We received the following question from a reader during the week and thought our answer might be worth sharing for people who didn’t hold any gold during the 2008 market turmoil…

“Just wanted to get your view on why the gold price is falling. I

thought it was regarded as a safe haven in turbulent times? Given all

the uncertainty now I would have thought the price might be going up –

any thoughts? Also given gold isn’t that easy to buy and sell (given

the spread on buy and sell prices), how would you normally protect it

from falling in value?”

A couple of possibilities immediately spring to mind. Firstly most people still (surprisingly) see the USD as the main safe haven so at times like these just about everything gets sold in exchange for USD. Which is why shares are falling, along with commodities, the NZD and other currencies and even gold. Of course because the NZD is falling, the gold price in NZD hasn’t actually fallen that much this week – only about $40 or so.

Another theory would be that the powers that be don’t want the masses to be in gold, and so they don’t want the gold price rising too rapidly, therefore central banks and their agents assumed to be the likes of JP Morgan sell paper gold at times like these to keep it down.

Odds are that the Chinese are buying at the moment we’d say and they’ll keep buying if it falls further, which will likely offer some support to the price.

We can’t know the real answer of course – it’s just a guess as to what happens. But our guess is that at some time in the future the masses will wake to to the fact that the USD isn’t actually safe and gold will be sought by more and more.

Our theory on protection from it falling is to either buy regularly to get a good average price, and/or to hold some cash to buy more when the price falls significantly to also get a better overall purchase price. There are options to hedge with futures etc but that isn’t for us.

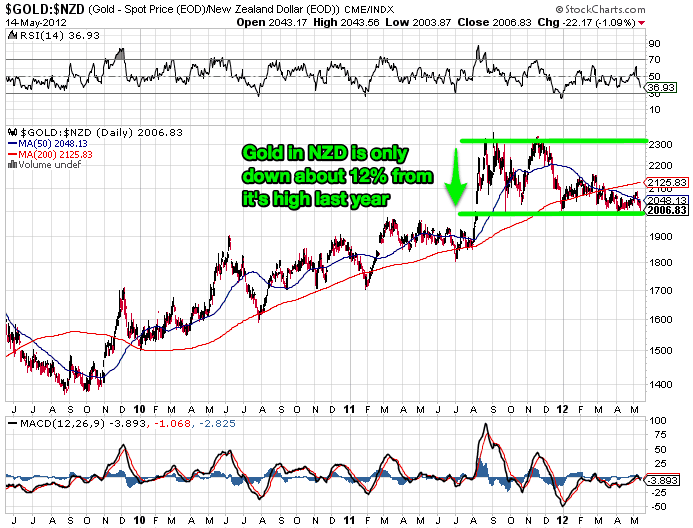

Look at the big picture and gold in NZD dollar terms is only down about 12% from its closing high of $2306.

So it’s not a major move in the big picture. For us it’s a case of be right and sit tight.

Hello from Rex Sellar,

As a new bullion buyer, I have limited historic knowledge on which to base my guesses as to how gold and silver might perform under NZ conditions should we experience a similar financial correction as occured in 2008.

I note that over about a year either side, our NZ$ exchange rate against the US$ ranged from 0.75 down to 0.55 and back up again to 0.75. Also, if we look back at real estate prices, they dropped (in real terms) 7.9% in 2008 and rebounded by 7.5% in 2009.

I note that during this period Gold rose from $1000 up to $1900 then stabilised back on the mean about $1400 but silver did the reverse and fell from $25 to $16 then back to about $25 again.

The ratio 1:52 up to 1:82 then back down to about 1:60.

QUESTION: Would you ‘guess’ that a crash in the $EU would affect NZ gold and silver in the same way as the 2008 adjustment?

Thanks Rex

Thanks Rex for posting your question – it is the million dollar one alright.

The easy answer is who knows for sure!

Our guess is that NZD gold and silver would follow the 2008 pattern somewhat. Mainly backed up by the fact that this is what they are doing currently based on the Euro fears. In short because the USD dollar is still seen as the safe haven by the majority of people, everything else is being sold. So currently with the Kiwi dollar weakening we are seeing gold in NZD holding quite well and hasn’t yet dropped below the lows of the past. See below chart. Even though gold in USD dollar terms has dropped dramatically in recent weeks. The kiwi movements have basically cancelled out the recent moves down in USD gold as it also did in the move up in USD gold earlier in the year, so we have had a very flat trading range.

So if a complete breakdown in the euro occurred then these current moves could be magnified perhaps.

http://content.screencast.com/users/FastVids/folders/Jing/media/b2b6be64-da3f-46bf-8e9e-b622ee5a5e75/00000043.png

Meanwhile silver in NZD terms hasn’t fallen as far as silver in USD but is still down nonetheless and right on the lows it reached over the new year holidays. And it has had a much larger trading range this year.

http://content.screencast.com/users/FastVids/folders/Jing/media/d9bb98ad-c841-4194-87e7-93adeea53f81/00000044.png

So the odds favor more extreme movements in silver compared to gold, particularly if fear is in the air as it is presently.

So in short while the USD remains seen as the safe haven our guess is that a weak kiwi will keep gold up in NZD terms.

Our guess is this will change at some point down the track, as of course the US has a good many problems itself.

Of course it really is any ones bet as to what will play out. He powers that be seem willing to do what it takes to hold the euro together. There will be surprises ahead most likely. But the odds favor more currency printing and bail outs down the track rather than a collapse it seems.

Just our guess of course.

Regards

Glenn.