Today we have a very informative article from an aquaintance of ours who publishes some great information on “Crisis Investing”. We follow J.S.’s thoughts closely and highly recommend his newsletter especially if you are interested in some very close guidance on investing in the stock market with far more detail that virtually any other newsletter around. Read more about him at the end of the article… The Current Stage of the New Zealand Real Estate Cycle By JS Kim.

All real estate cycles, no matter in what country they occur, can be evaluated within the framework of the monetary policies undertaken by its Central Bank. By understanding a Central Bank’s monetary policies, one can understand the risk/reward setup of the real estate market in one’s country.

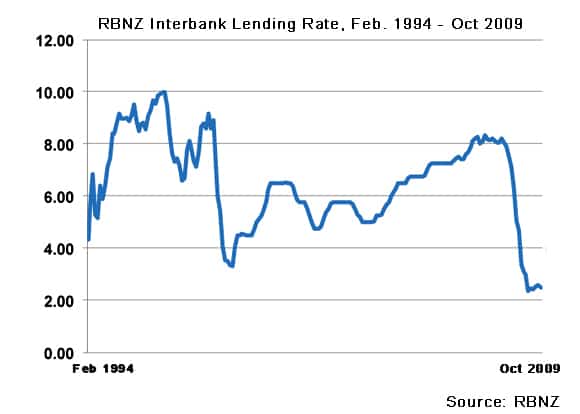

Today, I am going to evaluate New Zealand’s real estate market within the framework of the Reserve Bank of New Zealand’s monetary policies over the last decade or so. In recent years, the Reserve Bank of New Zealand (RBNZ) has drastically cut their interbank lending rates in line with other world leading central banks such as the Bank of England and the US Federal Reserve. Housing prices peaked in late 2007, spurred by cheap credit that the RBNZ had made available since December of 2001. In response to a growing housing bubble and in order to rein in malinvestment in the real estate market, the RBNZ pumped up interest rates to 8.28% in August 2007.Housing prices dropped due to the RBNZ’s monetary policies, and from a high of 8.33% in November 2007, the RBNZ started slashing interest rates again – a whopping 15 times from the high watermark level just a couple of years ago to its current October 2009 interbank lending rate of 2.49%!

Above, I’ve charted a history of the RBNZ’s monetary policy from February of 1994 to October of 2009 since understanding its monetary policy is often easier to do in a visual format. The RBNZ established interbank lending interest rates of 4.32% in February 1994, then increased this rate by more than 100% to 10.00% by October 1996, then slashed rates 67% to 3.30% by February 1999, then almost doubled them again to 6.50% by January 2001, then dropped them to 4.75% in December 2001, then tremendously hiked them to 8.33% by November 2007, and finally drastically slashing them again to a record low of 2.49% by October 2009.These wild swings in interest rates are not healthy, not promotional of economic growth, and certainly not indicative of interest rate patterns that would predominate in a free market where supply and demand set interest rates. So why does the RBNZ engage in interest rate decisions that seem to be more the work of a madman than somebody interested in promoting sustainable growth?

The answer is simple. Because the whole monetary system is fraudulent and unsound (a topic for another day), the RBNZ is forced to follow the lead of the European Central Bank and the US Federal Reserve or perhaps cause irreparable damage to the New Zealand economy. If these Central Banks act foolishly and irresponsibly, then often other Central Banks have no choice but to actively embrace similar policies. Former US Federal Reserve Chairman Alan Greenspan stated that the foolish actions of the US Federal Reserve in the 1920s almost caused the entire global economy to come crashing down. Today, the same shenanigans are once again occurring. If one can not see that the RBNZ is responsible for every real estate and stock market bubble and crash in New Zealand by way of their unnatural, interest-rate manipulations, one merely needs to study Austrian theories of money and credit to understand this process. In very simple terms, this is how the process works.

When a flood of cheap credit is deliberately made available to investors by the RBNZ, as was the case from the beginning of 2002 through the end of 2004, this cheap credit creates much more liquidity than would be dictated by free market conditions. In turn, investors funnel this excess liquidity into real estate markets, thus creating massive distortions in prices above and beyond fair market values. In response, the RBNZ tightens interest rates (as happened from 2005-2007), causing malinvestment to cease and consequently, markets to correct or crash. Distortions are sold by Central Banks as “growth” and returns to fair market valuations are sold by Central Banks as “crashes” when neither explanation is honest or correct.These are not mechanisms of a free market but mechanisms of interferences by Central Banks into free markets – a huge and very important distinction that is not understood nor appreciated by the great majority of investors. Central Banks also use this same free market manipulation and intervention scheme to manufacture artificial rallies in stock markets to sell the public on the idea of recovering economies when in essence, such “recoveries” are merely illusions that are destined to crumble.

This cycle brings us to the present day situation in the New Zealand real estate market, where the following was reported in early November 2009:

“New Zealand house prices advanced for the first time in 16 months in October, with a lack of houses for sale driving prices higher. Government agency Quotable Value’s residential house price index rose 0.2 percent in the year to October, compared with a 1.1 percent decline in September. It was the first increase in values since June 2008 but the trend in property values has been improving now for seventh straight months. The agency said market activity was well below spring levels, and the price was driven higher by buyers competing for a lower-than-usual number of listings.”

