This week:

– A Lucky Call

– Whats different about the highs in gold in NZ dollars over the past 6 months?

– Silver to rise even more from here?

– Got a question on Gold or Silver?

– This weeks articles

It’s been a bit of a slow news week this past week. We usually come across a few things over the course of a week and have trouble working out what to leave out of our weekly updates.

But it seems we have the opposite problem this week, with a struggle to work out what to comment on instead. So we thought we’d just kick off with some more detail on some Gold charts.

A Lucky Call

We were pretty well on the money with our thoughts last week that gold in NZ dollars looked ready to break out above the 50 day moving average. You can see in the chart below that the day after we wrote this, the price did spike up and close above the 50 day moving average (blue line). It then continued to rise up to around $2160. Over the past couple of days the price has fallen away again. It may return back close to the 200 day moving average again at just below $2100. So it could be another chance for us NZers to grab some more gold at a lower risk price. Then again it may not!

The other thing we notice from the chart is that since the price bottomed out at New Year, we have seen a series of higher highs and higher lows over the past 2 months. Shown by the green circles in the chart. This is often also a positive sign in a consolidating chart.

(Click on all charts to enlarge)

If we now look at a 3 year chart instead you can see that dips below the 200 day moving average have usually been just a very brief spike down. With June to November 2009 the only time in the last 3 years the price spent more than a few days at any one time below the 200 day moving average.

The current correction has also only spent a few days below the 200 day moving average. However unlike most times in the past few years it also hasn’t bounced strongly higher yet either. Why is this and how long will it last? Who knows? But our guess is it won’t last forever and in a couple years it will look like a pretty good price. We’d be quite happy if the price just continued to meander up like this for a while yet.

Whats different about the highs in gold in NZ dollars over the past 6 months?

A thought sprang to mind yesterday morning while watching the breakfast business news. The announcer commented that the NZ dollar to US Dollar exchange rate was back close to 85c.

So why did we care what a mainstream news broadcaster had to say about exchange rates?

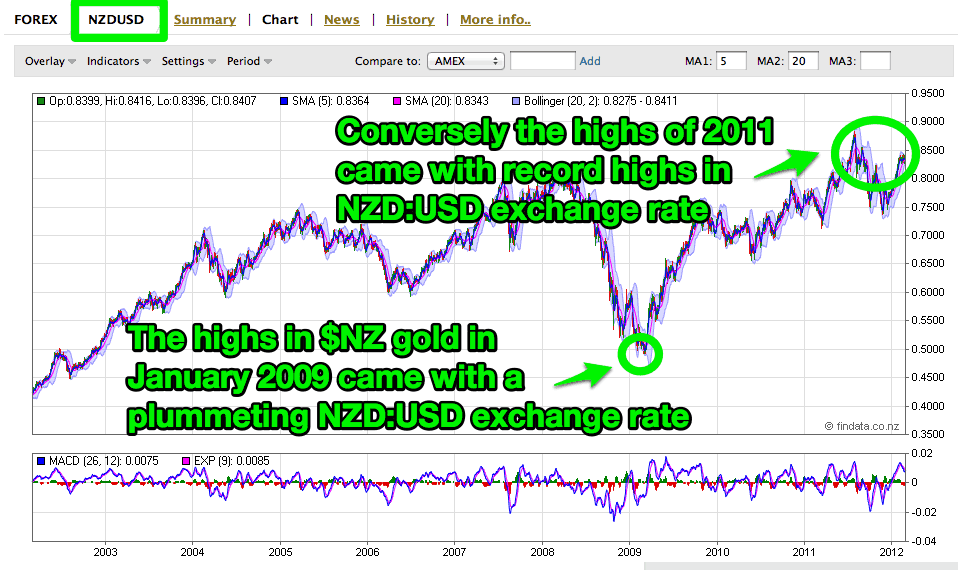

Well, we didn’t care at all. But it made us cast our mind back to January 2009 when NZ dollar priced gold was hitting new highs of about $1950 an ounce. And the fact that the NZD:USD exchange rate was plumbing news lows of just under 50c. See the NZD:USD chart below…

So what?

Well, contrast this with the highs of late 2011, which came in on the back of a record high NZD:USD exchange rate. Even with a record high dollar we’ve still got record high NZ dollar gold prices.

Yet again, so what you may ask? Stick with us.

On the same news program I heard them comment that while the high NZ dollar might be tough on exporters, it was shielding us consumers from the rising oil price. But is it really?

You see the news broadcasters make the mistake of comparing “elastic measures”. While our dollar might be high against the US dollar, it has lost value over the past 2 years in comparison to gold. So if you were just sitting in NZ dollars your buying power of US based products has improved somewhat over this time. But if you held gold here in NZ it has really improved.

Late Update: Silver to rise even more from here?

We wrote most of this email last night but as you may have noticed gold is up again overnight and silver has rallied massively overnight. As we finish writing the spot price of silver in NZD is $44.18 an ounce. Interestingly this is just above the 200 day moving average where NZD silver hasn’t been since September last year.

James Turk at KingWorldNews said yesterday

“…I have mentioned several times my expectation that once resistance at $35 is taken out, silver will climb to $68-$70 in 2 to 3 months. I still expect that outcome, but of course, only time will tell. I thought it might be tough going for silver in the $35-$36 area, but maybe not based on the strength we are seeing today.”

But regardless, Eric, I expect the silver price will begin to accelerate to the upside once $36 is hurdled. In many ways silver is positioned today like it was back in the summer of 2010. Long-time KWN listeners will remember the events from back then and my bullish views about silver. I feel the same way today.”

So it will be interesting to see what develops in Silver over the coming weeks. In NZ dollar terms will it power on above the 200 day moving average or will it turn back form here?

This weeks articles:

We’ve got 2 articles and a video for you this week. The video is a very interesting run down on the story of the Hunt brothers massive purchase of silver in the 1970’s. If you haven’t read too much about that then this could be a few minutes well spent on some silver history.

https://goldsurvivalguide.co.nz/the-real-hunt-brothers-silver-story/

The first article is If Gold Could Talk. If you’ve ever had any doubts about how gold should be performing then this is worth a read.

The other article has some more thoughts on why it may be that Warren Buffett is so negative on gold.

Got a question on Gold or Silver?

David is online during most of the day for a live chat on any questions. Otherwise, just leave your question and he’ll answer it ASAP. Just click the “Live Chat” Icon that floats down the right hand side of the screen.

As always if you’d like a specific quote you can get hold of David by: 1. Email: orders@goldsurvivalguide.co.nz 2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form and full product list Have a golden week!

Glenn (and David).

Founders

Gold Survival Guide

This Weeks Articles:

2012-02-26 04:55:06-05

Two weeks ago we had some thoughts to make on Warren Buffett’s negative comments on gold in our article, Confusing Investing with Wealth Protection: The Risks of Paper Gold. Now as a follow-up to that we have the below article. In it not only does David Galland also point out why Buffett is wrong but […] read more…

2012-02-27 04:25:56-05

Are you new to the world of gold? If so this interestingly written account gives a great summary of gold’s characteristics. It also asks (and answers) the question, “How do you know if you have enough gold?”… By Jeff Clark, Casey Research Have you ever had any doubts about gold? Does it sometimes feel like […] read more…

The Real Hunt Brothers Silver Story

2012-02-27 15:42:37-05

You may have read about the Hunt Brothers and how they cornered the silver market in the 1970′s causing the price to rise astronomically. We’ve read a fair bit about this episode in the past and now this recent video does a pretty good job of presenting a different take on the mainstream version of […] read more…

The legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Gold manipulation - is it for real? | Gold Prices | Gold Investing Guide