Prices and Charts

Gold Pullback Kicking Off?

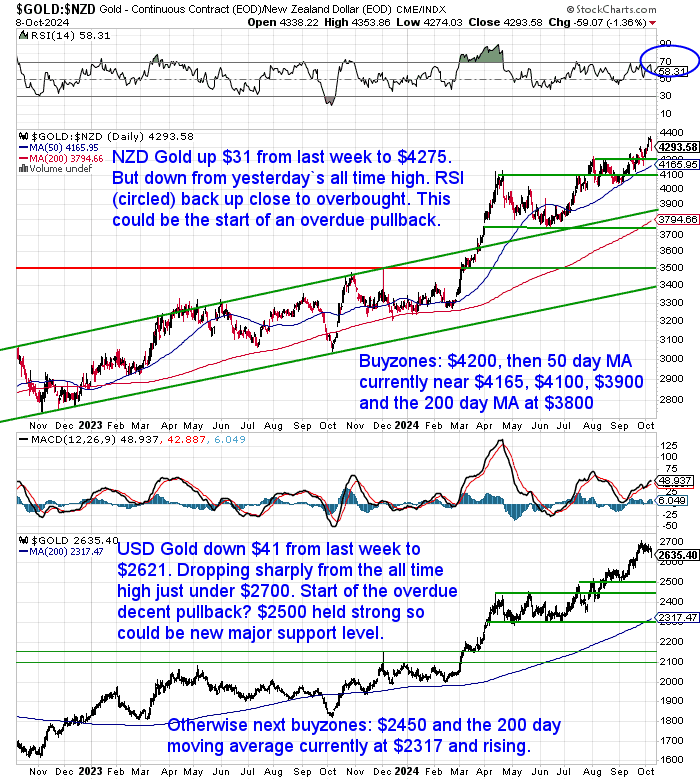

Gold in New Zealand dollars was up $31 from a week ago to $4275. But it is down $40 from yesterday’s all-time high of $4318. This could be the start of an overdue pullback. Buying zones to watch for are listed in the chart.

In USD terms gold was down $41 from a week ago to $2621. It dropped sharply today and so this could be the start of a decent pullback. There could be a serious buying opportunity approaching if you have been sitting on the sidelines. $2500 is looking like a major support level. Next buy zones below that are marked on the chart.

With articles like this one appearing in mainstream US news, these are indicators gold is due a pause: CBS: 4 signs you should invest in gold now

Silver Likely to Follow

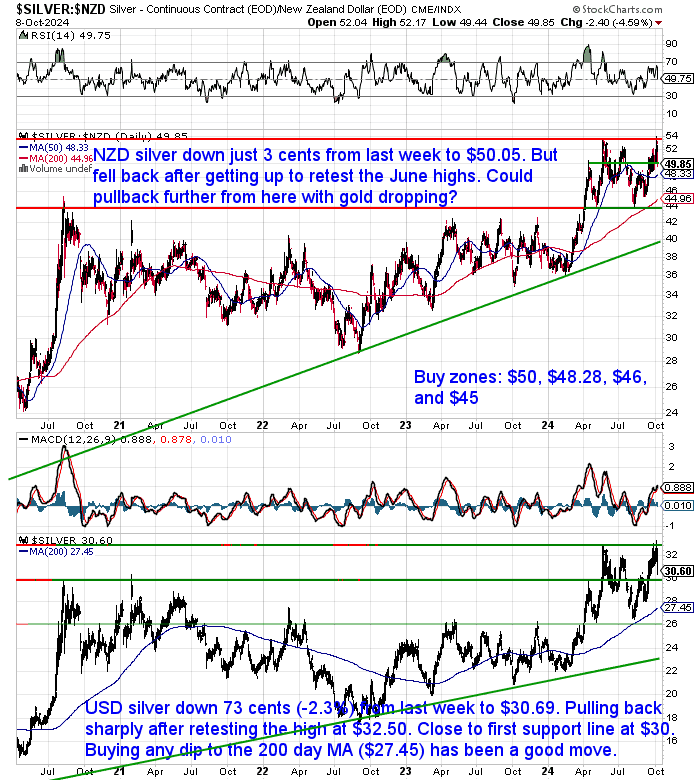

NZD silver got back up to retest the June highs in the past couple of days, before pulling back sharply overnight. So it is only down 3 cents from a week ago to $50.05. With gold looking likely to dip lower in the short term, silver will likely follow. We are down to our first buy zone at $50 already. The 50-day MA is at $48.28 and the 200-day MA at $45. Silver could drop all the way to 44 and still be in the uptrend. Although we’d be surprised to see it go that low.

While in US dollars, silver was down 73 cents or 2.3%. Pulling back sharply overnight after retesting the high at $32.50. Already down close to the major support line at $30. The 200-day MA (currently at $27.45) looks like a very good buying opportunity if it arises.

