SILVER COIN SPECIAL TODAY

1oz Perth Mint Silver Kangaroos 2016 BU (Brilliant Uncirculated)

Minimum order 500 coins

500 x 1oz Perth Mint 2016 Silver Kangaroos are

$13,230 ($26.46 per coin)

–

$200 cheaper than 500 Silver Maples

1000 x 1oz Perth Mint 2016 Silver Kangaroos are $26,130 ($26.13 per coin)

– $500 cheaper than 1000 Silver Maples

5000 x 1oz Perth Mint 2016 Silver Kangaroos are $128,000 ($25.60 per coin)

Bonus for 1000 coins or more – more details further down.

(Price includes fully insured delivery via Fed Ex directly to you anywhere in New Zealand or Australia.)

Get a Huge Vehicle Survival Pack Valued at $304 for Free

Free with any order of 1000 or more 1oz Silver Kangaroo coins.

This subscriber only deal (it’s not mentioned anywhere on the website) contains enough gear to spread across 2 vehicles. The pack includes:

- 2 x Inflatable Solar Lanterns

- 2 x 3-in-1 Car Escape Tools

- 2 x Credit Card Knives

- 2 x Credit Card Multi-tools

- 1 x Car Glove Box Survival Kit

- 1 x Vehicle First Aid Kit with Fire Extinguisher

Call David on 0800 888 465 to learn more about this deal or just reply to this email. Note: Minimum order is 500 coins.

This Week:

- The Banker’s Endgame and the Rise of Gold & Silver

- Flash Crash in Silver & a Tale of Two Gold Markets

- War on Cash Down Under Expands – Nano-Chips to Track A$100 Notes?

- Gold and the Blockchain: Gold and Cryptocurrencies Can Co-Exist

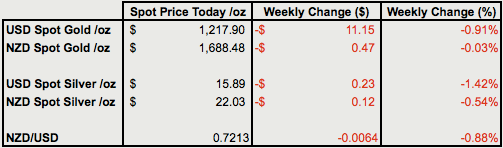

Prices and Charts

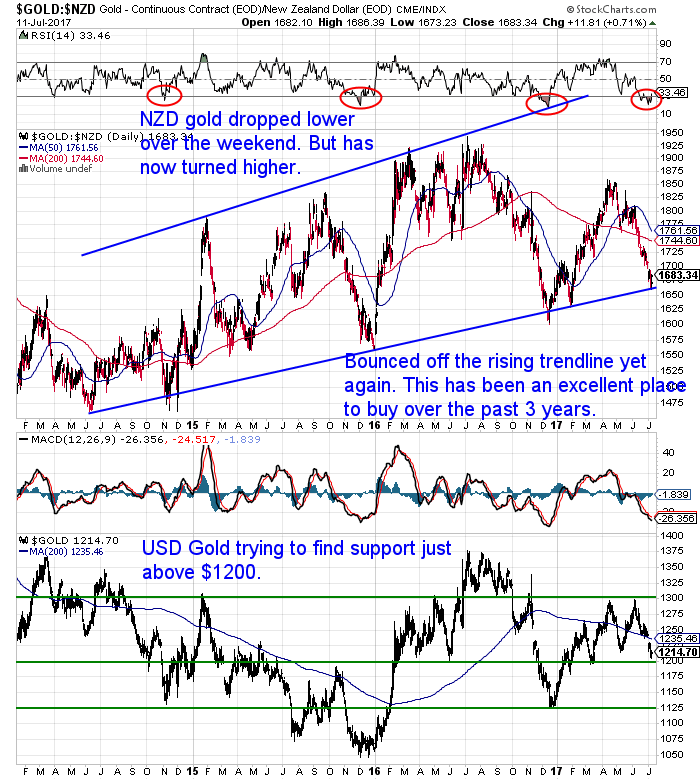

Gold Steady From Last Week

Gold finished largely unchanged from last Thursday. It dipped lower over the weekend as a result of the “flash crash” in silver (more on that to come).

But since then has turned higher.

Significantly gold in NZ dollars looks to have once again bounced off the rising uptrend line. As noted last week this has been an excellent entry point for NZ gold buyers over the past 3 years. Because the line has held and the price then moved higher each time it dipped down to this trendline.

These dips lower to touch the uptrend line have also occurred when the RSI overbought/oversold indicator has been in oversold territory below 30. See the red circles at the top of the chart.

Notice how this has just happened again?

So that makes 2 strong indicators that now is likely a very good to time to buy gold.

