This Week:

- Silver Outperforming Gold

- Still No Deposit Insurance for NZer’s in Case of Bank Failure – Well Not Much Anyway

- Will the RBNZ Bank Dashboard Help Us Pick a “Safe” Bank?

- John Key’s Exit

- All About Italy

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1639.84 | – $19.07 | – 1.14% |

| USD Gold | $1172.49 | – $0.86 | – 0.73% |

| NZD Silver | $23.93 | + $0.59 | + 2.52% |

| USD Silver | $17.11 | + $0.60 | + 3.63% |

| NZD/USD | 0.7151 | + 0.0078 | + 1.10% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1578 |

| Buying Back 1kg NZ Silver 999 Purity | $734 |

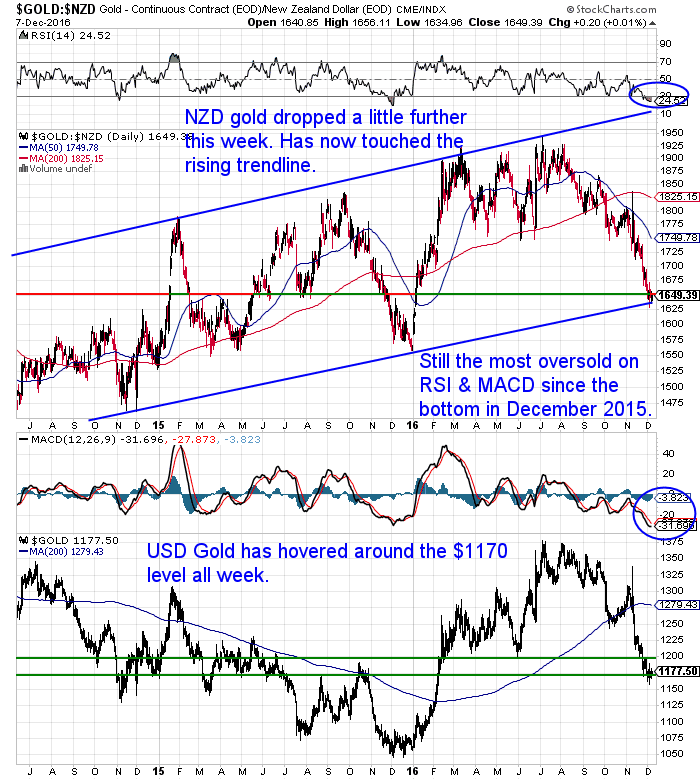

NZD gold edged lower again this week. It dropped below horizontal support at $1650. However it has now touched the rising trendline that stretches all the way back to 2014.

NZD Gold remains the most oversold it has been since the bottom in December 2015

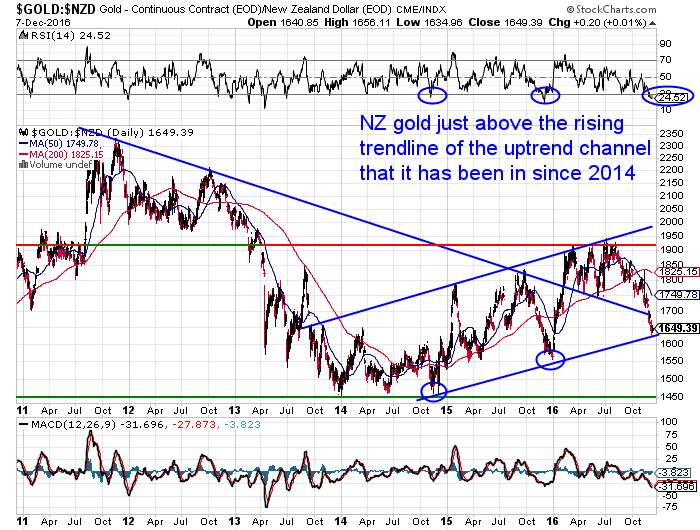

Today we’ve also included a long term NZD gold chart. This even more clearly shows the NZD gold price is sitting just above the rising trendline.

As noted above the overbought/oversold RSI indicator is the most oversold it has been in a year. The previous two occasions where the RSI reached as oversold levels as this, NZD gold moved sharply higher soon afterwards (see the circles on the chart below).

Of course there are no guarantees this will happen again. Sure gold could move even lower yet too. However right now is likely the lowest risk/highest reward set up in a year for NZ gold buyers. There looks to be much more upside than downside from here.

