NZ Inflation Rises, Global Risks Mount | Gold Survival Guide Weekly Wrap

Table of contents

Estimated reading time: 5 minutes

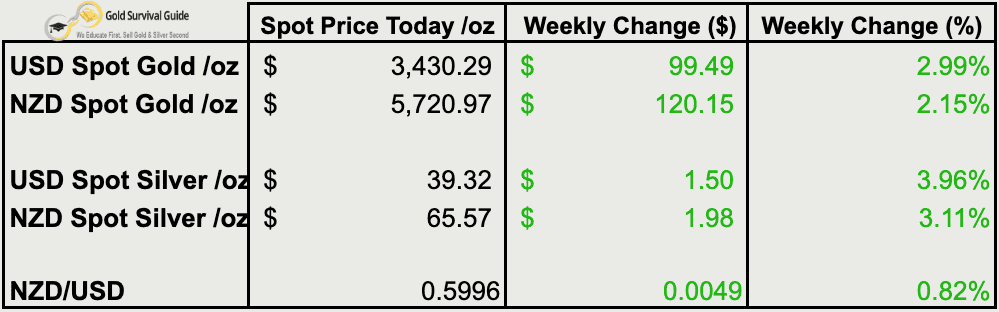

Weekly Price Overview – 23 July 2025

Precious metals extended gains as silver hit another record and the NZD rebounded from last week’s dip.

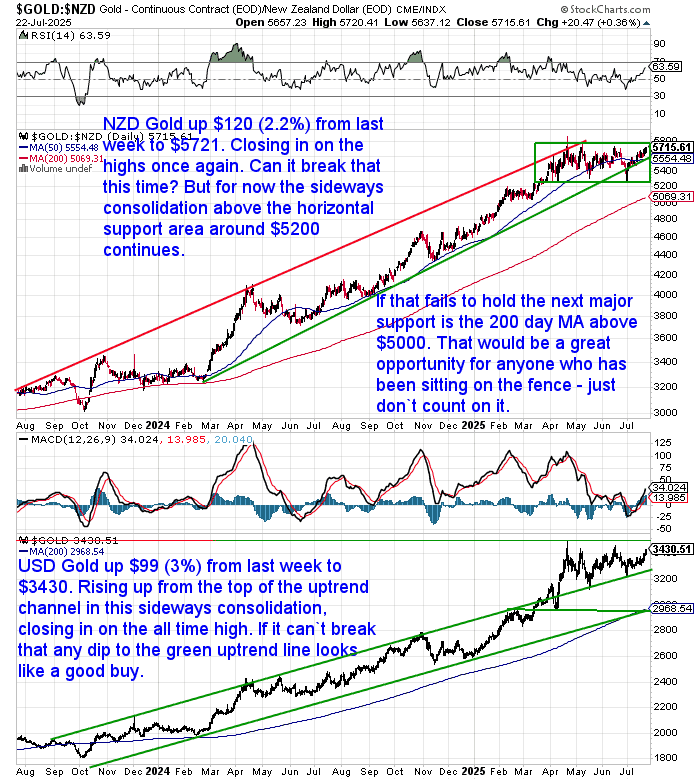

🟡 NZD gold added $120 to $5,721 (+2.15%), testing resistance near its all-time highs as the sideways consolidation above $5,200 continues. USD gold rose $99 to $3,430 (+2.99%), staying near the top of its uptrend channel with $3,450 in sight.

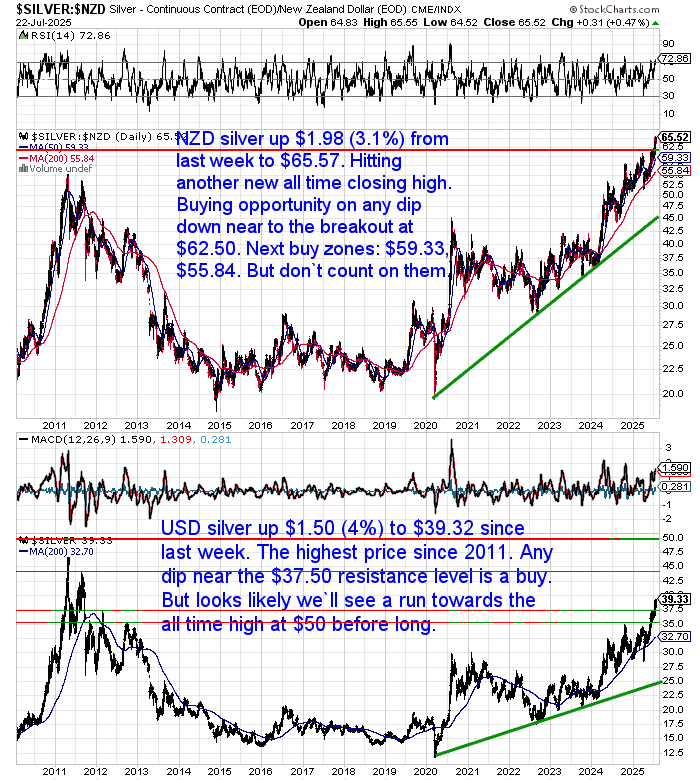

⚪ NZD silver surged $1.98 to $65.57 (+3.11%), hitting a new record high close. Dips toward $62 remain key support zones. USD silver climbed $1.50 to $39.32 (+3.96%), its highest price since 2011 and closing in on the $50 all-time high.

