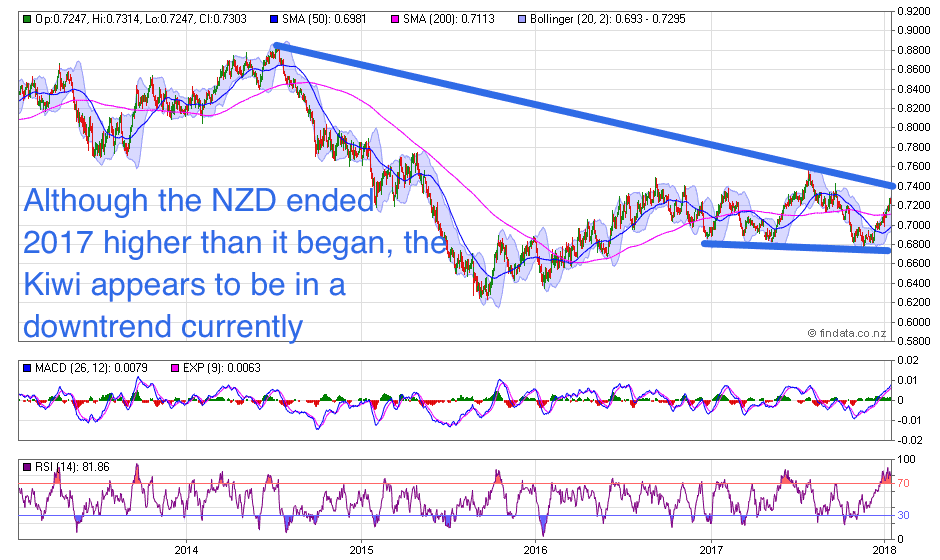

In our predictions for 2018 (made in the 2017 in Review and Punts for 2018 article) we said:

“The New Zealand Dollar will end the year lower than the US Dollar this year. In 2017 it was so only the rally at the end of the year that saw the Kiwi Dollar end the year higher. We think the dollar is actually already in a downtrend and the current rally is likely just a short term move before the longer term downtrend resumes.”

Here’s an article that we just came across on the Aussie dollar that also discusses the likely movement of the NZ Dollar this year. It supports our theory that we will see a weaker NZ Dollar this year.

The End of the Strong Aussie Dollar

First published at marketsandmoney.com.au

Did you know the third Monday of January is called ‘Blue Monday’? And that it’s claimed to be the most depressing day of the year? Apparently, it’s the day most people come back to work after Christmas.

Whether true or not, forex observers bullish on the Aussie dollar may indeed be feeling a little blue.

In my view, I think it pays to watch what the Aussie dollar does this year. Most mainstream analysts are tipping the Aussie dollar will remain high in 2018.

It’s easy to understand why they say that. The Aussie dollar has had a strong start to the year. However, it may be more cyclical than anything to do with the underlying strength in the Aussie dollar.