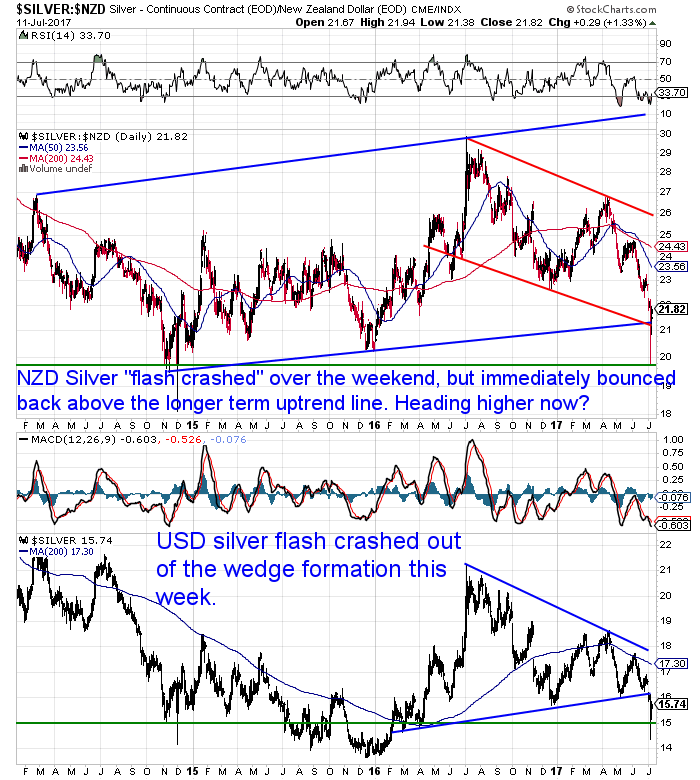

Flash Crash in Silver

The real action this week has been in silver. Overnight on Friday silver plummeted over $1 per ounce or around 11% in less than a minute. But then bounced back to be only a bit lower than it started within the next minute.

The silver chart shows this intraday spike lower quite clearly.

But of significance is that the price bounced back to close on both the short term downtrend line and the longer term uptrend line.

Since the weekend it has edged higher still.

With the RSI indicator barely out of oversold territory, this might finally be the start of the next move higher for silver.

Or it will back-fill the spike lower and look to find horizontal support around the $20 level.

The NZ Dollar has finally turned lower this week, after shooting higher without a rest for 2 months. Overnight in particular it fell sharply giving local gold and silver prices a boost higher today.

Look for it to try and find support at 0.72 initially. But it could have further to pull back in the medium term yet.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

Last Chance to Buy the Gold Dip This Year?

You’ve already read how the gold chart is pointing to now being a very good buying zome for gold.

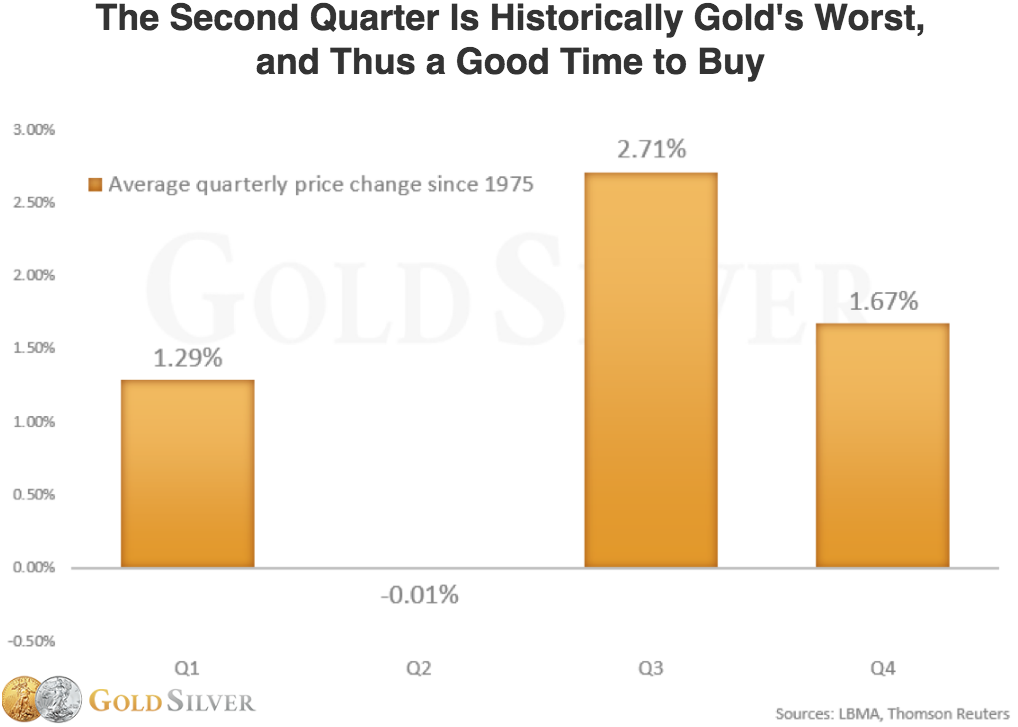

Jeff Clark this week shared some excellent historical data that shows the second quarter of the year is gold’s worst quarter for performance against the dollar. And therefore is the best time to buy gold.

This adds further support to now being a very good entry point.

Of course this data is for US Dollar gold price, so doesn’t take into account the impact of the NZD/USD exchange rate. However it can still show us the general trends for gold and we know from experience there is usually a close correlation for local gold prices.