Kiwi Dollar Retesting Breakout

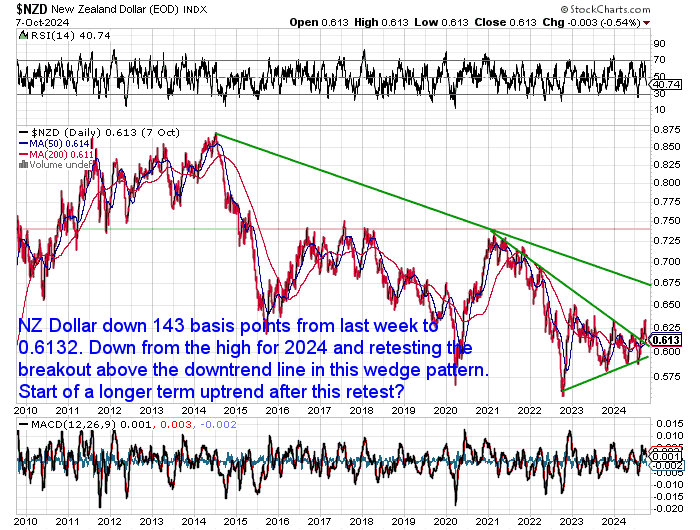

The New Zealand dollar was down 143 basis points from last week to 0.6132. It has pulled back from the high for 2024 and is retesting the breakout from the wedge pattern. So once this pullback is over our guess is this is the start of a longer-term uptrend in the Kiwi.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver’s Potential: Could it Outshine Gold?

Silver often plays second fiddle to gold, but its unique properties and potential for growth make it an intriguing investment. Lately it has been outperforming gold too. So this week, we look into the factors that could propel silver’s value beyond gold.

Discover:

- The industrial uses of silver that drive demand

- How silver’s supply dynamics might impact its price

- Whether silver’s historical performance suggests a potential for outperforming gold

Silver’s time might have come. Don’t miss this in-depth analysis.

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

Russian Government to Add Silver, Platinum and Palladium to Its Reserves?

One thing we don’t mention in the above article is the impact of government’s adding silver to their reserves assets…

Russia reportedly plans to add silver and boost its gold, platinum, and palladium holdings in its state fund next year.

This would be the first time Russia has held silver in its state fund.

According to an Interfax report, the 2025 budget calls for an allocation of 51.5 billion rubles to buy precious metals and gemstones. This is a 32 percent increase from previously announced budget plans.

How much silver Russia plans to include in its precious metals strategy remains unclear.

Source.

Here’s a link to a Jerusalem Post article on the topic. We’ll have to wait and see how legit this is. But a major nation adding silver to its reserves would be a significant move.

RBNZ Please Save Us!

Calls are ringing out for the Reserve Bank of New Zealand (RBNZ) to “save” the New Zealand economy and deliver a hefty rate cut today. By the time you read this there may have been a 50 basis point or half a percent cut announced.

Here’s just a splattering of the headlines we observed today:

The RBNZ Is In Focus This Week – The Kiwi Economy Requires Rate Relief, Quick

Read more

‘Economy is cratering’: Call for 1.5 percent official cash rate cut by Christmas.

Read more

A super-sized interest rate cut by the Reserve Bank looks increasingly certain this week as economists and financial markets push for a quicker reduction in borrowing costs.

Read more

Cutting Rates: A Band-Aid for a Self-Inflicted Wound

But of course the central bank doesn’t save the economy. It is doing exactly what it is designed to do! Which is to get us all deeper into debt with the commercial banks by buying non-productive assets and selling them to each other at ever higher prices!

Praising the reserve bank for cutting rates is a bit like applauding someone applying first aid to the victim they just purposefully stabbed 10 times in a row!

ASB: CPI Inflation Risks “Undershooting”

ASB expects a:

“…50bp cut by the RBNZ today but note that it is another close call (OIS markets have priced 45bps of cuts). The case for quickly normalising OCR settings has grown given the softening inflation and labour market outlook. Inflation pressures look set to shrink very soon, with the risk that CPI inflation risks undershooting the 1- 3% inflation target midpoint. Moreover, the soft economic outlook looks set to push the unemployment rate steadily higher (potentially above 6% by mid-2025). The largest regret now facing the RBNZ will be not cutting the OCR quickly enough. More OCR cuts now could mean a less sharp and protracted easing cycle further down the line, but we will have to wait and see.”

But We Say…

At the risk of sounding like a stuck record, the undershooting of inflation isn’t the risk. In our view it is rather inflation roaring back again.

This chart from Tavi Costa shows that:

“Inflation expectations have steadily risen since the Fed’s decision to cut interest rates.

It is also fascinating that the 5-year breakeven rates have nearly perfectly bottomed out after retesting what was once a major resistance level, which we now view as historical support.”

Source.

