This Week:

- When Will US $1400 Be Broken?

- How Does War Affect the Gold Price?

- What Are JP Morgan and a Number of Billionaires Hedging Against?

Prices and Charts

When Will US $1400 Be Broken?

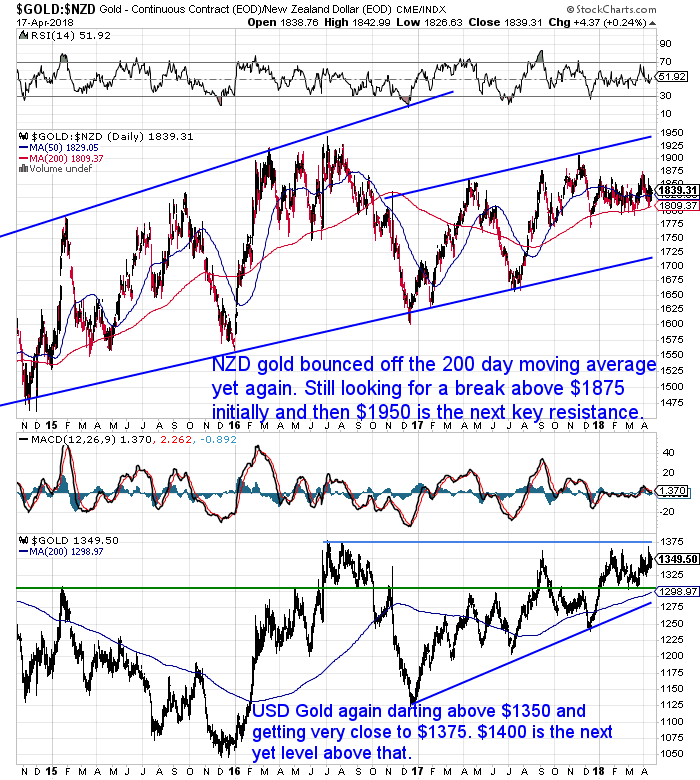

For the umpteenth time this year (well maybe about the 5th time at least!), NZD gold bounced up off the 200 day moving average (MA) line. Getting back above the 50 day MA, gold in NZ dollars is up almost 1% this week aided by the NZ dollar turning lower once again.

This sideways pattern in NZD gold is likely to continue until the USD gold price breaks out above the $1375 and $1400 levels (see the bottom half of the chart below for the USD price).

Who knows when this USD gold breakout will occur, but the rising pennant formation that USD gold has formed is generally a positive one. This simply means USD gold is making a series of higher lows and then bumping off overhead resistance.

More often than not this results in an upside breakout. We think that will happen this time too.

Silver: Needs Gold to Breakout First

NZD silver edged higher this week, continuing the theme since February of a quiet gentle rise.

When measured in NZ or US Dollars, silver is trading in a wedge formation from which it will have to break out of before too long.

The odds are this won’t happen until gold breaks out above that key US$1400 level. So hence why we are watching that level so closely. But looking at the USD silver chart in particular the wedge is getting very narrow. So a breakout may not be too many months away now.

NZ Dollar Dips

As noted already, the Kiwi dollar edged lower from last week after touching on the 0.74 mark again. But failed to get above that mark. Even though the NZ dollar is up for the year to date, it remains in a slight downtrend currently. This suggests it won’t be having a dramatic impact on gold and silver prices here for the next little while.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

How Does War Affect the Gold Price?

With trouble brewing further in Syria, the war drums are starting to beat louder once again.

Martin Armstrong outlined this week why he believes we are headed for a war before too long here: War is Coming Because We need it?

So it’s worth considering how does war affect the gold and silver price?

Check out this previous article of ours for a run down on how a war with Syria, North Korea or maybe even Russia may impact gold:

New Website Improvement: Find Articles by Category

Speaking of older articles, in case you hadn’t noticed we’ve had an update to the website. One of the improvements should make it much easier for you to find information and research on gold and silver that we’ve published previously.

Just head to our new Gold & Silver Blog page. (Under “Education” in the main menu).

All our previous posts have been categorised according to one of 12 topics.

Whether you’re considering: Why to buy gold or silver, what type of gold or silver to buy or how to store them, you’ll find it there. When you click through to each category, we also have a few must read articles at the top.

So check out the blog today.

Is Gold’s Out-Performance of the Other Metals Due to Growing Fears About the Economic Outlook?

Adrian Ash reports:

“…the way that the “hot money” is betting is split like never before over the 4 precious metals.

Gold they expect to go higher. Bullish bets on Comex gold futures and options contracts among hedge funds and other speculators are currently 10% greater…net of their bearish bets…than the 10-year average.

But as a group, that ‘Managed Money’ category has now been more bearish than bullish on silver for 9 weeks running.

That’s the longest stretch of net bearish betting on record according to data running back to 2006 from US regulator the CFTC.

On platinum the ‘Managed Money’ category also turned bearish again last week.

Even on palladium…the runaway precious metal superstar of 2017…hedge funds are barely half as bullish overall as they have been on average over the last 10 years.

Fourth, and looking just at the gold market, there’s a big split between professional wealth managers and private investors like you and me.

Most notably, sales of gold coins and small bars have sunk.

ETF trust fund products in contrast have grown to their largest in 5 years.

Allocated gold bullion holdings in London and Zurich vaults are also booming according to the latest UK and Swiss trade data.

But the wider public just aren’t interested.

The number of Google searches to ‘buy gold’ has sunk to levels not seen since before the financial crisis of 10 years ago.

What to make of it all?

The split between gold and the other precious metals could signal big trouble ahead for other investments like property or shares or corporate bonds.

That’s because gold finds just 10% of its annual demand from industrial uses. The vast bulk is used to store value, whether as necklaces, bracelets, bars or coin.

But for silver the level of industrial demand is 60%…for platinum 65%…and for palladium 97%.

So the fact that gold is out-performing the other metals suggests growing fears about the economic outlook. Because it suggests that storing wealth is becoming more important than trying to grow it.

The other key fact…that professional wealth managers are moving into gold as ‘retail’ investors stay away…also looks important.

Such ‘experts’ aren’t always right of course. Far from it!

But after the second-longest ever bull market in world stock markets, a turn towards caution may finally be here.

The political noise only adds to the case for getting a little investment insurance now, before it matters.

Especially for UK, Euro and Japanese investors still offered gold at late-2017 prices.

Adrian Ash

Head of Research, BullionVault”

We have written before that gold prices seem to be more driven by professional wealth management money flows than by retail buyers of gold in the east or the west.

So the fact that there is more money moving into gold from this sector could well be bullish for the price.

What Are JP Morgan and a Number of Billionaires Hedging Against?

We’re continuing the theme from the earlier Adrian Ash report and asking the question: “What is the big money doing?”

First an excellent infographic showing 5 of the biggest market risks that the world’s billionaires are preparing for:

Then a post and video that asks the question “What Does JP Morgan Know About Silver That YOU Don’t?”

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

So today could be a good time to follow the big money into gold and silver. Whether that’s a too big to fail bank, institutional investors or billionaires. Gold and silver are a great hedge against potential trouble and strife.

Get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|