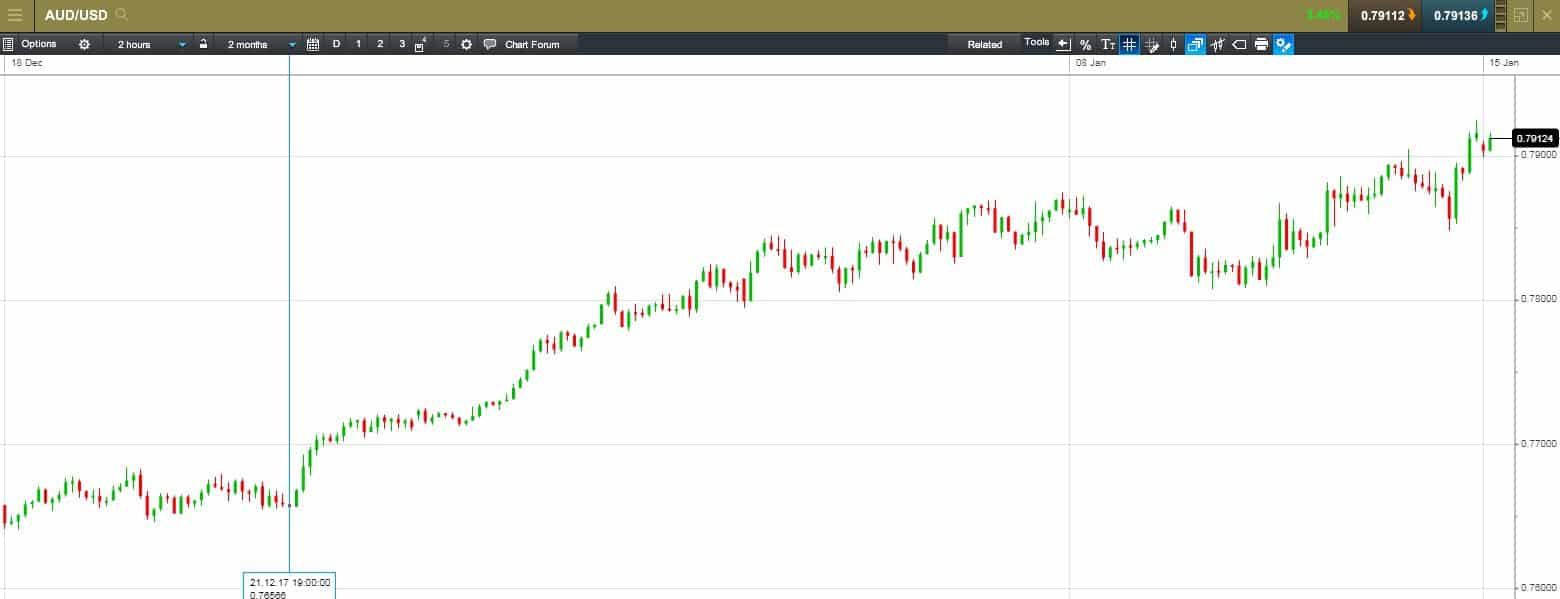

The rally in the AUD began a week before Christmas last year. The AUD/USD exchange rate was at US$0.7656 on 21 December. As at this morning, it’s trading at US$0.7912. A gain of 3.34% in just four weeks.

AUD/USD — Two hourly/60-day chart

Source: CMC Markets

Not a bad way to start the new year. But the rise may come as a surprise to some.

After all, the US Federal Reserve Bank raised the cash rate to 1.50% last December. Locally, the Reserve Bank of Australia held the cash rate at 1.50%.

Normally, the US and Australia having the same interest rate would spook the markets.

That’s because of something called interest rate parity. Essentially, this means that there’s little incentive for foreign capital to invest in Australia. If both countries offer the same cash rate, investors are more likely to stash their cash in the US rather than Australia, which is perceived to be a slightly riskier currency.

Commodity prices help the Australian Dollar

In spite of this, the Aussie dollar is getting a boost from stronger commodity prices. Recent price rises have helped push the dollar higher. Australia is a major exporter of copper, zinc, lead, iron and silver. As the value of these commodities started rising towards the end of 2017, it took the Aussie dollar up with it.

Head of FX Strategy at National Australia Bank Ray Attrill suggests we shouldn’t get comfortable with the strong Aussie dollar, saying:

‘Seasonality is also supportive of further commodity price gains in January. The CRB index has a tendency to rise at the start of the year. The Bloomberg heat map shows positive returns in eight of the last ten Januarys. If history repeats, the AUD is likely to continue drawing support from commodity prices in coming weeks.’

CRB Core Commodities Index

Source: Pound Sterling Live

[Click to enlarge]

From the chart above, going back a decade, you can see that commodity prices have a consistent track record of rising more in January than in any other month. In fact, in the past decade, only twice has the value of the core commodities fallen (in 2010 and 2015). And both times, those falls related directly to Chinese government spending.

This is something Atrill points out. In his recent note, he mentions solid manufacturing data from the Middle Kingdom is likely to support the rise of commodity prices for now, while warning about the longer-term prospects:

‘Looking further out, we still contend that commodities will be less AUD-supportive over the course of 2018. The relationship between China’s growth and commodities demand versus China’s monetary conditions works with a lag and the full impact of tighter conditions over the past few months have not yet worked through.’

While Atrill is cautious about the Aussie dollar’s outlook for the year ahead, the Big Four Aussie banks reckon the currency will hover around the mid-70-cent range.

In contrast, Hans Redeker, head of FX Strategy over at Morgan Stanley, says the Aussie dollar is similar to the Canadian and New Zealand dollar. He says the three currencies have seen years of economic growth out pacing income growth. He told markets last week:

‘The dominance of US rates in determining global funding costs resulted in local funding costs remaining inappropriately low, given the local needs of these economies, leading to a leverage boom.

‘Now, as these economies are running out of balance sheet leverage space, which reduces their growth potential, the US is pushing nominal rates gradually higher, creating further headwinds.’

Redeker is saying that these three currencies have risen much higher in value than they should have. And that people should be aware that all three are likely to weaken against the US dollar now that the Federal Reserve Bank is getting ready to increase interest rates again this year.

Because of this, Redeker forecasts that the Aussie dollar is going to tumble below 70 US cents. That would mean that the Aussie dollar’s rally is likely already over.

Kind regards,

Shae Russell,

Editor, Markets & Money

GSG Editors Note:

An environment of a weakening NZ Dollar is of course a good time to hold precious metals to protect your purchasing power.

For more help on when to buy precious metals check out: When to Buy Gold or Silver: The Ultimate Guide

Read more – Latest update on the falling NZ dollar: NZ Dollar Falls – Why is the NZ Dollar Weaker and Where to Now?

About the Author

Shae Russell

Drawing on her extensive experience, Shae is the lead editor of Markets & Money. Each day, Shae looks at broad macro trends developing around the world, combining them with her distaste for central banks and irrational love of all things bullion.