Silver Outperforming Gold

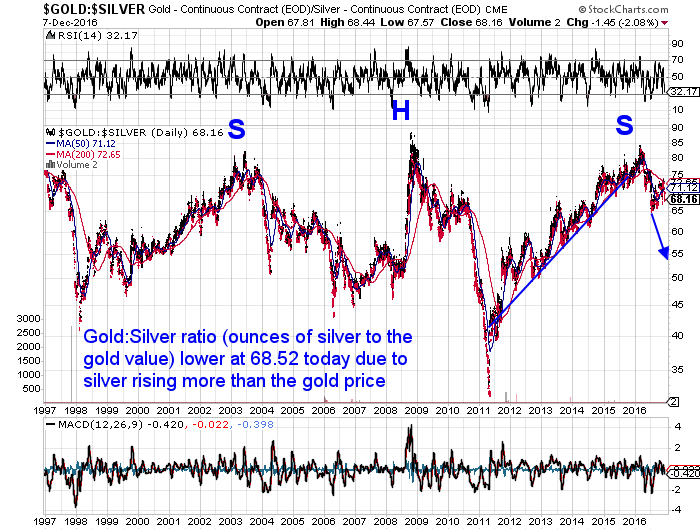

The performance of silver this week has been very unusual. More often than not when gold is falling silver is falling too, often at a faster rate. However this week silver has moved noticeably higher while gold has fallen. You can see this in the Gold/Silver Ratio chart below.

Why is silver outperforming gold?

Beats us! But maybe since silver has fallen so much further than gold over the past few years there are just not any sellers left at these levels?

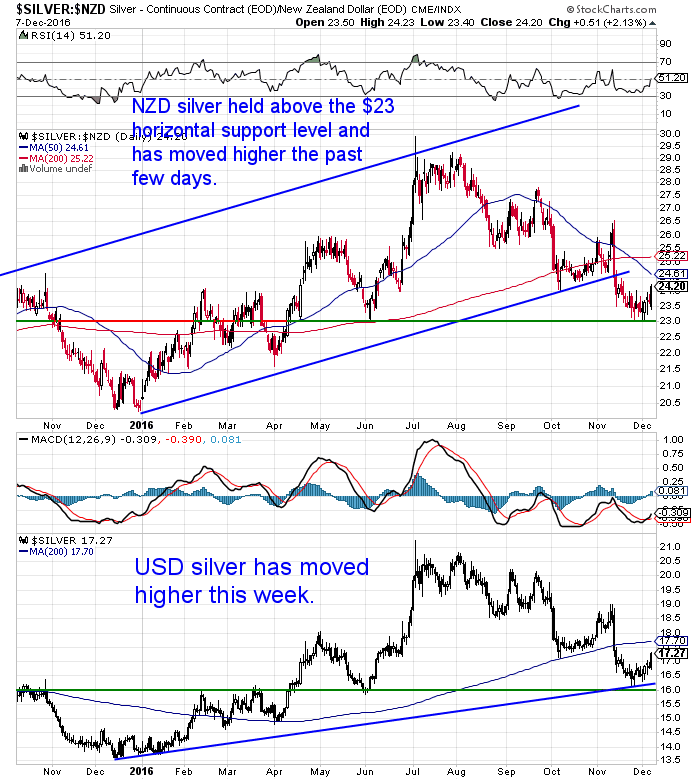

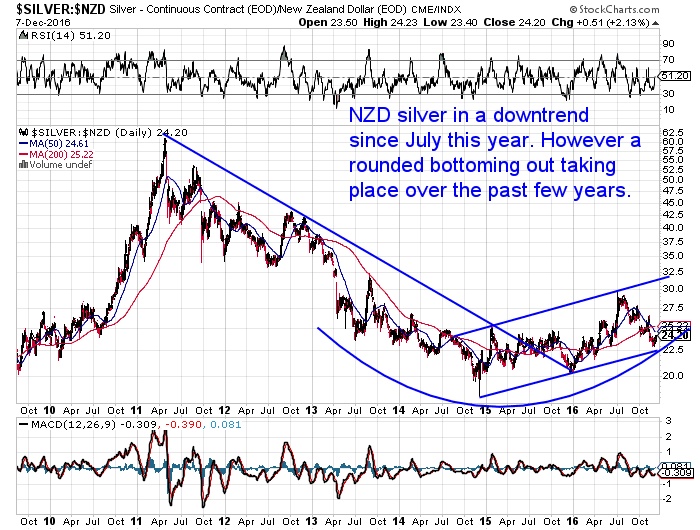

NZD silver looks to be trying to bottom out above $23, having risen 2.5% in the past week.