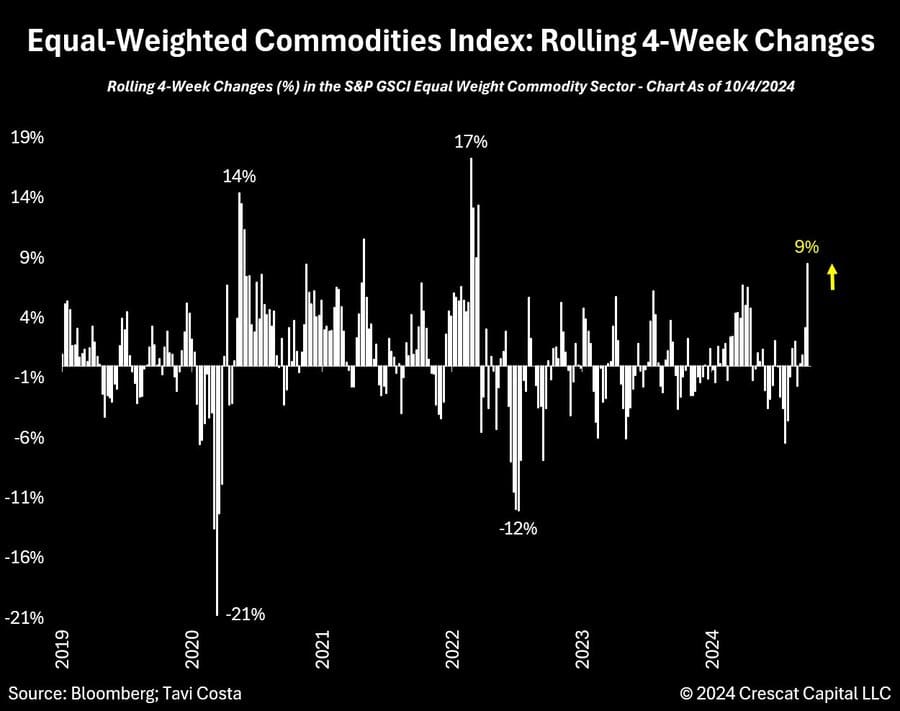

Tavi also points out that:

“We have just seen the largest increase in commodity prices since the period surrounding the Russian invasion in mid-2022.

In our view, this further demonstrates that inflation remains deeply entrenched in the system.

It’s somewhat ironic that this rise is occurring just as the Fed chooses to loosen its monetary policy, particularly after policymakers assert that they have seen progress in addressing rising consumer prices.

We believe that the suppression of the cost of debt in a highly inflationary environment creates an ideal macro setup to benefit hard assets like commodities, which continue to be historically underallocated by most investors.”

Source.

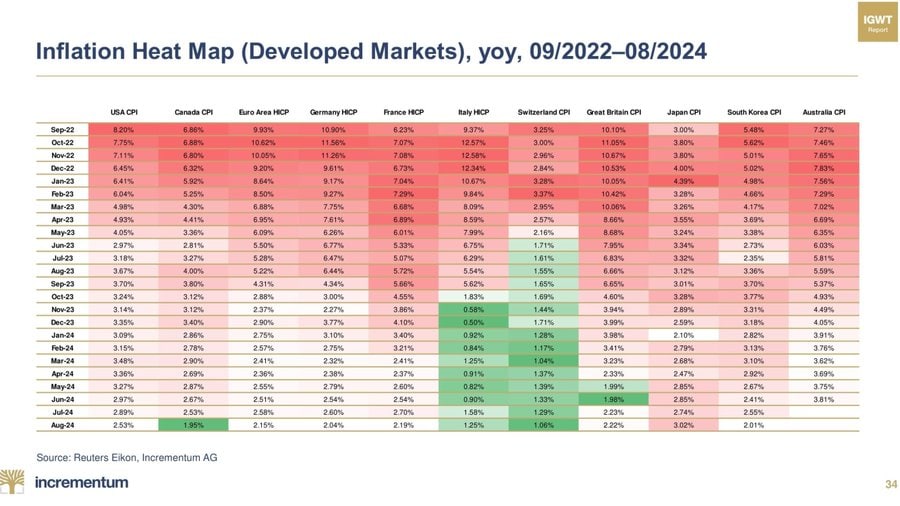

Add to that the latest inflation heatmap from In Gold We Trust Report:

“Our Inflation Heat Map for developed markets now includes green squares for Italy, Canada, and Switzerland, but we heed a warning… the battle against inflation has not been won.

Drastic rate cuts by central banks could be a fatal error, as many of our indicators show that inflation could quickly return with a vengeance. The next wave of inflation could be devastating, catching hapless central bankers by surprise.”

Source.

Short term: We’d say watch for a pullback in gold especially from here. But use that as a buying opportunity. As long term, this will simply be a pause at the start of the next leg up in precious metals.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

|