the total exports).

So Australia still remains our biggest trade partner overall with 19%. So we are not as reliant upon China as Australia is. However given Australia makes up a large proportion of our exports, if Australia heads into recession as a result of it’s exports to China plunging, we are likely to feel the impact of that via lower exports to Australia too. i.e. If Australia exports less it will import less as well.

Plus given that between China and Australia, they take almost 35% of New Zealand’s exports, if both are struggling then it’s unlikely New Zealand will escape unscathed.

Animal, Vegetable or Mineral?

Another potential brighter spot for New Zealand is that our exports are primarily agricultural whereas Australia’s are mostly mineral related. Exports of milk powder, butter, cheese, meat, fruit and seafood make up 32% of NZ’s exports. So food is likely to be less impacted than the likes of say iron ore, which is Australia’s main export.

However the plunging milk powder prices over the last year or so are testament to the fact that food exports can still be significantly impacted by global changes in supply and demand.

Will the flow of capital from China slow down?

Like Australia, Canada and many other nations, New Zealand has also seen capital flight from China head here.

So the unknown question is whether a slowing economy in China will see more or less capital leave China’s shores? (Even though there are meant to be strict capital controls upon this, it seems there are still ways around it from what we’ve read).

One angle is that a slowing Chinese economy will mean less money leaving. The other side says we may see more as accumulated capital seeks a safer place to reside.

We’re read arguments for both, so only time will tell.

However overall Maloney’s argument that Australia is likely to head into recession and see its real estate bubble pop, should have New Zealanders thinking closely about what this might mean for markets here.

We think where Australia goes we are likely to still follow. Even if we may be saved some of Australia’s pain. And given New Zealand was recently ranked 5th in the Global House Price Index, New Zealand’s property market, like Australia, may have a long way to drop to revert to the mean.

So a good idea to spread your eggs and be sure to own some financial insurance.

Pingback: Biggest Risk to Auckland and Wellington is a Market Crash - Gold Survival Guide