We’ve also added a longer term chart of silver in NZ Dollars today too. This shows silver still trending higher even though it has been falling since July. The chart also shows a rounded multi-year bottom looks to have taken place over the past few years.

The NZ Dollar has risen over the past week but is stuck between the 50 and 200 day moving averages for now.

Still No Deposit Insurance for NZer’s in Case of Bank Failure – Well Not Much Anyway

Don’t expect any change to the current Reserve Bank of New Zealand (RBNZ) policy when there is a bank failure.

[Not sure what the current policy is? Check out this article on why we will have bail-ins not bail-outs:RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR)]

As we’ve written previously and as this scoop.co.nz story notes, “New Zealand is the only country in the OECD without deposit insurance”.

The head of the RBNZ says this is unlikely to change.

- “Governor Graeme Wheeler told the finance and expenditure committee, at the central bank’s annual review this morning, that developing a deposit insurance fund would take an “awful long time” and New Zealand’s banking system is highly concentrated in bigger banks.

- “Where they tend to be most successful is in banking systems with a large number of very small banks, and some of those collapse over time, but our set up is completely different here,” Wheeler said “We do worry about the moral hazard issues, for example what is the incentives bank managers would feel knowing there’s a bailout fund set up.”

However there was a mention of a $5000 minimum guaranteed repayment. The first we’d heard of this:

- “Grant Spencer, deputy governor and head of financial stability, said there was scope for the minister to determine a minimum guaranteed repayment amount to protect small depositors, and the bank was having some discussion as to whether to fix that number more specifically, at around $5000.”

- Source.

So maybe a good reason to not keep much more than $5000 in the bank?

Will the RBNZ Bank Dashboard Help Us Pick a “Safe” Bank?

We’ve mentioned a while back the RBNZ’s plans to have a “dashboard” to highlight various financial measures and indicators for NZ banks. The idea being that the public can visit the RBNZ website and get a gauge on the relative risks between NZ banks. At a glance this seems like a good idea. Particularly when there is no deposit insurance, it behooves every depositor to know how their bank shapes up.

- “[T]he Reserve Bank views capital as “the single most critical piece of information in assessing financial stability,” with a bank’s capital ratio indicating its ability to “withstand a range of risks, including credit risk, liquidity risk and operational risk.”

However Toby Fiennes, the Reserve Bank’s head of prudential supervision also noted that:

- “Bank failures are correlated with capital in the sense that the more capital there is the less likely there is going to be a bank failure. But it isn’t a perfect match because there could be all sorts of things that are hidden. And bank failures can happen very quickly,” said Fiennes.

- “It [the dashboard information] does show the relative resilience of the banks. So a bank with more capital and more liquidity is, other things being equal, going to be more resilient and therefore safer than one with lower levels.”

- Source.

So while it might be a good idea to know how resilient your bank may be. There are a couple of considerations that may make this somewhat redundant.

New Zealand does have a highly concentrated banking system, made up of only a few banks.

Also perhaps the greatest risk to NZ banks would come from an offshore event, affecting the flow of credit into New Zealand (which we require given that we borrow more than we save).

The point being that if one bank was in trouble it would be highly likely that a number of them may be experiencing similar problems.

It’s worth reading the Interest.co.nz article on the dashboard as it also covers the OBR and deposit insurance too.

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

Get up to 25% off 120 serve mains buckets.

Get up to 25% off 120 serve mains buckets.

15 days emergency food for a family of 6.

John Key’s Exit

We don’t buy the mainstream view that “the time was right”, or “family reasons” for the sudden departure of Mr Key. The TPP (thankfully) looks dead and that was to be his main focus this year. So perhaps that played a part. His mate Barack is gone too.

We don’t have another reason yet but it will be interesting to keep an eye on where he ends up for any clues. He succeeded in us becoming a more surveilled state, and in potentially becoming a greater target in the eyes of extremists. We wish more New Zealanders would take a more critical view of government. What it means and does and take less notice of the mainstream media view.

Before you write to complain – hopefully by now you know we are apolitical here. We are critical of politicians and bureaucrats of all stripes and persuasions!

On the topic of John Key’s exit, Kris Sayce of Port Phillip Publishing in Aussie probably has it right:

- “Banker out, politician in

- On the subject of ‘who’s next?’ our friends across the Tasman may have given us the answer. As the Financial Times reports:

- ‘John Key has resigned as New Zealand’s prime minister, saying it felt like “the right time to” and that he wanted to leave on his own terms ahead of next year’s general election.