In Auckland and Wellington, housing prices respectively increased 2.5% and 1.6% in October 2009 from the same period a year prior. In Auckland, average home sale prices reached a 22-month high in October 2009. In response to these “improving” signs, Peter Thompson, managing director of Barfoot & Thompson, stated:

“It is a sure sign Aucklanders have shrugged off their concerns about the future, and are moving forward with their plans around home ownership. We’re seeing a slow, but steady, appreciation in sale values and we’re now back to the prices being fetched in the corresponding period in 2007 when the median was NZ$351,500.”

However, one must always evaluate any rise in real estate prices within the framework of the purchasing power of the New Zealand dollar as the media always reports new highs erroneously in terms of absolute amounts of dollars but never in the context of inflation-adjusted dollars.The RBNZ, from October 2007 to October 2009, dramatically slashed interest rates, thus deliberately weakening the New Zealand dollar by approximately 33% against gold (one of the only sound currencies in the world) in just two years time!

Thus the “recovery” in New Zealand housing prices, due to the monetary policies of the RBNZ, ultimately created a loss in terms of real wealth for all New Zealanders and is merely an illusion. Remember, if “recoveries” are not a process of free markets, but are instead artificially manufactured by Central Banks by devaluing currencies, one can be left with MORE money that can purchase LESS – this is a loss, not a gain, in terms of real wealth. In fact, when measured in terms of gold, even though Peter Thompson has claimed that the prices in October 2009 have now recovered to the equivalent median home prices of September 2007, it is not the amount of New Zealand dollars that you own that is important as I’ve just explained but it is what these dollars can buy. In terms of gold, in October 2009, these equivalent New Zealand dollars will now buy you 33% less gold than they would have in October of 2007. Consequently, a more accurate method of interpreting this recovery is in terms of gold and not in the absolute amount of New Zealand dollars. If one looks at this real estate recovery in terms of gold, one will realize a 33% loss of one’s wealth despite median real estate prices returning to their October 2007 levels.

Currently, if the RBNZ keeps its word, interbank lending interest rates will remain at a record low 2.5% until the second half of 2010. Thus, given that this occurs, it would not be surprising to see property values in New Zealand continue to rise into the end of the year and the first half of 2010 and possibly throughout 2010 before the bubble bursts. However, much of the sustainability of the re-inflated New Zealand housing bubble will depend on the stock market bubbles in Europe, the US and China growing larger as well. If the illusion of these bubbles burst first, then the jig will be up. However, due to foolish and unsustainable monetary policies undertaken by the US Federal Reserve, there is a good chance that serious damage to the US stock market rally will not happen until sometime after this year.

Because there are so many moving parts that determine daily price movements in real estate markets, I would have to follow New Zealand real estate markets daily and update my opinions daily about when I believe the New Zealand real estate market bubble is set to burst. However, I can tell you, beyond a shadow of a doubt, that the RBNZ’s monetary policies have created tremendous malinvestment in the New Zealand real estate markets (money inflow into real estate that would NOT happen under free market conditions). In turn, this malinvestment has created great distortion in real estate market prices. These distortions will also probably become greater before correcting back towards fair market valuations.

This is not a knock against the RBNZ, but against ALL Central Banks. Central Banks never create any sustainable benefit to any party except the elite bankers of its nation. If you think this sounds conspiracy tinged, know that former Vice Chairman of the US Federal Reserve, Alan Blinder, in 1994, stated, “the last duty of a Central Banker is to tell the public the truth.” I think that the New Zealand real estate market has a little more wiggle room to move higher if one is already invested.However, the risk-reward setup is terrible, in my estimation, for anyone seeking to enter real estate in New Zealand today. Understand the above artificial boom-bust cycle that Central Banks create as I have described it above, and you will understand, if you are currently invested, when to exit the New Zealand housing market in the future before it crashes.

As you ponder the New Zealand real estate market’s future, always keep close to your heart and mind the following statement by John Maynard Keynes, the father of the modern day economic system instituted by all developed governments today: “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose. (1919)”

If you understand this concept that less than one in a million understand even today, you should be able to use the policy decisions of the RBNZ to avoid getting hurt by the inevitable real estate market fall that is likely to happen sometime in the next year or two.

About the author:

J.S. Kim is the Managing Director & Chief Investment Strategist of SmartKnowledgeU™, a financial and research consulting company that offers hard-hitting investment guidance to help investors prosper during the ongoing and continuing global financial meltdown. His investment newsletter, the Crisis Investment Opportunities newsletter, has not suffered a single down year since its launch, returning +23.78% in just six months in 2007, +3.21% in 2008 and returning 37.54% YTD as of the end of September 2009. For more information, please visit http://smartknowledgeu.com

Pingback: Marc Faber: The dollar to go up short term but go to zero in 10 years | Gold Investing Guide

Pingback: An Unbelievable Investment Opportunity in Gold | Gold Investing Guide

Pingback: Could NZ house values drop by 80%? | Gold Investing Guide