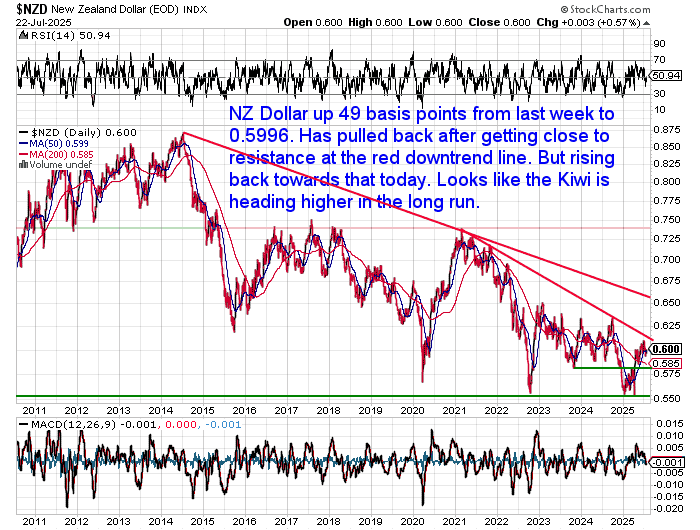

💱 NZD/USD firmed 49 bps to 0.5996 (+0.82%), rebounding after nearing resistance on its long-term downtrend. The Kiwi remains in a multi-year base-building phase.

📈 Both metals remain in strong uptrends. Short-term dips offer accumulation opportunities as silver leads and gold holds key support.

Best Gold for Barter in a Currency Collapse?

With gold above US$3,300 and NZ$5,500, could you actually use it in a currency collapse?

This week featured article covers:

✔ Why big bars may be impractical for trade

✔ The smaller gold coins & bars that work in real-world barter

✔ How to build a “Plan B” gold stack ready for anything

Inflation Rising: Blip or Start of a Cycle?

This week RNZ reported:

“Inflation predicted to hit 12-month high for June quarter”

ASB sees CPI topping 3% in Q3 but expects it to ease later, with an OCR cut likely in August. i.e. “inflation will be transitory”. Haven’t we heard that before?

But we think both global and historical signals might tell a different story.

NZ Inflation Ticks Higher

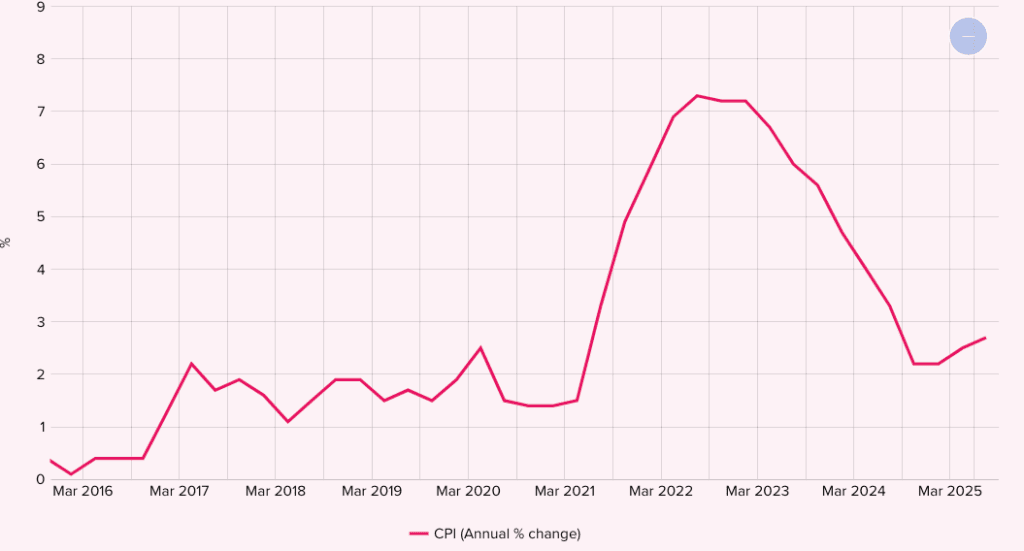

NZ inflation has turned up again after bottoming at 2.2% in Sept 2024.

RBNZ and Analysts: Too Optimistic?

RBNZ sees tariffs as disinflationary, and ASB expects a further interest rate cut soon. But could global pressures prove these forecasts wrong?

Global Inflation Expectations Rising

Tavi Costa warns:

- Surging US money supply

- Commodities broadly moving higher

- USD on track for worst year since the 1970s

📈 US Inflation Expectations – Breaking a multi-year downtrend

And this week Ray Dalio added his own warning:

“It’s virtually certain monetary tightening won’t come soon. History shows governments rarely defend the value of money until inflation pain becomes intense… perhaps not even then.”

He notes:

- USD down 5% vs major currencies, -27% vs gold, -45% vs Bitcoin in the past year.

- US stocks at record highs = “money is easy.”

His takeaway?

“Keep betting on weak money: the dollar going down and low or falling real interest rates.”

History Lessons: NZ’s 1970s CPI Peaks

The RBNZ’s long-term data shows three inflation peaks above 15% in the 1970s.

Chart of the Week: NZ CPI Long-Term – Could history rhyme?

Even if the RBNZ sees tariffs as disinflationary, we’re still wondering if this is instead the start of another multi-year inflation cycle?

If inflation pressures persist, what does your wealth protection strategy look like? Gold and silver have historically acted as insurance in times like these. Shop gold and silver deals here.