- ‘Mr Key, a former Merrill Lynch banker who won three consecutive elections and whose National Party is ahead in the opinion polls, said he would vote for Bill English, deputy prime minister, in a caucus meeting next week to choose a new party leader who will succeed him as prime minister.’

- After railing against the banker takeover, there now appears to be a reversal in New Zealand. Out with the ex-banker, and in with the career politician.

- Maybe it doesn’t matter. The establishment is the establishment.”

Yes indeed. It probably doesn’t matter who is prime minister or who is the ruling party for that matter.

More on Central Bank “Electronic Cash”

Last week in our newsletter we wrote about how the Swedish Central Bank is considering the implementation of a digital currency.

Supposedly it would be used alongside of cash, rather than in place of cash.

Today we have another article looking at this development in more detail:

The Worst Thing to Happen to the U.S. Dollar Since 1913

All About Italy

3 of the 4 articles on the website this week look at the goings on in Italy (see the end of this email for links to them). A couple were posted before the referendum over the weekend. This one since:

The Next Domino Falls as Predicted… Here’s What Comes Next

There’s a fair bit to happen in Italy yet but it does seem that they are heading in the direction of an exit from the Euro. Which would likely bring about the end of the EU.

- “This year, the eurozone authorities effectively made it illegal to bail out your own country’s banks. Instead, you have to force bondholders to take the losses.

- That sounds like a good idea, until you get to the practicalities. In the UK, bank bonds are typically held by the big institutions. Generally, those individuals who hold them have a pretty sophisticated understanding of how they work.

- But in Italy, many ordinary Italian savers have effectively been mis-sold Italian bank bonds as equivalent to a high-interest savings account. If they lose their savings, you have a riot on your hands.

- The Italian government under Renzi was groping towards a solution to the banks. Either he’d have told the European authorities where to go, or they’d have come to some sort of fudged agreement. The point is, the government was working on a plan.

- But now Renzi is resigning. That throws doubt on all the bailout plans and fudge and any other hopes and schemes that had been hatched up.”

- Source.

Jim Rickards also looks at how a bail in is on the cards, not just in Italy but in Germany too:

- “In the next financial crisis when these global too-big-to-fail banks are under stress, they’re not going to get bailed out with taxpayer money because the leaders know that’s too unpopular. There’s going to be a bail-in.

- In a bail-in, the government says, “No, we’re not going to help you. We’re not going to use government money. We’re not going to use central bank money. We’re going to take the money that’s in the bank and convert it to equity in the bad bank, where if you’re a bondholder, you’re not going to get 100 cents on the dollar. You’re going to get 80 cents on the dollar, etc., etc.”

- They’ll use the money already in the bank, whether it’s depositors, bondholders, or equity holders, and use that money to repair the balance sheet.

- We’ll see financial institutions taken over, and losses will be apportioned between depositors, stockholders and bondholders. This means bondholders take haircuts, uninsured depositors get new equity, and existing equity holders get wiped out.

- There’s only one problem. Merkel is applying this rule to Italy, but now the biggest bank in Germany, Deutsche Bank, is the one that’s in trouble. In order to maintain her hard line, Merkel will have to apply the bail-in method to Deutsche Bank. That means a bloodbath of losses the market is not ready for. It’s time to get ready because a panic is coming.

- If Germany forces Italy to bail-in BMP, then Italy will insist that Germany also bail-in Deutsche Bank when the time comes. Both banks are too-big-to-fail and are failing, but BMP is closer to the brink. It’s the “canary in the coal mine” for Deutsche Bank.

- Germany won’t like that, but if they don’t bail-in Deutsche Bank, the European Union will come apart because of acrimony between Italy and Germany.

- Compared to this dispute, UK Brexit is a sideshow. Greece is a sideshow of a sideshow. Italy is the real deal. If Germany and Italy can’t cooperate, then there is no European Union.

- Markets won’t wait while German and Italian politicians tiptoe around the bail-in question. They will draw their own conclusions and start a run on Deutsche Bank. That will take the stock down another 90% on top of the multiple crashes that have already occurred.

- The German government will let Deutsche Bank stock fall to €2 before they intervene. That’s how existing stockholders make their “contribution” to the bail-in. Deutsche Bank won’t fail and the stock won’t go to zero. But there’s still plenty of room to fall.