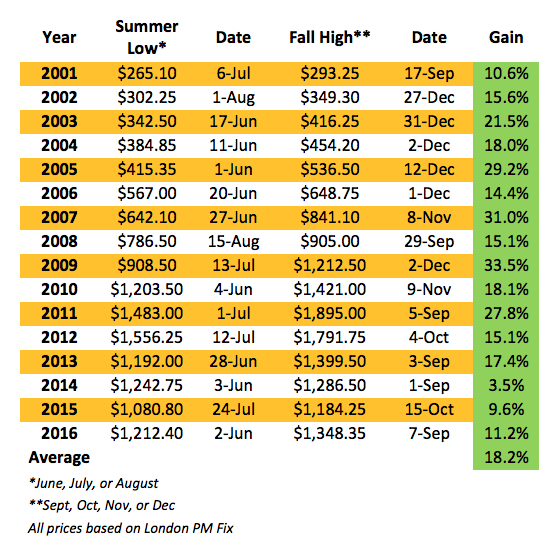

Bear in mind when he says summer he is referring to the northern hemisphere too:

“Here’s gold’s price performance by quarter…

Ah-ha. Since 1975, the second quarter (April through June) has clearly been gold’s weakest. And the strongest period is the third quarter (July through September).

What this means is that…

- You want to accumulate bullion now, when the price tends to be weaker, and before late Q3, when it tends to be stronger.

In the big picture, it’s less about snagging the exact bottom and more about pulling the trigger when history suggests you’re likely to get the best value. That’s how you get the most ounces for your money and ultimately make a profit.

What Summer Buying Can Do for You

Let’s take this idea of buying in the summer one step further…

We identified gold’s summer low for the past 15 years, and then calculated the return to its fall high and its year-ending price. Note that this period covers both a strong bull market (2001-2012) and a devastating bear market (2013-2015).

Check out the returns…

Gold’s Advances From Summer Lows

In every year of both the bull and bear markets, gold was higher later that fall. Not too shabby for short-term performance, eh?

What this data tells us is that while you’ll hold on to your bullion a lot longer than one season, odds are you can snag a great value by simply buying any dip over the next few weeks or so.

Ultimately, no one knows what the gold price will do for the remainder of the year. But gold isn’t just about price, either. It’s about holding one of mankind’s oldest asset—one that has withstood every conceivable crisis over millennia—so that your portfolio has some stability against the current economic, monetary, and fiscal plight our leaders have created.

Stocks, bonds, and any other manmade investment creations can’t provide the same level of protection as gold. Make sure you have exposure to an asset that is made-to-order for our current circumstances.

And history says now is a good time to do it.”

Be sure to check out our latest articles on the website below.

In particular the latest on

the war on cash down under. You’ll see our recommendations for how to prepare yourself for the ongoing crack down against cash.

Call David on 0800 888 465 for a quote or with any questions.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

—–

This Weeks Articles:

|

|

Wed, 12 Jul 2017 11:07 AM NZST

We’ve been writing extensively on the war on cash over the past couple of years. Particularly in relation to what is and may be happening in Australia and New Zealand on this front. In case you’ve not kept up there’s a selection of recent articles further down the page below. But the overriding theme has […]

|

|

|

Tue, 11 Jul 2017 6:09 PM NZST

Here’s some interesting thoughts on gold and the rise of cryptocurrencies, somewhat surprisingly care of the World Gold Council. Ever since BitCoin was invented, comparisons have been drawn with gold, often to gold’s detriment. Charles Morris, chief investment officer at Newscape Group and editor of AtlasPulse.com argues that BitCoin and gold can happily co-exist, while technological advances will ultimately work to gold’s benefit… […]

|

|

|

Tue, 11 Jul 2017 4:57 PM NZST

6 July (overnight Friday NZ time) saw some crazy action in silver prices. In a “flash crash” the silver price plummeted from just above $16 all the way down to the low $14’s in just one minute before bouncing back almost as fast and recouping the majority of the fall. Ronan Manly reported on what […]

|

|

|

Tue, 11 Jul 2017 12:32 PM NZST

It’s been a while since we heard from Darryl Schoon. His latest article looks at how the banker’s endgame is now accelerating. Plus Triffin’s Paradox, trade deficits and how Trump is likely to repeat the errors from the 1930’s. Then finally he discusses counterfeit coins and how to tell the difference between the counterfeit and […]

|

|

|

Fri, 7 Jul 2017 9:56 AM NZST

Wanting Some Great Value Minted Silver Bars? LIMITED STOCK – Just 20 Available Sunshine Minting (USA) 100oz .999 Silver Minted Bars $2483 each pick up (Insured delivery price add $9.20 per 100oz bar) Note: Locally refined cast 100oz bars are $2474 each – pick up (See the end of today’s newsletter for the difference between […]

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

Note:

- Prices are excluding delivery

- 1 Troy ounce = 31.1 grams

- 1 Kg = 32.15 Troy ounces

- Request special pricing for larger orders such as monster box of Canadian maple silver coins

- Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

- Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

- Note: For local gold and silver orders your funds are deposited into our suppliers bank account. We receive a finders fee direct from them. Pricing is as good or sometimes even better than if you went direct.

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

- To demystify the concept of protecting and increasing ones wealth through owning gold and silver in the current turbulent economic environment.

- To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

Copyright © 2017 Gold Survival Guide. All Rights Reserved.