- As for BMP, I expect Italians to vote “no” on Sunday. First Brexit, then Trump, now the next anti-establishment shoe to drop is in Italy. It won’t necessarily lead to the collapse of the euro or the immediate demise of the European Union, but it’s clear the revolt against the globalist agenda continues.

- The question is, how hard will the elites fight back?”

If you still don’t understand what is going on in Italy then check out this very comprehensive article from John Mauldin. It outlines how they got where they are and what would need to be done to have any hope of getting them out of it. Our read is they don’t stand much chance.

It’s Bail-Ins Not Bail-Outs

A common theme today of bail-ins rather than bail-outs. Be they in Italy or in a failing New Zealand bank in the future.

Gold and silver stand as the only financial assets without any counterparty risk.

As we noted at the start of today’s newsletter, gold in NZ dollars is now just above the long term uptrend line. Since the election of Trump we have also seen the purchase of gold and silver here in New Zealand dry up sharply compared to the months previous. This is often a good contrarian indicator here in the West, where people prefer to buy when the price is rising than falling.

We wonder whether we will see a bounce higher from these levels now. That would make this a pretty decent time to buy.

Get in touch if you have any questions about the buying process. David is only too happy to answer them.

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern Check out this cool new survival gadget.

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

This Weeks Articles:

The Next Domino Falls as Predicted… Here’s What Comes NextThu, 8 Dec 2016 10:17 AM NZST  The Italian referendum went as expected. A large majority voted not to enact any changes to the system of government. Their prime minister announced his resignation as he said he would. So what happens now and what will the impacts be on the European Union and the rest of the world?… The Next Domino Falls […] The Italian referendum went as expected. A large majority voted not to enact any changes to the system of government. Their prime minister announced his resignation as he said he would. So what happens now and what will the impacts be on the European Union and the rest of the world?… The Next Domino Falls […]

|

The Worst Thing to Happen to the U.S. Dollar Since 1913Thu, 8 Dec 2016 10:00 AM NZST  Last week in our newsletter we wrote about how the Swedish Central Bank is considering the implementation of a digital currency. Supposedly it would be used along side of cash, rather than in place of cash. But as this article explains this is a slippery slope and points to everyday people having even less financial […] Last week in our newsletter we wrote about how the Swedish Central Bank is considering the implementation of a digital currency. Supposedly it would be used along side of cash, rather than in place of cash. But as this article explains this is a slippery slope and points to everyday people having even less financial […]

|

A Major Banking Collapse Looks ImminentMon, 5 Dec 2016 4:35 PM NZST  See why the Italian banking system is a mile high house of cards and how a bail in may well be a possibility in the now too distant future… A Major Banking Collapse Looks Imminent By Nick Giambruno This surprises almost everyone… You don’t own the money in your bank account. Once you deposit money […] See why the Italian banking system is a mile high house of cards and how a bail in may well be a possibility in the now too distant future… A Major Banking Collapse Looks Imminent By Nick Giambruno This surprises almost everyone… You don’t own the money in your bank account. Once you deposit money […]

|

After Trump, Brexit… December 4 is the Next Flashpoint in the Global Populist RevolutionMon, 5 Dec 2016 3:39 PM NZST  Learn about the line up of events bubbling to the surface in multiple countries in the European Union currently. See why it’s not just the pending results in the Italian referendum due out tomorrow to worry about… After Trump, Brexit… December 4 is the Next Flashpoint in the Global Populist Revolution By Nick Giambruno On […] Learn about the line up of events bubbling to the surface in multiple countries in the European Union currently. See why it’s not just the pending results in the Italian referendum due out tomorrow to worry about… After Trump, Brexit… December 4 is the Next Flashpoint in the Global Populist Revolution By Nick Giambruno On […]

|

Fed Rate Hikes and Gold Prices – Interesting ResearchThu, 1 Dec 2016 6:52 PM NZST  ONE DAY GOLD DEAL With prices falling, as is often the case people aren’t buying. So today only we have a special from one of our suppliers who needs to move some gold. Today only for NZ gold 9999 purity: $30,000 plus at spot plus 2.5% (Normally $1719; today $1702) $100,000 plus at spot plus […] ONE DAY GOLD DEAL With prices falling, as is often the case people aren’t buying. So today only we have a special from one of our suppliers who needs to move some gold. Today only for NZ gold 9999 purity: $30,000 plus at spot plus 2.5% (Normally $1719; today $1702) $100,000 plus at spot plus […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |